RoboStreet – November 14, 2025

Shutdown relief and a softer tariff tone are colliding with higher-for-longer rates and AI valuation risk—stay selective, respect the range, and let quality lead.

U.S. equities spent the week consolidating just below all-time highs, with the major indices holding firm rather than breaking decisively in either direction. The volatility index hovering around 17 tells the story of a market that is not complacent, but comfortable enough with the current macro backdrop to avoid panic. Price action has been defined more by rotation and digestion than by a strong directional trend.

The market is consolidating against a backdrop of interest rates that are still in “higher for longer” mode. The 10-year Treasury is stuck in a 3.6%–4.2% range—low enough to avoid real damage, but high enough to cap further multiple expansion. That range now acts like a center of gravity: it cools off the most speculative trades without yet forcing a broad, forced unwind of risk.

Underneath the surface, sector performance has been uneven. Technology and AI-linked names remain the main source of volatility, swinging around earnings and policy headlines. Cyclicals and small caps responded positively to progress on the government shutdown and the eventual resolution, as fiscal uncertainty eased and fears of prolonged disruption to economic data subsided. Defensive areas of the market quietly did their job, cushioning swings in leadership and offering stability for investors who have already ridden a substantial portion of the rally.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The week’s narrative began with Washington and ended with corporate earnings. Early on, signs of bipartisan progress toward ending the record-long U.S. government shutdown sparked a strong rally. Equities moved higher as investors took comfort in the idea that federal agencies would reopen and critical data releases would resume. That optimism was ultimately validated when the shutdown formally ended after 43 days, shifting the conversation from “if” to “what next” and “for how long.” While this removed a key immediate overhang, investors are already looking ahead with caution to the next funding deadline, knowing this resolution is temporary.

At the same time, high-profile comments from major bank CEOs cast a longer shadow over risk assets. Warnings about the likelihood of a 10 to 20 percent equity pullback over the coming year or two amplified concerns that valuations, particularly in AI-focused technology names, have run ahead of fundamentals. These remarks helped trigger a notable tech selloff earlier in the week, with some AI winners selling off even after posting strong growth and raising guidance. The message from the tape was clear: the bar for upside surprises in expensive growth stocks is now very high.

Tariffs and trade policy added another layer to the story. A softer tone on China trade tensions, including moderation around certain tariff threats, provided relief to semiconductors and export-heavy sectors that had been bracing for escalation. Chipmakers and globally exposed industrials saw a bounce as investors welcomed any sign that the trade environment might become less hostile at the margin. That said, markets still view trade as an ongoing, structural risk rather than a solved problem, especially in areas tied to advanced technology and supply-chain security.

Earnings results added nuance rather than clarity. Applied Materials reported better-than-expected earnings and revenue with solid guidance, reflecting continuing strength tied to AI-driven chip demand. Despite that, the stock sold off as investors focused on export restrictions, China exposure, and how much future demand has already been priced in. Nvidia, while not reporting this week, remained a central character in the market’s psychology. Persistent concerns around AI valuations, as well as headlines about efforts to curb its exports to China, pressured the stock and reminded investors that policy risk is now inseparable from the AI trade.

In media and entertainment, the crosscurrents were just as visible. Disney delivered another mixed update to a market that has grown far more demanding. The company continues to push hard into streaming and digital engagement, while legacy businesses and traditional TV remain a drag on the story. Elsewhere in the content ecosystem, Warner Bros. Discovery rallied on reports that multiple strategic players, including Paramount Skydance, Comcast, and Netflix, are exploring potential bids. That renewed takeover chatter reinforced the idea that media consolidation remains very much alive in a world where scale, libraries, and distribution increasingly determine who wins and who fades.

This week’s sentiment can best be described as a cautious equilibrium. The end of the shutdown and a slightly friendlier tariff backdrop removed some tail risks and supported a constructive base case. At the same time, the rhetoric from bank CEOs and the behavior of high-multiple tech stocks signaled that many investors are increasingly mindful of downside scenarios, particularly after a long, powerful rally.

The low headline volatility masks an important shift underneath: a more selective and valuation-sensitive market. Investors appear more willing to question lofty AI and growth valuations, even when companies deliver strong operational performance. “Beat and sell off” has become a recurring pattern in popular trades, a classic late-cycle sign. Meanwhile, sectors with clearer cash-flow visibility and less policy exposure have enjoyed steadier, less dramatic gains.

The bond market continues to enforce discipline. With the 10-year yield contained but elevated, the market no longer has the tailwind of falling discount rates to justify higher and higher multiples. Instead, investors are forced to differentiate between companies with durable earnings power and those whose stories rely heavily on distant, uncertain cash flows. Early signs that unemployment is drifting higher, even from very low levels, are reinforcing the sense that we are late in the expansion and that the cost of capital will remain an important constraint.

Overall, risk appetite is intact but more discriminating. There is respect for the prevailing uptrend and for the fundamental resilience of many large-cap companies, but little appetite to pay any price for growth. The message from price action is not fear, but fatigue and selectivity.

Against this backdrop, I remain firmly in the market-neutral camp. Momentum has clearly returned after prior pullbacks, and the long-term trend in U.S. equities remains higher. However, the risk profile of that trend has shifted. Interest rates look set to stay elevated longer than the market hoped earlier in the year, unemployment appears to be nudging off the bottom, and policy risk—from shutdown brinkmanship to tariff decisions and export controls—remains a persistent, if intermittent, source of volatility.

