After coasting to record highs last week, Wall Street was jolted back to reality Monday as a sweeping wave of global trade tensions and tariff threats dragged the major indexes sharply lower. The Dow plunged over 600 points intraday, with all 11 S&P 500 sectors finishing in the red. The hardest-hit areas were the consumer discretionary, energy, communication services, and technology sectors, which are especially sensitive to global trade and consumer sentiment.

By mid-afternoon Monday, the Dow had fallen more than 660 points, while the S&P 500 and Nasdaq Composite dropped 1.2% and 1.3%, respectively. The selloff came just days after both the S&P and Nasdaq notched new all-time highs heading into the holiday-shortened week. But the calm was short-lived.

At the center of the storm: a series of new letters from President Trump targeting countries like Myanmar, Laos, South Africa, Kazakhstan, and Malaysia with potential tariffs ranging from 25% to as high as 40%, starting August 1. These threats echoed earlier warnings sent to Japan and South Korea and reignited concerns that the fragile global trade truce may soon collapse.

What’s especially concerning for investors is the uncertainty surrounding both the scope and timing of these tariffs. While some officials have suggested that there’s still room for negotiation through July, the lack of clear messaging has left markets guessing. Wednesday marks the official end of the administration’s three-month tariff pause, and without resolution, markets could be entering a new period of heightened volatility.

Adding to the unease is the fact that the market has largely run out of major bullish catalysts. The Fed has adopted a more measured tone, and corporate earnings will need to do the heavy lifting from here.

Investors will turn their attention midweek to the release of the Federal Reserve’s June meeting minutes, scheduled for Wednesday. After June’s stronger-than-expected jobs report, expectations for a near-term rate cut have cooled, though volatility in the bond market continues. The 10-year yield remains in a broad 3.6% to 4.8% range, currently trading lower after signs of labor market softening.

Tuesday brings consumer credit data for May, and on Friday, the federal budget report could provide fresh clues on fiscal policy and spending trends.

Meanwhile, earnings season is revving up. Reports expected this week include Delta Air Lines, Conagra Brands, Levi Strauss, Simply Good Foods, PriceSmart, AZZ Inc., Kura Sushi USA, and WD-40. Investors will be looking for signs that corporate America can continue to support elevated stock valuations, especially after such a strong first half of the year.

In commodities, oil prices remained relatively stable despite news that eight OPEC+ members will boost daily output by over 548,000 barrels, well above analyst expectations. Brent crude edged higher by 0.5% to $68.64 per barrel, while WTI slightly declined to $66.91. Seasonal demand and skepticism over OPEC+ compliance likely muted the market’s reaction.

On the currency front, the U.S. dollar found some footing Monday, although a sustained rebound remains elusive. The greenback remains sensitive to both Fed policy expectations and geopolitical risks.

