In a world of rapid financial movements, the allure of quick gains often overshadows the path to lasting prosperity. Yet, for those with their sights set on enduring financial triumph, the adoption of a long-term investment strategy proves to be the golden key. Long-term investment, a practice of holding assets over extensive timeframes – spanning years, even decades – holds the potential to harness the compounding effect and capitalize on market growth over time. In this discourse, we embark on an exploration of the vast potential housed within a long-term investment strategy. Accompanied by invaluable insights and recommendations from Tradespoon, this narrative endeavors to empower you in making judicious investment choices that set the stage for a financially triumphant future.

Long-term investment unfurls a myriad of compelling benefits, rendering it an attractive strategy for seasoned investors and newcomers alike. Chief among these advantages is the promise of elevated returns. By remaining steadfastly committed to the market for prolonged stretches, investors tap into the magic of compounding, where earnings beget more earnings over time. The ripple effect of compounding has the potential to significantly amplify the overall growth of an investment portfolio.

Furthermore, long-term investment functions as a buffer against the tempestuous volatility of short-term market fluctuations. While the stock market may buckle in the face of near-term gyrations, historical data illuminates its tendency to ascend over extended periods. This means that by clutching onto investments for the long haul, investors can endure market downturns, positioning themselves to reap substantial rewards when the market eventually rebounds.

A further edge of long-term investment lies in the mitigation of transaction costs. Frequent asset trading, commonly known as active trading, often results in escalated brokerage fees and taxes. On the contrary, long-term investors stand to minimize these overheads through the embrace of a buy-and-hold ethos, effectively curtailing the expenses linked with ceaseless trading.

Embarking on the journey of long-term investment mandates an informed consideration of pivotal factors that augment the prospects of triumph. Foremost, the allocation of assets plays a defining role. Through the diversification of one’s portfolio across varied asset classes – encompassing equities, bonds, real estate, and commodities – risks can be tempered and returns optimized. The counsel of Tradespoon advocates a discerning evaluation of one’s risk tolerance and financial aspirations, aligning asset allocation with investment objectives.

Additionally, the fundamentals underpinning chosen investments merit rigorous scrutiny. Rigorous research and analysis, involving the assessment of a company’s financial soundness, competitive standing, and industry trends, empower the identification of investment opportunities carrying robust potential for long-term growth.

The temporal dimension also looms prominently. Long-term investment imparts the gift of time, facilitating the harnessing of compounding’s magic and the smoothing out of short-lived market oscillations. A protracted commitment to the investment journey holds the potential to catalyze substantial wealth accumulation, ushering investors closer to the realization of their financial ambitions.

Tradespoon champions the adoption of time-honored strategies engineered to amplify the prospects of long-term investment triumph. One such strategy is dollar-cost averaging. This methodology involves periodic investments of fixed sums, regardless of prevailing market conditions. Consistent investments over time mitigate the impact of market volatility, potentially leading to the acquisition of more shares when prices are subdued – thus, leveling the average cost of investments.

Value investing stands as another widely endorsed strategy. This approach entails the identification of undervalued assets boasting robust fundamentals and latent growth potential. Practitioners of value investing capitalize on the market’s natural tendency to self-correct, reaping rewards as undervalued assets appreciate over time.

Growth investing, by contrast, zeroes in on enterprises boasting above-average growth rates. These companies funnel earnings into expansion, translating into remarkable stock price appreciation across timeframes. Discerning growth investors meticulously analyze growth prospects, competitive advantages, and market trends to pinpoint auspicious investment opportunities.

For the realization of long-term investment triumph, Tradespoon offers the following guidance:

Crystalize Financial Goals: The definition of investment objectives – whether centered on retirement provisions, homeownership, or educational funds – serves as a compass guiding investment decisions and ensuring resolute focus.

Harbor the Long-Term Outlook: Resilience against the sway of transitory market fluctuations is pivotal. Adhering to the investment strategy in the face of such oscillations, armed with the knowledge that the market rewards the patient, constitutes a cornerstone of success.

Forge Portfolio Diversity: The dispersion of investments across diverse sectors and asset classes is a strategic defense against risk, while concurrently amplifying the potential for returns.

Cyclic Reassessment and Rebalancing: Regularly gauge portfolio performance and tailor holdings to sustain the desired asset allocation. This recalibration preserves alignment with risk tolerance and financial aims.

Stay Informed: Vigilant observance of market trends, economic currents, and industry developments bestows the wisdom required for well-informed decisions and the identification of potential openings.

