RoboStreet – December 4th, 2025

December opened with more of a stumble than a crash. After a powerful Thanksgiving rebound that pulled the S&P 500 and Dow back into the green for November and narrowed the Nasdaq’s losses, the new month began with all three major indices in the red. That early-week slip wasn’t a classic “risk off” flush so much as a reset after a sprint higher, and it fits a broader pattern we’ve seen for weeks now: prices are moving more than fundamentals, and the market is constantly renegotiating where it’s willing to take risk rather than whether it wants risk at all.

The November rebound itself was driven by a very specific cocktail of catalysts. Dovish-leaning comments from key Fed officials pushed the odds of a December rate cut above even, as policymakers highlighted cooling inflation and rising labor-market risks. Shutdown-delayed economic data then arrived in a supportive but not overheated band: retail sales were positive but modest, producer prices rose gently, and housing data improved off the lows. Together, those reports reinforced a soft-landing narrative—growth slowing, not collapsing—which was enough to pull in dip buyers, especially in tech and other rate-sensitive areas. The result was a sharp sentiment swing from worry to relief in just a few sessions.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The start of December reminded investors that the path from here will not be linear. On Monday, the S&P 500, Dow, and Nasdaq all slipped as long-term yields climbed again, in part due to a global bond selloff tied to more hawkish signals out of Japan. Utilities, the usual defensive refuge, led the declines, while small caps, low-volatility strategies, and momentum names lagged. Value and quality factors, on the other hand, attracted fresh interest. At the same time, long-duration Treasuries struggled: TLT dropped more than a percent on a day when the S&P 500 was also down, underscoring that with the 10-year Treasury still whipping around in a 3.6%–4.2% range, bonds can’t be counted on as a reliable hedge.

By Thursday, the leadership picture had flipped again. The Dow finished slightly lower, but the S&P 500 and Nasdaq pushed modestly higher, and the Russell 2000 stole the show with a 0.7% gain. That move marked the small-cap index’s seventh record close of the year and its fourth straight day of gains greater than 1%. Under the surface, that tells you traders are leaning into domestically focused, rate-sensitive growth stories on the assumption that a Fed cut next week could unlock more upside. In other words, the market is still willing to take risk—but it is increasingly choosy about which pockets of the market deserve that risk.

The macro data backdrop remains one of slow cooling rather than sudden breakage. The ISM manufacturing PMI slipped to 48.2 in November, keeping the sector in contraction and extending one of the most persistent manufacturing slumps in recent history. The weakness is showing up more clearly in employment components, a sign that higher rates are biting the most interest-sensitive parts of the economy even as the broader consumer picture holds up. That combination—soft manufacturing, still-resilient demand—is consistent with late-cycle behavior and helps explain why both equity and bond markets are reacting so sharply to incremental changes in rate expectations.

The labor market adds another layer of nuance. Initial claims for unemployment benefits fell to about 191,000 in the week through November 29, the lowest level in roughly three years and clear evidence that we have not seen a wave of layoffs. At the same time, the unemployment rate has drifted up to around 4.4%, and the pace of monthly hiring has slowed. Because of the recent government shutdown, the full November jobs report has been delayed to December 16, leaving investors to stitch together a patchwork of signals. In an environment of tighter immigration, the economy may not need the same volume of job creation to maintain stability as it did earlier in the decade, but the mix of low claims, a higher unemployment rate, and softer survey data keeps the “higher for longer” risk very much alive.

Psychologically, the most important shift over the past month has taken place in the AI complex. Earlier in November, the Magnificent Seven and other AI leaders sold off more than 6% from their highs, and even Nvidia’s strong earnings couldn’t immediately reverse the downtrend as investors balked at heavy spending plans and stretched expectations. The market’s message was straightforward: investors still believe in the long-term AI story, but they no longer believe in paying any price for it. As December began, that stance evolved rather than reversed.

The Magnificent Seven were roughly flat on down-index days, semiconductors nudged higher, and Nvidia regained ground on the back of a new $2 billion investment in Synopsys at a premium valuation. That deal highlights a more mature phase of the theme, where infrastructure, design tools, and “picks-and-shovels” providers with real leverage to AI build-outs are being rewarded, while more speculative story stocks face a higher bar. Overseas moves in names like Alibaba and Dell have also reminded investors that AI is global, politically sensitive, and still tethered to traditional corporate spending cycles.

