RoboStreet – May 1, 2025

The U.S. stock market has been navigating a volatile landscape, with recent tariff-related turbulence giving way to cautious optimism. After experiencing significant selloffs and heightened volatility due to tariff tensions, major indices are set to close their second consecutive week of gains, thanks in part to stronger-than-expected earnings from tech giants and growing clarity surrounding the Federal Reserve’s policy decisions.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This week started with a complex set of influences on the U.S. stock market, from tariff developments to corporate earnings results. The S&P 500 and Dow Jones Industrial Average managed to climb higher on Monday, closing in positive territory, while the Nasdaq Composite was weighed down by headwinds from the tech sector, closing down over 1%.

The standout piece of economic data was the U.S. GDP contraction for Q1 2025, which came in at -0.3% annualized, surprising markets by falling short of expectations and contrasting sharply with the 2.4% growth seen in Q4 2024. This contraction, driven by weaker consumer spending and surging imports as businesses stockpiled ahead of tariffs, initially triggered a wave of market declines. Investors were left grappling with the implications of this negative growth figure, which spurred fears of a potential recession.

However, by midday, the market found some stabilization as investor sentiment improved, particularly on the back of more positive earnings reports from tech companies like Microsoft and Meta Platforms.

Tariffs remained a central theme influencing market sentiment this week. On April 29, markets rose as China eased tariffs on select U.S. goods, providing some reprieve for U.S. companies that had been facing uncertainty due to escalating trade tensions. The S&P 500, Nasdaq, and Dow all saw gains, but the uncertainty surrounding tariffs continues to cloud the outlook for companies, particularly those that rely heavily on imports and exports.

Companies like Stellantis and Polestar suspended their 2025 forecasts due to ongoing tariff uncertainty, while General Motors lowered its operating profit forecast for the year by $3 billion, citing the adverse impact of tariffs. The effects of these tariffs continue to ripple through the market, with firms adjusting their projections and stock prices fluctuating in response to the ongoing trade climate.

Meanwhile, consumer confidence data released on April 29 showed a concerning drop. The Conference Board’s Consumer Confidence Index fell to 86, a five-month low, driven by inflationary concerns stemming from tariffs. The Expectations Index, a subcomponent of the report, plunged to 54.4, its lowest level since October 2011, signaling deep pessimism about the outlook for the economy, jobs, and income growth. Though stocks initially faltered in response, markets later regained some momentum.

Earnings season continued to play a pivotal role in shaping market sentiment. Microsoft reported better-than-expected fiscal Q3 earnings, with revenue rising 13% year-over-year, driven by robust growth in its cloud-computing division. The company’s cloud business, which includes Azure, saw a 21% revenue increase, further bolstering investor confidence in its future prospects. The stock jumped more than 8% on the news, offering a welcome boost to the broader market.

Meta Platforms, the parent company of Facebook and Instagram, also posted strong results, reporting a 16% year-over-year increase in revenue. The company exceeded analysts’ expectations, driven by a 10% growth in advertising prices, which more than doubled projections. Meta’s positive results helped to lift its stock by 6.4%, further contributing to the upward momentum in the tech sector.

However, not all earnings reports were positive. McDonald’s stock fell 1.3% after reporting a decline in U.S. comparable-store sales, missing earnings expectations. Similarly, Qualcomm’s strong fiscal Q2 earnings were overshadowed by disappointing guidance for Q3, with the stock falling 5.8% in response.

Meanwhile, CVS Health saw a major upside, rising 9.5% after reporting earnings that far exceeded expectations. The healthcare giant raised its full-year earnings guidance, helping to bolster investor sentiment within the health sector.

The Federal Reserve’s stance on interest rates continues to be a crucial factor for investors. With inflation still a concern and the economy showing mixed signs of growth, the market is keenly watching the Fed’s upcoming moves. The expectation is that the Fed will likely hold rates steady during its May meeting, with the possibility of a rate hike in June depending on inflation data and broader economic conditions.

