In a refreshing shift of momentum, the stock market surged on Monday, breaking free from a six-day downward spiral that had gripped the S&P 500. Investors, buoyed by optimism, embarked on the week with a sense of anticipation, primed for the unveiling of corporate earnings reports and the unveiling of pivotal economic indicators.

A focal point for market observers will be the eagerly awaited release of first-quarter U.S. gross domestic product (GDP) figures, alongside the core personal-consumption expenditures (PCE) price index. This index, a preferred metric of the Federal Reserve for gauging inflation, holds the potential to provide crucial insights into the nation’s economic health and may influence future monetary policy decisions.

Last week presented its own set of trials. Federal Reserve Chairman Jerome Powell’s remarks initially left investors grappling with uncertainty regarding the trajectory of interest rates for the remainder of the year. The breach of the critical 4.5% level by the 10-year Treasury yield further compounded worries among market participants, reigniting concerns about potential headwinds for equities should it climb to 5%.

The market landscape was further colored by the release of retail data and simmering geopolitical tensions. While March’s retail sales figures surpassed expectations, offering a glimmer of hope with robust consumer spending, geopolitical uncertainties, notably the escalation of the Iran-Israel conflict, cast a pall over market sentiment, contributing to heightened volatility and exerting downward pressure on major indices such as the S&P 500.

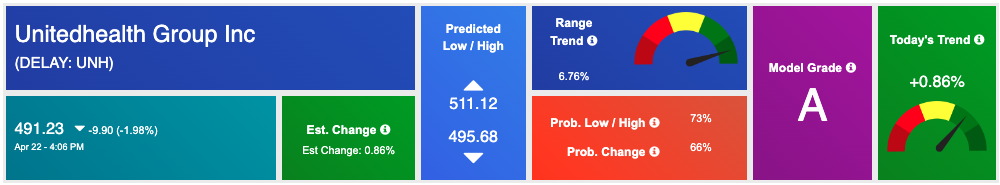

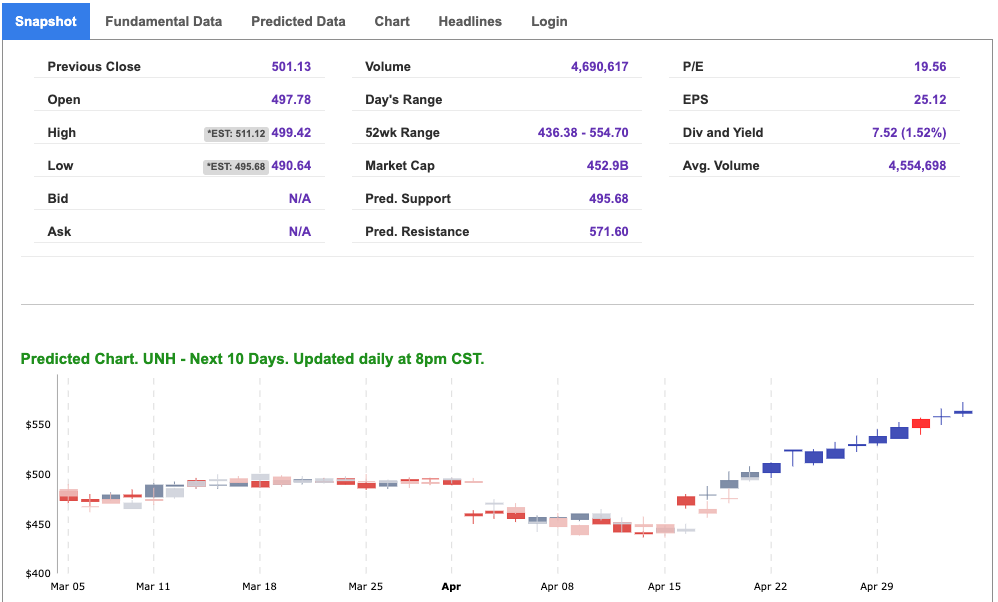

Against this backdrop of uncertainty, corporate earnings reports provided a beacon of insight into the resilience of businesses amid challenging economic conditions. Noteworthy among them was UnitedHealth Group (UNH), which emerged as a standout performer, showcasing strength and stability in a market fraught with volatility. The company’s robust financial results underscored its reliability, presenting investors with a compelling opportunity in the healthcare sector.

