As the week progresses, financial markets find themselves navigating through a storm of economic data and shifting sentiments. Thursday saw stocks advancing amidst falling bond yields, although technology shares trailed behind following concerning retail sales and jobless claims data. Meanwhile, European markets found solace in gains from the automotive and defense sectors, offsetting losses in banking stocks.

January delivered a frosty blow to consumer spending, with retail sales plummeting by 0.8% from December, a figure that surpassed economists’ forecasts. The Commerce Department’s report painted a picture of cautious consumer sentiment, evidenced by decreased spending across various sectors. Notably, expenditures at gas stations and home improvement stores saw significant declines of 1.7% and 4.1%, respectively, likely attributed to harsh weather conditions. Additionally, online sales contracted by 0.8%, reflecting a broader trend of subdued consumer activity.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

This decline in retail sales comes at a time when consumers face multiple economic headwinds. Elevated interest rates, lingering inflation, and tightening credit conditions have collectively squeezed household budgets. Many Americans are also drawing down their pandemic savings, further limiting their spending capacity. However, amidst these challenges, one bright spot remains—the job market. Despite economic uncertainties, robust job creation has provided stability and supported consumer confidence to some extent.

Turning to inflation, concerns persist as the latest Consumer Price Index (CPI) figures revealed a stubbornly high inflation rate. In January, the CPI rose by 3.1% year-over-year, a slight moderation from December’s 3.4% pace. However, this figure still exceeded economists’ expectations, indicating that inflationary pressures remain resilient. Core CPI, which excludes volatile energy and food prices, remained unchanged at 3.9%, suggesting that underlying inflationary trends are firmly entrenched.

Federal Reserve officials have cautioned that bringing inflation down to the central bank’s 2% target will pose a significant challenge. The latest CPI data underscored this point, highlighting the persistent nature of inflationary forces. While the start of the year showed some progress in moderating headline inflation, core metrics suggest that pricing pressures continue to linger.

For investors, the combination of weak retail sales and stubborn inflation presents a conundrum. On one hand, subdued consumer spending raises concerns about economic growth prospects and corporate earnings. On the other hand, persistent inflationary pressures could prompt central banks to adopt more aggressive tightening measures, potentially dampening market sentiment.

As markets digest these economic data points, volatility is likely to remain elevated, with investors closely monitoring upcoming reports for further insights into the trajectory of the economy. In particular, the release of the Producer Price Index (PPI) data and corporate earnings reports will provide critical clues about the underlying health of businesses and the broader economy.

In this environment, investors may seek to adopt a cautious approach, diversifying their portfolios to mitigate risks and capitalize on emerging opportunities. While uncertainties abound, prudent risk management and a keen eye on economic indicators will be key to navigating the evolving market landscape.

Cisco and Deere made notable moves in Thursday’s trading, with Cisco facing a downturn post-disappointing guidance, while Deere exceeded expectations but saw a dip due to a cautious outlook. Conversely, Super Micro appeared poised for a new high, reflecting the varied landscape of market responses.

Wednesday marked a rebound for stocks after a two-day downturn, with notable movements including Uber’s rise following authorization for stock repurchase and Upstart Holdings’ decline post-disappointing outlook. However, concerns loom over hotter-than-expected inflation readings, which triggered a retreat from record highs on Tuesday.

