Stocks open at fresh highs as mega-cap tech nears $4T, banks flex balance-sheet strength, and cooler inflation gives the Fed cover to ease, leaving bears with less to stand on than the consumer.

We’re opening the week with the Dow, S&P 500, and Nasdaq either at or pressing into new highs. That move isn’t just momentum chasing — it’s being driven by three aligned forces: easing U.S.–China tension, an expected Fed rate cut this week, and an earnings season that’s running stronger than feared.

Talks between Washington and Beijing have cooled the tariff shock that hit markets earlier in the month. The tone has shifted from “full escalation” toward “managed negotiation,” and that alone is enough to take some pressure off semiconductors, hardware, and supply chain names. At the same time, the market is assuming the Fed will cut again to protect growth into year-end, which has kept long-term yields contained and allowed equity multiples to hold. And on the corporate side, early earnings have been broadly better than expectations. The message from large-cap companies so far is that margins are intact, cash flow is healthy, and guidance (for now) remains under control.

You can see the effect most clearly at the top of tech. Both Microsoft and Apple are trading as if the market believes the AI infrastructure buildout is not a story stock theme but an operating reality — something closer to utility-grade demand. That confidence is what’s allowing investors to stay long risk even with macro noise still in the background.

Where Markets Are Right Now

That backdrop is showing up in today’s tape. Stocks started the week higher, led by the Nasdaq, with the Dow and S&P 500 also in the green. Futures were already pointing to strength on optimism around U.S.–China progress, and cash trading followed through.

The tone is classic “risk-on with policy cover.” Investors are rotating out of hedges and back into equities. Gold, which spiked last week when markets were operating without clean data and were leaning on safety, is now backing off as money returns to growth. The expectation going into the Fed meeting is simple: softer inflation momentum plus stable long rates gives the Fed room to ease. The market is trading as if that easing is coming.

One open question for this week: does the current calm between the U.S. and China represent real stabilization in trade policy, or just a temporary pause before the next tariff headline? Investors are treating it as at least a near-term truce, and that alone is enough to keep tech and cyclicals supported.

How We Got Here

By Friday’s close last week, this setup was already in motion.

We started last week under pressure. Fresh tariff threats sparked a fast derisking in semiconductors and other China-exposed names, and money rotated into areas tied to supply disruption and commodity security. But by midweek, the rhetoric around tariffs began to soften. The conversation shifted from sweeping penalties to structured talks, and that allowed buyers to step back into risk.

Earnings helped reinforce that turn. Large money-center banks delivered solid results, showing resilient fee income, strong capital, and balance sheets built to handle higher-for-longer rates. Some smaller regional lenders, by contrast, showed credit stress and had to answer tougher questions. That split has become a theme: scale and balance sheet strength are being rewarded; fragility is not.

The macro backdrop also evolved. Because of the government shutdown and delayed data, markets were essentially flying on anecdotes — Fed comments, corporate guidance, and high-frequency signals — instead of the usual official releases. In that vacuum, investors reached for safety: gold spiked, and Treasuries firmed as yields drifted lower.

Then the inflation data finally landed, and it came in cooler than expected. The takeaway wasn’t about the exact decimal points — it was about direction. Pricing pressure is easing, not accelerating, and the recent tariff noise hasn’t immediately spilled over into consumer prices. That was the green light for the “Fed can still cut” narrative. As soon as that theme hit, equities broke to new highs, with the Dow clearing key psychological levels and the S&P 500 and Nasdaq following.

That’s the moment we carried into this week: de-escalating trade tone, friendlier monetary expectations, and proof that big-cap earnings power is still intact.

Guidance From Here

We’re still positioned market-neutral with a constructive lean. The upside is real, but it’s not automatic.

Rates are still the metronome. As long as long-term yields stay contained, the market will keep rewarding growth, AI infrastructure, strong balance sheets, and dependable cash generation. If yields lurch higher, leadership will immediately rotate toward defensive balance-sheet strength and away from high-multiple growth.

Breadth is the next test. The market already believes in the mega-cap core — the companies seen as the backbone of AI buildout and the winners of this capex cycle. What’s less certain is whether the next tier down can participate. The largest banks are being rewarded for scale and balance sheet quality. Regionals are being forced to prove, every quarter, that credit risk isn’t eroding. Energy is re-entering the conversation as supply risk tightens. Industrials and globally exposed names now trade off whether U.S.–China tension actually cools or merely pauses.

And then there’s the consumer. Confidence has softened and inflation expectations at the household level have ticked up a bit, even as official inflation readings cool. That combination — a stretched consumer plus higher-for-longer rates — is still the cleanest path to a late-cycle slowdown. We can’t ignore that risk.