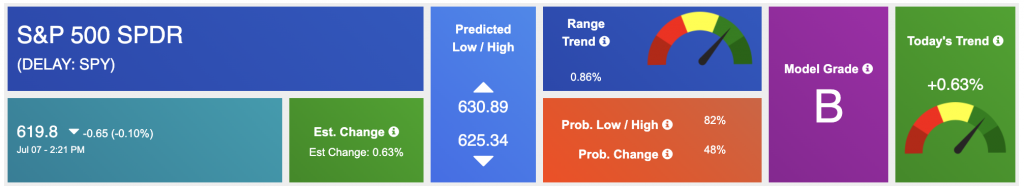

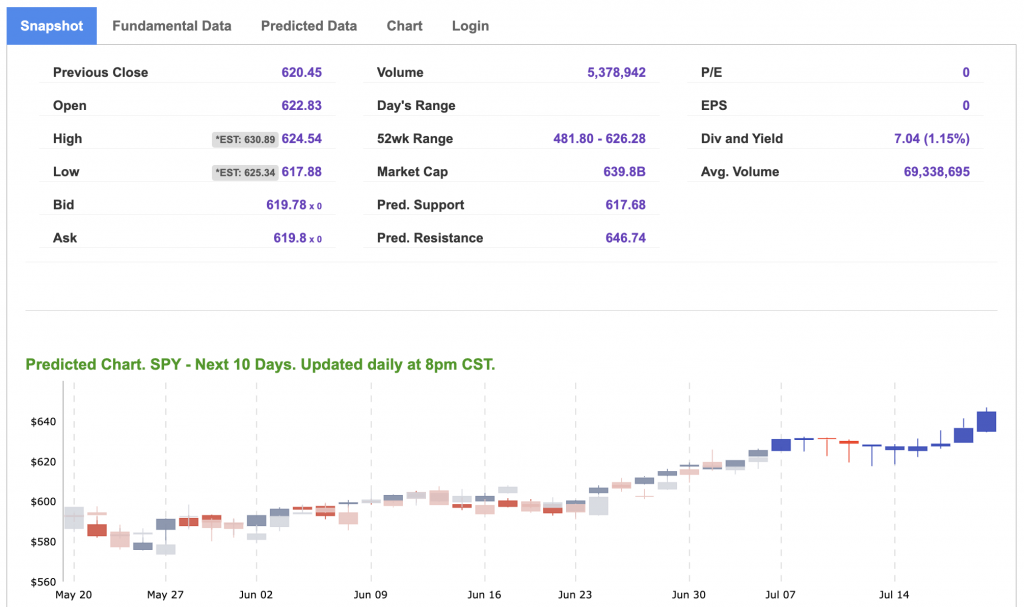

Despite the current volatility, key technical levels remain intact for now. The SPY (S&P 500 ETF) continues to show resilience above the 580–590 short-term support range. On the upside, a rally to the 630–640 level is possible if sentiment stabilizes and earnings deliver. That said, the longer-term trend is showing signs of fatigue, with rising unemployment and sticky interest rates posing ongoing threats.

From a strategy standpoint, I remain in the market-neutral camp. The path forward is likely to be choppy, with the odds of recession climbing. The biggest risks to the current bull case are that interest rates stay elevated longer than expected, the labor market weakens further, and global trade disruptions escalate into a broader downturn.

Traders should approach the next few weeks with caution. Until there is more clarity on tariffs, earnings, and the Fed’s next move, risk management and selective positioning remain key. The rally may not be over, but the easy part certainly is.

