Stocks bounced on a Senate deal to end the shutdown, but higher yields and a backlog of data keep this a precision tape. We recap the late-week wobble, then lay out positioning and what to watch as a heavy earnings slate hits.

Equities opened firm and built through the session after a bipartisan Senate agreement to end the record-long shutdown reduced a key tail risk. The Dow added roughly half a percent while the S&P 500 and Nasdaq outpaced on a tech rebound. The relief rally had a familiar catch: Treasuries sold off, pushing yields higher and reminding everyone that multiples remain hostage to the rate path. Tech strength looked like a reset from last week’s drawdown rather than a blank check; valuation discipline and leadership breadth are still on trial.

With agencies set to reopen, the market also braced for a flood of delayed economic releases—fuel for near-term swings as traders re-anchor around fresh data. Gold was bid early on the idea that softer labor and weaker sentiment keep optionality alive for cuts down the road, even as the Fed’s message remains “progress, not mission accomplished.”

The week began with a “cooling-but-resilient” growth narrative and a cautiously constructive tape. By mid-week, the conversation pivoted to labor and the Fed: private trackers showed slower hiring and more announced layoffs, and Chair Powell’s careful phrasing tamped down hopes for a quick pivot. Into Friday, the University of Michigan’s preliminary sentiment slipped to its weakest since mid-2022, and shutdown plus tariff chatter pushed indices lower into the close.

Rates drifted up across the back half of the week, squeezing rate-sensitives and complicating duration math for growth. Under the surface, breadth narrowed, advance/decline lines softened, and negative momentum divergences left the tape vulnerable to headline shock. Big Tech behaved like a sorter, not a tide—clean execution was bought; small misses were punished. Semis wore the cross-currents of export exposure and data-center visibility; Energy’s early pop faded after a chunky U.S. inventory build and Saudi price moves into Asia.

Airlines sagged on operational headlines, while Staples found late-week relative bids for cash-flow certainty. The 10-year swung through a wide corridor that was sufficient to reprice factors multiple times in a single session; crude round-tripped on supply headlines; gold chopped at a high perch.

After the closing bell tonight, the docket spans both macro levers and niche signals. CoreWeave will be read for AI-infrastructure demand and capacity commitments; Occidental Petroleum for capital discipline, buyback cadence, and hydrocarbon price sensitivity; Paramount Skydance for integration and balance-sheet runway in a shifting media landscape; Rocket Lab and AST SpaceMobile for financing visibility, backlog quality, and launch cadence; eToro for retail risk appetite and take-rate trends; Rigetti Computing for quantum roadmap and cash burn; Venture Global for LNG timelines and contract optionality.

This week’s earnings calendar stretches across sectors and geographies, with several key names offering macro and thematic read-throughs. Cisco reports Wednesday, serving as a bellwether for enterprise IT budgets, AI networking demand, and backlog conversion. Disney follows Thursday morning, with investors focused on parks performance, streaming unit economics, and the evolving bundle strategy. Applied Materials reports Thursday after the bell, providing a critical update on the semiconductor cycle, export controls, and AI-driven capex. Also due to report this week: GlobalFoundries, JD.com, Sea Ltd., TransDigm, Flutter Entertainment, Circle Internet, Nebius, Oklo, Fermi, and Quantum Computing. Across the board, the key question remains: are management teams turning 2025 storylines into booked revenue, credible margins, and clean cash flow?

