The U.S. stock market saw a turbulent week, culminating in a mixed bag of developments, including a rise in Treasury yields, a worrisome 7-year note auction, and a slide in oil prices. Investors are bracing for heightened volatility in the coming months, with concerns over inflation and the prospect of a government shutdown looming large. In this finance news article, we delve into the factors influencing the markets, particularly in the tech sector, as well as the potential implications for various assets and industries.

On Thursday, the stock market grappled with uncertainty, and technology stocks led the decline. The Nasdaq’s performance mirrored this trend, influenced by the continuous rise of the 10-year Treasury yield, which has climbed to 4.65%, a substantial increase from its March level of just over 3%. The market is grappling with the fear that inflation may persist despite the Federal Reserve’s efforts to raise short-term interest rates. Rising long-term bond yields have particularly affected tech companies, as their valuations are based on the assumption of future profits. Higher long-dated bond yields diminish the appeal of these future earnings, creating pressure on tech stocks. Both the Nasdaq and S&P 500 remain below their yearly peaks as a result.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The energy sector also witnessed notable developments, with U.S. crude futures retreating more than half of the previous day’s 3.6% gain, closing at $91.71 a barrel. The market volatility and this decline in oil prices have raised questions about the possibility of geopolitical talks between the U.S., Saudi Arabia, and Israel potentially including an energy component. If such an agreement were to materialize, it could lead to an increase in Saudi crude imports to the U.S., potentially impacting both crude oil prices and U.S. gasoline prices.

The Federal Reserve Bank of Kansas City reported that the Tenth District manufacturing survey’s composite index was at minus 8 in September, indicating a contraction in manufacturing activity. This contraction, along with decreased future expectations, underscores persistent concerns about the state of the industry’s economic conditions.

Investors remain focused on the trajectory of the U.S. economy, especially after the Federal Reserve signaled a prolonged period of higher interest rates. Simultaneously, the looming possibility of a government shutdown poses yet another risk for investors. All eyes are on the upcoming September unemployment data and Services PMI data, which will provide crucial insights into economic trends.

Interest rates are a significant focal point, as demand for treasuries appears weak, potentially driving rates even higher. This lack of demand from key players like Japan and China can result in declining treasury prices and rising yields, exerting pressure on equity valuations.

In a notable shift, the IPO market has sprung back to life with the offerings of companies like $CART and $ARM. These stocks surged by up to 30% on their first day, only to reverse and settle around their IPO prices. This fluctuation in IPO stocks serves as a barometer for risk appetite, with market participants closely monitoring price action. This resurgence in IPO activity marks a departure from the subdued market conditions of the past two years.

Lastly, Apple ($AAPL) faces a challenging period as its stock dips below August lows. It’s worth noting that it is not far from the 200-day moving average, a historical level where the market has often found a bottom. Apple’s performance will be closely watched to gauge broader market sentiment.

The U.S. stock market continues to navigate through a landscape of uncertainty, with inflation concerns, rising interest rates, and the specter of a government shutdown weighing on investor sentiment. Tech stocks, in particular, are facing headwinds due to higher long-term bond yields. Market participants are closely monitoring economic data and geopolitical developments for clues about the future trajectory of financial markets. Based on these levels there is one symbol I will be looking into in the coming week.

