RoboStreet – June 27, 2025

As the final trading days of June wrap up, the stock market continues to press toward new highs—but the mood among traders is far from euphoric. The S&P 500 and Nasdaq are both within half a percent of setting new record closing highs, driven by strength in artificial intelligence stocks, a brief reprieve in geopolitical tensions, and speculation about potential shifts in Federal Reserve leadership and policy direction.

On the surface, this appears to be a strong finish to what had been a volatile quarter. Yet a deeper look reveals an increasingly fragile market. Breadth has improved modestly but remains narrow. Volatility is quietly climbing. And key economic data points continue to show signs of deterioration. The market may be rising, but so are the risks.

From my perspective, this is not a breakout to chase. I remain in the market-neutral camp. A short-term push in the S&P 500 toward the $600–$620 level is still possible, particularly if Powell hints at easing or economic data comes in soft enough to justify a rate cut. But support remains fragile in the $570–$580 range, and longer-term, the trend is under pressure. Recession risks are increasing. Interest rates may stay higher for longer. And the labor market is showing the early signs of stress that are often ignored—until they’re not.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The week began under the shadow of escalating conflict in the Middle East. U.S. forces reportedly struck nuclear infrastructure in Iran, while Israel conducted operations targeting key facilities, including Evin Prison, a high-profile detention center for political dissidents. Global markets braced for escalation, and oil prices spiked accordingly. Brent crude rose to $77.30 a barrel on Monday—up from just $62 at the beginning of June—amid concerns that Iran might close the Strait of Hormuz, a move that could significantly disrupt global energy supplies.

Gold also surged in early trading, briefly topping $3,360 per ounce. Safe-haven demand increased, and the 10-year Treasury yield dipped as low as 4.35%, as investors sought cover from potential volatility.

But by midweek, sentiment shifted sharply. President Donald Trump announced a U.S.-brokered ceasefire between Israel and Iran. The ceasefire de-escalated immediate fears of a broader regional conflict and allowed markets to refocus on domestic policy and economic data. Oil prices retreated modestly, and gold fell back as the initial rush to safety faded. While this ceasefire calmed nerves in the short term, the geopolitical risk has not been resolved—it has simply been deferred. Any re-escalation would almost certainly trigger another wave of volatility, particularly in commodity markets and defense-related sectors.

This week also marked the start of Fed Chair Jerome Powell’s semiannual testimony before Congress. Powell largely stuck to script, emphasizing that the central bank remains focused on inflation, which he described as “somewhat elevated.” He acknowledged that tariffs planned by the Trump administration could place additional upward pressure on prices, but offered no clear indication of when the Fed might cut rates.

The most notable development came from elsewhere in the Fed. Governor Christopher Waller suggested that a rate cut could come as soon as July, citing softening labor data and growing risks to growth. Waller’s remarks stood in contrast to Powell’s more cautious tone and have fueled increased market speculation that the Fed may ease sooner than markets previously expected.

Adding further intrigue, a Wall Street Journal report on Thursday revealed that President Trump is actively considering naming a successor to Powell as early as September or October. The possibility of a more politically aligned Fed chair—especially one open to more aggressive rate cuts—has begun to shift market expectations for monetary policy. Treasury yields dropped further, and the dollar weakened notably on the news.

Still, the bond market reflects the ongoing tension between inflation control and growth support. The 10-year Treasury continues to trade within a wide and volatile range—between 3.6% and 4.8%—and the yield curve remains inverted. Investors may be pricing in easing, but they are also hedging against the possibility of stagflation or a policy misstep.

Throughout the week, a stream of economic data painted a mixed but increasingly fragile picture of the U.S. economy.

Retail sales fell 0.9% in May, marking the sharpest monthly decline of 2025 and highlighting the growing strain on consumer demand. First-quarter GDP was revised downward to a contraction of 0.5%, worse than the initial -0.2% print. Meanwhile, durable goods orders unexpectedly surged by 16.4%, a positive surprise that may reflect companies rushing to buy inventory ahead of potential tariffs rather than genuine demand strength.

Labor market indicators offered both comfort and concern. Initial jobless claims dropped to 236,000 last week—better than the expected 244,000—but continuing claims rose to 1.97 million, their highest level since late 2021. This divergence suggests that while layoffs may not be surging, re-employment is becoming more difficult. The four-week average for initial claims is now 245,000, up from 230,000 in the prior month.