In the bond market, Treasury yields have remained volatile, trading between 3.6% and 4.8% this week. The yield curve has seen a slight flattening after the release of soft inflation data, but overall, bond markets are still reflecting concerns over persistent inflationary pressures. Treasury yields are likely to continue fluctuating, with the market eagerly awaiting the April jobs report, which is expected to show slower job growth compared to March.

This week also saw a rise in initial jobless claims, which surged to 241,000 in the week through April 26, the highest level since February. The uptick in claims, which exceeded analysts’ expectations, raised concerns ahead of the upcoming jobs report. Although jobless claims remain within a broader range that has held steady over the past year, the increase in unemployment claims signals potential weaknesses in the labor market.

Economists are expecting the April jobs report to show a significant slowdown in job creation compared to the strong figures from March. Unemployment is expected to remain at 4.2%, but rising jobless claims and a cooling labor market add to the growing concerns about a potential recession.

In light of the increasing recession risks and the rising unemployment rate, I am currently adopting a market-neutral stance. While the market has shown some resilience, the overall economic backdrop remains challenging, with trade tensions, weak consumer sentiment, and rising jobless claims adding to the risks.

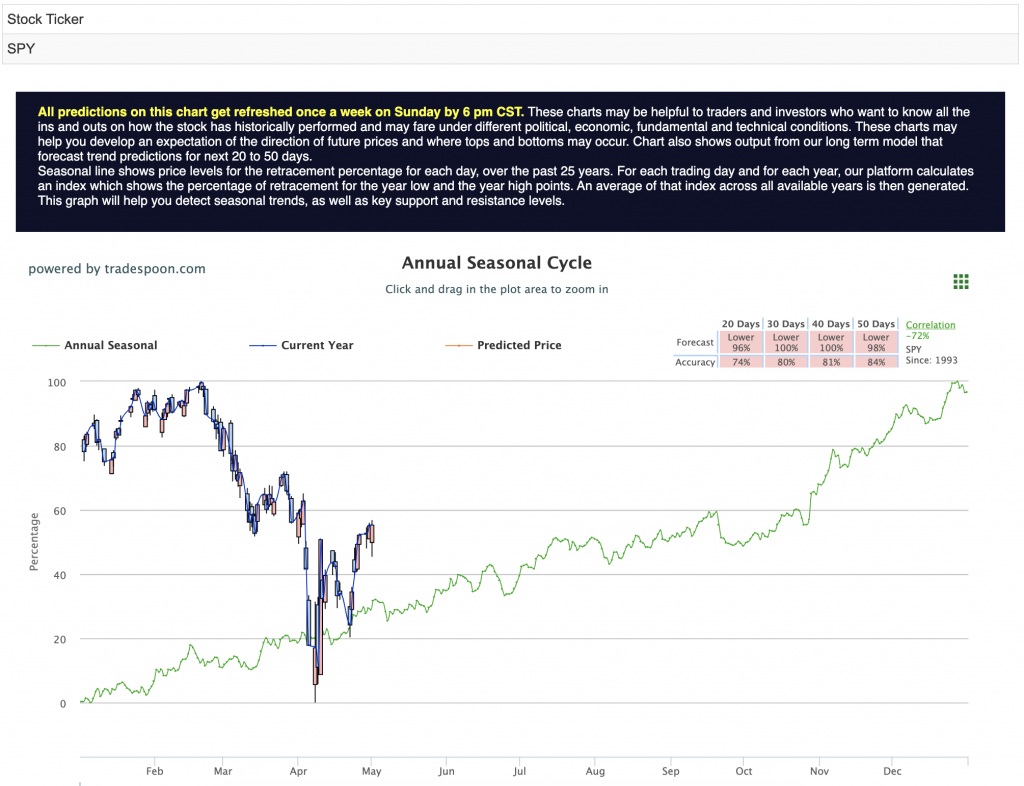

In the short term, the S&P 500 has resistance levels around $565–580, with key support between $500–530 over the next few months. The market is likely to trade sideways in the near term, with volatility persisting. Long-term trends remain under pressure, driven by the risk of higher interest rates for an extended period and growing concerns about the broader economic slowdown. For reference, the SPY Seasonal Chart is shown below:

