RoboStreet – October 9, 2025

Early beats (DAL, PEP), cautious Fed, tariffs in focus, gold near records, dollar softer—can the rally keep climbing without official data?

The market finally exhaled. After notching fresh highs early in the week, stocks eased as the VIX hovered near 17 and indexes retested their peaks, a pause that felt more like digestion than deterioration. The backdrop explains the hesitation: Washington’s funding lapse has entered day nine, freezing the usual macro playbook and forcing investors to stitch together the economy from alternative data and corporate guidance. With the official jobs report postponed, the market is trading on inference—and every earnings call suddenly matters more.

Rates stayed inside familiar guardrails, with the 10-year oscillating around the 4.0%–4.2% band while the 2-year held near 3.6%. Fed speakers kept the tone cautiously dovish after September’s 25 bp cut, acknowledging that tariff dynamics could keep a little heat under inflation even as growth cools. That combination—orderly yields and no hawkish surprises—helped preserve risk appetite even as price action backed off intraday highs.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Earnings season cracked open and the first trickle was encouraging. Delta Air Lines delivered a clean beat and lifted its outlook, reigniting interest across the airline complex. The message under the hood was premium-cabin strength, corporate travel resilience, and disciplined capacity—exactly the levers that restore operating leverage if fuel behaves. Consumer staples added a steady note as PepsiCo topped expectations and named a new finance chief, a continuity signal on costs and capital returns. Oil, meanwhile, slipped as headlines pointed to progress on a Gaza cease-fire framework, trimming geopolitical premium and quietly improving the setup for fuel-sensitive industries.

The week’s early leadership came from AI again. AMD ripped higher—up roughly 26% on Monday—after unveiling a multi-year partnership with OpenAI to deploy on the order of 6 gigawatts of AI compute anchored by AMD GPUs. That headline put a fresh charge into the broader tech tape, helping the Nasdaq and S&P 500 mark new highs to start the week and reminding everyone that capex for AI infrastructure remains the cycle’s center of gravity. Nvidia’s upcoming report now doubles as a sentiment check for megacap growth and for how fast the build-out can continue into year-end.

Outside tech and travel, single-stock and policy news added texture. Regional-bank consolidation resurfaced with a $10.9 billion all-stock deal that would combine Fifth Third and Comerica; Comerica jumped on the news while the buyer gave back some ground, the usual M&A spread mechanics at work. Boeing guided toward higher 737 MAX output—about 42 jets a month—nudging industrials. Verizon announced a new CEO and slipped on the transition headlines, a common first-day reaction in a slow-growth category. And in a very clear piece of industrial policy, the White House took a 10% stake in Trilogy Metals and advanced the Ambler mining road, a move aimed at on-shoring copper and other critical minerals. It’s part of a broader tariff-and-supply-chain push that has lifted the average U.S. tariff rate toward 10% year over year and generated meaningful revenue, with obvious implications for input costs and domestic investment.

Macro crosscurrents rounded out the picture. Gold set a record at $3,922.70 this week before easing to the high-$3,800s, a safe-haven bid that coexists with equity strength because the market’s dominant narrative is “easing without breaking.” The U.S. dollar remains weaker year-to-date, another tailwind for multinationals. On the consumer side, a New York Fed survey showed more households expect higher unemployment a year from now, and third-party labor gauges like ADP hinted at softer September hiring. Even so, the S&P 500 is up roughly 15% year to date, comfortably outpacing the SPDR S&P Retail ETF’s 6.5% gain. Over the past month, retail has lagged—down about 3.2%—while the S&P 500 rose 4.2%. Holiday-season forecasts calling for 2.9%–4.0% sales growth fit a “normalizing, not collapsing” spending pattern.

Chronologically, the tape’s rhythm was straightforward. Monday’s AI-driven pop pushed the Nasdaq and S&P 500 to fresh records. Tuesday brought a pullback as the shutdown extended and the absence of government data undermined confidence at the margin. By Thursday, trading turned sideways: the Dow was little changed intraday, the S&P 500 hovered near flat, and the Nasdaq drifted modestly lower as investors weighed solid early earnings against the ongoing data blackout. Oil’s slippage on cease-fire progress lightened inflation anxiety, but it didn’t fully offset the uncertainty coming from Washington.

My stance hasn’t changed: I remain in the bullish camp, with momentum re-asserting itself and the broader uptrend intact. My working roadmap has SPY advancing toward the 680–700 zone on the next push higher if earnings hold serve and leadership remains with AI-adjacent winners, with near-term support in the 620–640 band on any macro wobble. The two risks that would force a quicker de-risk are a rates surprise—specifically the 10-year snapping above the recent range—or a post-shutdown data catch-up that shows unemployment turning decisively higher. Until then, the path of least resistance is still up, and the market continues to reward patient buys on quality weakness.

This was a week of records without data—proof that positioning, liquidity, and the durability of the AI-capex theme can carry risk assets even as policy headlines churn. Early earnings were solid, the Fed stayed broadly predictable, oil eased, and holiday spending forecasts point to steady—if slower—consumption. Barring a sharp rates shock or a decisive labor-market break once the data blackout ends, the base case remains a resilient bull trend heading into peak earnings.

In that kind of mixed-signal, low-volatility tape, process beats prediction. At Tradespoon, our adaptive models update in real time—surfacing breakouts as they form, mapping sector rotation as it unfolds, and framing high-probability paths with clear risk levels so you can act with conviction rather than react to noise.

If the crosscurrents feel overwhelming, you’re not alone. Put our tools to work to filter signal from noise, stay focused on what drives performance, and let disciplined execution compound the trend in your favor.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

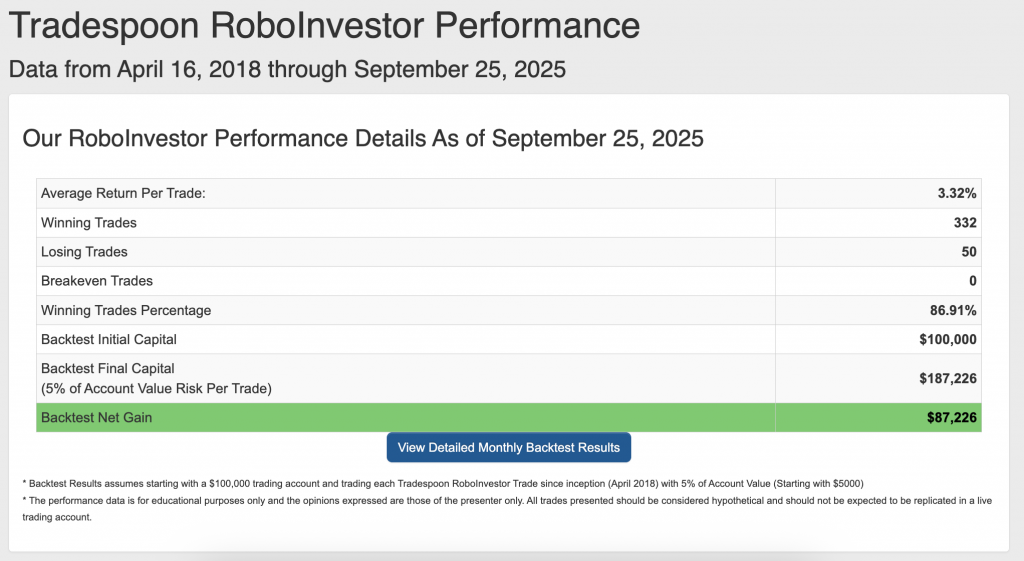

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 86.91% going back to April 2018.

As we near the end of Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!