RoboStreet – November 6, 2025

Slower hiring, sticky inflation, and tariff noise meet a patient Fed—the bid narrows; own quality, size positions, keep dry powder.

Stocks slipped into Thursday as the week’s story shifted from “soft-landing confidence” to “show-me.” The tape opened heavy on fresh private labor readings while a crowded earnings calendar and tariff headlines kept nerves taut. Volatility hovered in the high-teens and, despite the weakness, indexes continued to coil just under highs—a reminder that momentum hasn’t vanished, it’s just more expensive to own.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Tuesday felt cautiously constructive. The market still leaned on cooling-but-resilient growth, and hopes for at least one cut into year-end lingered. But beneath the surface, rotations were busy. Renewed talk of aggressive U.S. tariffs on Chinese EVs and semiconductors put a ceiling on parts of the AI complex and the global supply chain trade, even as the broader “AI infrastructure” theme held together. Energy tried to lead early, then faded. Big Tech stayed the main gravity well—results have been sturdy enough to support the Nasdaq, but dispersion around the megacaps has widened, with money rewarding clear execution and punishing even small wobbles. That’s classic late-cycle leadership: narrower, choppier, and hypersensitive to headlines.

By mid-week, the narrative pivoted to labor and the Fed. Private reports pointed to slower hiring and a noticeable uptick in announced layoffs—enough to dent risk appetite and revive “higher for longer” worries. With the government shutdown still stalling official data, investors had to triangulate from private trackers, which added to the uncertainty. Chair Powell’s tone stayed cautious: inflation is better but not yet where the Fed wants it, and while a December cut remains the base case for many, conviction has slipped. That nudge was enough to push rate-sensitives into the red and cool the broader tape.

The intraday path told the same story in miniature. An ugly open gradually stabilized, but the close still skewed lower, with Consumer Discretionary and Tech carrying most of the weight. Airlines sold off after an FAA directive to reduce schedules starting Friday—one more reminder that idiosyncratic headlines can still bulldoze sector narratives. Within semis, earnings jitters were evident: Qualcomm struggled post-print while Arm clawed back early losses. AI remains the anchor theme, but the market is far less forgiving of crowded positioning and any hint of deceleration.

Commodities underscored the fragility of leadership. Crude gave back early strength as traders weighed a chunky U.S. inventory build against Saudi price cuts for December into Asia. The result: Energy’s morning shine didn’t make it to the close. That’s been the commodity pattern all quarter—tactical bursts, quick reversals, and little follow-through without a fresh catalyst.

Earnings remain a coin sorter, not a tide. NVIDIA is the week’s pressure point for sentiment, and the bar is high; export risk and data-center visibility will matter as much as headline beats. Microsoft and Amazon continue to benefit from AI and cloud durability, but even strong reports aren’t lifting all boats. The read-through is simple: treat megacaps as singles and doubles, not a one-way beta trade.

Rates continue to frame everything. The market wants cooling growth that validates easing without crushing profits. Rising layoffs and slower hiring argue for accommodation in time, but the Fed won’t pre-commit with inflation still sticky. That leaves us in a data-dependent drift where every print can tip the balance and where multiples are more elastic than comfortable.

My stance is unchanged: tactically market-neutral. Momentum has resumed, but the risk that rates stay firm while unemployment drifts higher argues for balance and discipline. For reference, I still see the SPY rally stretching toward 680–700 with near-term support in the 620–640 zone over the next few months. The long-term uptrend is intact; the path won’t be straight.

What to do with that? Prioritize balance sheets and cash flows you can underwrite through rate chop. In AI infrastructure, stick with names that have diversified demand and limited single-market export exposure. In cyclicals, prefer domestic beneficiaries of re-shoring and defense tailwinds over pure global supply-chain proxies. Keep Energy tactical until the fundamental tape—stocks, spreads, inventories—lines up for more than a day.

Final thought: volatility is perking up, recession odds are inching higher, and policy clarity is a step behind the data. That combination means risk management first. Scale entries, define exits, and let position sizing carry the load. This is a stock-picker’s market—own what you truly understand, and keep dry powder for the inevitable dislocations.

Meet RoboInvestor, our flagship AI-driven advisory built for exactly this kind of market. It strips out the noise and the emotion, surfaces statistically sound setups, and helps you act with precision and conviction—no matter what the headlines throw at us.

Every other weekend, you’ll get the RoboInvestor newsletter: a concise read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas designed to be ready for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

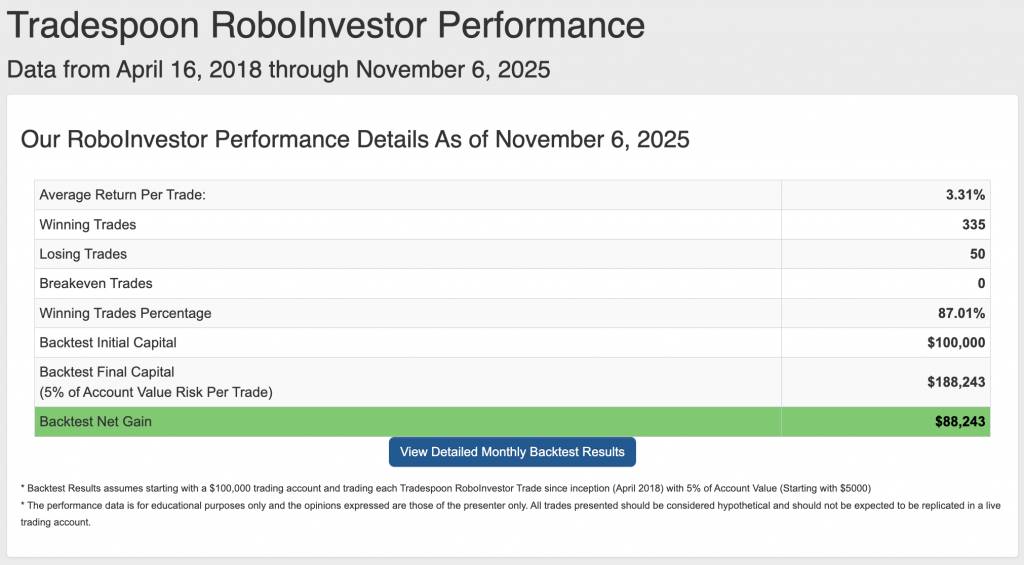

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.01% since April 2018.

As we head into the back half of Q4 2025—with October nearly in the books—investors are navigating a market defined by renewed tariff rhetoric, an uncertain Fed path, mixed economic signals, and persistent geopolitical crosscurrents. Volatility remains contained but jumpy around headlines, while earnings and guidance are doing the heavy lifting for direction. In this backdrop, partnering with a disciplined, insight-driven framework matters more than ever to cut through noise, manage rate and labor-market risk, and position proactively for the final stretch of the year.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!