RoboStreet – May 29, 2025

As we approach the end of May 2025, Wall Street finds itself navigating a tumultuous market landscape shaped by trade concerns, fiscal stress, and a complex economic backdrop. Despite some signs of optimism, volatility continues to dominate the market, with mixed earnings reports, shifting consumer sentiment, and ongoing inflationary pressures contributing to an unpredictable environment. This volatility comes amid heightened recession risks, as concerns about higher interest rates, rising unemployment, and an uncertain trade policy persist. While some optimism has returned with tariff delays and consumer confidence rebounds, the overall market outlook remains cautious, and uncertainty is likely to continue in the near term.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Last week, markets saw significant volatility, beginning with Moody’s downgrade of U.S. sovereign debt from Aaa to Aa1. This triggered a rise in Treasury yields and raised doubts about the long-term health of the U.S. economy, halting a five-day stock rally and dampening investor optimism.

A brief moment of relief came with President Trump’s announcement of a temporary U.S.-China tariff truce, which boosted market sentiment on Monday. However, this optimism quickly waned as concerns about fiscal policy and inflation took center stage.

By Tuesday, focus shifted to the growing U.S. deficit. Trump’s new tax-and-spend proposal, potentially adding $4–5 trillion to the deficit, fueled fears about government spending sustainability. A weak $16 billion Treasury auction heightened concerns, pushing yields higher and causing the Dow to drop 0.3% as investors reassessed their positions.

Midweek turmoil was exacerbated by the 30-year Treasury yield breaking 5%, signaling persistent inflation risks and the likelihood of prolonged higher interest rates. This reminded investors that the economic environment remains precarious.

Retail earnings were mixed, with Target and Lowe’s reporting revenue declines, signaling weakening consumer spending. Conversely, Urban Outfitters and Ralph Lauren posted strong earnings, highlighting a divergence in consumer behavior. This reflected concerns that higher inflation and interest rates are affecting consumer patterns.

Meanwhile, the cryptocurrency market surged, with Bitcoin breaking all-time highs above $111,000. Growing concerns over traditional financial markets and regulatory changes sparked renewed interest in digital assets as investors sought alternatives amid rising uncertainty.

As the week closed, President Trump reignited trade fears with new tariff threats, including 25% tariffs on iPhones and 50% on EU goods. This sent shockwaves through the market, with Apple and other tech stocks falling, prompting a broader sell-off in the tech sector.

In response, investors flocked to safe-haven assets. Gold surged 2%, Treasury yields dropped, and the VIX spiked to 24.7, signaling renewed market jitters. The ongoing trade and fiscal uncertainty kept investors on edge, questioning whether optimism can be sustained amid rising risks.

As we moved into this week, the shortened trade week began as the market saw some recovery, driven by the news that President Trump had delayed 50% tariffs on European Union goods. This tariff reprieve provided a much-needed relief to markets, helping to fuel a rally on May 27. The Dow surged over 700 points, the S&P 500 rose by 2.05%, and the Nasdaq climbed 2.47%, snapping four-day losing streaks for the Dow and S&P 500. This positive momentum was bolstered by an unexpected jump in consumer confidence, which surged by 12.3 points to a reading of 98, marking a sharp reversal after five consecutive months of decline.

The improved consumer sentiment was largely attributed to the tariff-related reprieves, as consumers grew more optimistic about the economic outlook. However, inflationary concerns remain top-of-mind, with consumer inflation expectations still holding at 6.5% for the next 12 months, slightly down from 7% in April. This rebound in confidence, while welcome, also underscores the cautious optimism that dominates the market.

This week also brought mixed corporate earnings reports, contributing to the market’s volatility. AMC Entertainment saw a dramatic 22% surge to open the week, thanks to strong Memorial Day weekend revenues from two major releases. However, Home Depot’s earnings missed expectations, reflecting the ongoing challenges in the retail sector, which has faced significant headwinds from rising inflation and interest rates.

In tech, investors eagerly awaited Nvidia’s earnings report, which was released after the bell on May 28. Nvidia’s performance will be critical for sustaining the broader tech sector’s outperformance, which has been a bright spot amidst broader economic uncertainty.

On the economic front, the Bureau of Economic Analysis revised its first-quarter GDP estimate, showing a smaller-than-expected contraction of 0.2%, an improvement from the initial 0.3% drop. This revision pointed to weaker-than-expected consumer spending and government expenditure, though stronger investment and exports helped offset the downturn. The labor market showed some signs of strain, with weekly jobless claims rising by 14,000 to 240,000, signaling that the labor market may be starting to feel the impact of inflation and higher rates.

