U.S. equities are entering the new week with a familiar tension: resilience in price action, caution beneath the surface.

Last week ended with markets holding together—but only just. The Dow hovered near record territory, while the S&P 500 and Nasdaq managed a late rebound after testing key technical levels earlier in the week. Volatility remained elevated but contained, with the VIX hovering near the high-teens as indices negotiated their 50-day moving averages. This is no longer a market that trends effortlessly higher. Each rally attempt is being evaluated through the lens of rates, earnings quality, and headline risk.

That dynamic carried directly into Monday.

Over the weekend, renewed tariff rhetoric and rising odds of a partial U.S. government shutdown injected fresh uncertainty into the tape. Early futures reflected those concerns, with traders openly pricing political risk as lawmakers remained divided over funding. Yet once cash trading began, markets followed a now-familiar pattern: initial hesitation, followed by fast repricing.

Stocks gained traction early in the session, shaking off shutdown fears and weekend headlines much like they did last week when geopolitical rhetoric softened. By mid-day, major indices were higher, market breadth was constructive, and participation broadened beyond a narrow set of leaders. Equal-weight indexes advanced alongside the majors, signaling engagement rather than index masking.

Click Here to Subscribe to Our YouTube Channel So You Don’t Miss Out!

The tone, however, remained controlled. Consumer discretionary lagged, reinforcing that higher rates and selective spending still matter, while leadership rotated across technology, communications, financials, and defensively positioned growth. This was not speculative chasing; it was measured risk exposure. Rates continue to anchor sentiment.

The bond market remains the market’s primary reference point, and with yields elevated and volatile, investors remain unwilling to chase broadly. Inflation data has been steady enough to keep the Federal Reserve patient, but not soft enough to justify imminent easing. As a result, valuation discipline remains tight and conviction remains selective.

A dense earnings calendar collides with a heavy slate of economic data, creating the potential for rapid repricing across sectors. Mega-cap technology dominates the mid-week spotlight, offering a critical read on enterprise spending, AI monetization, cloud demand, and hardware cycles. Apple follows later in the week, where investors will focus on iPhone trends and early signals around its evolving AI strategy.

Outside of tech, industrial and energy earnings will help frame the global growth picture. Results tied to infrastructure investment, manufacturing demand, and commodity pricing should provide insight into whether capital spending remains resilient or is beginning to cool. Financial reports later in the week will further clarify the health of the consumer and underlying credit trends.

At the same time, macro data will arrive in quick succession. Updates on home prices, consumer confidence, GDP, jobless claims, and the Fed’s preferred inflation gauge—Core PCE—will help determine whether the economy is cooling in line with expectations or maintaining enough momentum to keep rate cuts off the table.

When earnings and macro data converge like this, markets don’t drift—they recalibrate.

Sentiment remains cautious rather than bearish. Gold’s continued strength reflects ongoing hedging against policy uncertainty, geopolitical risk, and rate volatility rather than a wholesale retreat from risk. Investors remain engaged, but positioning remains deliberate.

My positioning remains market-neutral. Not because the longer-term trend is broken, but because short-term momentum has weakened and financial conditions remain restrictive. This is not a market that rewards emotional reactions to headlines. It rewards patience, selectivity, and risk management.

If earnings reinforce steady demand and macro data stabilizes expectations, equities can continue to work higher. If rates re-accelerate or labor data deteriorates, sentiment could shift quickly. Until then, discipline around exposure and respect for key levels remain paramount.

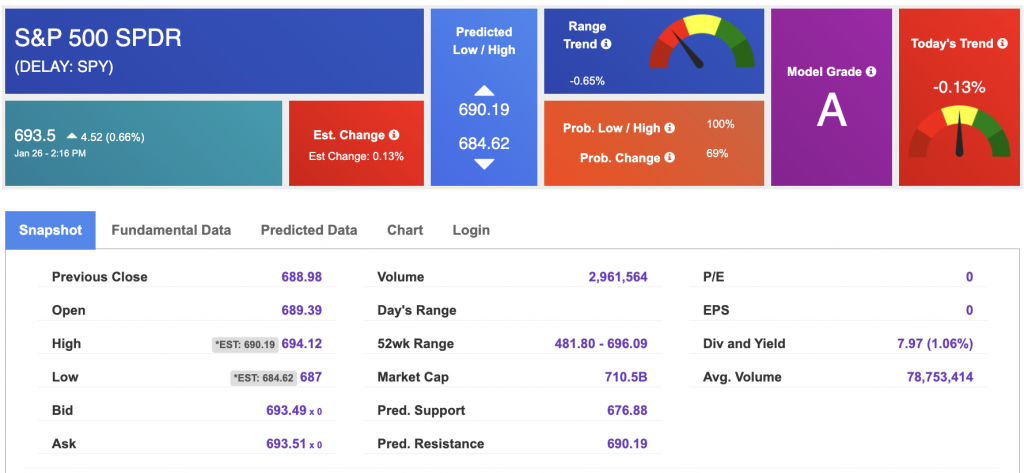

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $60.73 per barrel, down 0.57%, at the time of publication.