The unemployment rate has remained steady at 4.2% since March, but with tariffs set to kick in July 9 and again in August, the pressure on businesses to manage costs—including through labor reductions—could grow quickly.

Taken together, the data suggest we are entering a period of economic cooling, even as inflationary risks persist. That’s a textbook setup for stagflation—where growth stalls but inflation remains elevated—and it’s one that the Fed may struggle to navigate cleanly.

Amid the macroeconomic noise, several sectors showed resilience and leadership. Technology and semiconductors remained in the spotlight, with Nvidia reaching fresh record highs and Super Micro Computer continuing its steep climb. The iShares Semiconductor ETF gained 0.8% on Thursday alone, as investors poured back into AI-related names.

Industrial stocks have quietly been among the year’s top performers, buoyed by infrastructure spending, defense contracts, and their relative insulation from consumer spending slowdowns. The sector is up 10% year-to-date.

Earnings this week provided a mixed bag. Darden Restaurants (DRI) rallied nearly 10% on stronger-than-expected results, showing that consumer discretionary spending hasn’t completely dried up. But FedEx (FDX) dropped sharply after withholding full-year guidance, raising questions about shipping volume and global demand. That divergence underscores just how uneven the recovery remains.

For the first time in several weeks, market breadth improved meaningfully. On Thursday, nearly 370 of the S&P 500’s 500 components finished higher, a rare show of broader participation that could help sustain the rally—if it continues. However, the rally is still disproportionately driven by a handful of mega-cap tech stocks, and any cracks in those names could quickly reverberate across the indexes.

Despite strong surface-level performance, this market remains delicate. Volatility is up. The VIX has climbed steadily throughout June, even as indexes approach their highs—a rare divergence that suggests traders are hedging aggressively. Earnings remain mixed. Economic data continues to weaken. And the Fed is navigating a tightening window for making the right call.

If the ceasefire holds, if tariffs are delayed, and if July’s data comes in weak enough to justify a cut, then yes—SPY could grind higher into the $600–$620 range in July. But none of those outcomes are guaranteed. And if one or more of them go the other way, we could easily see SPY retest the $570–$580 range, or lower. For reference, the SPY Seasonal Chart is shown below:

For now, hope is lifting markets. But caution is what keeps portfolios intact.

My outlook remains market-neutral. This is not a time for aggressive positioning. It’s a time to observe, manage risk, and prepare for both upside opportunities and downside volatility. The path forward is narrow, and the air is getting thin. If the market climbs further, it will need broader participation, clearer policy direction, and real improvement in growth, not just hope.

And that’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

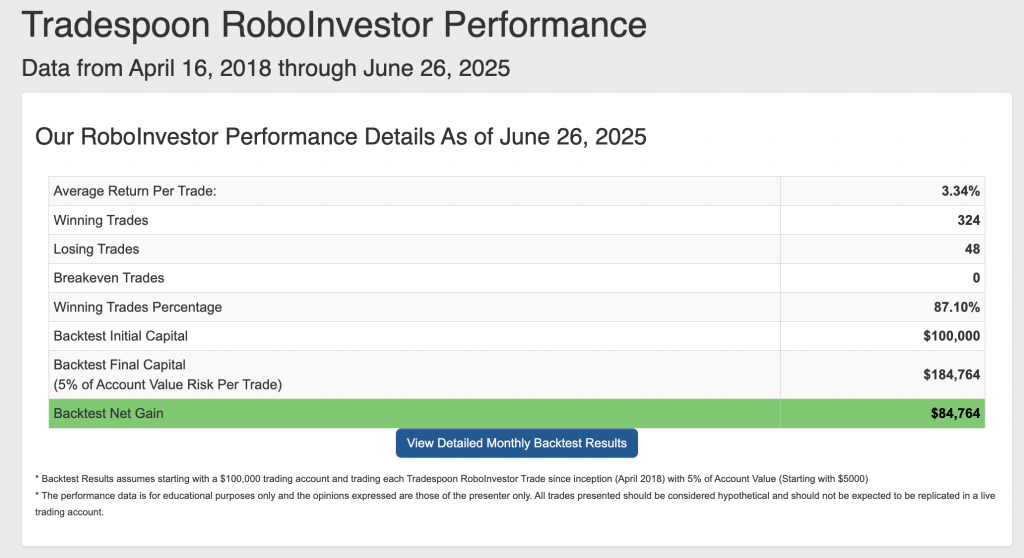

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.10% going back to April 2018.

As we near the end of Q2 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!