This week kicked off with a mixed performance across major indexes as the market continues to be influenced by a range of factors, from tariff tensions to upcoming earnings reports. On Monday, the S&P 500 and Dow Jones Industrial Average managed to end the day in positive territory, while the Nasdaq Composite struggled, closing down more than 1%. Tech stocks faced notable headwinds, particularly as tariffs and broader market sentiment continue to weigh on investor confidence.

Although no major tariff-related news emerged on Monday, the ongoing trade tensions between the U.S. and China remain a dominant theme. The lack of progress in trade talks continues to put pressure on markets, particularly those sensitive to tariff impacts. Treasury Secretary Scott Bessent remarked that the ball is in China’s court to de-escalate trade tensions, with the expectation that Chinese exports to the U.S. could face significant declines if tariffs remain in place. Projections suggest a contraction of up to two-thirds in Chinese goods exports to the U.S. this year, which could put millions of jobs at risk. These ongoing uncertainties around tariffs remain an ever-present concern for investors.

While trade uncertainty lingers, the market did see a boost last week after President Trump indicated his openness to a trade deal with China and affirmed his support for Federal Reserve Chairman Jerome Powell. As a result, the S&P 500 finished the week with a solid 4% gain, marking the highest level since Trump’s announcement on April 2 regarding tariffs. Yet, despite this optimism, the uncertainty surrounding tariffs remains unresolved. The clock is ticking on the 90-day window before the latest tariffs take effect, with no clear deals in sight with other countries to mitigate their impact.

With earnings season in full swing, investors are turning their attention to corporate results and economic data to provide a clearer picture of the health of the economy. This week, roughly a third of the S&P 500 companies are set to report quarterly earnings, including some of the most prominent names in tech. Companies like Apple, Meta Platforms, Amazon, and Microsoft will all be reporting results, and their performance is likely to be closely watched as a gauge for broader market sentiment.

Monday saw tech stocks like Nvidia, Micron Technology, Tesla, and Advanced Micro Devices struggle, with Nvidia’s 3.6% decline marking the worst performance in the S&P 500. Meanwhile, companies outside of tech, including Coca-Cola, Visa, and McDonald’s, will also be releasing earnings, with investors looking for insights into consumer behavior, inflationary pressures, and potential risks in the global supply chain.

In terms of economic reports, this week’s focus will be on key data points including the ADP Employment Report, the first-quarter GDP update, personal income and spending data, and the PCE Price Index. These reports will help shape expectations around economic growth and inflation, with the GDP update particularly crucial in providing insight into the state of the economy. Additionally, manufacturing data, including the ISM Manufacturing Index, and employment figures will offer a snapshot of labor market conditions.

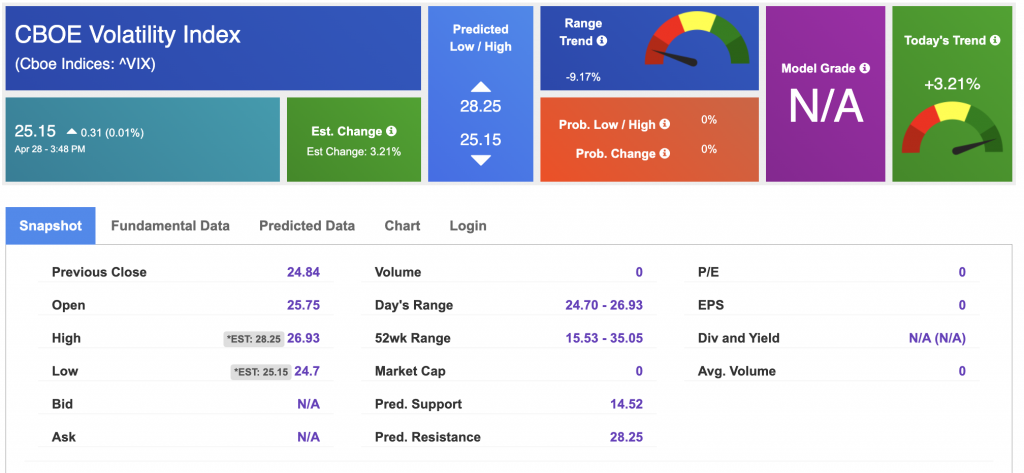

As of Monday morning, the VIX, a key gauge of market volatility, stood at 25.56—significantly lower than the spike earlier this month, when it surged as high as 60. A VIX level above 20 typically signals heightened uncertainty among traders, and the fact that it has been hovering above 30 for much of April is a reflection of ongoing market anxiety.

