In a day marked by minimal market movement, U.S. indices closed with mixed results, reflecting the ongoing struggle to find a decisive catalyst after recent weeks of substantial gains. Key factors influencing the market dynamics included small caps, a weaker dollar, and declining yields following the release of Consumer Price Index (CPI) and Producer Price Index (PPI) data.

The Dow Jones Industrial Average experienced a modest decline, while the S&P 500 and Nasdaq Composite both recorded marginal gains of 0.1%. The lack of a clear market catalyst left investors grappling for direction.

The recently released consumer price index revealed a year-over-year increase of 3.2% in October, a slight deceleration from the 3.7% recorded in September and August. Economists had anticipated a more significant slowdown, expecting a 3.3% inflation rate. The moderation can be attributed in part to a 5% decline in gasoline prices over the month, counteracting the steady rise in shelter costs.

On a monthly basis, the headline index remained flat, contrary to expectations of a 0.1% growth slowdown from September’s 0.4% rate. Core prices, excluding volatile food and energy indexes, reflected a year-over-year increase of 4%, a marginal dip from September, indicating a steady cooling trend. The core CPI measure rose 0.2% over October, slightly slower than the previous month but in line with expectations.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Wednesday’s focus shifted to the producer price index (PPI) and retail sales data. Producer prices fell 0.5% in October, surprising analysts who had anticipated a 0.1% increase. Simultaneously, retail sales declined by 0.1% month over month, defying expectations of a 0.3% drop. Despite the headline decline, a closer look reveals a more resilient consumer demand, as falling gasoline prices played a significant role in the overall retail sales downturn.

The cooler-than-expected inflation readings on Tuesday prompted a surge in stock prices, and Wednesday’s positive market momentum continued as traders reacted to signs of inflation cooling. With Fed-funds futures assigning a zero percent chance of interest rate hikes in the next two Federal Open Market Committee meetings, optimism surrounding a potential pivot in the Federal Reserve’s stance has contributed to the November stock rally.

In a twist against expectations, October’s retail sales dipped by only 0.1%, defying economists’ projections of a 0.3% drop, and revealing a more robust consumer demand. Despite concerns, a closer look shows falling gasoline prices as a primary driver for the decline, with sales at gas stations slipping by 0.3% from September. Excluding motor vehicles and gas stations, total retail sales actually increased by 0.1% month over month, surpassing the predicted 0.1% drop. This unexpected resilience underscores a positive outlook for the approaching holiday season and challenges the initial worry surrounding the dip in retail sales.

Walmart, despite reporting third-quarter earnings surpassing analyst estimates and revising fiscal-year guidance upward, saw its stock plummet by 8.1%, disappointing investors with its future outlook. Then, Target Corp. made waves in the market with third-quarter earnings that exceeded expectations, propelling its stock upward. Despite a 4.2% dip in total revenue, Target’s adjusted earnings marked a significant increase from the previous year, well above expectations. Target’s robust performance amid revenue challenges signals resilience and strategic prowess, offering investors valuable insights amidst broader economic uncertainties.

Alibaba faced a 9.1% drop in U.S.-listed shares after reporting better-than-expected fiscal second-quarter earnings. However, concerns over U.S. export controls on advanced computer chips and the decision not to spin off the cloud division impacted investor sentiment.

Cisco Systems reported positive fiscal first-quarter earnings but reduced its fiscal year outlook, causing a 9.8% decline in its stock. The company cited a slowdown in product orders as the primary factor. Macy’s, on the other hand, reported third-quarter adjusted earnings exceeding expectations, leading to a 5.7% increase in its shares.

Intel’s stock rose by 6.7% after receiving a Buy rating from Mizuho, which cited significant new server product launches and customer announcements in the next six months.

Investors witnessed a day of minimal movement as the market paused following a strong November rally. Oil prices slid, and Treasury yields continued their post-CPI decline.

Amid the uncertainty, a shift to a market-neutral stance is underway, driven by low recession probabilities in economic data. The recent equity rally, triggered by a decline in interest rates and the U.S. Dollar ($DXY), has surpassed expectations, with a robust Christmas rally already in progress.

The prevailing sentiment among market participants is that the Federal Reserve is unlikely to raise rates this year and the next, with a high probability of rate cuts in the first half of 2024. This sentiment is viewed as bullish for the market.

