RoboStreet – November 21, 2025

Nvidia’s earnings sparked a headline-grabbing rally that flipped into a sharp selloff, and with the VIX back near 24, indices below the 50-day, tariffs re-entering the narrative, and labor data cooling, this week’s NVDA and WMT results now sit at the center of whether the market stabilizes toward 680–700 or slips back to defend 620–640 support.

This week’s market action was a reminder that rallies built on a single catalyst can fade fast when the broader tape is fragile. What began as an early surge—sparked by Nvidia earnings enthusiasm—quickly flipped into a sharp risk-off reversal on Thursday. By the close, the Nasdaq Composite had slid 2.2%, the S&P 500 dropped 1.6%, and the Dow fell 386 points (-0.8%). The intraday swing was even more dramatic: at one point the Nasdaq was up 2.6%, the S&P 500 up 1.9%, and the Dow up 1.6%, before all three rolled over hard. That kind of reversal isn’t just noise—it’s a signal that momentum is thinning and conviction is uneven.

Under the surface, volatility is rising alongside technical deterioration. The VIX pushed into the mid-to-high 20s, touching an intraday high near 28.27 before easing back, and currently sits around 24. Markets are also trading below their 50-day moving averages, reinforcing that the short-term trend has turned defensive. When price breaks below key intermediate support while volatility rises, investors are no longer paying for upside—they’re paying for protection. That shift matters.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Rates remain another rotating pressure point. The 10-year yield continues to swing in a wide band between roughly 3.6% and 4.2%, reflecting a market still unsure whether growth is cooling enough to justify near-term easing, or sticky inflation and fiscal uncertainty keep the Fed sidelined longer. That range-bound volatility in yields has been feeding into equity volatility all week, particularly in growth and rate-sensitive sectors.

On the macro and commodity side, oil gave back early gains after the U.S. floated a plan to restart peace talks between Russia and Ukraine, trimming some geopolitical risk premium right ahead of new sanctions. Meanwhile, the dollar regained much of what it had initially lost after the jobs report, signaling that global capital remains positioned for a longer period of policy uncertainty and potentially “higher for longer” rates.

A major early-week tailwind came from Washington, where bipartisan progress toward ending the government shutdown helped fuel a risk-on rally. Markets interpreted it as a release valve: fewer fears of prolonged data delays, less drag on growth, and a reduced chance of policy chaos spilling into corporate confidence. Industrials and financials were early leaders as sentiment leaned optimistic.

But that relief met a more complicated economic picture. Shutdown-delayed labor data finally hit the tape, and while the headline payroll gain of 119K for September beat expectations, the unemployment rate moved up to 4.4% and prior months were revised lower. In other words, hiring is still positive, but the forward slope is flattening. The market’s read-through was straightforward: the Fed may have more room to cut later, but the reason it might cut is starting to show up more clearly.

That tension was reflected in rate expectations. Traders nudged December cut odds higher after the jobs data, but the shutdown’s disruption to key releases has kept confidence shaky. Markets are still pricing cuts as possible, not certain, and that uncertainty is keeping both yields and equities jumpy.

Tariffs also remained a meaningful background force. The VIX’s spike this week echoed its earlier surge during April’s “Liberation Day” tariff shock, and even though this week’s volatility wasn’t at that extreme, the memory of tariff-driven fragility is clearly embedded in positioning. The market isn’t just reacting to earnings anymore—it’s constantly recalibrating policy risk.

Earnings are now the next major hinge point. Nvidia and Walmart headline a busy week, and given how heavily the market leans on megacap leadership, these prints matter far beyond their individual sectors. Nvidia carries the weight of AI optimism and tech valuation expansion. Walmart is a real-time pulse check on the consumer in a world where unemployment is drifting higher. Strong numbers can stabilize confidence; soft guidance could reinforce the “late-cycle slowdown” narrative that’s creeping back in.

Investor mood shifted distinctly from hopeful to cautious across the week. The early rally on shutdown optimism and AI strength was quickly replaced by a more defensive posture as tech wobbled and macro signals cooled. The violent Thursday reversal was the emotional pivot point: it showed that buyers are still there, but they’re skittish and quick to take profits when the market fails to follow through.

The rise in the VIX above the 20 “normal volatility” threshold confirms that risk appetite is thinning. When implied volatility climbs while indices break below moving averages, it’s less about panic and more about a market resetting expectations. Investors are no longer comfortable assuming a smooth climb higher, they’re acknowledging two-way risk again.