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

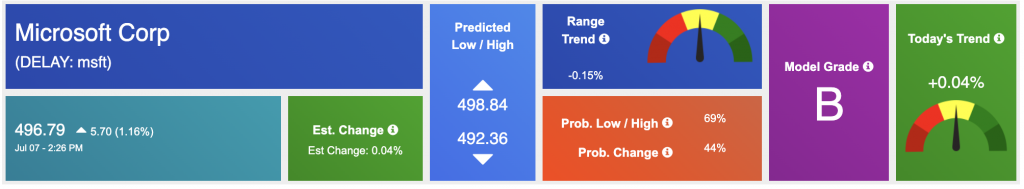

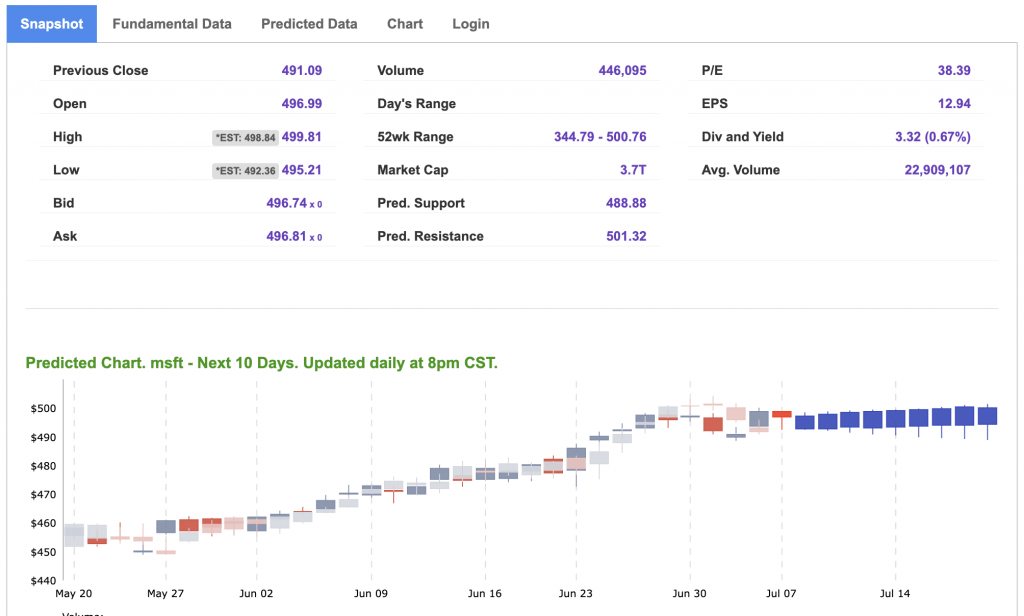

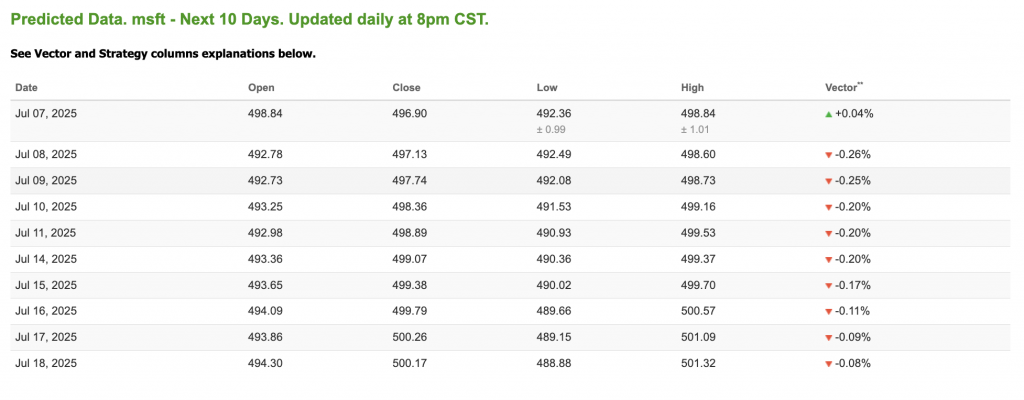

Our featured symbol for Tuesday is MSFT. Microsoft Corp. – MSFT is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $496.79 with a vector of +0.04% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, NVDA. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

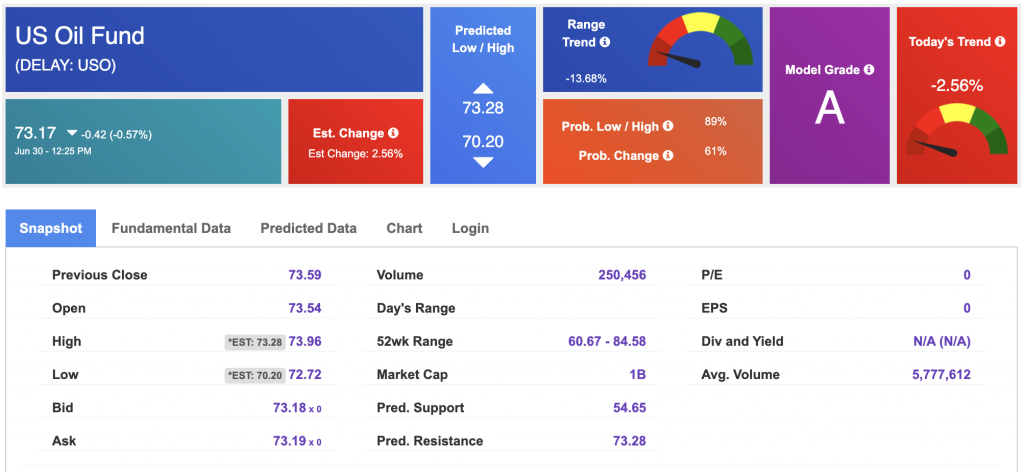

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $68.02 per barrel, up 1.51%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.17 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