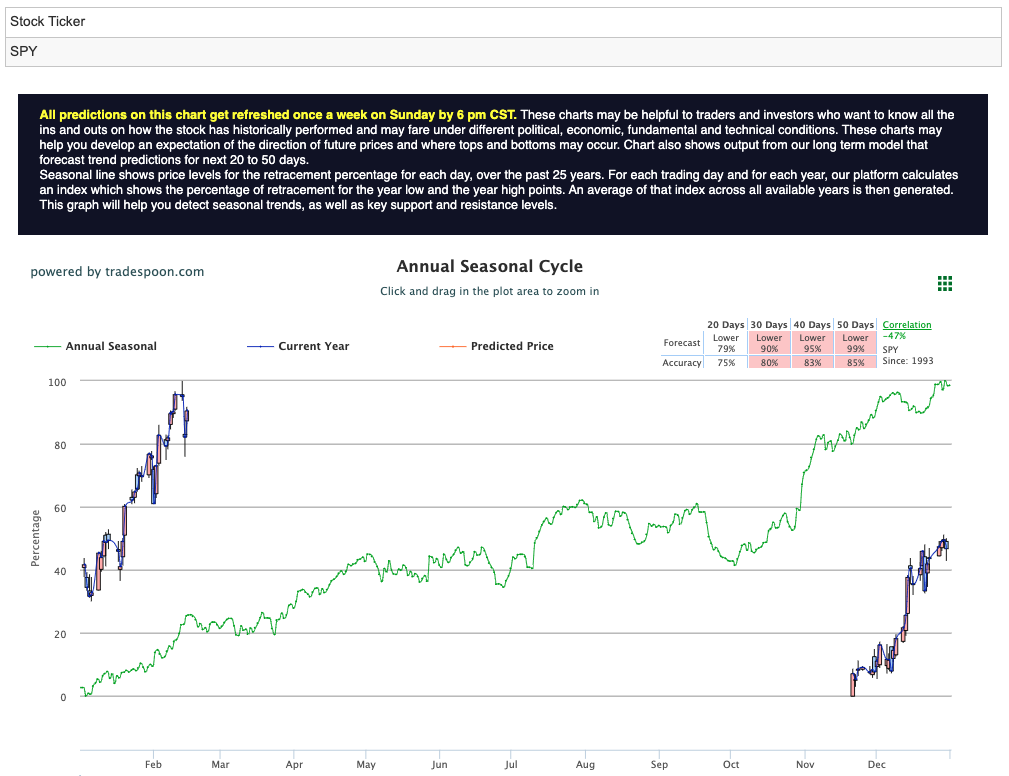

Amidst heightened volatility, all eyes turn to Friday’s Producer Price Index (PPI) data, February expiration events, and upcoming earnings reports, particularly NVIDIA’s. Market sentiment remains cautious as inflationary pressures persist, driving correlations between treasuries and equities to reverse course. Analysts foresee potential resistance levels for the SPY around $500-$510, with short-term support at 460-470, emphasizing a pattern of higher highs and higher lows, albeit with a note of caution that the peak of the rally may have passed. To provide a visual reference, the SPY Seasonal Chart is presented below:

As financial markets continue to navigate through economic data and evolving sentiments, the volatility spurred by inflation concerns underscores the delicate balance between optimism and caution. With eyes firmly fixed on upcoming data releases and earnings reports, there is one symbol that has caught my and my A.I.’s attention.