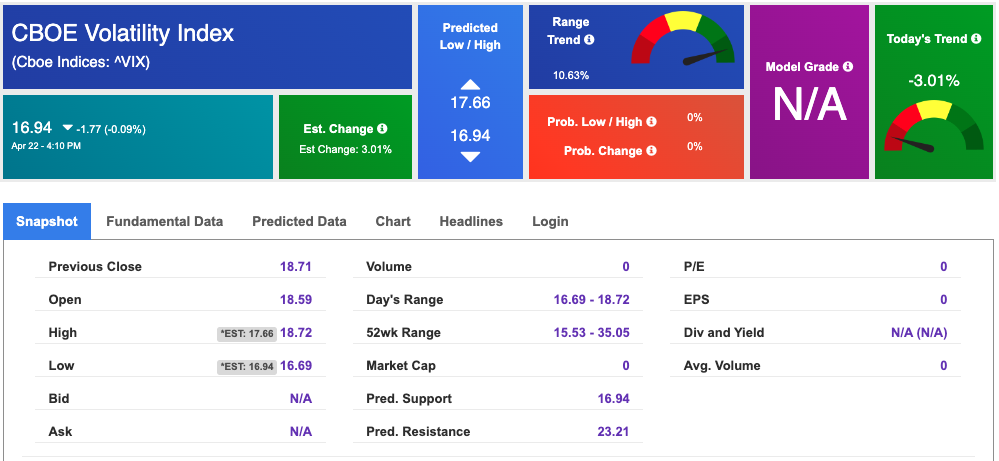

As geopolitical tensions escalated with Israel’s strikes on Iran, investor sentiment remained mixed, prompting a flight to safe-haven assets and a retreat from higher-risk equities. The confluence of geopolitical uncertainties and mounting inflationary pressures has contributed to heightened market volatility, with the VIX index hovering near 20, indicative of heightened levels of fear and uncertainty among investors.

Looking ahead, while major indices flirt with record highs, recent weeks have seen increased volatility, fueled by geopolitical tensions in the Middle East and robust economic data that have stoked fears of inflationary pressures.

The S&P 500 has weathered three consecutive weeks of declines as investors closely monitor the evolving landscape of inflation, interest rates, and Federal Reserve policy. With key economic data on the horizon this week, market sentiment hangs in the balance, poised to shift in response to new insights into rate expectations.

In individual stock news, Nvidia staged a comeback, surging 4.4% following a significant downturn last week. The company’s market cap took a substantial hit, shedding $212 billion in a single day, attributed to broader pressures within the technology sector. Conversely, Verizon faced headwinds, slipping 4.7% amid user losses in its consumer wireless postpaid phone business, despite delivering better-than-expected earnings.

Tesla shares experienced a 3.4% dip after the company announced price cuts for its vehicles in a bid to stimulate sales amidst softening demand. Additionally, merger talks between Salesforce and Informatica reached an impasse, with disagreements over terms derailing discussions of a potential $10 billion deal.

Looking ahead, a flurry of earnings reports are slated for release from notable companies, including Tesla, Visa, PepsiCo, and Microsoft, among others. With the second quarter underway, investors are advised to brace for continued market volatility and a prevailing downward trend bias, particularly as they await the Federal Reserve’s April decision.

