Tariffs, Central-Bank Twists, and Tech Titans: Navigating a Market Teetering on Record Highs

RoboStreet – July 24, 2025

This week’s market narrative felt like a tug-of-war between headline risk and hard data, with the S&P 500 and Nasdaq carving out fresh record highs even as traders nervously watched the VIX hover near 16. Tariff volleys from Washington, shifting tides at the European Central Bank, and the opening salvo of Q2 earnings all combined to keep investors on their toes—and yet, through this complexity, a steady thread of underlying resilience emerged.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The drama began Monday, when President Trump announced a sweeping 30 percent tariff on imports from the European Union and Mexico—set to take effect August 1—as well as threats of a 10 percent levy on nations aligned with “anti-American” BRICS policies and a 20 percent duty on Vietnamese goods. Global auto giants quickly sounded the alarm: General Motors alone warned of a $1 billion earnings hit in 2025. The Dow responded with a 600-point drop, its steepest one-day slide in months. Yet by Tuesday afternoon, rumors of informal talks between U.S. and EU trade representatives began circulating. Those whispers helped claw back nearly half of Monday’s losses, illustrating how rapidly sentiment can swing when diplomacy enters the fray.

Amid the tariff headlines, U.S. economic releases offered both reassurance and cause for caution. June retail sales came in at +0.6 percent month-over-month—triple the consensus estimate—driven by strength in online spending and auto purchases. Core retail categories (excluding autos and gas) also outperformed, suggesting that consumers remain willing to spend beyond necessity. Meanwhile, weekly jobless claims dipped to 217,000, down from 221,000, and below the Wall Street Journal consensus of 227,000. Taken together, these readings reinforce the narrative of a stubbornly strong labor market.

But the inflation backdrop remains challenging. June’s Consumer Price Index rose 2.7 percent year-over-year, up from 2.6 percent in May, with tariffs on imported goods contributing to higher core prices. Shelter costs and used-car prices also ticked up, signaling that wage pressures and supply constraints continue to ripple through the economy. As a result, the 10-year Treasury note swung between 3.6 percent and 4.8 percent throughout the week, finally settling closer to 3.6 percent after the employment data, while the two-year yield held near 3.9 percent—levels that underscore how markets are wrestling with the prospect of “higher for longer” interest rates.

On Thursday, the European Central Bank hit pause on its rate-cutting cycle, keeping the main deposit rate at 2 percent after eight consecutive quarter-point reductions. June inflation in the euro area matched the ECB’s 2 percent target, up from 1.9 percent in May, and Q1 GDP growth accelerated to 0.6 percent from 0.3 percent in the previous quarter. Despite this progress, ECB President Christine Lagarde emphasized that the bank remains in “data-dependent wait and see” mode, a refrain that echoed Federal Reserve Chair Jerome Powell’s guidance in the U.S. The parallel stances gave President Trump fresh ammunition to criticize the Fed for not cutting rates, and rumors of potential White House pressure on Powell briefly pushed U.S. short-term yields higher and the dollar lower.

Roughly 50 S&P 500 companies have reported Q2 results so far, and 88 percent have beaten analyst estimates—a strong showing that has helped markets absorb tariff-induced volatility. Consumer staples leaders PepsiCo and Domino’s Pizza cited robust pricing power and supply-chain improvements, driving shares higher. Yet travel and leisure names painted a more uneven picture: United Airlines lowered its full-year revenue guidance, citing weaker cargo demand and shifting booking patterns.

Intel surprised skeptics by demonstrating that its turnaround story is very much alive. Despite one?time charges, management’s upbeat outlook for the coming quarter underscored a belief that demand for its data?center products—and the company’s improving cost structure—will drive a meaningful recovery.

Google once again showed why it remains at the forefront of the cloud revolution. Its latest results reinforced that the company’s deep enterprise relationships and sticky ad business continue to power growth, reassuring investors that both its core search franchise and fast?expanding cloud division have ample room to run.