The U.S. Dollar ($DXY) and longer-dated treasuries have dipped below their 50-day moving averages (DMA). The ongoing weakness in the dollar, coupled with declining yields, is anticipated to fuel the market rally through the end of the year.

Market participants are closely monitoring the possibility of a government shutdown. While optimism remains, caution is advised, with the S&P 500 rally potentially capped at $450-470 levels. Short-term support is expected in the range of 400-430, with the market likely to exhibit patterns of higher highs and higher lows in the coming weeks. For reference, the SPY Seasonal Chart is shown below:

The energy sector experienced a significant pullback, testing the 200 DMA amid weak global demand and reduced geopolitical risks. WTI oil futures dropped 4.1% to $73.50 a barrel, impacting energy stocks. The S&P 500’s energy sector emerged as the largest laggard, declining by 2.2%, while the utilities sector led with a gain of 0.8%. As the market navigates these dynamics, investors remain vigilant for potential shifts in the coming weeks.

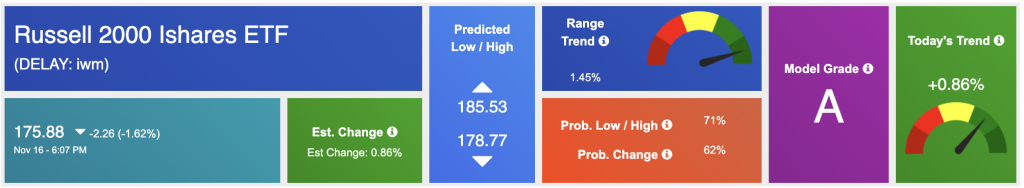

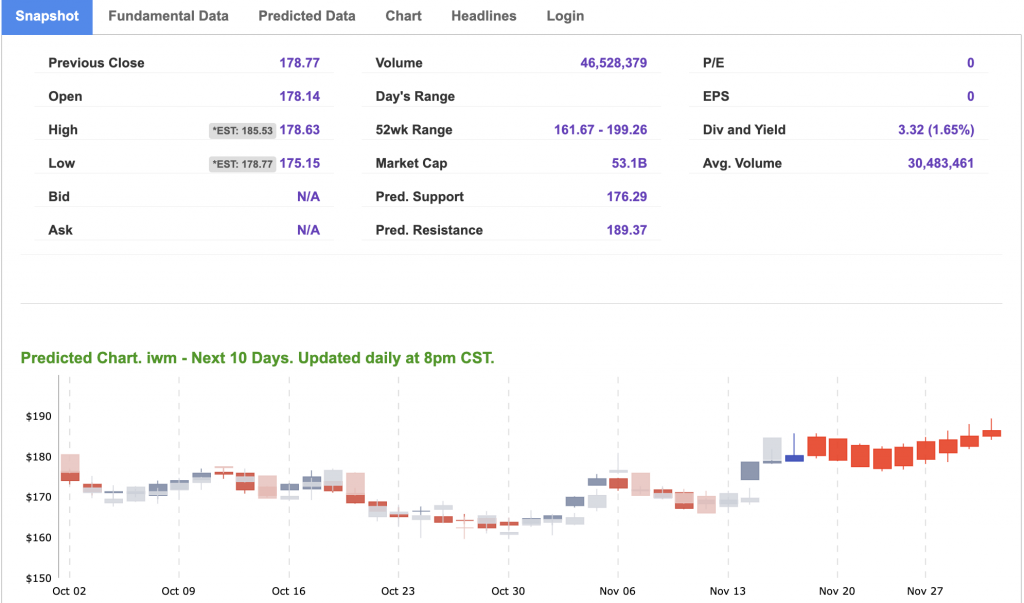

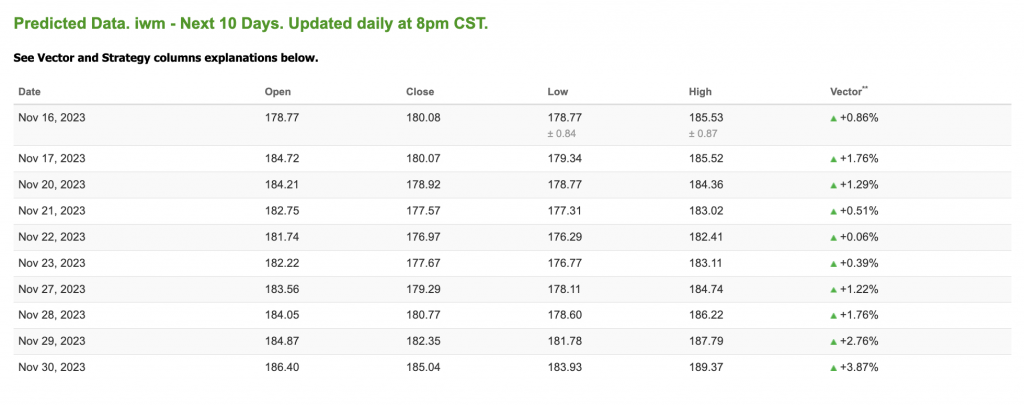

As the broader U.S. market grapples with mixed results and investors seek stability in the face of uncertainties, one symbol that stands out is the iShares Russell 2000 ETF ($IWM). This exchange-traded fund tracks the performance of the Russell 2000 Index, composed of small-cap stocks. In the current market landscape, $IWM presents a compelling opportunity for investors looking to capitalize on specific trends discussed in the preceding article.

