The stock market soared on Monday, propelled by optimism surrounding the upcoming Federal Reserve’s monetary policy decision and the tech sector’s strong performance amidst the latest artificial intelligence breakthroughs. Investor sentiment swayed amidst shifting expectations over interest rates against a backdrop of recent inflationary spikes.

The tech behemoths stole the spotlight, driving the market frenzy with their impressive gains. Leading the charge was Nvidia, whose shares surged ahead of CEO Jensen Huang’s keynote address, promising groundbreaking updates on AI-driven innovations. Alphabet also took center stage, riding high on rumors of a potential collaboration with Apple to integrate Google’s Gemini AI engine into iPhones. Meanwhile, Tesla and Meta Platforms flexed their muscles, contributing to the sector’s electrifying rally. Not to be outdone, Amazon and Microsoft also posted solid gains, adding further momentum to the tech surge.

Amidst a backdrop of recent market fluctuations, the Magnificent Seven, comprising mega-cap tech stocks, reclaimed their dominance with a resounding rally. Spearheaded by Tesla, Alphabet, and Meta Platforms, the group collectively notched its most impressive performance since March 12. However, despite approaching record highs, individual stocks within the group fell short of reclaiming their all-time peaks, underscoring the market’s cautious optimism.

In the realm of cryptocurrencies, the waters remained choppy following a weekend selloff. While uncertainty loomed, the bullish narrative for cryptos persevered, buoyed by growing investor interest and the tantalizing prospect of Bitcoin supply adjustments.

The market grappled with the aftershocks of last week’s inflationary tremors, triggered by the CPI and PPI surpassing expectations. This unexpected surge sent shockwaves through the financial landscape, stoking fears of an overheating economy and prompting a surge in yields. Against this backdrop of uncertainty, investors eagerly awaited signals from the Federal Reserve, with hopes pinned on clarity regarding future interest rate trajectories and inflation-fighting measures.