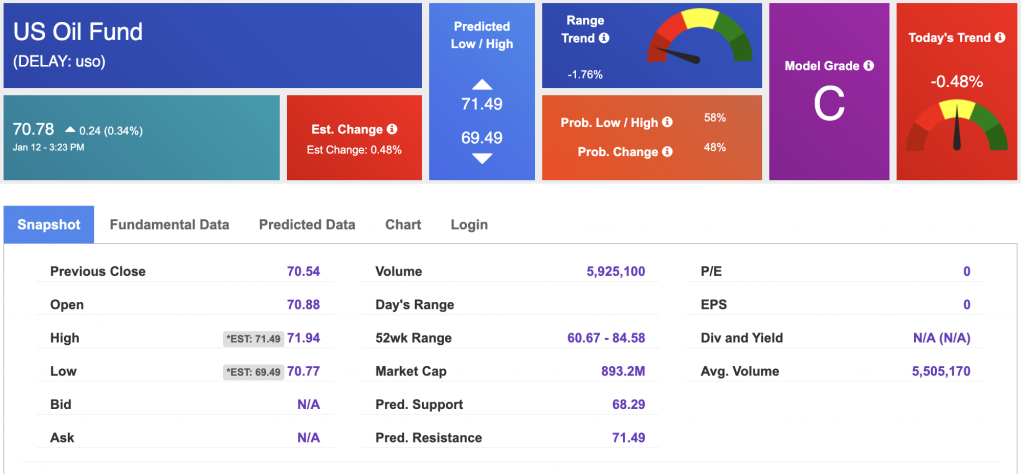

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.78 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

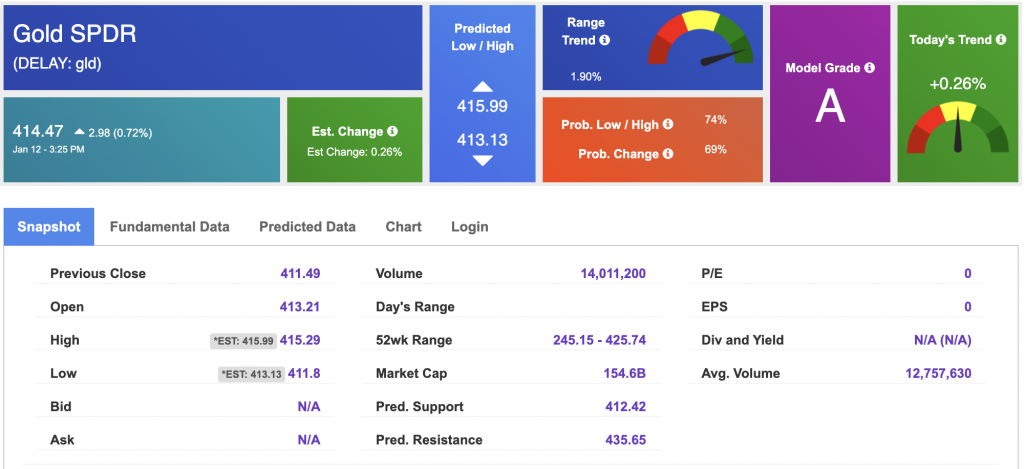

The price for the Gold Continuous Contract (GC00) is up 1.42% at $5,050.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $414.47 at the time of publication. Vector signals show +0.26% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

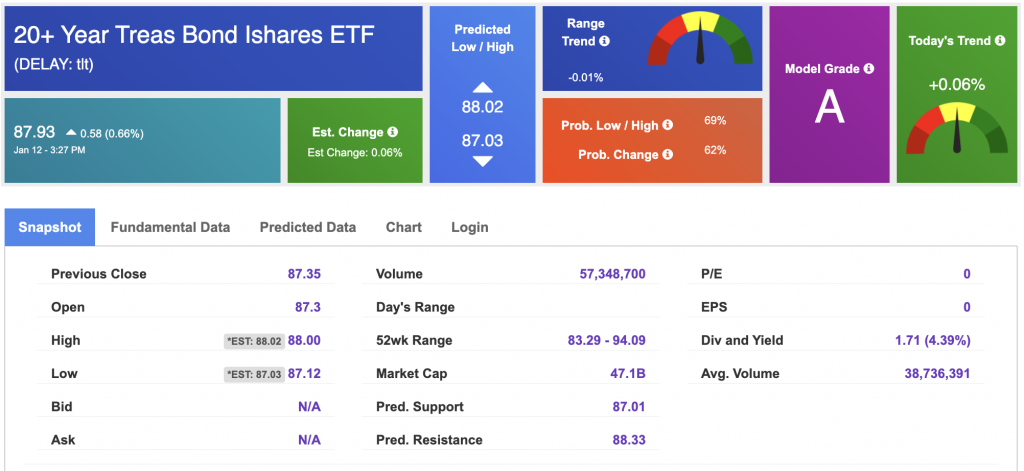

The yield on the 10-year Treasury note is down at 4.216% at the time of publication.

The yield on the 30-year Treasury note is down at 4.805% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $15.95 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!