RoboStreet – September 12, 2025

AI gains drove indexes to new highs, but weak jobs, sticky inflation, and looming Fed cuts reveal a fragile foundation

The first full week of September highlighted just how divided the market remains. On one hand, the Nasdaq pushed into uncharted territory, setting a fresh intraday high of 21,885.62 as the AI trade kept rolling. Broadcom, Lam Research, Palantir, and Nvidia carried much of the weight, powering record closes even as fewer than half of S&P 500 components finished the week higher. Beneath the surface, breadth was weak, leaving investors uneasy about just how narrow the rally has become. Treasury yields moved lower as rate-cut expectations intensified, with the 10-year note drifting down toward 4.08 percent while the 30-year hovered close to 5 percent. Volatility remained muted, with the VIX holding around 15, though the calm reflected investors waiting for the week’s data releases rather than true confidence.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In short, the rally’s strength was undeniable at the index level, but the foundation underneath looked increasingly fragile. What investors celebrated as Fed-driven relief was also a reminder that rate cuts are not being delivered in a vacuum—they are coming because the economy is slowing.

Early-Week Headwinds: Tariffs and Trade Policy

Markets began the week under pressure as trade returned to the spotlight. A federal appeals court struck down much of the Trump-era “reciprocal” tariff framework as unlawful, though the duties remain in place pending appeal. The legal setback underscored the risks tariffs continue to pose, from distorted jobs data to higher producer prices. Consumer staples and industrials were among the first to sag under the renewed cloud of uncertainty. Ironically, the ruling also eased some long-term fears by suggesting a path toward rolling back emergency tariff powers, which helped stocks regain footing mid-week. Still, tariff pressures remain embedded in inflation metrics and hiring patterns, and investors recognized that this legal twist was unlikely to resolve those distortions quickly.

Mid-Week Boost: Antitrust Relief and AI Momentum

Relief arrived mid-week when Alphabet secured a favorable ruling in its U.S. antitrust case. Rather than a forced breakup of Chrome or Android, the company will only need to unwind exclusive search deals and share some data. The narrower scope of penalties sparked a 10 percent surge in Alphabet’s stock and lifted the entire Communication Services sector. Apple also benefited, as its lucrative Google search deal avoided disruption. The rally reinforced the sense that Big Tech can still navigate regulatory challenges without losing the growth engines that drive its valuation.

The momentum intensified when Broadcom reported another blowout quarter. Revenue rose 22 percent year-over-year to $15.96 billion, powered by a $10 billion wave of new AI chip orders. AI sales soared more than 60 percent, prompting management to raise forward guidance. Shares spiked nearly 10 percent, helping offset investor anxiety around weakening macro data. Nvidia, Palantir, and Lam Research all rode the AI tide higher, ensuring the Nasdaq finished the week in positive territory even as other sectors struggled.

Labor Market Shock and Recession Fears

The most consequential data of the week arrived with the August jobs report, which confirmed that the labor market is losing momentum. Nonfarm payrolls increased by just 22,000, far below expectations, and prior months were revised downward to show a net loss of 13,000. The unemployment rate rose to 4.3 percent, the highest since 2021. Weakness was concentrated in manufacturing and wholesale trade, though healthcare and services added enough jobs to prevent an outright contraction.

Initially, the weak data was welcomed as further confirmation that the Federal Reserve will cut rates at its September 17 meeting. Fed funds futures now price in near certainty of a quarter-point cut, with more than a 70 percent chance of three cuts by year-end. But sentiment quickly turned more cautious. Easing policy may not be enough to stabilize an economy already flirting with recession, and the prospect of cuts underscored the risks of being too late rather than too early.

Inflation Watch: CPI and Jobless Claims

Thursday’s CPI report added another layer of complexity. Headline inflation ticked up to 2.9 percent year-over-year, from 2.7 percent in July, while core inflation held steady at 3.1 percent. On a monthly basis, prices climbed 0.4 percent overall and 0.3 percent on a core basis, underscoring that inflation is not retreating as quickly as the Fed might prefer. At the same time, jobless claims spiked to 263,000, the highest since 2021. Together, the two reports created a picture of mild stagflation—sticky prices colliding with weaker job growth.