Market participants are now forecasting a higher likelihood of a rate cut during the Federal Open Market Committee (FOMC) meeting in June, as opposed to the May meeting. The next FOMC meeting is set for May 7, and while rate cuts are not expected imminently, traders are anticipating more clarity in the coming weeks regarding the Federal Reserve’s stance on interest rates. The shift in expectations reflects concerns about economic growth, particularly in light of persistent inflation and the effects of tariffs on trade.

With earnings reports in full swing and key economic data on the horizon, this week promises to be a pivotal one for market direction. As the market braces for another round of earnings, the economic landscape will also play a key role in shaping sentiment. Economic reports—especially the GDP update and employment data—are likely to be major market movers, potentially offering more clarity on the Fed’s next move.

The trade war with China continues to cast a shadow over the market, with tariffs remaining a key concern. While the broader market may move higher, as seen with the Dow and S&P 500’s modest gains, the tech sector is likely to face ongoing challenges in the near term, particularly as major tech stocks like Nvidia and Tesla struggle. However, with the spotlight now on earnings and economic reports, investors will be closely watching how companies navigate inflationary pressures, labor market conditions, and global supply chain challenges.

As the market remains volatile and uncertainty persists, traders and investors will need to stay focused on the key data points and earnings results that will shape the outlook for the rest of the year. The continued tariff drama, combined with the economic data to come, could determine whether the current market rally has legs or if the headwinds will persist for the tech-heavy Nasdaq.