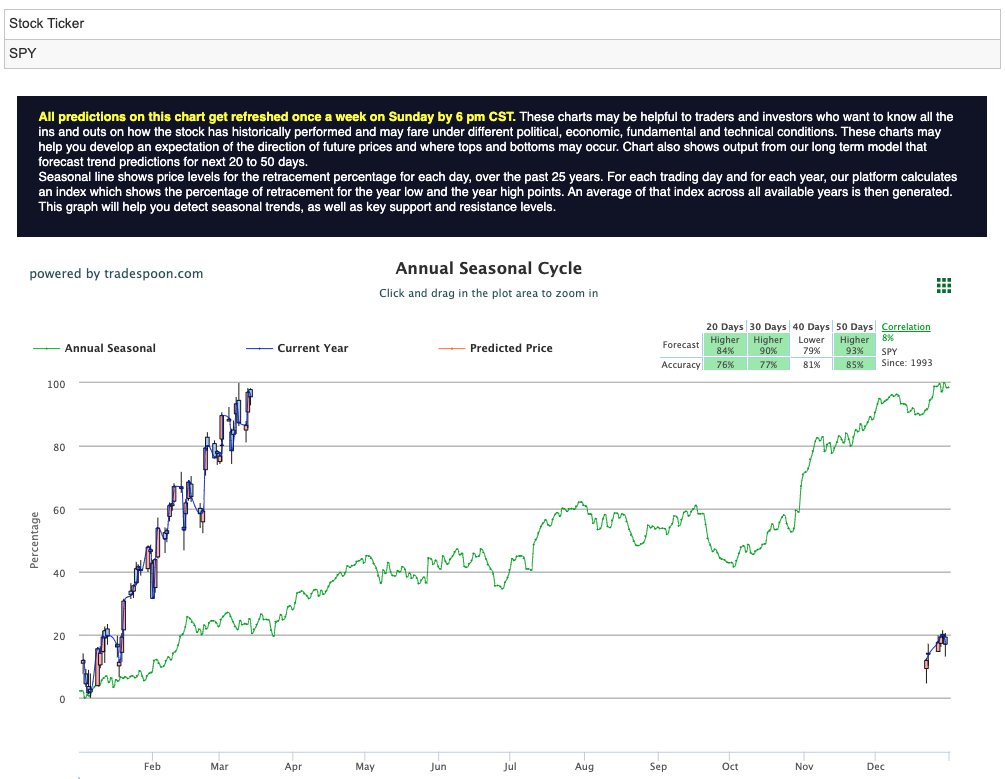

The stock market’s recent surge, propelled by tech titans and fueled by speculation surrounding the Federal Reserve’s decision, underscores the dynamism and unpredictability of today’s financial markets. As investors navigate through uncertain waters, strategic positioning and a keen eye for opportunity will be crucial in weathering the storm and emerging stronger on the other side. Notwithstanding, a note of caution resonates among market analysts, as many underscore the significance of short-term support levels ranging from 480 to 490 on the S&P 500 ETF (SPY). This cautious sentiment reflects investors’ guarded approach amidst the mounting pressures of inflation. For reference, the SPY Seasonal Chart is shown below:

In the face of this economic turbulence, investors are adopting a cautious stance, navigating the treacherous waters with prudence and foresight. The looming Federal Reserve decision looms large on the horizon, serving as a compass for market sentiment and guiding investment strategies in the days ahead.

As the market braces for potential turbulence, all eyes remain fixed on the Federal Reserve’s impending decision and its ramifications for interest rates and inflation. While value stocks bask in the glow of a potential yield curve normalization, lingering inflationary concerns cast a shadow of doubt, underscoring the need for vigilance and adaptability in the ever-evolving financial landscape.