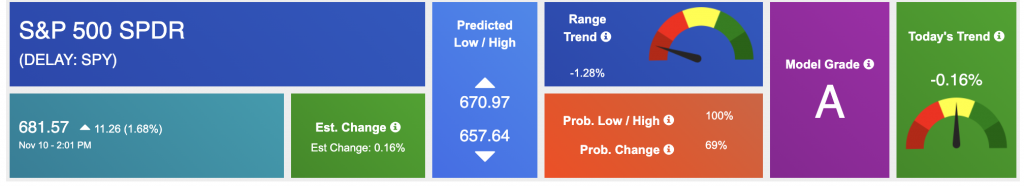

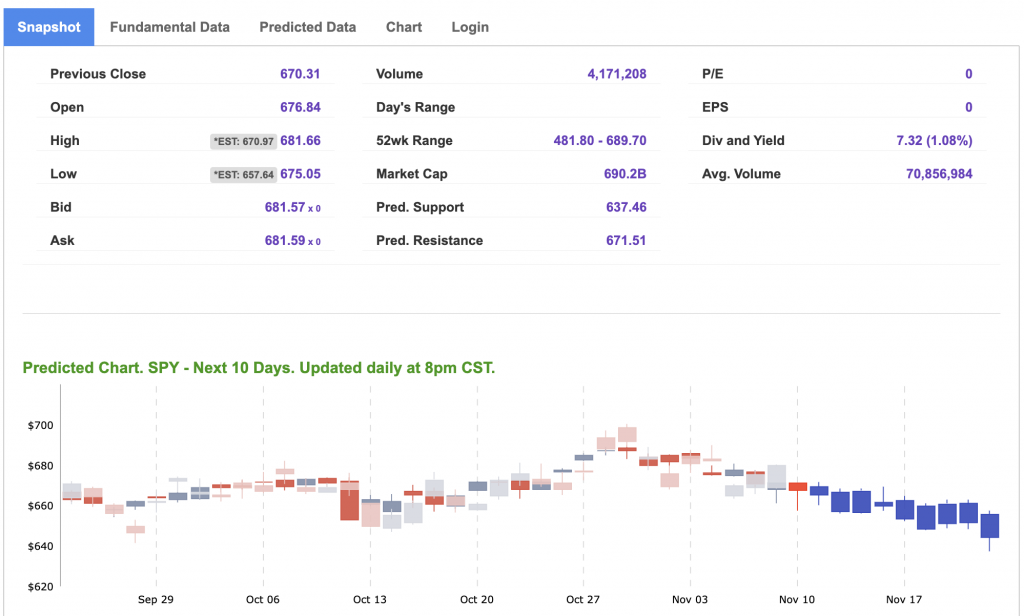

The shutdown relief narrows the policy tail and stabilizes the growth debate, but the near-term regime is still defined by yields and breadth. If reopening agencies unleash a run of soft labor and cooler-than-feared prices, duration can breathe and leadership can broaden; if prints surprise hot or guidance leans cautious, higher rates will re-tighten the tape back into mega-cap defensiveness. Our framework is unchanged: respect momentum, demand confirmation. We continue to see room for SPY to stretch toward the 680–700 zone if breadth improves and earnings participation widens, with 620–640 as a tactical support area over the coming months.

In practice, that means keeping entries disciplined and risk defined. We prefer self-funded compounders with resilient margins, selective AI-infrastructure exposure where export risk is manageable and revenue visibility is strong, and opportunistic hedges added for strength. Use the equal-weight vs. cap-weight spread, percentage of stocks above their 50-day, and advance/decline lines as your “green-light/ yellow-light” dashboard. Early-day strength without breadth is a trim, not a chase; pullbacks into support with stabilized yields are add points for defined-risk structures. Let the backlog of data—and this week’s earnings commentary—set the tempo, not the headlines alone.

Monday’s bounce is real, but it’s a rates tape until proven otherwise. A shutdown deal lowers noise; a data flood and dense earnings calendar raise the stakes. Stay clinical on entries, insist on cash-flow visibility, and let breadth—not just price—confirm the next leg.

