Against the backdrop of escalating tensions in the Middle East following last week’s Hamas attacks, U.S. stocks rallied for the third consecutive session. The market’s resilience was underpinned by declining bond yields, signaling a growing belief that the Federal Reserve’s interest rate hikes have concluded. Moreover, investors were treated to a slew of encouraging corporate earnings reports. In this article, we delve into the driving forces behind this bullish momentum, explore standout earnings, and dissect the evolving economic outlook.

The broad-based rally on Tuesday saw all sectors of the S&P 500 trading higher, a testament to the market’s buoyant mood buoyed by dovish comments from Federal Reserve officials. The Federal Reserve’s newfound caution regarding interest rate hikes injected fresh vigor into investor sentiment, bolstering risk appetite.

In a surprising twist, traditional safe-haven assets, and government bonds, experienced a retreat. The 10-year Treasury bond yield dipped below 4.7% from 4.8%, the two-year note yield edged just below 5%, and the 30-year bond yield fell to 4.86% from 4.97%. This unorthodox shift in the bond market further stoked confidence in equities.

PepsiCo kicked off the earnings season on a high note, reporting third-quarter adjusted earnings of $2.25 per share, outshining analysts’ expectations of $2.15. The company also delivered on revenue, posting $23.5 billion, surpassing market forecasts. Beyond these impressive financials, PepsiCo raised its full-year guidance, expressing optimism that fiscal 2024 financial results could reach the upper end of expectations. As a result, PepsiCo’s stock recorded a robust 1.9% gain. In stark contrast, Groupon took a nosedive, with shares plummeting over 30%, triggered by a substantial decline in the valuation of its stake.

Rivian Automotive surged ahead by 4.6% to reach $19.64 after receiving an analyst upgrade from “Neutral” to “Buy,” accompanied by a price target of $24. This positive sentiment followed Rivian’s announcement of a $1.5 billion convertible notes sale aimed at fortifying its cash reserves. Electronic Arts enjoyed an uptick as Bank of America upgraded its rating from “Neutral” to “Buy” and increased the price target to $150 from $145.

The oil market witnessed a turnaround as prices pulled back, relinquishing gains of approximately 4% made on Monday amid the ongoing turmoil. Both Brent crude and West Texas Intermediate barrel prices registered declines.

Defense stocks, led by Northrop Grumman, had enjoyed significant gains in the wake of the Hamas attack on Israel, surging by 11% on Monday. However, Northrop Grumman saw a 1.4% dip on Tuesday, while Lockheed Martin, which had surged 8.9% on Monday, fell by 0.3%.

Federal Reserve officials, including Atlanta Fed President Raphael Bostic, voiced their reluctance to implement further interest rate hikes. They believe the U.S. economy is on a stable trajectory, avoiding any imminent recession. This echoed similar sentiments expressed by Fed Vice Chair Philip Jefferson and Dallas Fed President Lorie Logan earlier in the week.

This week holds the promise of crucial economic data releases, including the Core Producer Price Index (PPI) scheduled for Wednesday and the Consumer Price Index (CPI) on Thursday. On Friday, we anticipate the release of the Import Price Index data.

