RoboStreet – July 10, 2025

This week saw Wall Street caught between optimism and uncertainty, as investors grappled with heightened tariff threats, mixed economic data, and the kickoff of a critical earnings season. Markets swung between caution and bullishness, leaving investors navigating turbulent waters.

The week opened with a jolt as Wall Street faced renewed trade war fears. President Trump escalated global trade tensions by threatening tariffs of up to 40% against several countries, including Myanmar, Laos, South Africa, Kazakhstan, and Malaysia, beginning August 1. This stark announcement sent markets tumbling on Monday, with the Dow Jones Industrial Average plunging more than 660 points intraday. All 11 sectors of the S&P 500 closed in negative territory, led by steep losses in consumer discretionary, energy, communication services, and technology.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Though initially rattled, markets displayed resilience as the week progressed. By Thursday, traders seemed to have shrugged off ongoing tariff threats, including new 50% tariffs aimed at Brazil, linked to political developments involving former Brazilian President Jair Bolsonaro and disputes over U.S. tech firms. Despite the volatility, the Dow Jones surged 300 points on Thursday, buoyed by strength outside the struggling tech and communication sectors, indicating selective investor confidence amid broader concerns.

Wednesday brought clarity from the Federal Reserve’s June meeting minutes, which signaled cautious optimism for further rate cuts in 2025, boosting market sentiment. The Fed maintained its stance of a 4.25%–4.50% benchmark interest rate, though traders reduced their expectations for an imminent July rate cut following robust June employment figures (147,000 new jobs versus the 110,000 forecast). This mixed data, accompanied by weaker ISM manufacturing and services reports, kept investors uncertain about the economy’s underlying strength.

Treasury yields remained volatile, with the benchmark 10-year yield settling around 4.35%, reinforcing the market’s cautious outlook amid conflicting economic indicators. Jobless claims data released on Thursday showed slight improvement, dropping to 227,000 from a downwardly revised 232,000, providing modest support for both yields and the dollar.

Earnings season kicked off with notable results, providing critical insights into corporate America’s health. Delta Air Lines took center stage, posting second-quarter earnings that surpassed analyst expectations, prompting shares to surge approximately 12%. Delta’s strong report, which included a reaffirmation of its full-year outlook, lifted airline stocks broadly, notably boosting United Airlines by 14%.

Yet the picture remained mixed across sectors. Tesla awaited key delivery figures, and FedEx’s lack of clear guidance created headwinds in tech and transport stocks. Sector rotation became evident, with consumer discretionary and industrial sectors rallying, even as earlier tech winners like Nvidia, fresh from reaching an unprecedented $4 trillion market valuation, experienced slight pullbacks.

In commodities, oil markets absorbed the news of increased output from OPEC+ members with relative stability, driven by seasonal demand and ongoing skepticism about compliance. Brent crude edged slightly higher, closing near $68.64 per barrel, while WTI dipped marginally.

Meanwhile, Bitcoin surged briefly to a record high of $112,021 midweek before retreating slightly, reflecting investor caution despite the ongoing cryptocurrency enthusiasm.