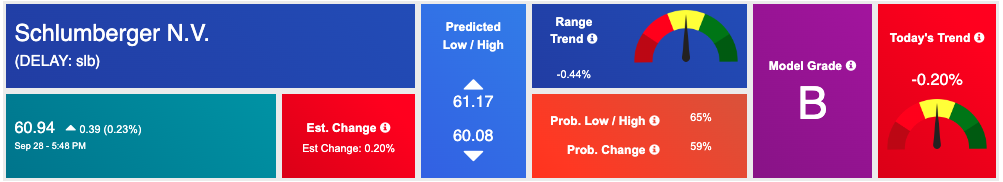

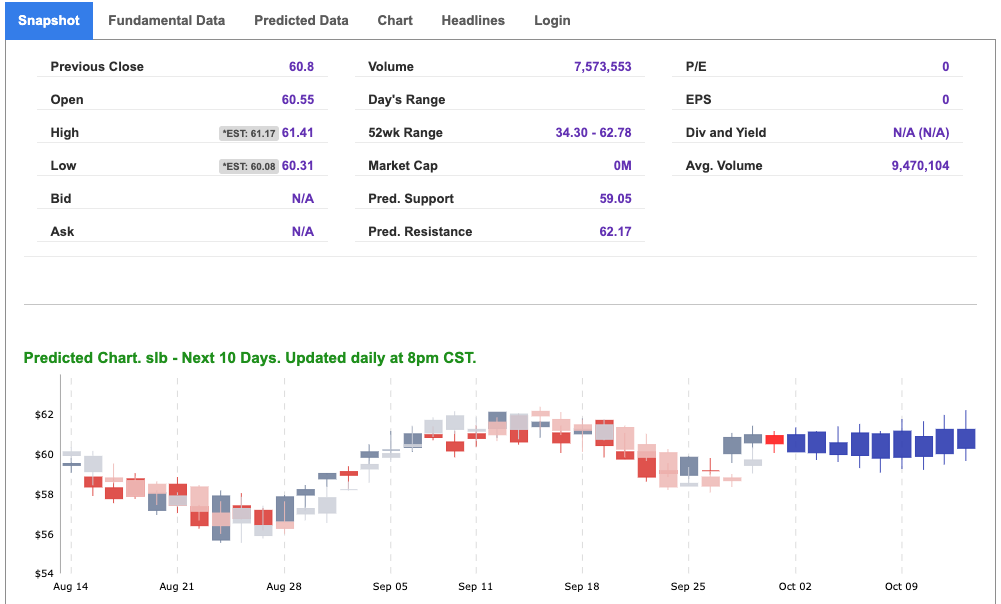

Amid the swirling currents of market volatility and economic uncertainty, the energy sector has emerged as an intriguing space for investors seeking opportunities. In particular, Schlumberger Limited ($SLB), a global leader in oilfield services, stands out as a company poised to thrive in the current market conditions.

Schlumberger Limited (SLB) is a powerhouse in the energy industry, renowned for its comprehensive suite of oilfield services and technology solutions. Operating in more than 120 countries, the company provides essential services such as drilling, well construction, reservoir management, and more, enabling oil and gas operators to extract valuable resources efficiently. Schlumberger has continually evolved to meet the demands of the ever-changing energy landscape.

Several factors make Schlumberger an attractive investment opportunity amidst the current market conditions. Despite recent fluctuations in oil prices, global energy demand remains robust. As economies recover from the pandemic-induced slowdown, the need for energy resources, including oil and natural gas, continues to surge. Schlumberger, with its extensive global presence, is well-positioned to benefit from this ongoing demand.

The geopolitical landscape, characterized by discussions between the U.S., Saudi Arabia, and Israel regarding energy agreements, has the potential to reshape energy markets. Schlumberger’s expertise and global reach make it a key player in navigating these developments, potentially opening up new avenues for growth. Schlumberger has weathered numerous market cycles, demonstrating its resilience in challenging times. The company’s ability to adapt and innovate in response to industry shifts positions it to capitalize on emerging opportunities while mitigating risks.

Schlumberger Limited ($SLB) presents a compelling investment opportunity in the energy sector. As markets grapple with uncertainty and seek refuge in sectors with proven stability, Schlumberger’s long-standing reputation, global presence, and adaptability make it an attractive prospect. While all investments come with inherent risks, the company’s strategic positioning and historical resilience suggest that now might be a good time for investors to consider adding $SLB to their portfolios as they navigate the complex currents of today’s financial landscape.