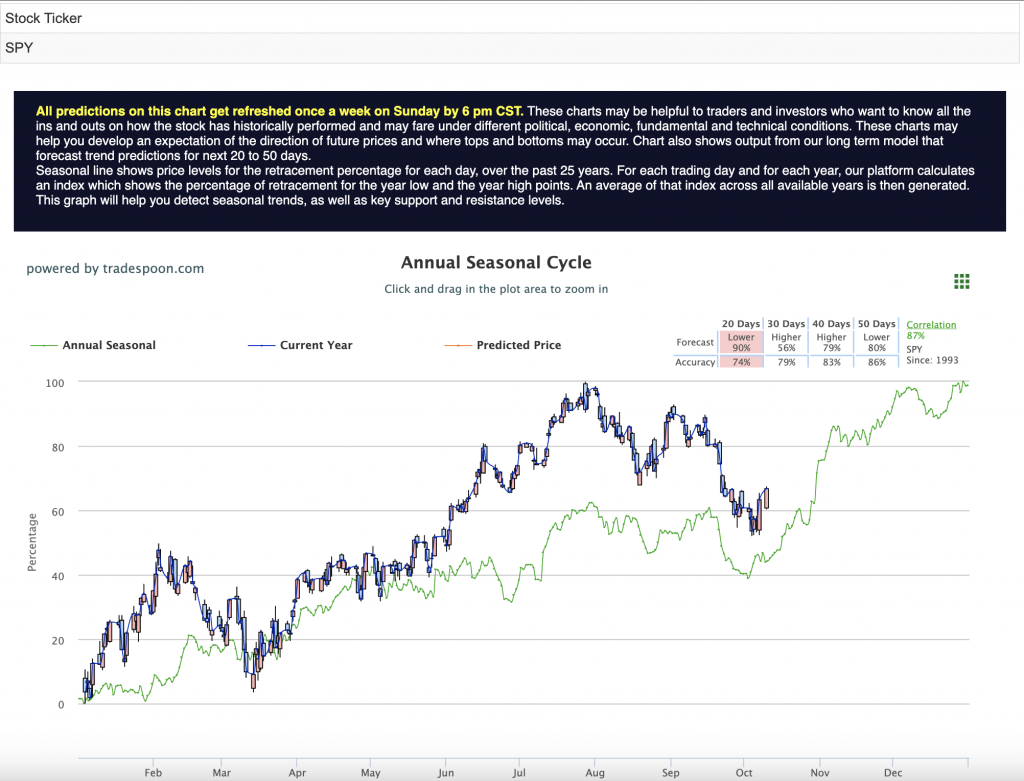

In light of these developments, some market observers are adopting a cautiously neutral stance. They cite the low probability of a recession based on current economic data. While the market has demonstrated resilience, analysts caution that the S&P 500 rally could face resistance within the $450-470 range, with support levels estimated between 400-430. They also hint at a potential correction, possibly breaking August lows. October could bring heightened volatility, but strong earnings expectations and year-end seasonality are poised to provide a market floor near the 200-day moving average. For reference, the SPY Seasonal Chart is shown below:

In conclusion, amidst global uncertainties, the U.S. stock market continues to shine, with the Federal Reserve’s dovish signals and robust corporate earnings serving as catalysts for growth. As investors keep a watchful eye on economic data and geopolitical developments, the dynamic nature of the market assures us that surprises are always in store.