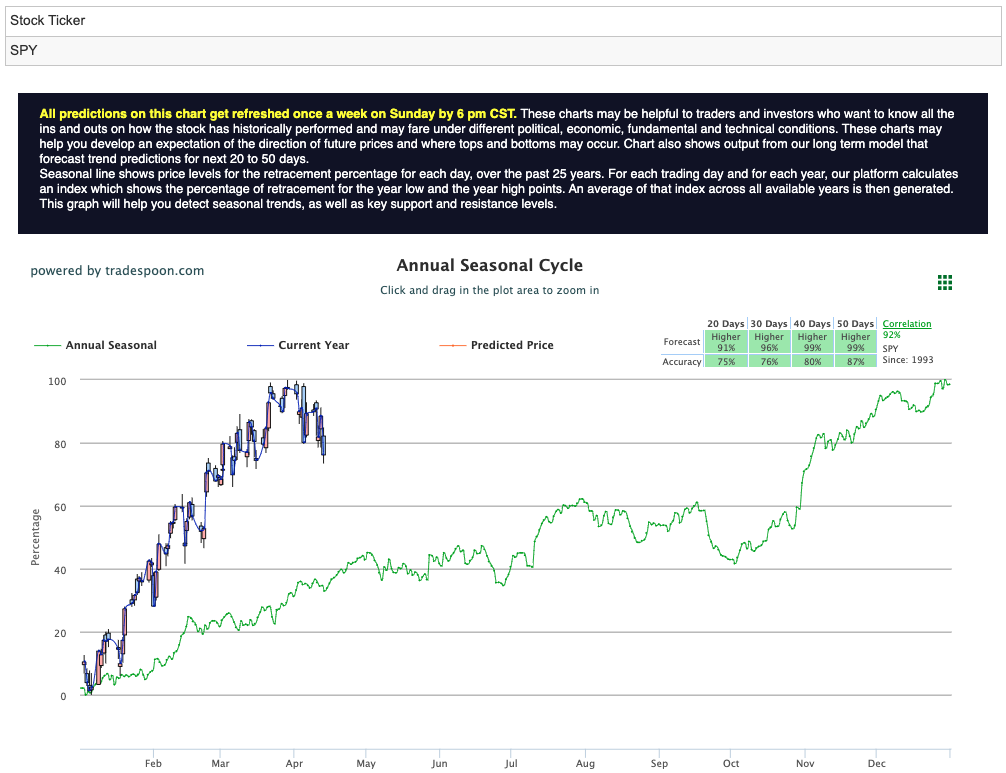

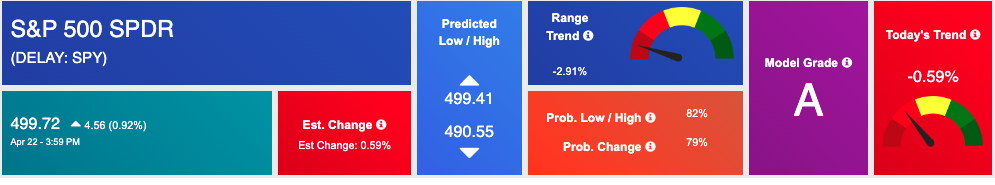

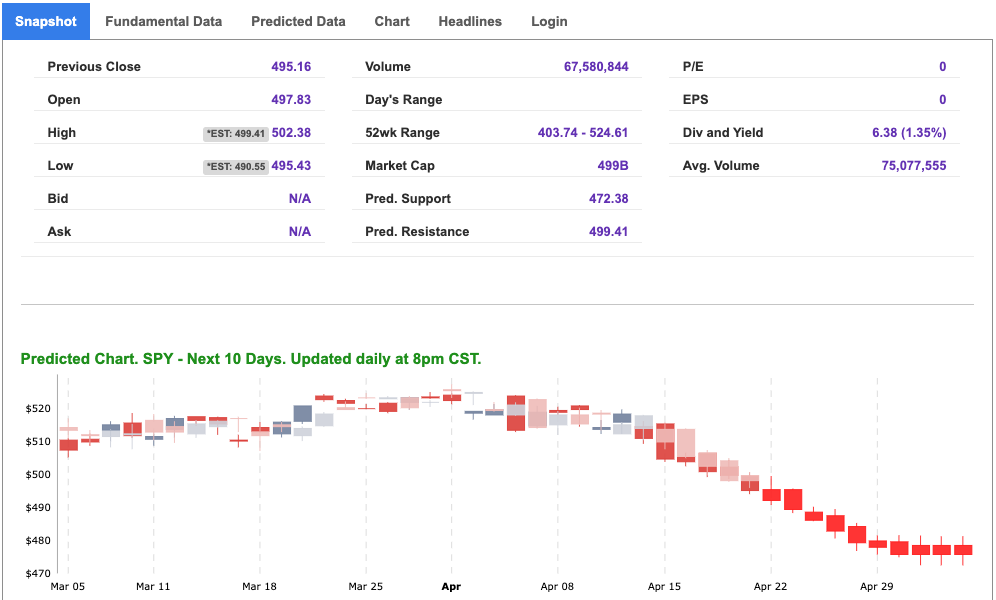

Navigating through uncertain terrain demands vigilance and adaptability. Staying abreast of developments from Chairman Powell’s speeches, economic data releases, and earnings reports will be crucial in formulating informed investment strategies. The SPY rally could potentially see levels between $530 and $540, with short-term support anticipated within the $480 to $500 range. For reference, the SPY Seasonal Chart is shown below:

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, UNH. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