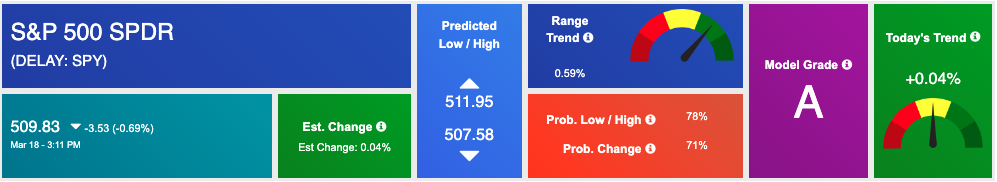

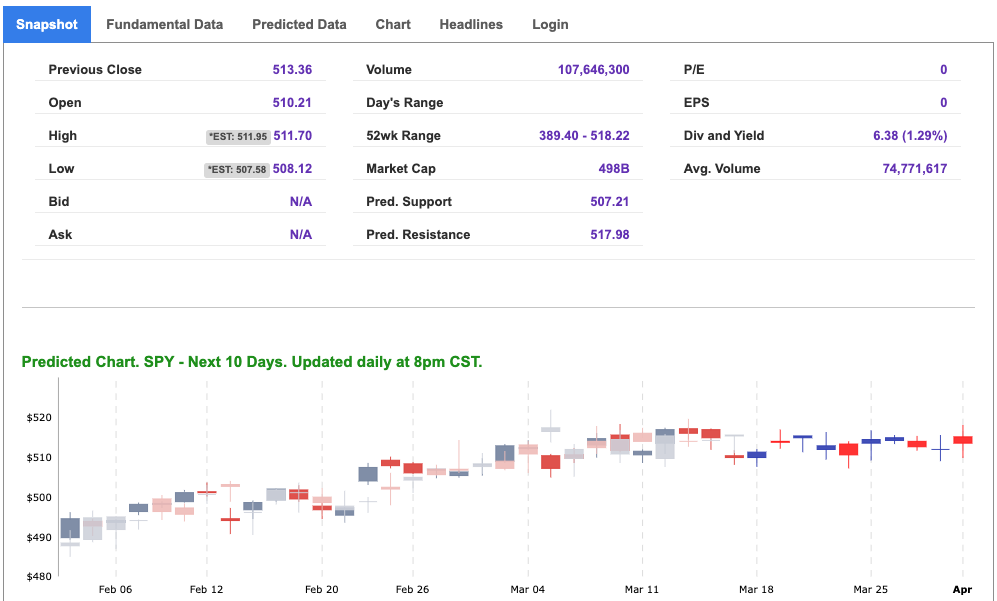

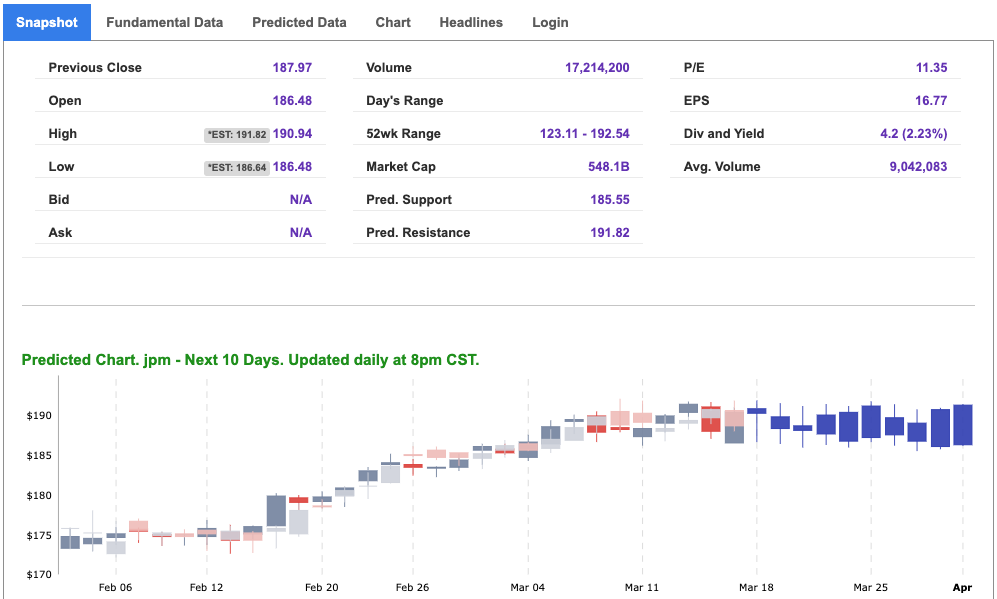

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

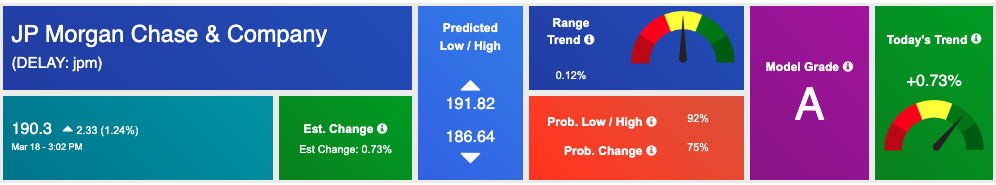

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, JPM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

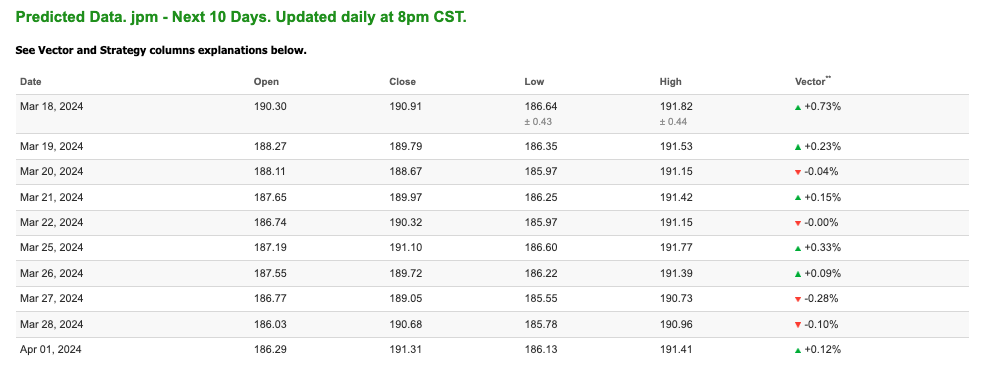

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $76.33 per barrel, up 0.03%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.59 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