From a tactical standpoint, I view SPY as trading within a broad, yet meaningful range. On the downside, I see support in the 620 to 640 area, a zone where buyers are likely to step in if sentiment sours but fundamentals remain intact. On the upside, a continuation of the rally toward the 680 to 700 band is plausible if earnings hold up, AI and chip-related spending continue to flow, and the Federal Reserve avoids any sharp hawkish surprises. Within that framework, I expect more sideways motion, rotation, and stock-level dispersion than a smooth, one-way melt-up.

In practical terms, I think this environment calls for respect for the range and discipline in timing. Into strength toward the upper end of the band, it makes sense to become more selective with new buys, trim weaker beta exposure, and avoid chasing emotionally charged moves in crowded AI or growth names. Into weakness closer to support, the better play is to upgrade quality—rotating into stronger balance sheets and more durable cash flows—rather than blindly buying every dip.

AI and semiconductors remain core long-term themes, but they should be treated as such: long-term. The combination of high expectations, policy scrutiny, and heavy positioning means drawdowns can be sharp even when the underlying thesis is intact. For patient investors, volatility in names like Nvidia, Applied Materials, and related ecosystem players can create opportunities, but only if position sizes are controlled and time horizons are genuinely long.

At the same time, I would not ignore consumer, media, and more traditional cyclicals. Disney and its peers are real-time indicators of how households are spending, how advertising dollars are allocated, and how business models are adapting to a streaming-first world. The response of these stocks to macro data and earnings will offer important clues about the health of the consumer and the sustainability of the current expansion.

Looking ahead, my guidance is straightforward. Stay invested, but stay selective. Emphasize companies with clear earnings visibility, solid balance sheets, and reasonable valuations. Be cautious about extrapolating recent AI-driven gains indefinitely, and be realistic about the path of interest rates. Use volatility, especially around macro data and marquee earnings releases, as an opportunity to improve the quality of your portfolio rather than as an excuse to react emotionally.

The long-term trend still looks constructive, but after a record shutdown, shifting tariff rhetoric, and a fresh round of AI repricing, we’re clearly in a phase where discipline matters more than direction. From here, risk management, careful stock selection, and patience will decide who keeps their gains and who quietly hands them back to the market.

What to do with that? Start by prioritizing balance sheets and cash flows you can underwrite through a choppy, higher-for-longer rate band. In AI infrastructure, lean toward platforms with diversified demand and limited reliance on any single export-sensitive market. In cyclicals, favor domestic beneficiaries of reshoring, defense, and infrastructure spending over pure global supply-chain plays that live and die by the next tariff headline. Keep Energy tactical until the fundamental tape—prices, spreads, and inventories—confirms the move, not just the news.

Final thought: headline volatility looks calm, but under the surface dispersion is rising, recession odds are drifting higher, and policy clarity is still a step behind the data. That combination argues for risk management first. Scale entries instead of all-in bets, define exits before you click “buy,” and let position sizing and time horizon do the heavy lifting. This is a stock-picker’s market—own what you truly understand, and keep some dry powder for the inevitable AI and policy-driven dislocations.

Meet RoboInvestor, our flagship AI-driven advisory built for exactly this kind of rangebound, headline-sensitive market. It cuts through shutdown noise, tariff chatter, and AI hype, surfaces statistically sound setups, and helps you act with precision and conviction—so you can stay invested, stay disciplined, and stay a step ahead of the next swing.

Every other weekend, you’ll get the RoboInvestor newsletter: a concise read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas designed to be ready for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

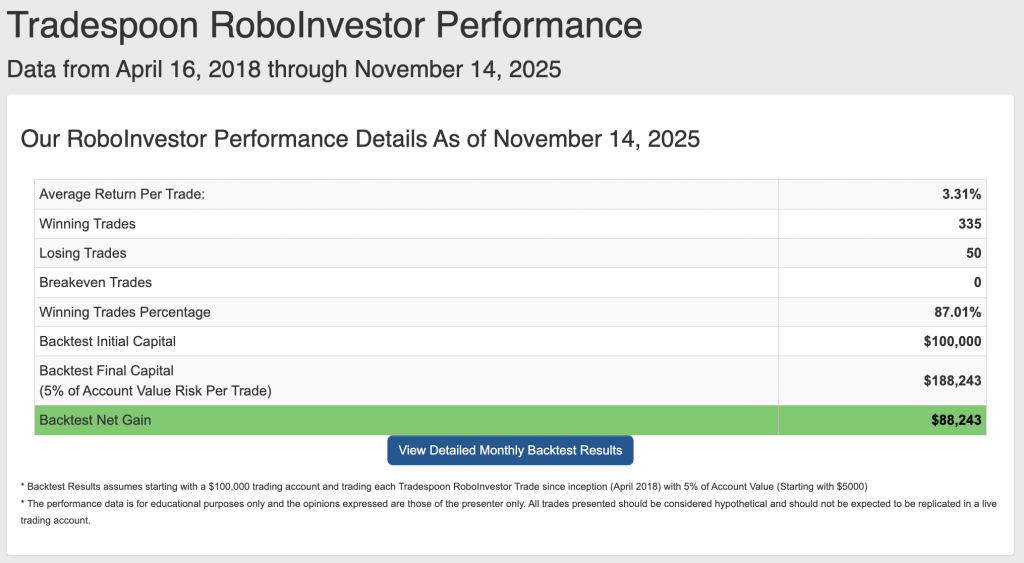

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.01% since April 2018.

As we head into the back half of Q4 2025—with October nearly in the books—investors are navigating a market defined by renewed tariff rhetoric, an uncertain Fed path, mixed economic signals, and persistent geopolitical crosscurrents. Volatility remains contained but jumpy around headlines, while earnings and guidance are doing the heavy lifting for direction. In this backdrop, partnering with a disciplined, insight-driven framework matters more than ever to cut through noise, manage rate and labor-market risk, and position proactively for the final stretch of the year.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!