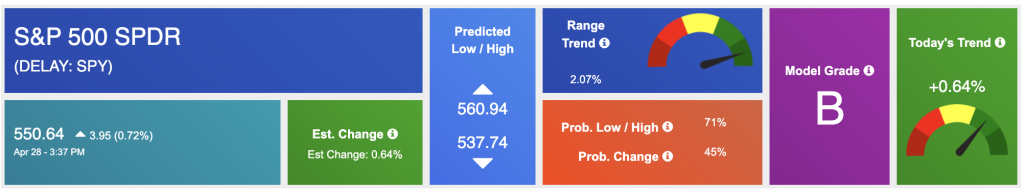

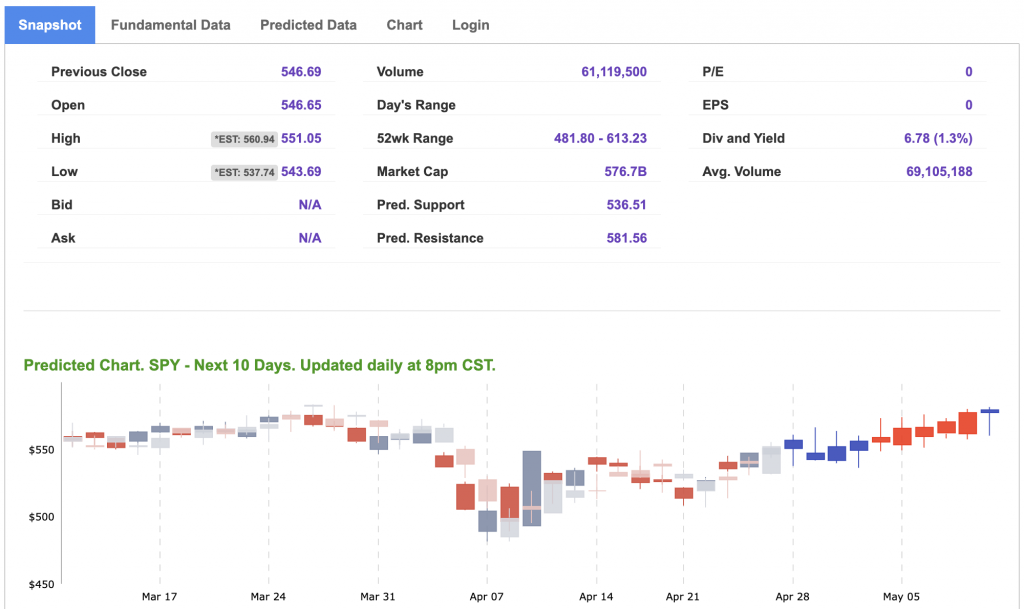

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

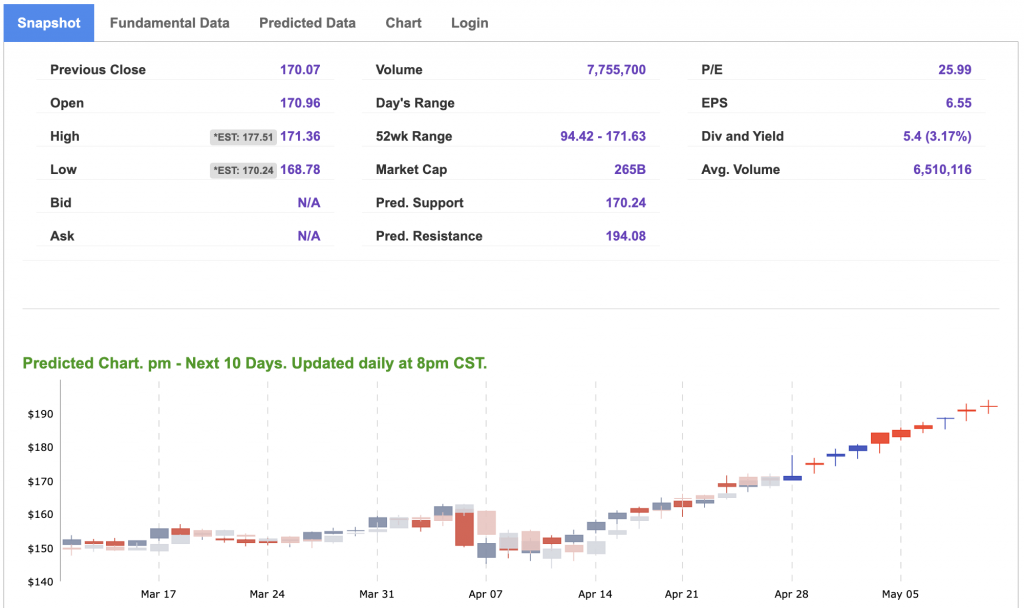

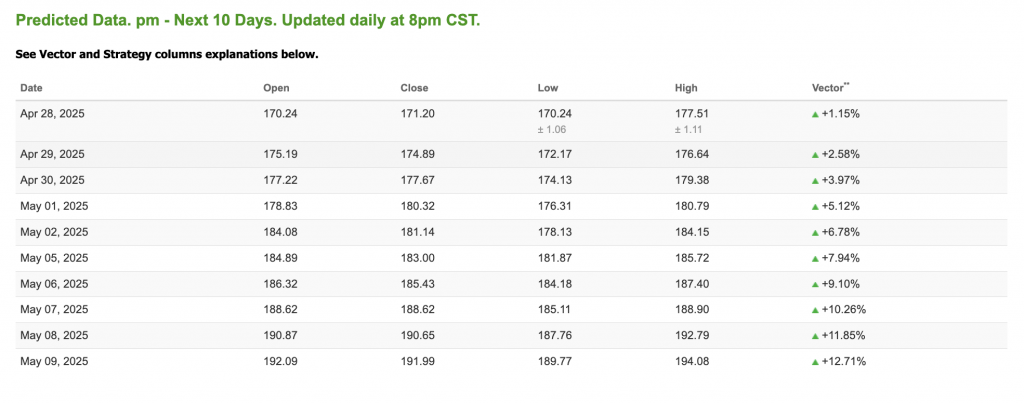

Our featured symbol for Tuesday is PM. Philip Morris International – PM is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $170.24 with a vector of +1.15% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, PM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $61.89 per barrel, down 1.79%, at the time of publication.