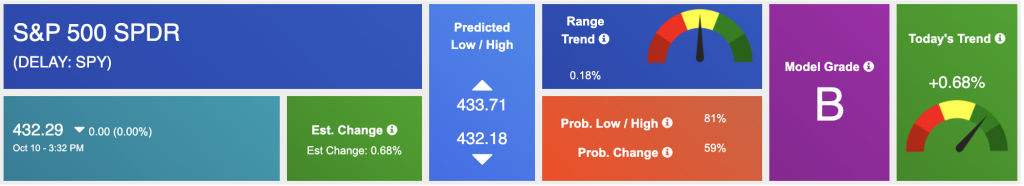

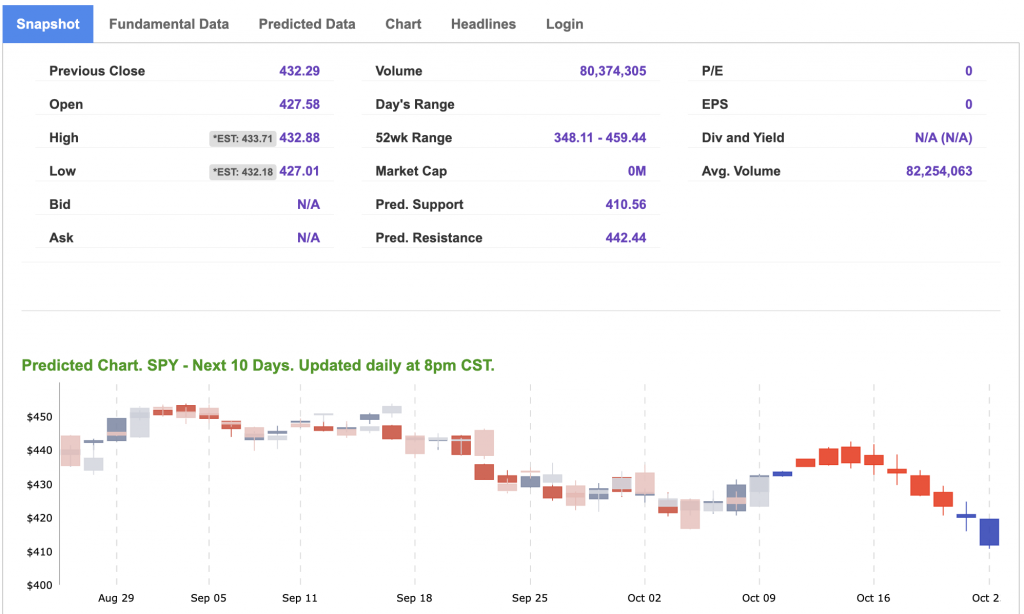

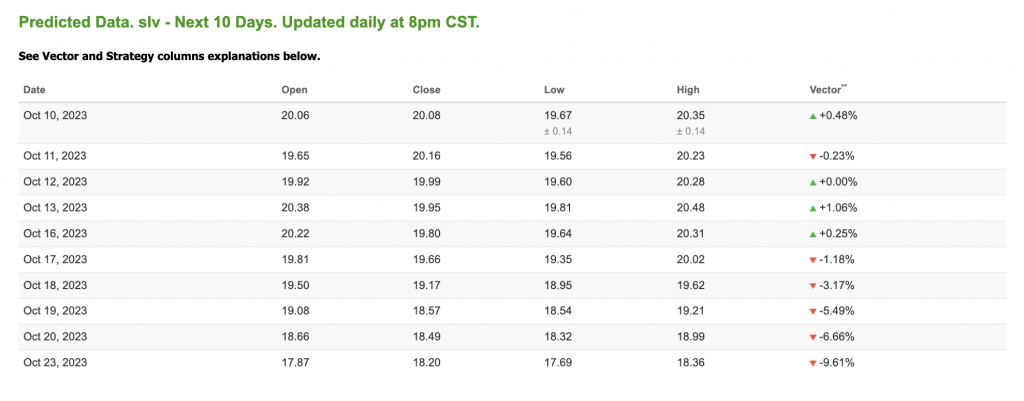

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

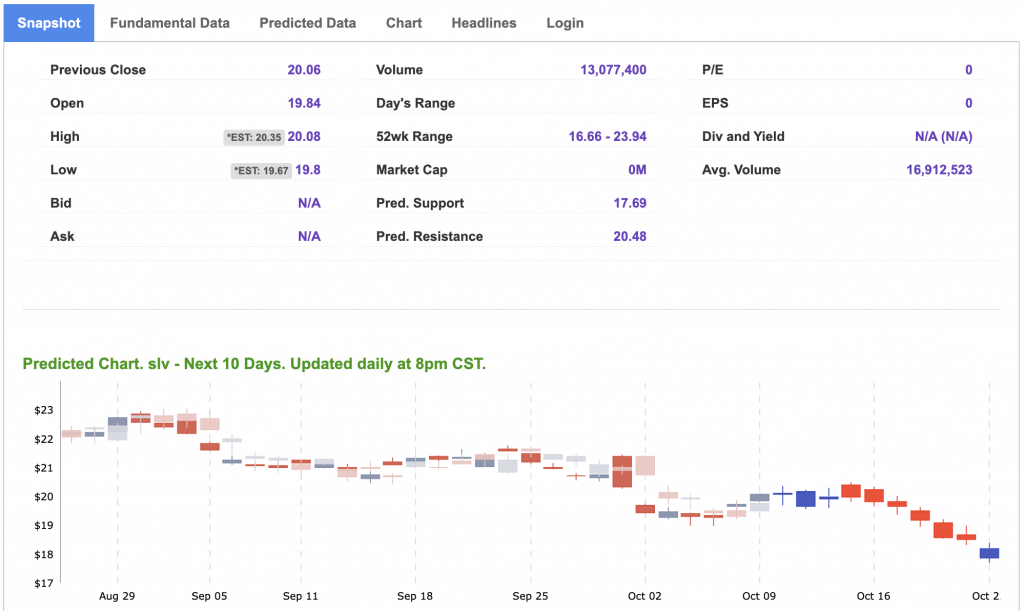

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

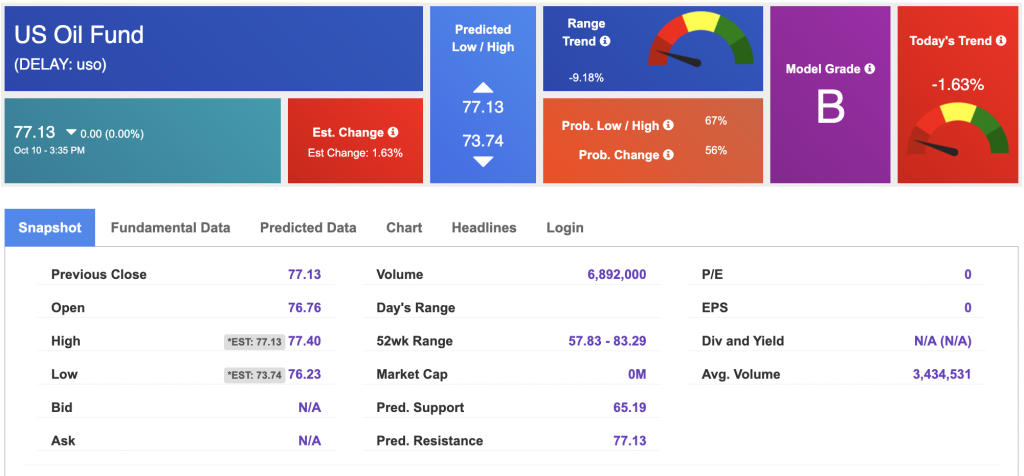

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $85.81 per barrel, down 0.66%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $80.86 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

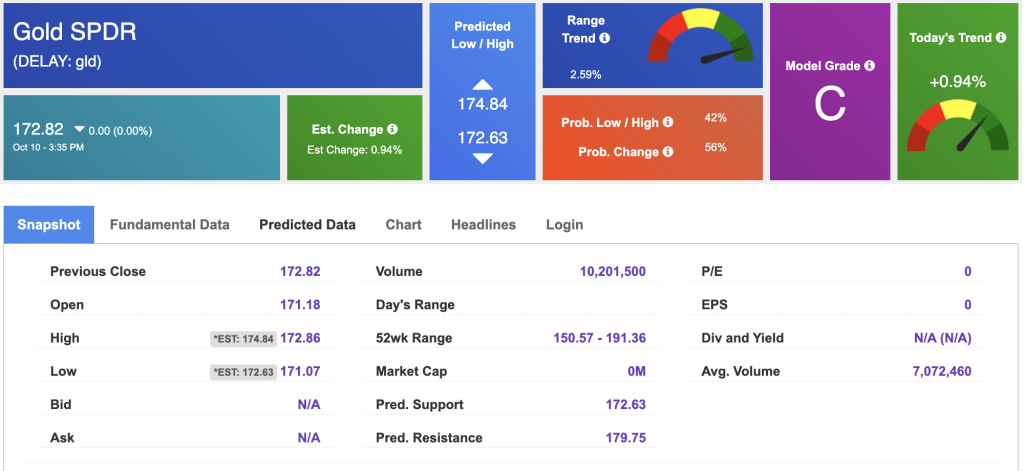