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

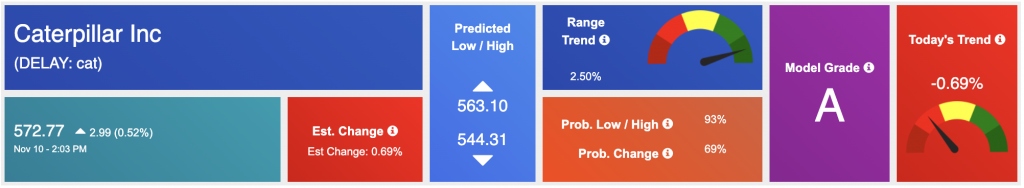

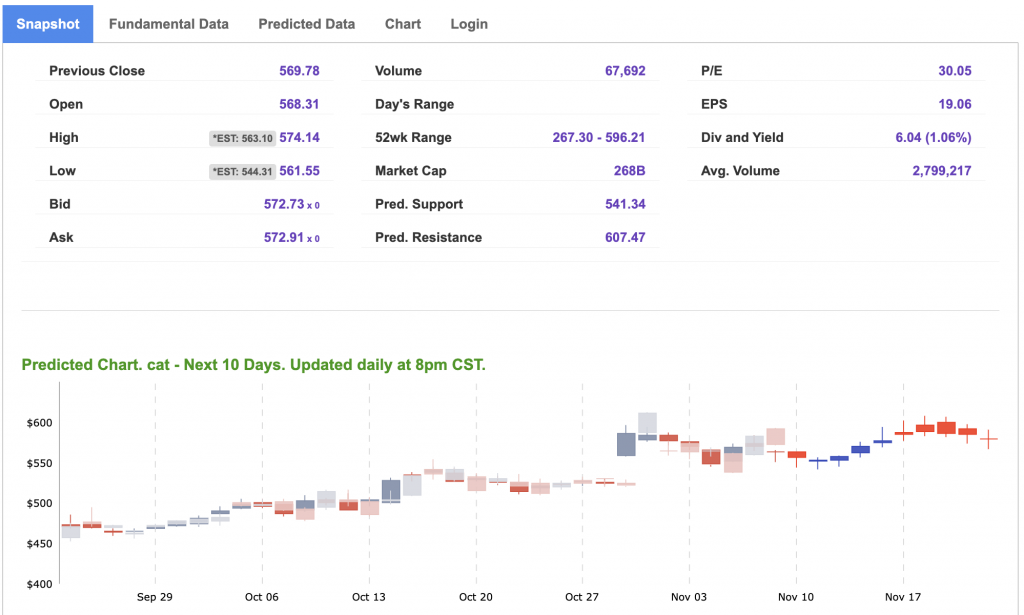

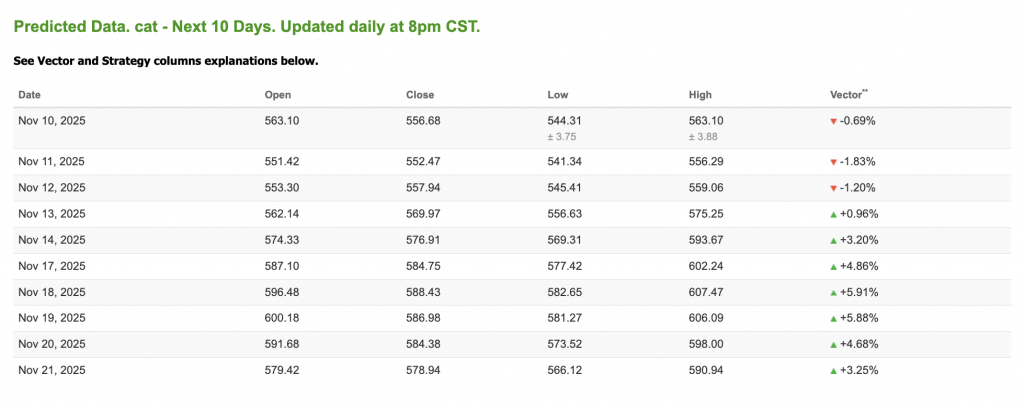

Our featured symbol for Tuesday is CAT. Caterpillar Inc. (CAT) is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $572.77 with a vector of -0.69% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, cat. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

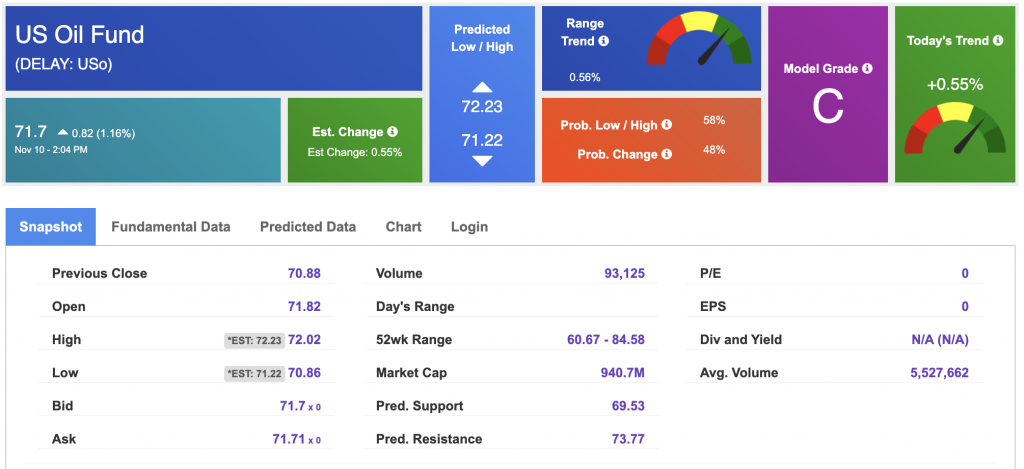

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $57.50 per barrel, down 0.07%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.7 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