The iShares Russell 2000 ETF encapsulates the performance of 2,000 small-cap companies, offering diversified exposure to this segment of the market. Small-cap stocks often display greater growth potential and responsiveness to domestic economic conditions, making $IWM an attractive option for investors seeking dynamic opportunities.

The prevailing weakness in the U.S. dollar ($DXY) and the declining yields, as discussed in the article, bode well for small-cap stocks. Historically, smaller companies tend to benefit from a weaker dollar and lower interest rates, creating a favorable environment for $IWM. As stated, a shift in the market sentiment toward a market-neutral stance, emphasizing stability amid economic data suggesting a low probability of recession. In such a landscape, small caps often serve as a strategic choice, and $IWM positions investors to benefit from this shift.

The consensus among market participants, as discussed in the article, points toward the Federal Reserve’s inclination to hold off on rate hikes and potentially consider rate cuts in the first half of 2024. This dovish stance aligns with the growth narrative often associated with small-cap stocks, making $IWM an attractive consideration.

Navigating the intricacies of the current market, investors are seeking opportunities that align with emerging trends and provide a hedge against uncertainties. In this context, $IWM emerges as a strategic investment, offering exposure to the resilience of small-cap stocks, favorable currency dynamics, and the overall market sentiment. As investors look for a well-rounded portfolio, $IWM represents a timely opportunity to capitalize on the discussed market conditions and position for potential growth in the small-cap segment.

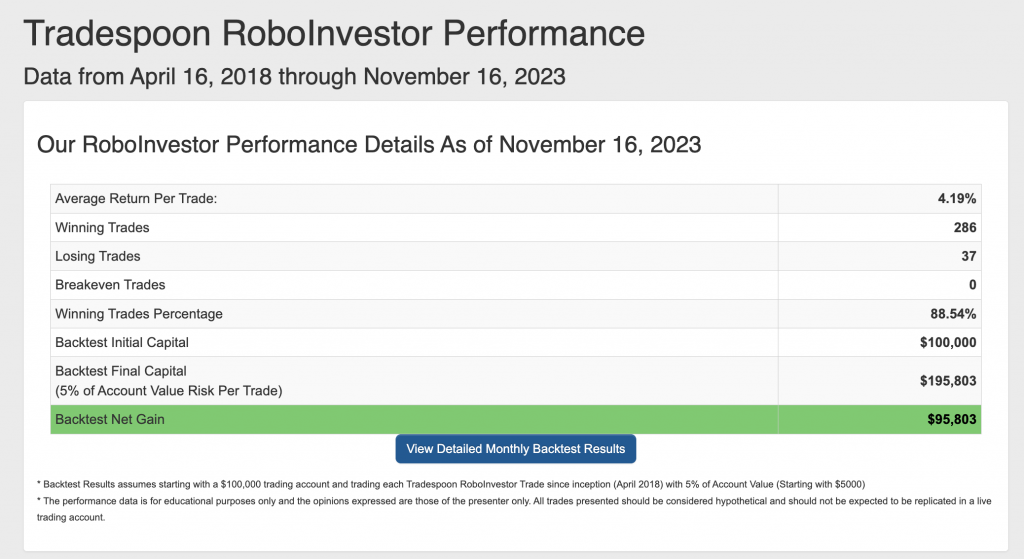

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.54% going back to April 2018.

As we enter Q4, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!