The price for the Gold Continuous Contract (GC00) is up 0.51% at $1873.90 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $171.45 at the time of publication. Vector signals show -0.57% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

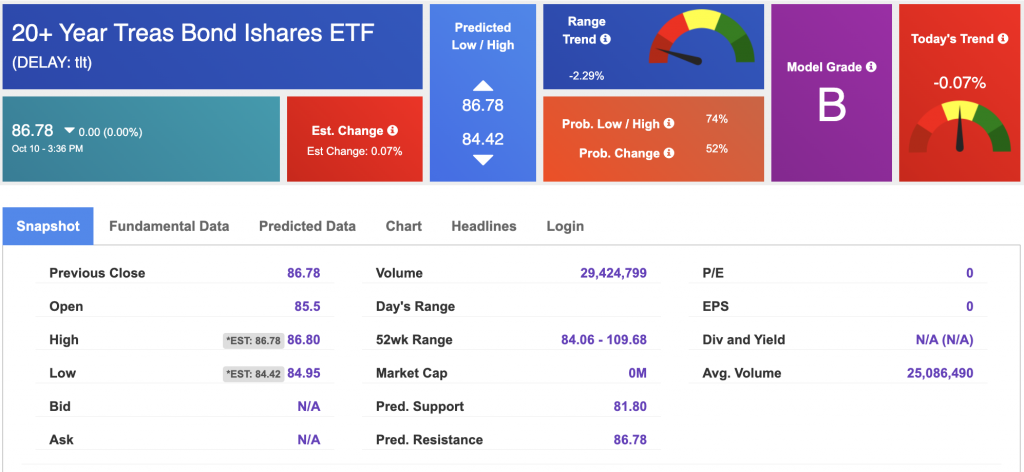

The yield on the 10-year Treasury note is down at 4.670% at the time of publication.

The yield on the 30-year Treasury note is down at 4.838% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $17.03, up 3.79% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!