While the allure of long-term investment is undeniable, it’s imperative to steer clear of common pitfalls that might impede the journey to success. A few mistakes warrant caution:

Emotion-Fueled Choices: Permitting emotions such as fear or greed to dictate investment decisions can result in suboptimal choices. Sticking resolutely to the long-term plan and circumventing impulsive actions hinged on fleeting market perturbations is paramount.

Neglecting Diligence: Rigorous scrutiny and analysis of potential investments prior to capital commitment are indispensable. Failure to grasp the essence of an investment may expose investors to gratuitous risk.

Excessive Trading: Excessive buying and selling entail the accrual of transaction costs and taxes, which erode investment returns. Frequent trading is best avoided unless it dovetails with a meticulously designed strategy.

In the chronicles of long-term investing triumph, a few luminaries shine brighter. Among them, the resplendent name of Warren Buffett occupies a preeminent spot. Revered as the “Oracle of Omaha,” Buffett has etched his identity as one of the globe’s most accomplished investors, riding the waves of a long-term investment strategy to incredible success. His modus operandi involves the identification of undervalued companies fortified by sturdy fundamentals, enduring competitive advantage, and exceptional leadership. Businesses with long-range horizons are the apple of his investment eye, warranting holdings that span years, even decades.

The tale of Buffett’s conglomerate, Berkshire Hathaway, stands as a testament to the might of long-term investment. Over decades, Buffett’s astute stewardship transformed the textile manufacturing entity into a multinational behemoth encompassing diverse domains. His disciplined dedication to long-term investment has ushered in unparalleled wealth for himself and Berkshire Hathaway stakeholders.

Individuals are not the solitary beneficiaries of long-term investment’s allure. Institutional investors, encompassing pension funds and endowments, have inscribed their own chapters of triumph. Such institutions preside over substantial capital reservoirs, typically earmarked for the sustenance of retiree benefits or the fortification of an institution’s financial resilience.

Pension funds, entrusted with safeguarding retirees’ financial security, are staunch adherents of the long-term investment creed. Their strategy, predicated on a diversified portfolio and centered on stable growth, endeavors to secure consistent returns over time. The delicate equilibrium of risk and reward factors into asset allocation, asset-liability coherence, and long-term resource requisites.

Endowments, dedicated to the sustenance of educational institutions, charitable entities, and foundations, also hoist the banner of long-term investment. These entities bask in the luxury of perpetual timelines, channeling their energies into fostering sustained capital growth through diverse investment portfolios. The aim: to generate returns outpacing inflation, in service of ongoing missions and enduringly funded futures.

The triumphs of pension funds and endowments reverberate the symphony of long-term investing principles – asset allocation, diversification, and a patient gaze. It’s worth noting that while these success narratives illuminate the potential of long-term investment, personal strategies ought to be tailored to individual financial objectives, risk appetites, and timelines. Consulting financial experts or seeking counsel from esteemed investment establishments, much like Tradespoon, bequeaths sagacious insights and the design of a bespoke long-term investment roadmap.

Realizing the Dream Through Long-Term Investment The triumphs of long-term investment stalwarts – such as Warren Buffett, pension funds, and endowments – serve as guiding lights for those striving to carve out their own triumphs. By embracing disciplined approaches, engaging in thorough research, and threading investments with long-term dreams, individuals unlock the potential of compounding and ride the tides of market expansion, erecting an edifice of enduring wealth. Be it the individual investor or the institutional entity, the adoption of a long-term investment philosophy paves the boulevard to a future graced by prosperity and security.

Long-term investment unfurls a realm of prospects for those ardently seeking sustainable financial victory. Through the integration of proven strategies, meticulous research, and an unwavering focus on extended goals, investors can nimbly traverse the undulating landscapes of market dynamics and potentially harvest substantial rewards. The expedition to financial victory beckons patience, discipline, and an ardent commitment to the vista of the long term. With Tradespoon’s indispensable guidance, initiate your long-term investment journey today, sculpting your trajectory toward a future enriched with prosperity.

