RoboStreet – October 16, 2025

Tariffs and a data blackout jolt risk; JPM and TSM set the tone as VIX nears 25. Gold sits near records, oil slips, and the 10-year dips below 4%—can earnings keep the rally alive?

The week began with a clean reset. After Friday’s tariff scare, Monday opened to softer rhetoric and a broad relief rally led by AI-adjacent tech. With cash Treasuries closed, equities proved they didn’t need falling yields to stabilize; mega-caps carried the tape while gold and silver extended their policy-hedge bid. That early strength set an optimistic tone into the earnings slate, where banks would effectively moonlight as macro proxies in a data-light environment.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

By midweek, the market’s attention snapped back to policy and positioning. The government shutdown kept marquee releases on ice, so guidance and Fed commentary became the de facto data stream. Consumer sentiment was mixed—fragile expectations but slightly easier inflation anxieties—reinforcing a “slowing, not stalling” backdrop that investors were willing to fund so long as earnings didn’t contradict it. At the same time, tariff headlines re-ignited U.S.–China tension: posts about potential new levies, framed as a response to “economically hostile” behavior, revived supply-chain and cost concerns across tech and manufacturing before the tone briefly cooled again.

Against that noise, semiconductors acted like ballast. Partnerships and capacity signals—Broadcom’s work with OpenAI, AMD’s deepening ties, and foundry momentum—kept the AI-capex flywheel turning. Taiwan Semiconductor’s strong report underscored how AI demand is pulling forward revenue, and it sharpened the setup for Nvidia’s upcoming print, which now doubles as a referendum on whether AI infrastructure spend can compound into year-end. The Nasdaq routinely found support on this theme even when cyclicals chopped.

Financials took center stage as nowcasters. JPMorgan and its peers set expectations around deposit costs, early credit normalization in cards and C&I, and underwriting pipelines—details that matter more than backward beats while the official data are delayed. The read-through was nuanced rather than dramatic, and that was enough to keep the soft-landing base case intact—until risk appetite wavered into Thursday.

Late week, markets pivoted to “safety first.” Regional-bank loan worries knocked cyclicals, the 10-year slid back through the psychologically heavy 4% line, and the VIX pressed to roughly 25 as indexes retested their 50-day moving averages. Oil extended a multi-session slide on inventory builds and lower refinery runs; gold printed fresh highs on the combination of tariff risk and rising cut odds. Overseas, Macau’s revenue disruption added a headwind to leisure, while a high-profile consumer deal helped explain why discretionary never fully caught traction.

Stepping back, the tape still resolves to the same tug-of-war: trade escalation and shutdown-driven uncertainty on one side; AI-led earnings power and a gentler inflation pulse on the other. Rates remain the market’s metronome—think of the 10-year oscillating in a well-worn range—while volatility has re-priced from summer calm to a level that demands respect. That doesn’t break the thesis; it simply narrows the runway.

Our roadmap is unchanged but more tactical. If bank commentary “holds serve” and semis validate demand into Nvidia’s print, SPY can grind toward 680–700 on the next push, with 620–640 as near-term buy-the-dip support. The risks to monitor are straightforward: a sustained volatility regime near or above this week’s highs, a decisive jump in long rates back through the recent range, or an unemployment inflection once the data backlog clears. Until then, lean on what’s working—AI horsepower, quality balance sheets, disciplined cyclicals on weakness—while carrying modest protection against policy shocks that can ripple faster than the next press conference.

Bottom line: this was a week of relief and recalibration that ended in a cautious safety bid, not a thesis break. Earnings are the macro, rates set the backdrop, and investor psychology is toggling between patience and protection as we wait for the data to catch up.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

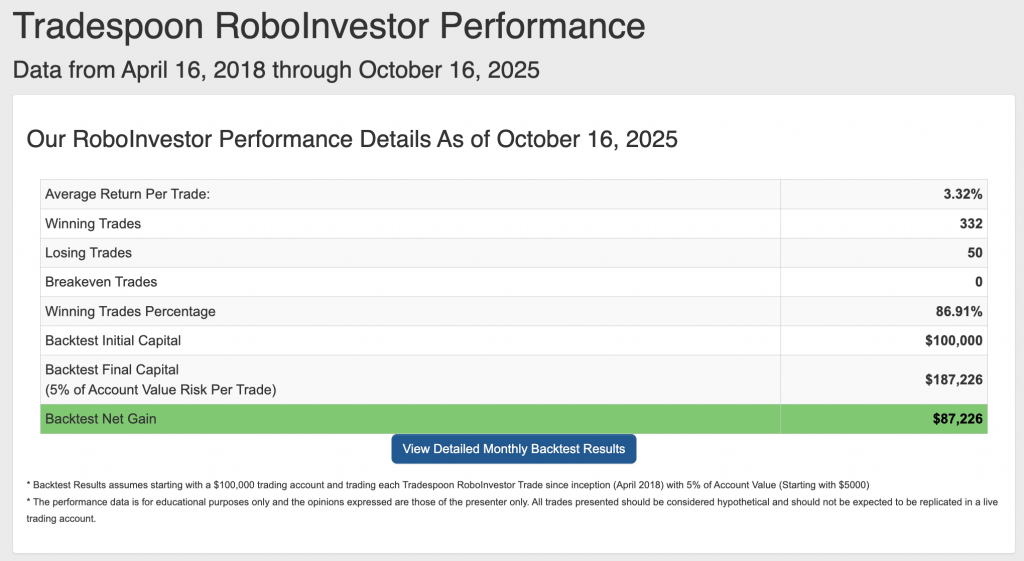

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 86.91% going back to April 2018.

As we near the end of Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!