Markets took the news as a green light for the Fed to prioritize growth. Stocks and bonds rallied in tandem, with the Dow surging nearly 600 points, the S&P 500 gaining 0.8 percent, and the Nasdaq adding 0.7 percent. The dollar weakened slightly, down 0.3 percent, as traders leaned into dovish bets. Bitcoin joined the rally with a modest gain. The Treasury curve flattened as yields fell across maturities, signaling growing conviction that cuts are imminent.

Sector and Asset Class Moves

Defensive positioning showed through despite record closes. Gold surged to a new all-time high near $3,685 an ounce, benefiting from falling yields and safe-haven demand as investors hedged against both recession and policy missteps. Small-cap stocks, represented by the Russell 2000, rose more than one percent on hopes that lower rates would revive domestic growth. Energy went the other way: crude oil prices fell nearly two percent as the International Energy Agency forecast higher supply amid weak demand. Energy stocks finished the week among the worst performers, joining consumer staples and banks, which were weighed down by lending concerns following the jobs report.

The fiscal backdrop provided another source of unease. The U.S. budget deficit has widened to nearly $2 trillion this fiscal year, limiting the government’s flexibility should the slowdown deepen. With both monetary and fiscal levers under strain, investors are increasingly aware that cushioning the downturn may be harder than in past cycles.

Market Outlook

For now, the S&P 500 remains rangebound, with resistance clustered around 650 to 660 and support between 600 and 620. Volatility is compressed, but the calm is deceptive. Headline-driven swings are likely to continue until the Federal Reserve clarifies its path at the September meeting. Investors are wrestling with the same central question: will rate cuts arrive in time to stabilize activity, or will they chase a downturn that is already underway?

The coming weeks will provide critical answers. Oracle and Chewy’s earnings reports will test whether consumer and enterprise spending are softening in line with macro trends. The Fed’s meeting on September 17 will set the tone for the remainder of the year, while ongoing tariff litigation and supply-side energy concerns remain potential sources of volatility. For now, the path of least resistance is sideways trading with sharp swings, as markets attempt to balance record-breaking enthusiasm for tech against unmistakable signs of economic fatigue.

In this climate of mixed signals and subdued volatility, a disciplined, data-driven approach is more important than ever. At Tradespoon, our adaptive predictive models are designed to respond in real time—surfacing breakout candidates, uncovering hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by the noise and contradictions, you’re not alone. Let our tools help you cut through the clutter and stay focused on what truly matters.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

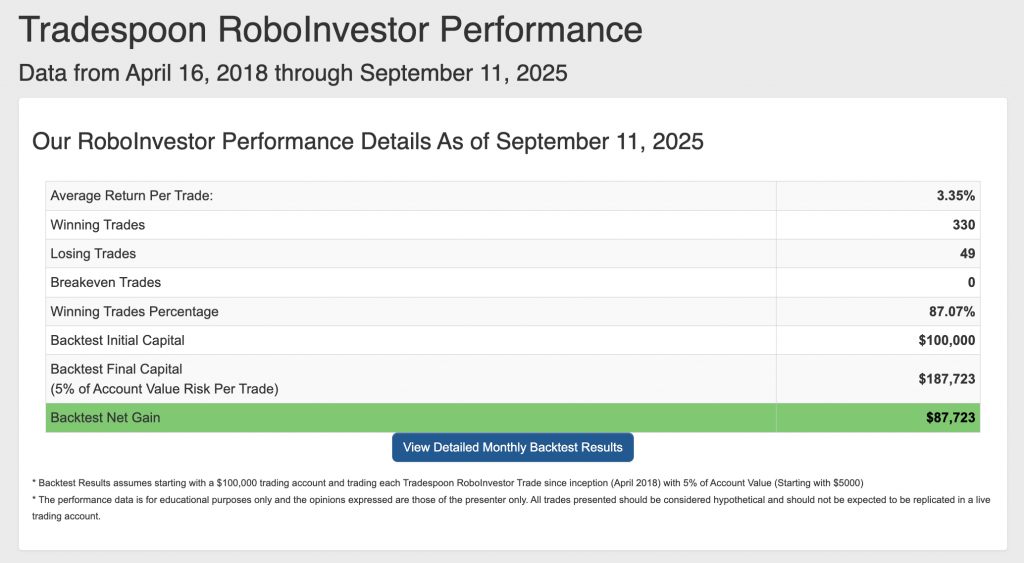

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.07% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!