RoboStreet – June 13, 2025

As we near the midpoint of June, markets continue to walk a precarious tightrope between optimism and anxiety. A quieter week for volume didn’t mean a lack of drama—investors were juggling a fresh batch of earnings reports, ongoing trade tensions between the U.S. and China, renewed tariff threats from Donald Trump, and a critical set of inflation and labor data that added new wrinkles to the macroeconomic picture.

Despite all this, major indices edged higher. The S&P 500 gained 0.4% on Thursday, putting it just 1.7% shy of its all-time closing high of 6144.15. The Nasdaq followed suit, rising 0.2%, while the Dow ticked up 102 points, or 0.2%. While this may appear like a quiet grind higher, under the surface, the market continues to digest a complex mix of crosscurrents.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The market’s modest rally was largely driven by Thursday’s release of the Consumer Price Index (CPI) for May, which came in softer than expected. Year-over-year inflation eased to 2.5%, a signal that price pressures may be gradually subsiding. That reading gave bulls a reason to breathe, particularly as it coincided with a similarly modest Producer Price Index (PPI) reading earlier in the week.

Together, the data prompted a shift in Fed expectations. According to CME’s FedWatch Tool, the odds of a rate cut in September now exceed 57%. With interest rates still seen as the most powerful force guiding markets in 2024 and beyond, this news was a welcome reprieve for investors fearing a more hawkish Fed response to stubborn inflation.

Yet while inflation softened, labor data kept sentiment from fully breaking into euphoria. The U.S. economy added 139,000 jobs in May—enough to suggest stability, but not strength. More troubling was the uptick in weekly jobless claims, which rose to 248,000, hinting that the labor market may be slowly losing steam. The unemployment rate held steady at 4.2%, but signs of cooling have added to broader concerns about economic deceleration heading into the second half of the year.

One of the most notable drags on the Dow this week was Boeing (BA), which tumbled nearly 5% on Thursday after reports of a fatal Air India crash involving a Boeing aircraft near Ahmedabad, India. The flight was carrying 242 passengers and crew. In response, the U.S. Department of Transportation announced that both the FAA and NTSB would send teams to assist in the investigation, alongside resources from Boeing and GE.

For investors, the incident triggered a wave of déjà vu. Boeing has been under a cloud since the 737 MAX tragedies in 2018 and 2019, which led to a global grounding and regulatory reckoning. While it’s unclear whether the current crash shares similar technical causes, the market reacted swiftly, repricing the risk premium around Boeing’s commercial aircraft division.

Adobe (ADBE) was the week’s earnings standout. On Thursday, the software giant reported second-quarter adjusted EPS of $5.06 on revenue of $5.87 billion, beating expectations on both counts. Adobe also raised its full-year revenue guidance, crediting a surge in demand for its AI-driven creative tools. The report reinforced a broader bullish narrative around enterprise tech and artificial intelligence, particularly as stocks like Microsoft, Oracle, and IBM also notched all-time highs this week.

In contrast, Lululemon (LULU) delivered a more sobering picture. While earnings beat estimates, the company lowered its forward guidance, citing weakening consumer sentiment and tariff-related uncertainty. The revision rattled retail investors and served as a reminder that discretionary spending, especially on premium brands, may be coming under pressure.

Perhaps the most dramatic development of the week came from the geopolitical front. Former President Donald Trump resurfaced with a proposal to impose sweeping new tariffs—dubbed “Liberation Day” duties—if reelected. His comments sparked a sharp two-day selloff, wiping over $6 trillion from the S&P 500’s market cap and triggering the third-largest weekly spike in the CBOE Volatility Index (VIX) on record.

Markets found some relief as news emerged of a tentative framework between U.S. and Chinese officials to resume rare earth exports and reestablish a “trade cease-fire.” The agreement, reportedly reached in London, was described by Beijing as “an agreement in principle,” while U.S. Treasury Secretary Scott Bessent, when pressed for details, replied, “We’re in the midst of constructing it.”

The lack of clarity sent mixed signals. Investors are wary of another drawn-out trade saga, especially one that could drag other sectors, like semiconductors, autos, and retail, into another supply chain nightmare. Nonetheless, markets stabilized by week’s end, perhaps taking solace in the fact that, at least for now, escalation has been paused.

Volatility remains low (VIX near 17), and markets have absorbed recent headlines with more resilience than we saw in April and May. Still, under the surface, there’s an unmistakable hesitancy—every bounce feels fragile, every new high comes with a caveat.