Despite a turbulent start to the week, the U.S. stock market is displaying signs of recovery, fueled by strong earnings from key tech companies and a potential shift in the Federal Reserve’s policy stance. However, with tariffs, a sluggish labor market, and soft GDP data continuing to weigh on investor sentiment, the outlook remains uncertain. As we move into the summer months, investors will need to remain vigilant, balancing short-term optimism with long-term caution as the risks of an economic slowdown loom large.

In this complex environment, a well-balanced and diversified strategy is essential. Agility is your advantage—capitalize on emerging opportunities while protecting against potential risks. Staying informed during earnings season and as macroeconomic conditions unfold will help you make timely, well-informed decisions.

While market challenges persist, ample opportunities for growth and strategic positioning remain. By focusing on key indicators and maintaining discipline, you can confidently navigate the market and position yourself for success.

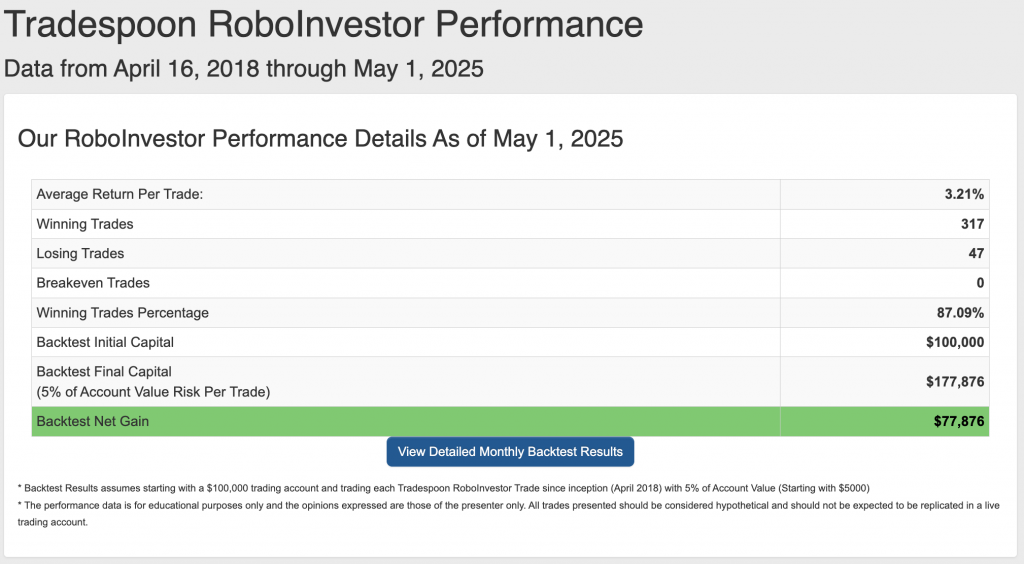

Step into the future of investing with RoboInvestor—your AI-powered advisory service designed to pinpoint high-profit opportunities in today’s dynamic market. Our advanced technology cuts through the noise, providing clear, data-driven insights and strategies. Say goodbye to emotional bias and hello to precision in every trade.

Every other weekend, you’ll receive our exclusive newsletter featuring my latest market analysis, technical outlooks, updates on existing positions, and fresh trade recommendations to act on when the market opens on Monday.

Whether it’s blue-chip stocks, ETFs, commodities, or even inverse ETFs, RoboInvestor offers a flexible approach tailored to current market conditions. With a model portfolio holding 12 to 25 positions, we’ve recently adopted a more selective strategy, focusing on the best opportunities for growth while remaining cautious.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.09% going back to April 2018.

As we enter Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!