This is also the environment where leadership narrows. Tech, especially semiconductors, remains the market’s heartbeat, but valuation sensitivity is increasing. Nvidia slipping on jitters—even briefly—was enough to drag the Nasdaq and remind everyone how concentrated the upside has become. In short, sentiment is not collapsing, but it’s no longer carefree.

I’m staying in the market-neutral camp here. Momentum has clearly deteriorated, and the combination of rising volatility, weaker technical structure, and policy-macro uncertainty argues against leaning aggressively long or short. The market still has a path higher, but it needs cleaner confirmation than what we saw this week.

The core risk remains the same: interest rates stay higher for longer while unemployment ticks up. That mix squeezes both valuation and demand at the same time. It doesn’t guarantee a downturn, but it raises the odds of choppy, headline-driven trading where rallies can evaporate fast—exactly what we saw Thursday.

Structurally, I still see the SPY capable of pushing toward the 680–700 zone if earnings and macro surprises stabilize sentiment. But in the nearer term, the market needs to respect its footing. I view 620–640 as the key short-term support range for the next couple of months. If we hold that area and volatility cools, the market can rebuild a base for another leg higher. If we lose it with VIX trending up, we should expect a deeper reset before the long-term trend reasserts itself.

Action-wise, this is a “selective offense, broad defense” moment. Favor high-quality names with real earnings durability and pricing power. Be careful chasing extended tech moves without support. Watch Nvidia closely—not just the numbers, but the forward demand tone and margins. And keep an eye on Walmart as a consumer stress test; it may tell us more about 2026 growth than any single macro print.

Above all, respect the tape. When markets are below the 50 DMA and volatility is elevated, patience and precision beat aggressiveness. Let earnings and the next wave of macro data earn back conviction. Until then, neutral positioning with a readiness to scale into strength—rather than predict it: is the cleanest playbook.

Meet RoboInvestor, our flagship AI-driven advisory built for exactly this kind of rangebound, headline-sensitive market. It cuts through shutdown noise, tariff chatter, and AI hype, surfaces statistically sound setups, and helps you act with precision and conviction—so you can stay invested, stay disciplined, and stay a step ahead of the next swing.

Every other weekend, you’ll get the RoboInvestor newsletter: a concise read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas designed to be ready for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

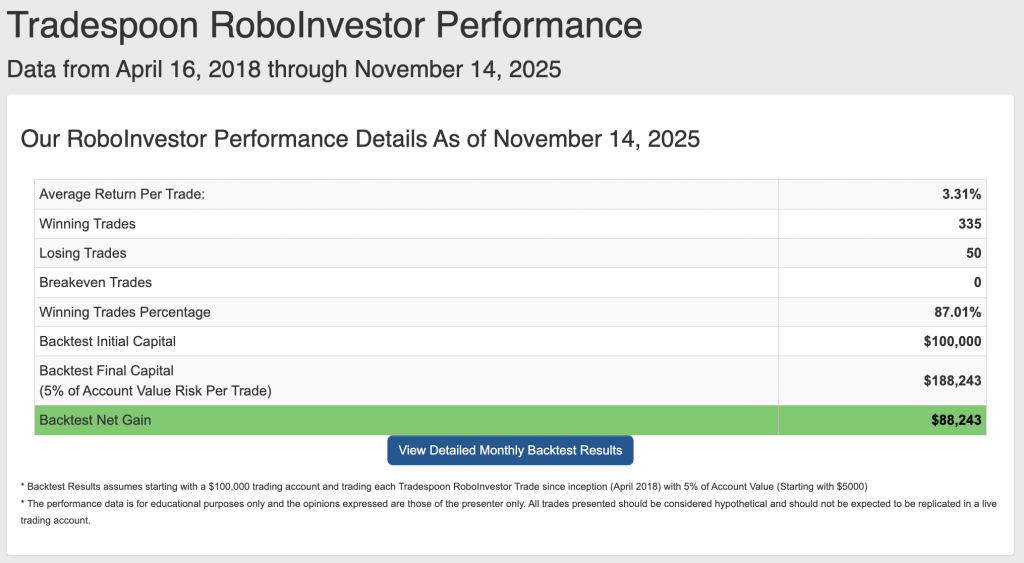

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.01% since April 2018.

As we head into the back half of Q4 2025—with October nearly in the books—investors are navigating a market defined by renewed tariff rhetoric, an uncertain Fed path, mixed economic signals, and persistent geopolitical crosscurrents. Volatility remains contained but jumpy around headlines, while earnings and guidance are doing the heavy lifting for direction. In this backdrop, partnering with a disciplined, insight-driven framework matters more than ever to cut through noise, manage rate and labor-market risk, and position proactively for the final stretch of the year.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!