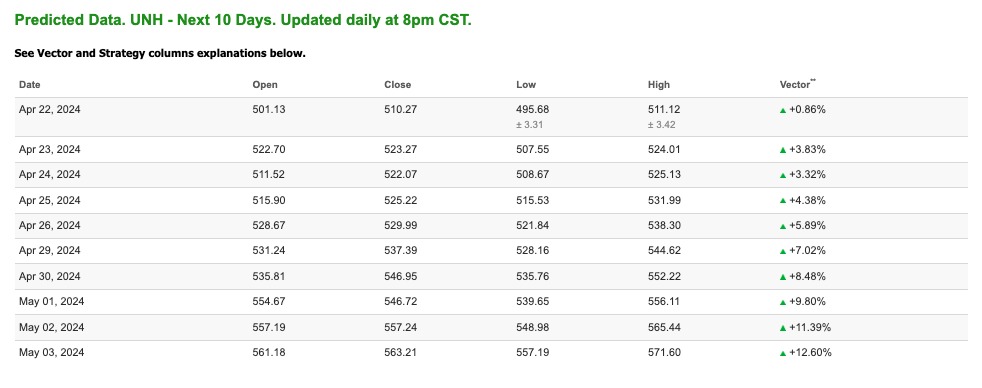

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $83.02 per barrel, down 0.14%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $78.78 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

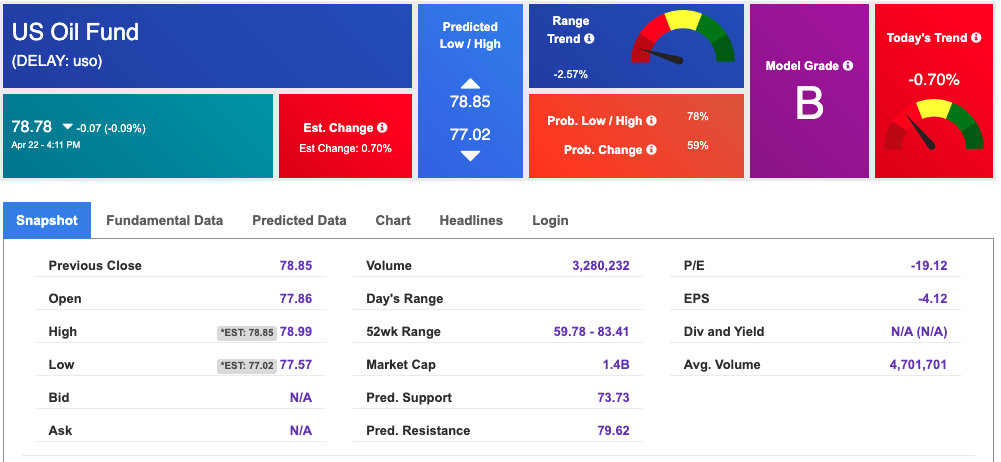

The price for the Gold Continuous Contract (GC00) is down 3.01% at $2341.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $215.57 at the time of publication. Vector signals show +0.05% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

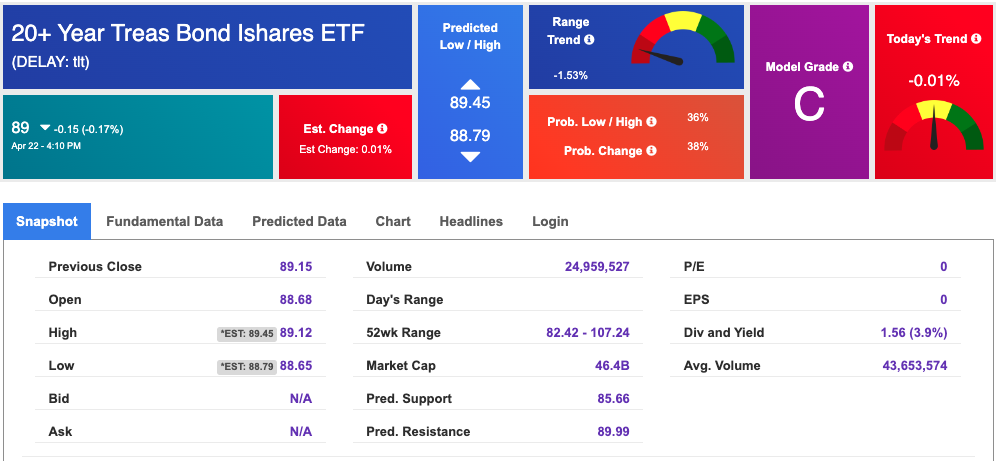

The yield on the 10-year Treasury note is down at 4.614% at the time of publication.

The yield on the 30-year Treasury note is up at 4.718% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $19.23 up 0.11% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!