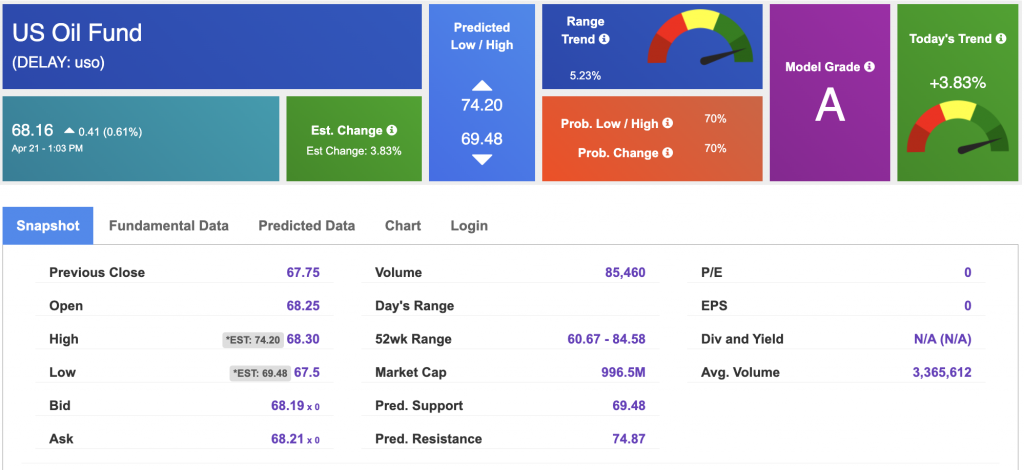

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $68.16 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is up 1.72% at $3,355.10 at the time of publication.

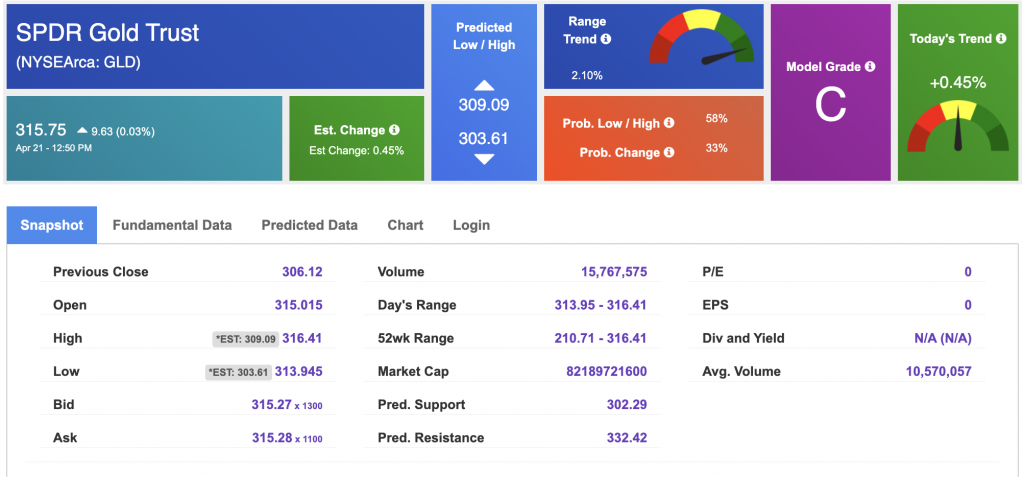

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $315.75 at the time of publication. Vector signals show +0.45% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

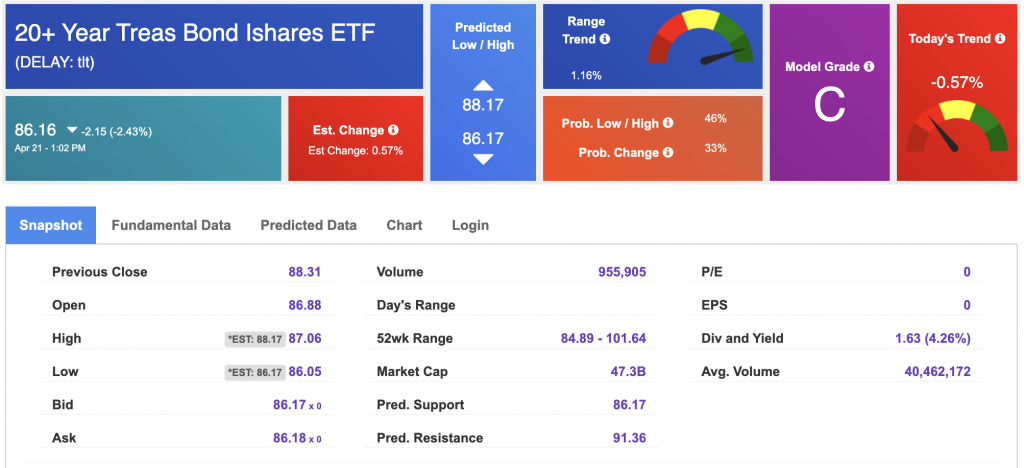

The yield on the 10-year Treasury note is down at 4.211% at the time of publication.

The yield on the 30-year Treasury note is down at 4.687% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $25.15 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!