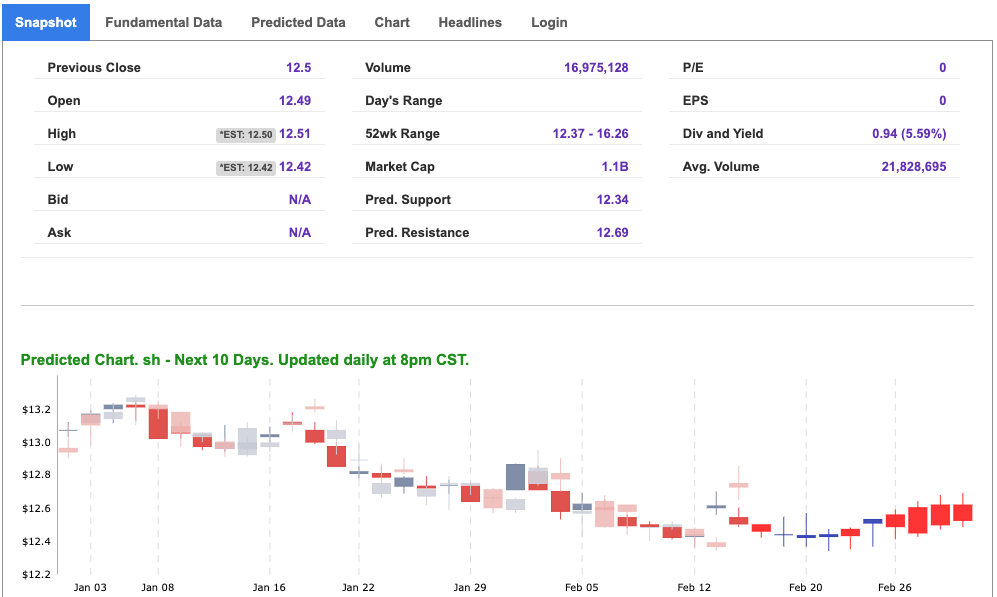

ProShares Short S&P 500 ($SH) is an exchange-traded fund (ETF) designed to provide inverse exposure to the performance of the S&P 500 Index. Essentially, $SH aims to deliver the opposite returns of the S&P 500 daily. This means that when the S&P 500 declines, $SH typically increases in value, and vice versa. It is a popular choice among investors seeking to hedge against downturns in the broader stock market.

In the current market climate, where concerns over weak retail sales and persistent inflationary pressures loom large, $SH emerges as a compelling hedge against potential downturns. Amidst worries about economic growth prospects and corporate earnings, $SH’s inverse exposure to the S&P 500 presents a strategic opportunity for investors to diversify their portfolios effectively. By incorporating $SH into their investment strategy, investors can mitigate specific market risks associated with the S&P 500, thereby enhancing overall portfolio diversification. This diversification can be particularly crucial during periods of heightened market volatility and economic uncertainty.

Furthermore, in an environment where market volatility is expected to remain elevated, $SH offers investors the opportunity to profit from increased volatility. As economic data points are digested and market sentiments fluctuate, $SH may experience upward movements, allowing investors to capitalize on short-term trading opportunities. This potential for profit from market volatility further enhances $SH’s appeal as a hedge against downside risks.

Overall, amidst the backdrop of weak retail sales, stubborn inflation, and market volatility, $SH stands out as a prudent choice for investors seeking to navigate through turbulent market conditions. Its inverse exposure to the S&P 500, coupled with diversification benefits and the potential for profit from market volatility, positions $SH as a valuable asset in investors’ toolkits for managing risk and preserving capital.

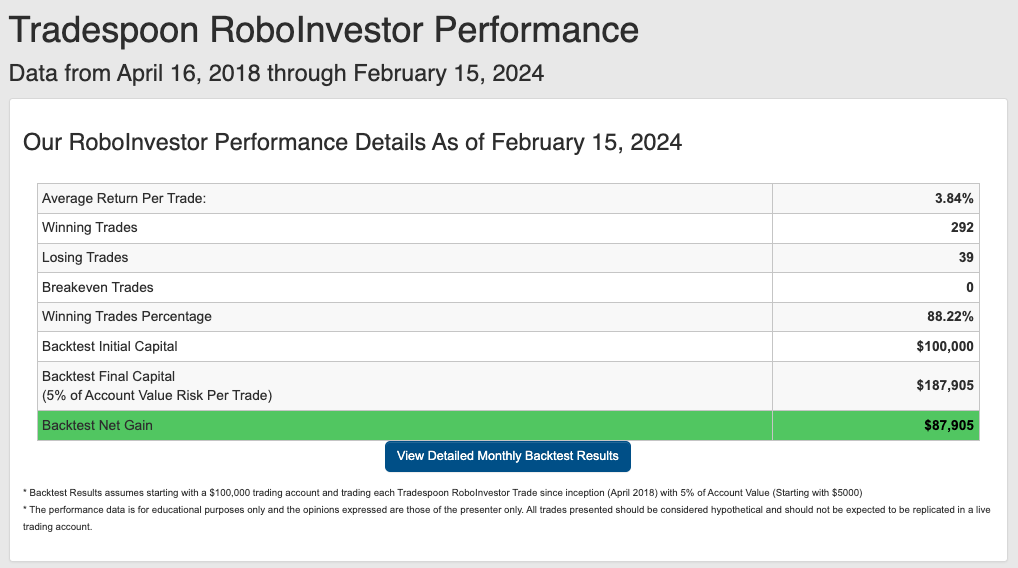

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step further into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!