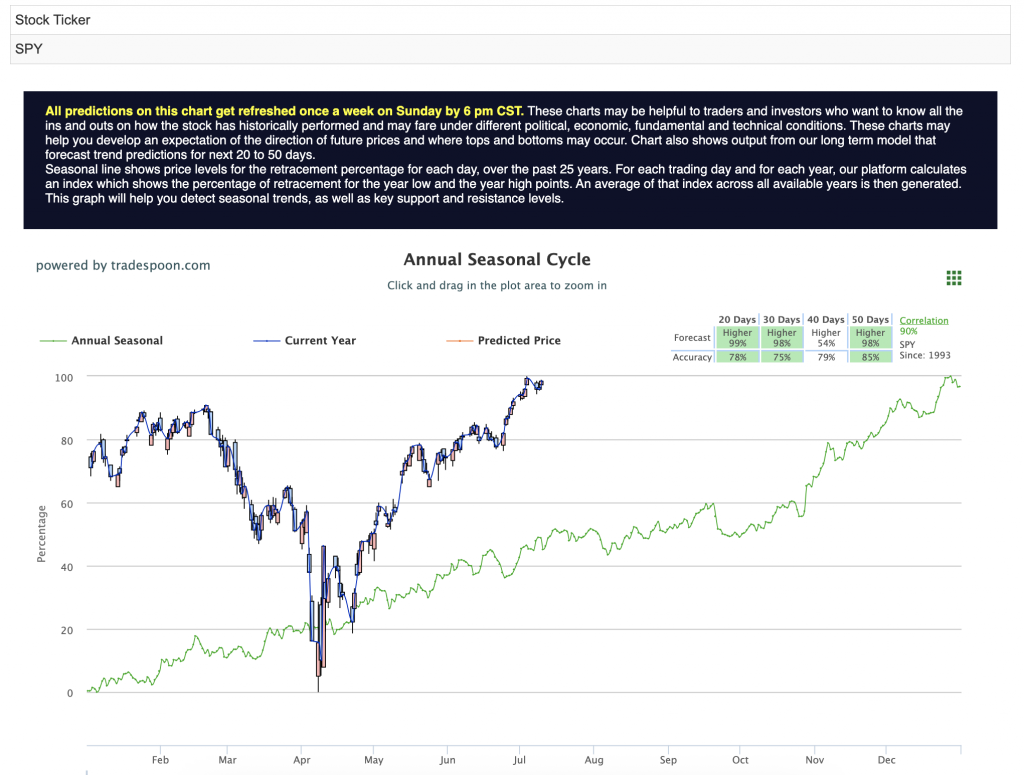

Technical indicators provided key insights into market dynamics. Despite early-week volatility, the SPY ETF showed resilience, holding firm above the 580–590 short-term support range, with potential upside toward 630–640 if corporate earnings hold steady. However, broader market sentiment remains cautious due to persistent threats from rising unemployment and prolonged high interest rates, increasing the odds of a recession. For reference, the SPY Seasonal Chart is shown below:

In this uncertain landscape, a neutral market stance is prudent. Investors are advised to approach opportunities selectively and prioritize risk management. The next several weeks will be crucial, with tariffs, Fed policy clarity, and earnings performance expected to define market direction.

And that’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

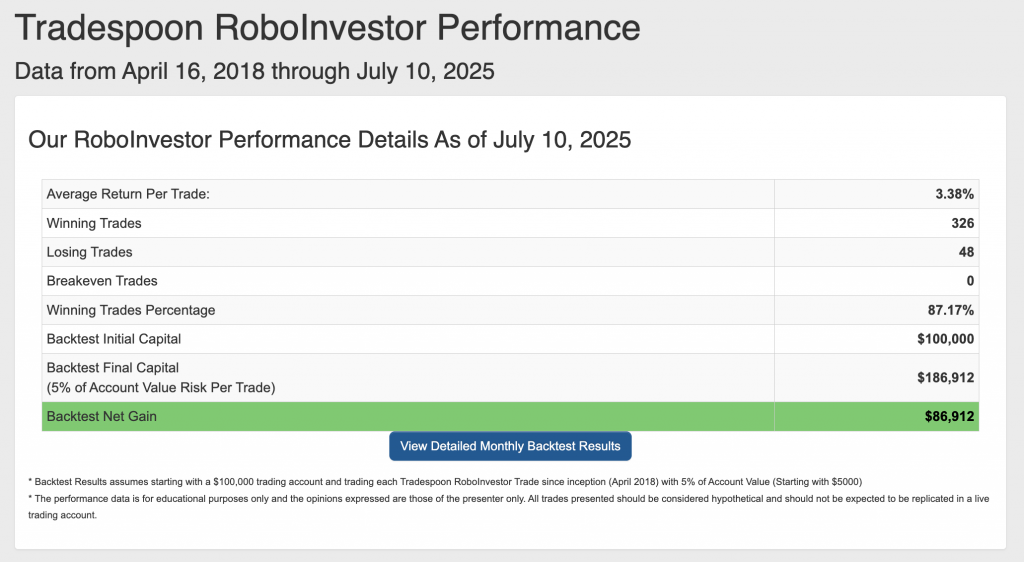

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.10% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!