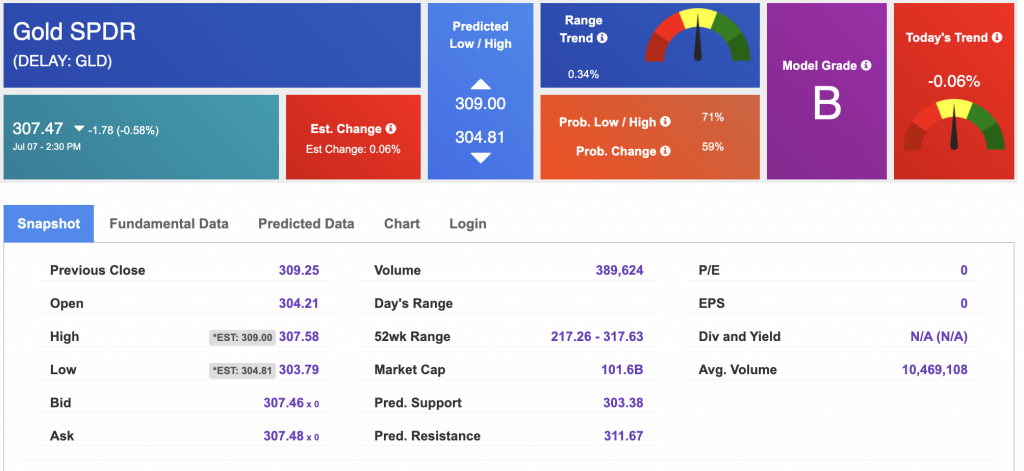

The price for the Gold Continuous Contract (GC00) is up 0.18% at $3,348.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $307.47 at the time of publication. Vector signals show -0.06% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

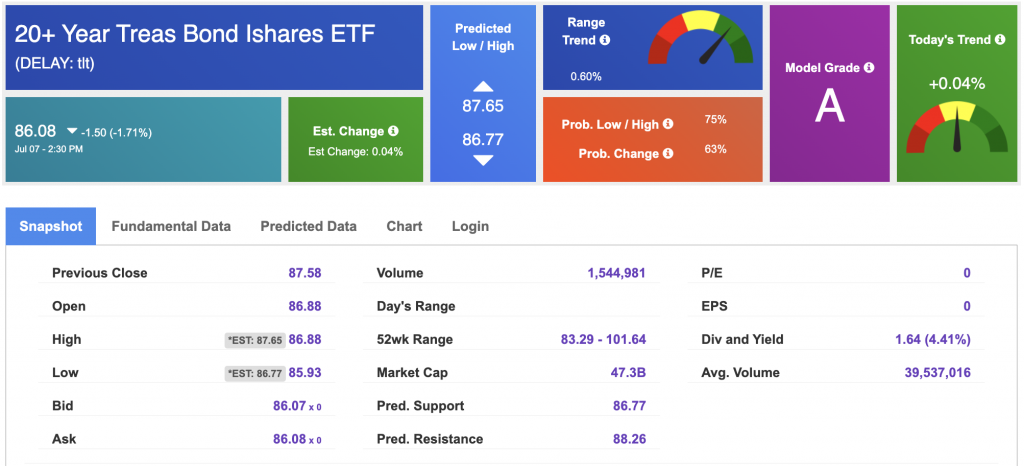

The yield on the 10-year Treasury note is up at 4.387% at the time of publication.

The yield on the 30-year Treasury note is up at 4.922% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

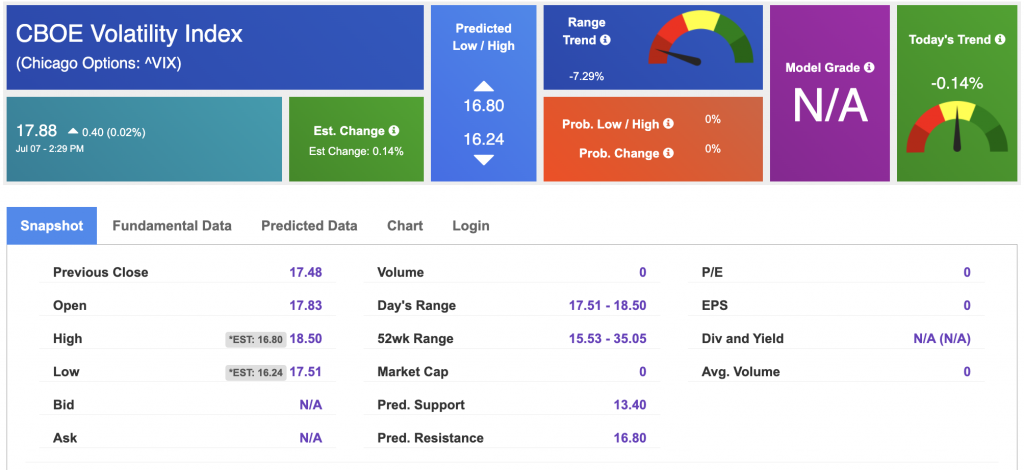

The CBOE Volatility Index (^VIX) is priced at $17.88 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!