Crypto has been sending a very different signal. Bitcoin slid roughly 7% back below a key support level recently reclaimed, extending a November drawdown of more than 25% and dragging down crypto-linked equities such as MicroStrategy, Coinbase, and major miners. The Crypto Fear and Greed Index has sunk into “extreme fear,” and historically middling December seasonality means that combination of stressed sentiment and ambiguous technicals is more likely to generate sharp volatility than a clean trend. In effect, we have one corner of the market—AI and high-quality growth—where investors are afraid of missing the next leg higher, and another—crypto—where they are worried they were far too early. That split is typical of a late-cycle, range-bound tape where positioning and narratives are doing as much work as fundamentals.

Against this backdrop, I remain market-neutral at the index level and increasingly selective underneath. The late-November surge improved momentum off the lows, but the rally is choppier and more fragile than the smooth advance we saw earlier this year.

My base case is that SPY trades in a broad band over the next few months, with support in the 620–640 area and upside toward 680–700. The long-term uptrend is intact, but the easy phase of that trend is behind us. The key risk is that rates stay restrictive just as unemployment edges higher and manufacturing stays weak, putting pressure on the most expensive corners of the market.

Practically, that means using the range rather than trying to predict its immediate breakout. As SPY moves toward the upper end of that zone, I would rather trim risk, rebalance, and reduce exposure in names where narrative has outrun fundamentals, particularly in the highest-multiple growth stories.

When we do revisit the lower end of the range, I want to be ready with a clear shopping list of high-quality companies and resilient sectors that can handle a slower, bumpier economy—businesses with real cash flow, strong balance sheets, pricing power, and durable competitive advantages, especially in the AI infrastructure and enablement layers. Across assets, I remain cautious about stretching too far out the yield curve given how TLT and equities can sell off together, and I continue to treat crypto as a tactical satellite at best, not a core pillar of a long-term portfolio.

In short, discipline matters more than direction here: stay neutral at the index level, stay selective underneath, and let volatility create chances to add and trim rather than reasons to overreact.

That’s exactly where RoboInvestor comes in—our flagship AI-driven advisory built for a rangebound, headline-sensitive market. It cuts through shutdown noise, tariff chatter, and AI hype to surface statistically grounded setups and highlight where risk-reward is most compelling, so you can stay invested, stay disciplined, and move with precision instead of reacting to every headline.

Every other weekend, you’ll receive the RoboInvestor newsletter—a concise, focused read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas designed to have you prepared and confident for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

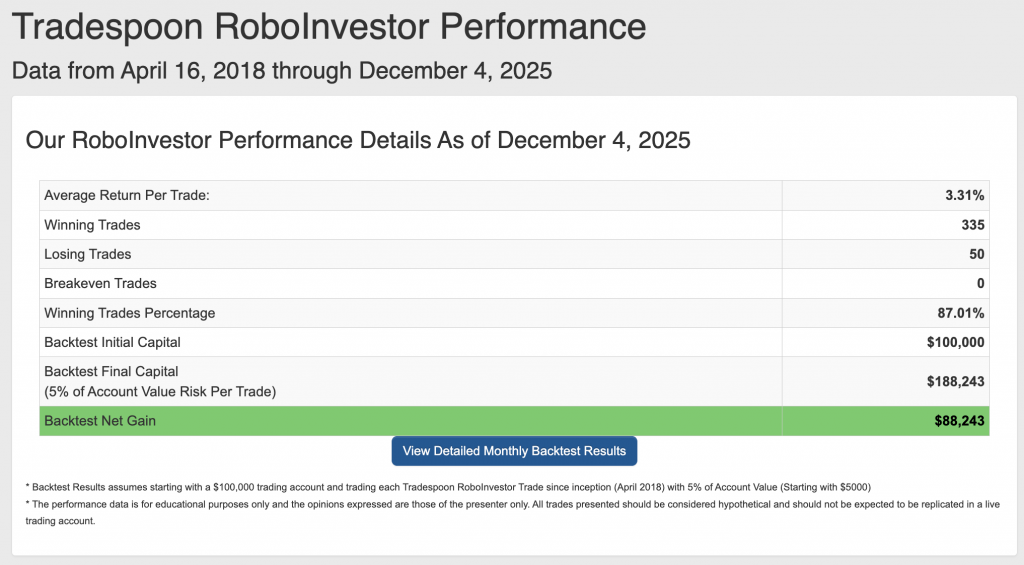

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.01% since April 2018.

As we head into the end of 2025—with October nearly in the books—investors are navigating a market defined by renewed tariff rhetoric, an uncertain Fed path, mixed economic signals, and persistent geopolitical crosscurrents. Volatility remains contained but jumpy around headlines, while earnings and guidance are doing the heavy lifting for direction. In this backdrop, partnering with a disciplined, insight-driven framework matters more than ever to cut through noise, manage rate and labor-market risk, and position proactively for the final stretch of the year.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!