Tactically, we continue to prefer adding high-quality names on controlled pullbacks rather than chasing new highs. In practice, that means: cash-heavy tech tied to real AI infrastructure demand; large, diversified financials with fee engines and capital strength; selective energy exposure as geopolitics tightens supply. Gold stays in the toolkit as a hedge you add when stress builds, not something you chase when the tape is euphoric.

The sequence tells the story. Tariff fear cooled into negotiation. Softer inflation reopened the door for a Fed cut. Earnings confirmed margins are holding. That combination pushed equities to new highs to start the week. The market is rewarding discipline and durability — not bravado.

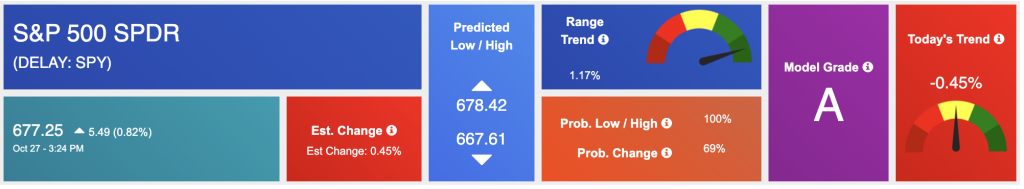

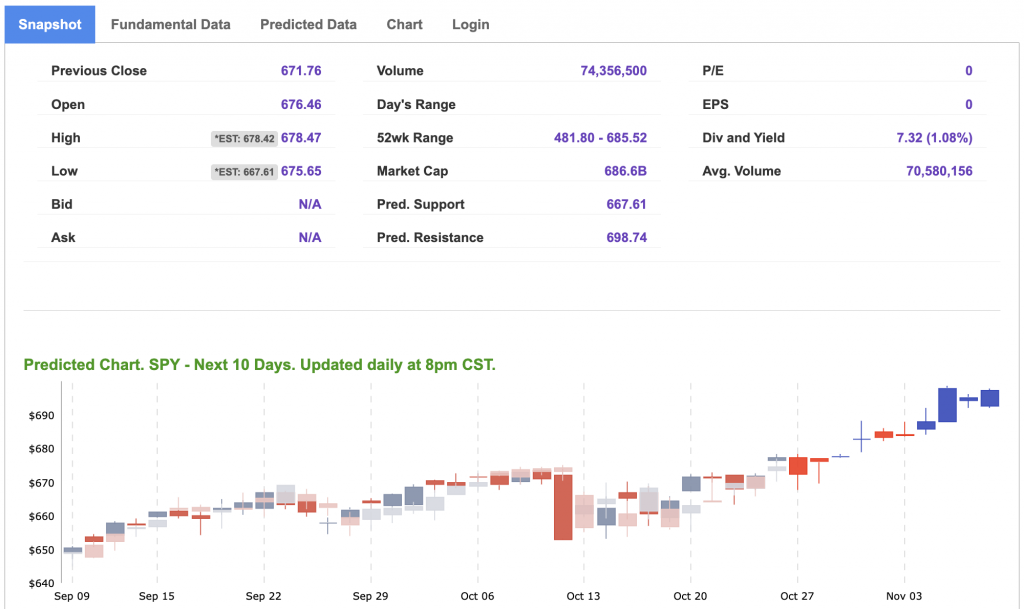

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

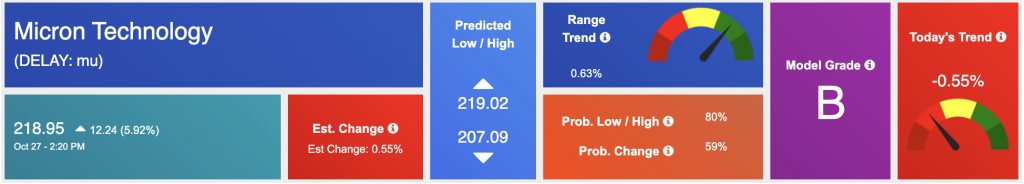

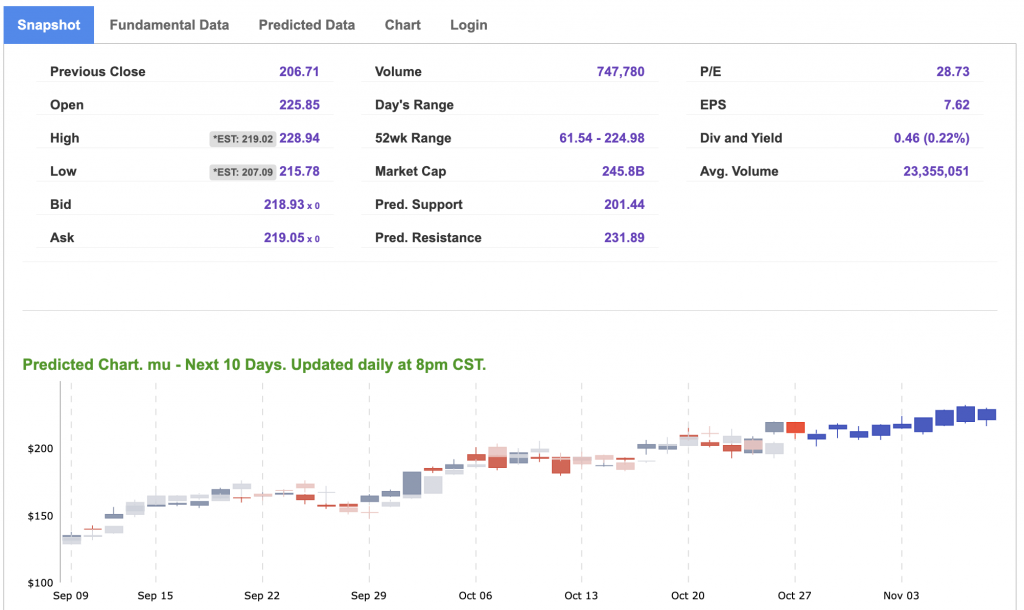

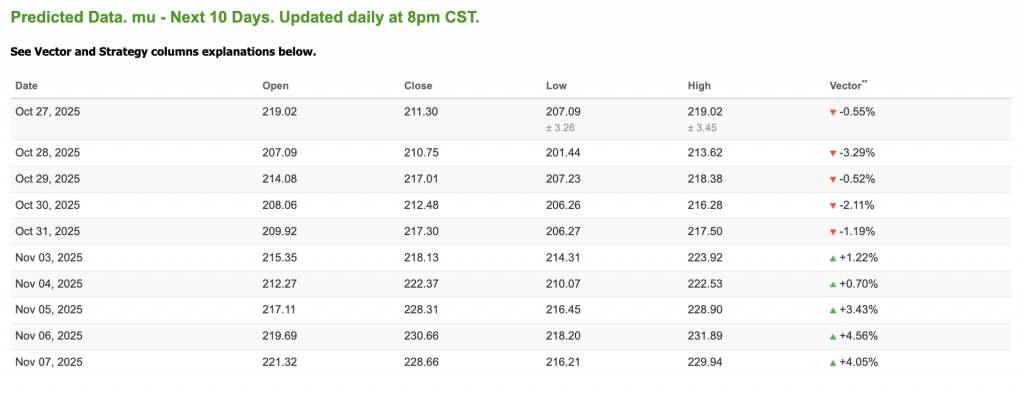

Our featured symbol for Tuesday is MU. Micron Tech (MU) is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $218.95 with a vector of -0.55% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, MU. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

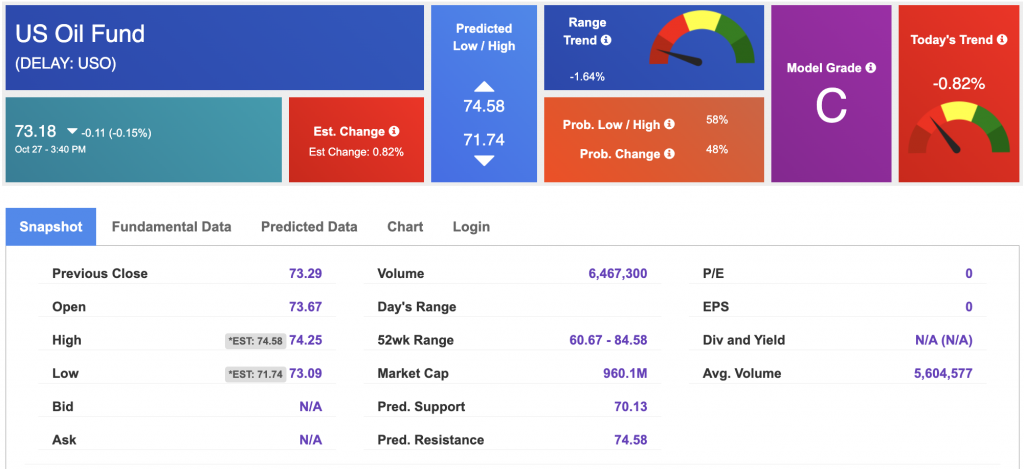

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $57.50 per barrel, down 0.07%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.18 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