As we move into June, my outlook remains market-neutral. The odds of a recession have increased, with risks from both inflation and the Federal Reserve’s aggressive interest rate policy. While short-term rallies, such as those fueled by tariff delays or consumer confidence rebounds, may occur, I expect the market to continue trading sideways in the near term.

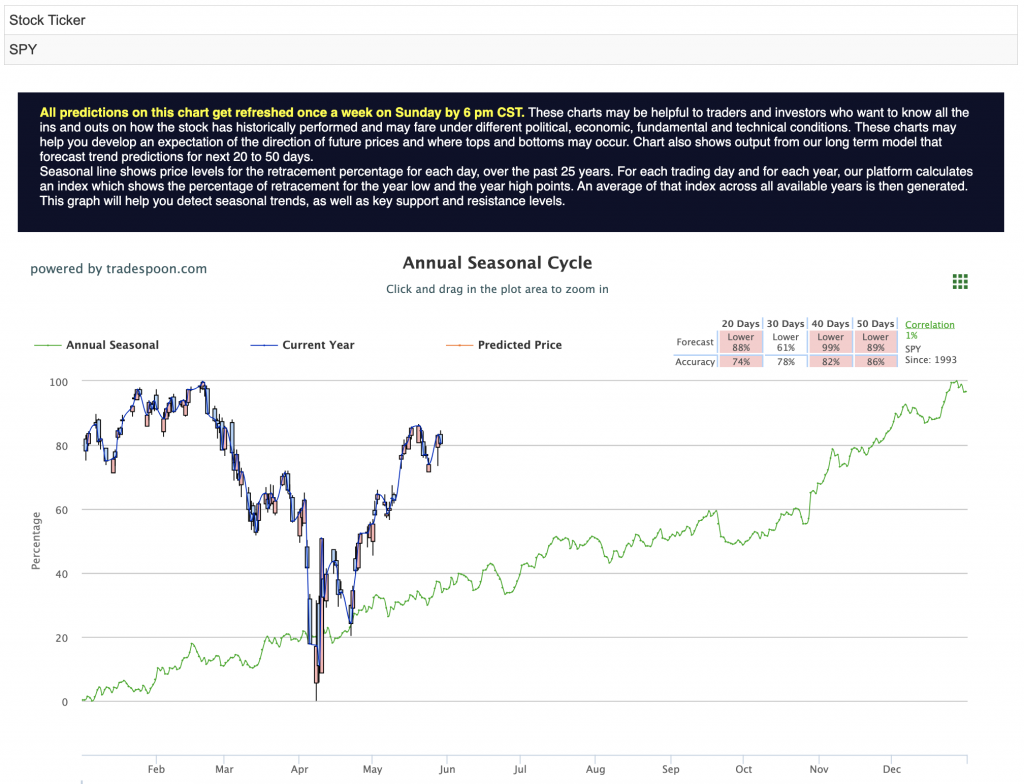

The SPY rally is likely to be capped at the $600–620 range, with downside support between $540–550 for the next few months. This range reflects the balance between optimism driven by tariff relief and the underlying economic risks that could weigh on the market. The longer-term trend remains under pressure due to ongoing fiscal challenges, inflationary concerns, and the possibility of rising unemployment. For reference, the SPY Seasonal Chart is shown below:

Looking ahead, several key reports will likely shape market expectations. The release of the FOMC minutes will provide further clarity on the Federal Reserve’s stance on interest rates, and Thursday’s GDP and jobless claims data will give us a clearer picture of the economy’s trajectory. On Friday, inflation data and consumer sentiment reports will be closely watched, as they will provide further insight into the economic outlook for the remainder of 2025.

While optimism has returned, the market remains highly sensitive to trade policy, fiscal developments, and inflation. Investors should maintain a disciplined, diversified approach to managing risk as volatility continues to be a defining feature of the market in the near term.

In conclusion, this week has provided a vivid snapshot of the challenges and opportunities investors are facing in 2025. The market has demonstrated resilience, with trade-related optimism and a rebound in consumer confidence helping to offset the ongoing risks of inflation and fiscal stress. However, the long-term trend remains under pressure as the likelihood of a recession increases. With volatility expected to persist, a market-neutral outlook remains prudent for the time being.

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.06% going back to April 2018.

As we progress through Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!