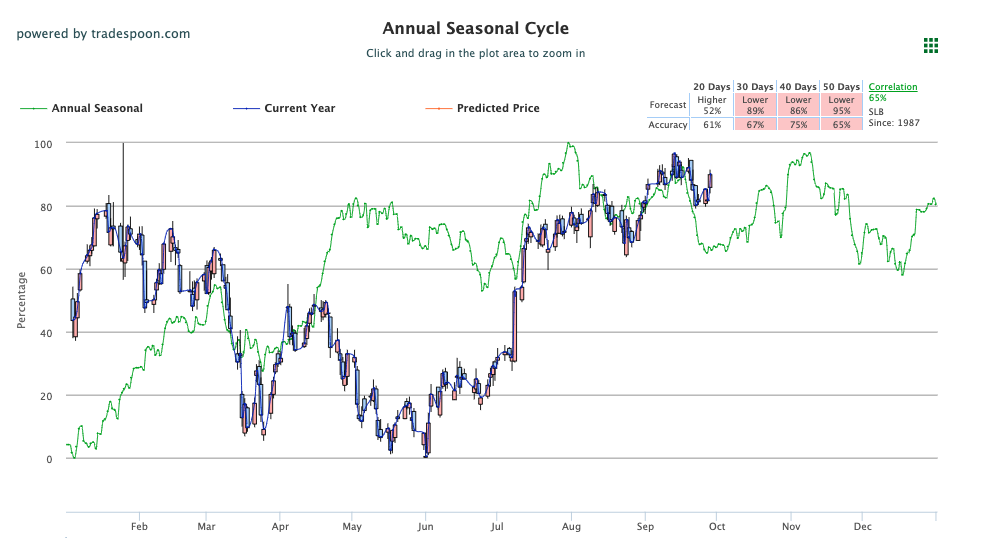

Looking at our Seasonal Chart, the premier tool for long-term forecasts, we see an uptick in the next 20 days where SLB could shoot higher. With several factors still out there to be resolved there is a potential for this symbol to be forecasted even higher. For reference, the SLB Seasonal Chart is shown below:

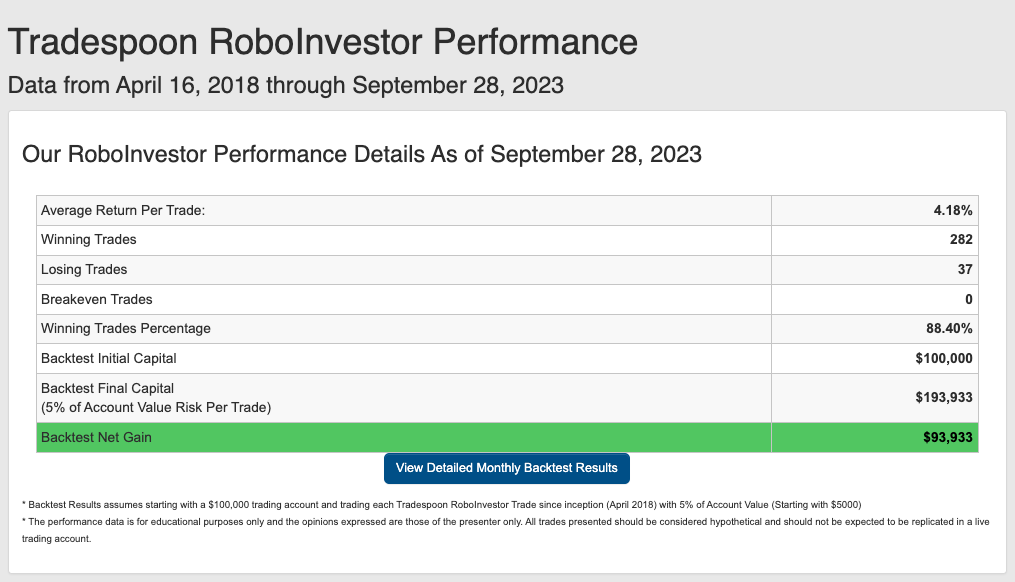

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.40% going back to April 2018.

As we inch closer to Q4 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!