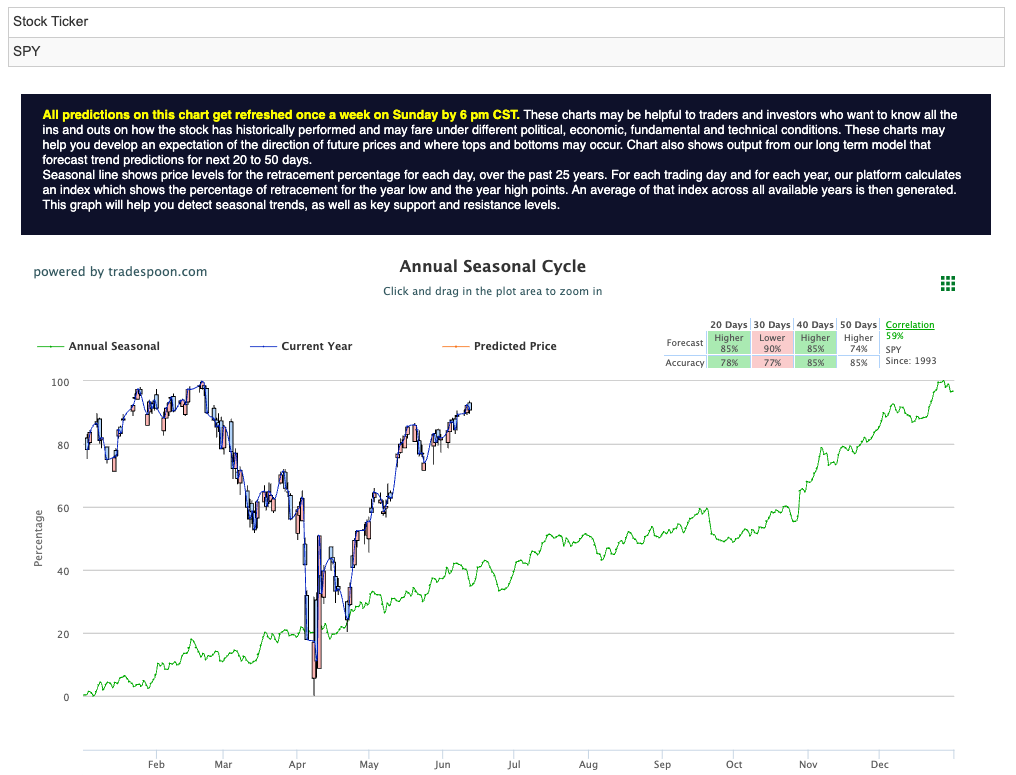

From a technical perspective, SPY continues to hover just below its all-time high, with upside targets in the $600–$620 range. Key support sits around $540–$550. The current trading behavior suggests we’re entering a sideways consolidation phase—a pattern often seen when macro narratives are unclear and institutional investors await stronger conviction. For reference, the SPY Seasonal Chart is shown below:

The long-term trend, however, remains under pressure. The probability of a “higher-for-longer” interest rate environment combined with rising unemployment and renewed tariff risks suggests the next few months may remain range-bound and choppy.

Despite the noise, the market’s ability to grind higher this week—even amid fresh geopolitical tension and mixed economic signals—is a testament to investor resilience. But resilience is not the same as conviction. For now, traders appear content riding momentum and reacting to data, rather than positioning for a clear directional move.

As we head into next week, attention will shift to the upcoming FOMC meeting, more earnings results (including from FedEx and Lennar), and any additional commentary on trade from Washington and Beijing. In this environment, staying nimble and data-driven remains essential.

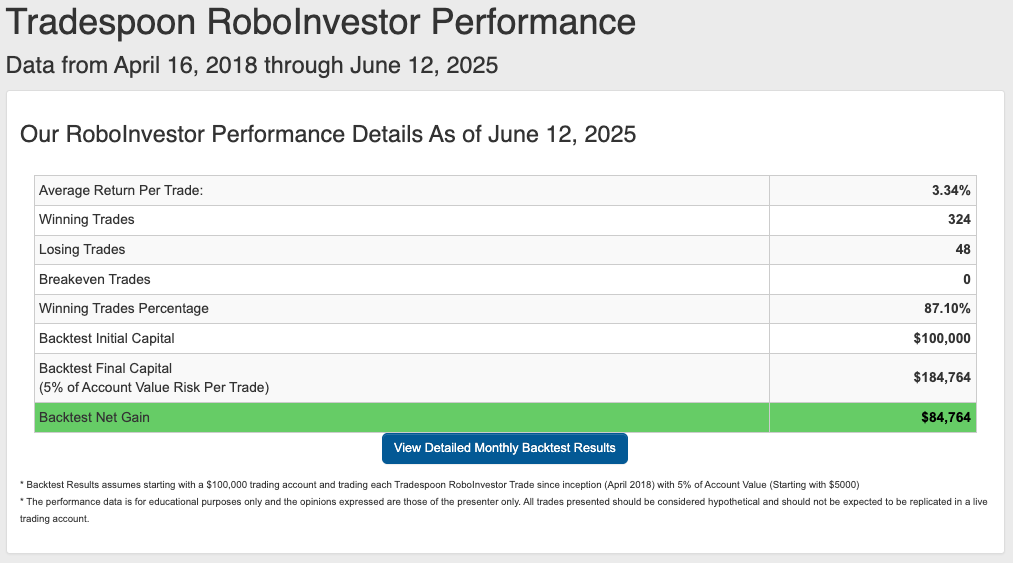

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.10% going back to April 2018.

As we near the end of Q2 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!