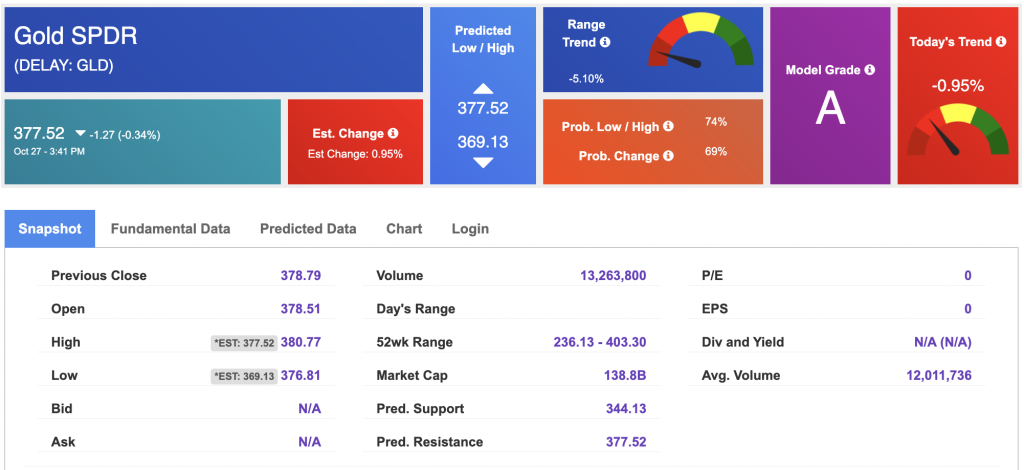

The price for the Gold Continuous Contract (GC00) is up 4.17% at $4,388.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $377.52 at the time of publication. Vector signals show -0.95% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

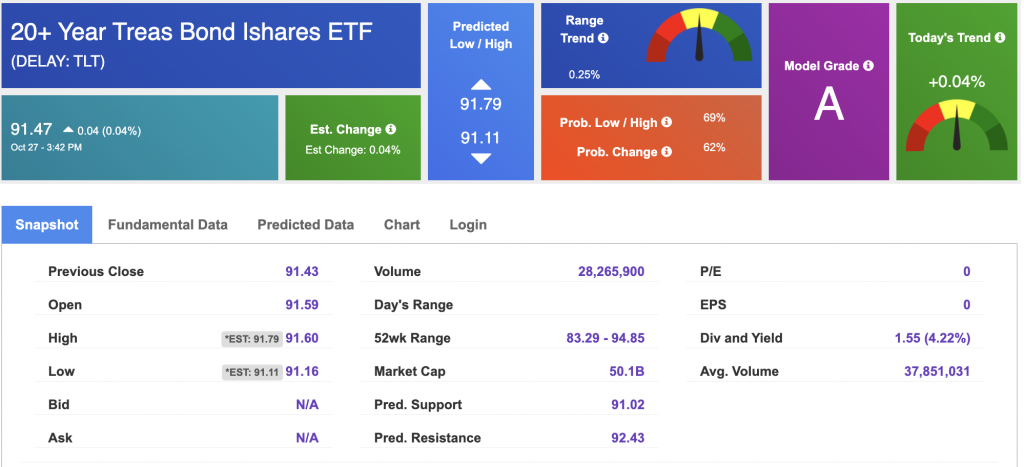

The yield on the 10-year Treasury note is down at 3.985% at the time of publication.

The yield on the 30-year Treasury note is down at 4.555% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

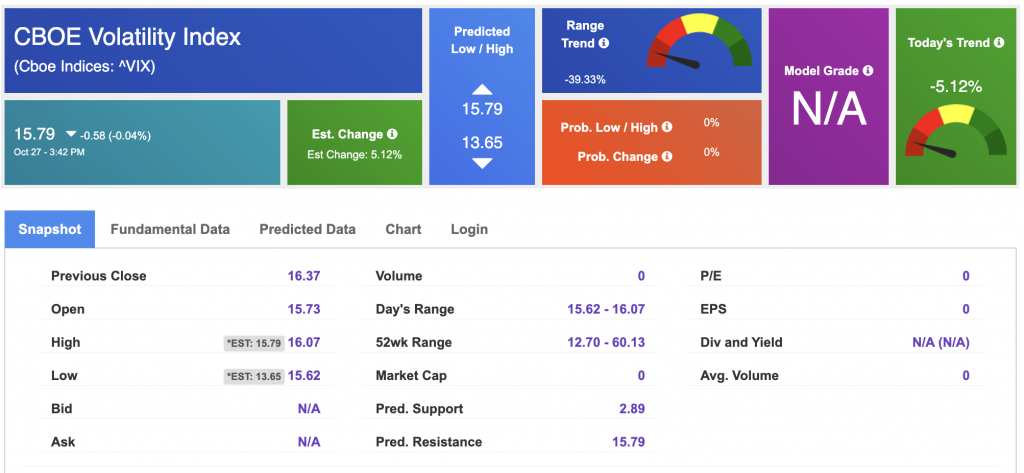

The CBOE Volatility Index (^VIX) is priced at $15.79 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!