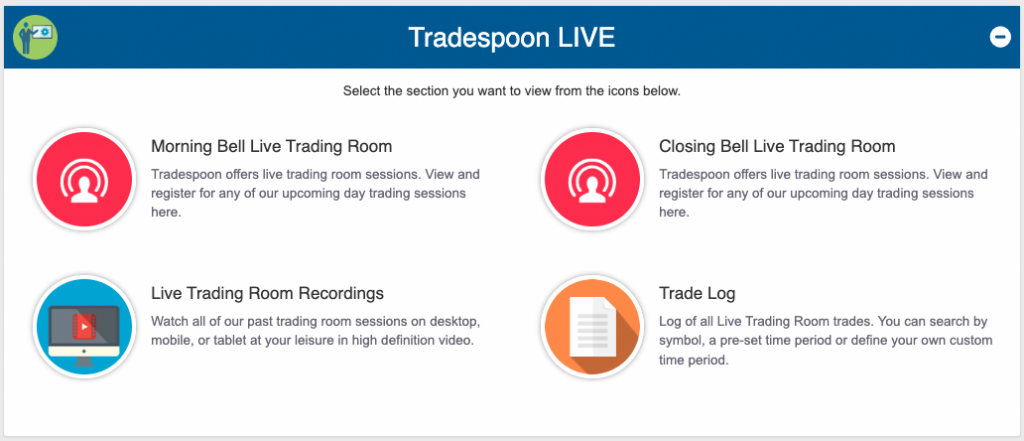

The very essence of the Tradespoon trading community mirrors this voyage. A sanctuary meticulously curated to endow you with an unparalleled trading odyssey, it empowers you to harness the prowess of our impartial AI trading program and glean wisdom from the paragons of trading. Your sojourn among us envelopes you in a nurturing milieu fostering growth and unfurling an expanse of expertise, inviting you to partake in an enriched trading journey.

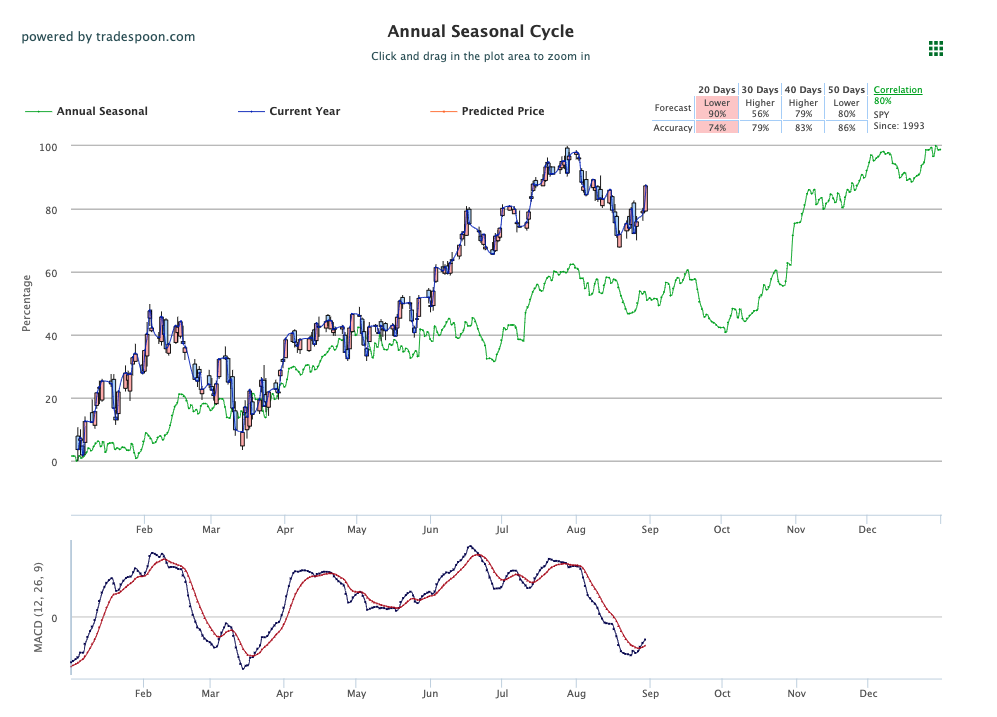

For more information on Tradespoon’s tools and our trading community, we recommend reviewing our latest Strategy Roundtable, held weekly on Tradespoon.

Being part of our Tradespoon trading community is immensely advantageous; here, you can exchange multiple tactics with fellow traders. During my recent Strategy Roundtable session (which is held weekly on Tradespoon), we did just that! This opportunity to collaborate and learn from others in the world of trading should not be passed up. I recommend checking out our latest Roundtable webinar in its entirety below:

Tradespoon Strategy Roundtable

Join us and unlock your trading potential with Tradespoon today!

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!