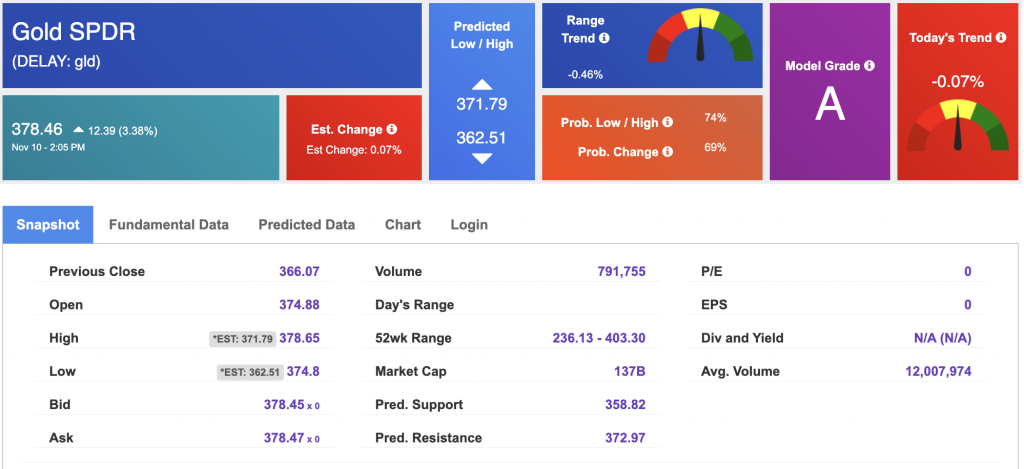

The price for the Gold Continuous Contract (GC00) is up 4.17% at $4,388.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $378.46 at the time of publication. Vector signals show -0.07% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

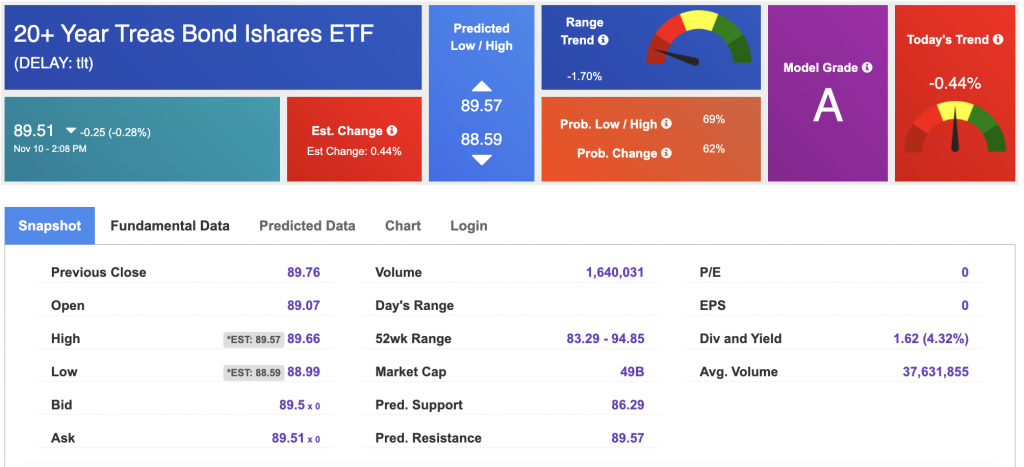

The yield on the 10-year Treasury note is up at 4.118% at the time of publication.

The yield on the 30-year Treasury note is up at 4.708% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

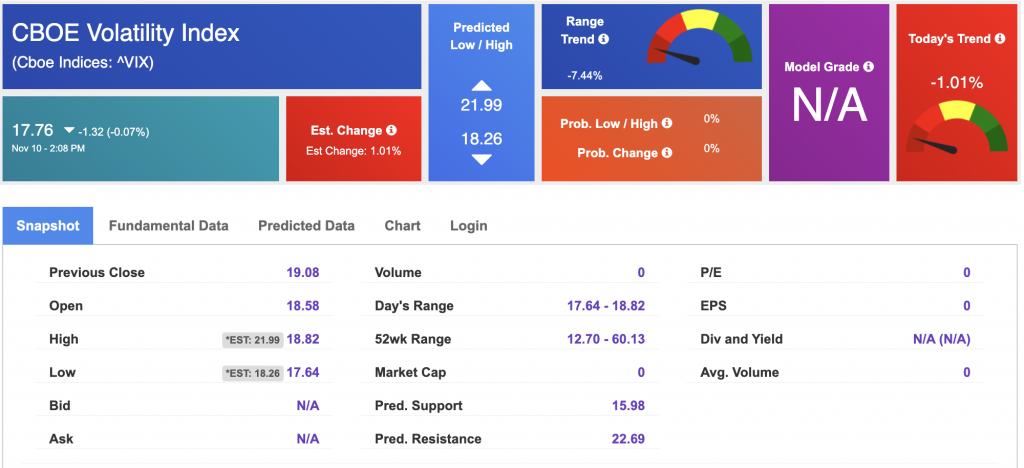

The CBOE Volatility Index (^VIX) is priced at $17.76 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!