RoboStreet – August 28, 2025

Markets hit fresh records on Fed optimism and earnings strength, but tariffs, politics, and labor risks threaten to derail momentum

The stock market continues to navigate a tightrope between optimism and caution, with the S&P 500 pushing to fresh record highs this week. On Thursday, the index climbed 0.3% to set an intraday peak of 6,498.93, on track for its 20th record close of the year. That milestone reflects both investor confidence in corporate earnings and expectations for Federal Reserve policy shifts, but the underlying tone remains mixed. Treasury yields weakened on softer economic data, while volatility stayed contained with the VIX near 15. Beneath the surface, however, risks tied to tariffs, labor markets, and political uncertainty continue to loom.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Fed’s Balancing Act: Jackson Hole Sets the Tone

Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole symposium on August 22 provided the market with its biggest tailwind. Powell acknowledged that while inflation has moderated, downside risks in the labor market and broader economy now warrant consideration for rate cuts as early as September. That acknowledgment was enough to trigger a sharp rally—sending the Dow Jones Industrial Average up 850 points for its first record close of 2025, while the S&P 500 also logged a weekly gain.

But Powell stopped short of offering certainty. The Fed remains data-dependent, particularly on Personal Consumption Expenditures (PCE) inflation data and consumer spending reports due in the coming weeks. These figures will shape how aggressively the Fed can move. The bond market reflected this uncertainty: while Treasury yields edged lower overall, the 10-year note remained volatile in its broad 3.6%–4.8% range, showing that fixed-income investors are far from convinced that inflation risks have fully subsided.

Economic Data: Growth Upgraded, Labor Still Fragile

Fresh data on Thursday added another layer of complexity. The Commerce Department revised second-quarter GDP growth upward to 3.3% annualized, above the previously reported 3.0%. Stronger investment and consumer spending fueled the revision, suggesting the economy retains resilience even as higher rates bite.

Yet the labor market signals are less comforting. Jobless claims edged lower this week, but forecasts point to slower job creation ahead. Economists now expect August payrolls, due next week, to show a potential uptick in unemployment. The jobs picture has become the critical hinge for Fed policy: a cooling labor market could justify rate cuts, but a sharp downturn would reignite recession fears.

Tariffs further complicate the outlook. Import activity dropped in Q2, lifting headline GDP but reflecting distortions as companies stockpiled goods ahead of tariff increases. The result is growth that looks stronger on paper but rests on shaky foundations.

Tariffs, Politics, and Fed Independence

The political backdrop is proving just as consequential as the economic one. President Trump’s trade and personnel decisions are injecting volatility into markets. His decision to impose a 50% tariff on Indian imports has raised concerns about supply chains and consumer prices, while efforts to fire Fed Governor Lisa Cook and a Surface Transportation Board member have stoked fears about central bank independence.

Governor Cook has already filed a lawsuit to block her dismissal, arguing that the president’s move violates statutory protections for Fed officials. The legal battle could redefine the balance of power between the White House and the Fed, adding a layer of uncertainty at a time when monetary policy is already in flux. For investors, this clash raises the risk that political interference undermines Fed credibility, potentially destabilizing the very foundation of U.S. financial markets.

Corporate Earnings: Tech Meets High Expectations, Retail Sends Mixed Signals

Earnings season added fuel to market moves, particularly in technology and retail.

Sector Rotation: A Broader Rally Takes Shape

One of the week’s most encouraging signals for market breadth was the rotation away from mega-cap technology. The S&P 500 Equal Weight Index outperformed its cap-weighted counterpart, a sign that gains are spreading across sectors.

Cyclicals and value areas—energy, financials, real estate, industrials, and utilities—saw steady inflows, while high-valuation tech stocks cooled. For investors, this broadening of participation is a constructive sign: it reduces dependence on a small cluster of AI-driven giants and suggests a healthier foundation for the rally. However, it also reflects hedging behavior, as investors temper their enthusiasm for richly priced tech by diversifying into sectors better positioned for a lower-rate environment.

Market Outlook: Neutral Stance Amid Fragile Gains

Despite the headline excitement of record highs, the underlying tone of the market remains one of caution. The SPY ETF faces resistance between 650–660 and support at 600–620, keeping the index in a sideways range. Volatility is low but risks are high, with tariffs, Fed independence questions, and labor market cooling all potential triggers for disruption.

I remain in the market-neutral camp. In the short term, sideways trading is likely to dominate as investors await clarity on payrolls, inflation, and Fed policy. In the long term, pressure persists: the risk of higher-for-longer interest rates, rising unemployment, and geopolitical turbulence all point to a fragile trend.

The rally has momentum, but it is built on uneven ground. For now, caution remains the most prudent stance.

In this environment of mixed signals and quiet volatility, disciplined trading and data-driven strategy are essential. At Tradespoon, our predictive models are built to adapt in real-time—highlighting breakout candidates, identifying hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by headlines and contradictions, you’re not alone. Let our tools help cut through the noise and keep you focused on what matters most.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

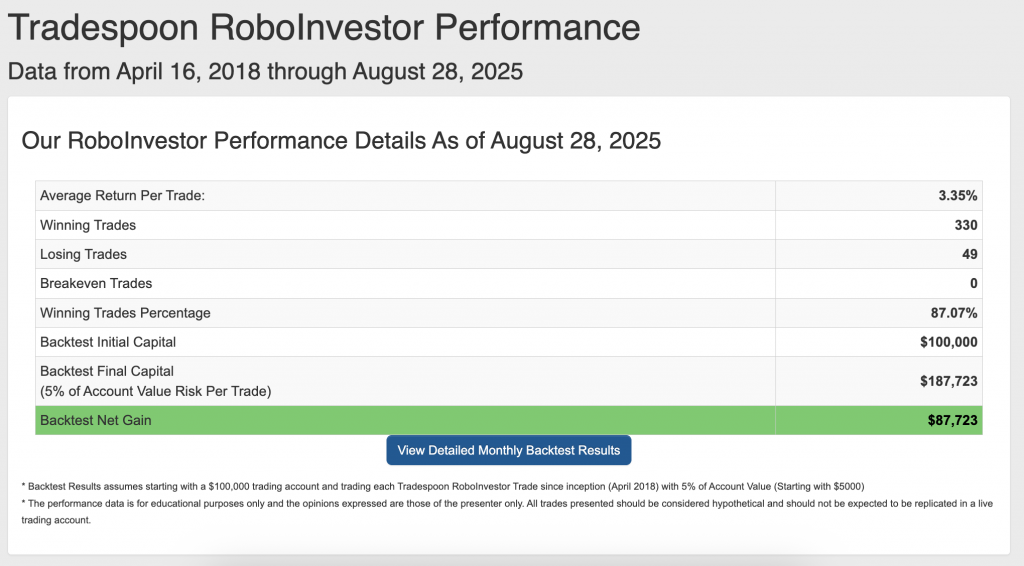

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.07% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!