Tesla provided a cautionary note: shares fell after an earnings miss, a continued slump in European deliveries, and CEO Elon Musk’s warning of “rough quarters” ahead as federal EV tax credits are phased out. These mixed messages underscore how even leading innovators can face headwinds when subsidies and global demand dynamics shift.

Policy announcements drove clear sector divergences. Nvidia rallied after news it had resumed AI-chip exports to China, helping the Nasdaq close at fresh highs on Wednesday and Friday. In contrast, solar-energy stocks like Sunrun and First Solar sold off after the administration rolled back green-energy subsidies, illustrating how policy reversals can quickly upend thematic trades. Financials and consumer staples moved in tighter ranges, with Citigroup and Dollar Tree buoyed by analyst upgrades but facing broader macroeconomic headwinds.

From a technical standpoint, SPY’s near-term upside target sits around $630–640, corresponding to its upper resistance band, while support in the $580–590 area should hold as downside buffers. Given rising recession odds, elevated rates, and labor-market ebbs, a sideways trading range seems the most likely path over the next few months. Longer-term, however, stretched valuations and policy uncertainty argue for caution.

All eyes now shift to the next wave of Q2 reports from IBM, Tesla, Microsoft, Meta Platforms, Apple, and Amazon—companies whose results will either broaden this market rally or expose cracks in leadership. The Fed’s Beige Book, July GDP figures, and Powell’s congressional testimony later this month will offer crucial insights into the Fed’s policy trajectory. In an environment defined by rapid policy shifts, tariff unpredictability, and uneven earnings, disciplined portfolio construction—balancing growth exposure with defensive anchors—remains the best compass for navigating the highs and lows ahead.

That’s where RoboInvestor steps in. Our AI-powered advisory service delivers clear, data-driven insights tailored for today’s complex market. By removing emotional bias and replacing it with analytical precision, RoboInvestor helps you cut through the noise and seize high-probability opportunities with confidence.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

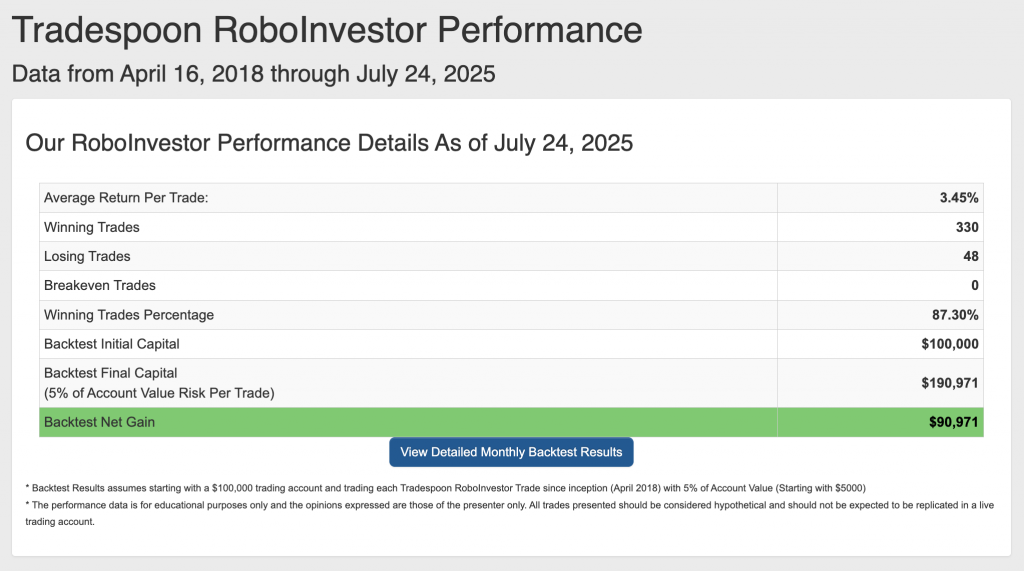

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.30% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!