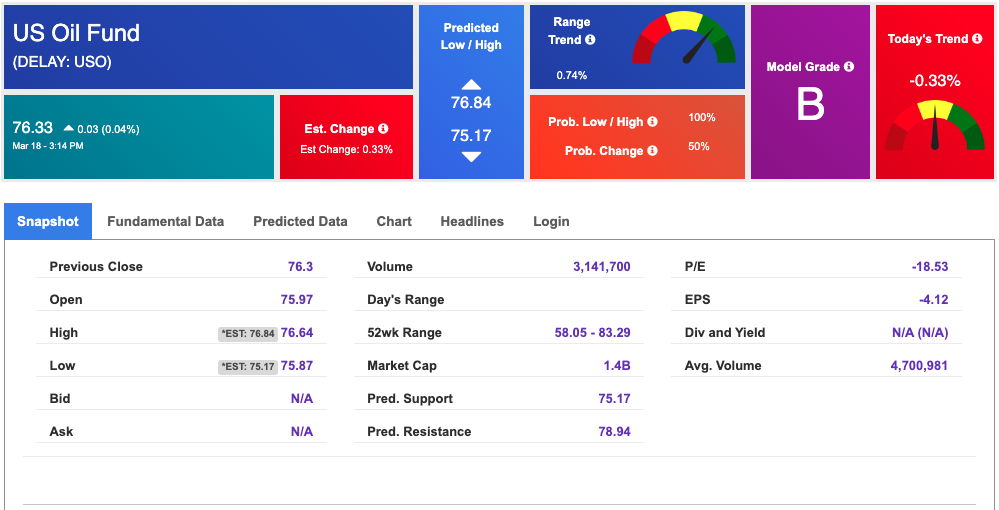

The price for the Gold Continuous Contract (GC00) is up 0.09% at $2163.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $199.71 at the time of publication. Vector signals show -0.07% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

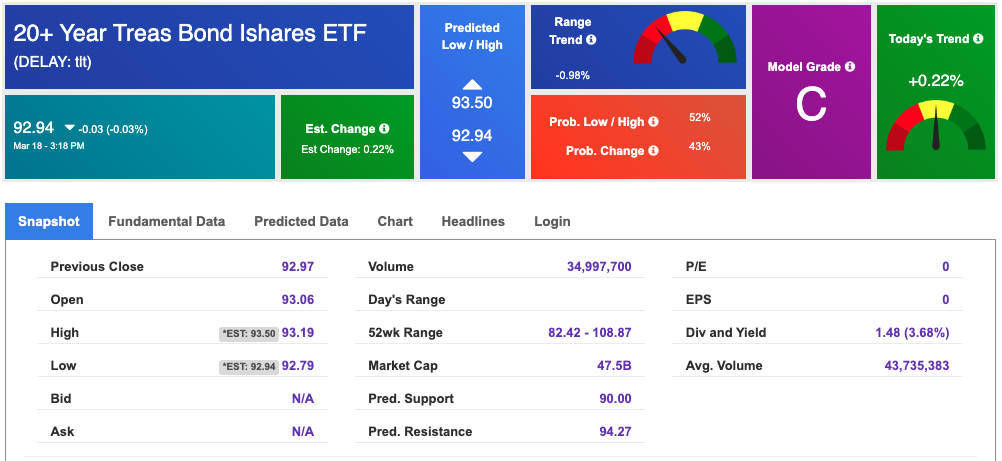

The yield on the 10-year Treasury note is up at 4.332% at the time of publication.

The yield on the 30-year Treasury note is up at 4.456% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

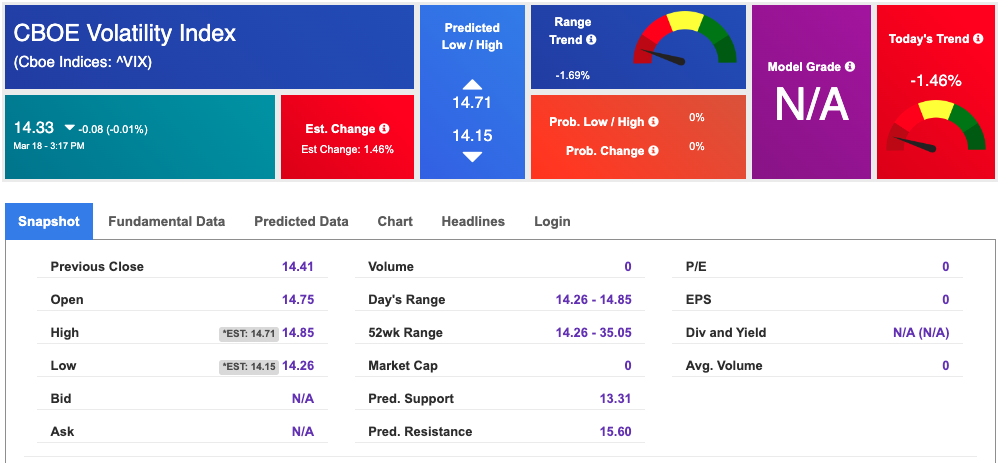

The CBOE Volatility Index (^VIX) is priced at $14.33 down 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!