RoboStreet – September 25, 2025

Indexes hit records on easing and AI capex, then cooled as GDP was revised to 3.8%, the dollar surged, and narrow breadth exposed the rally’s weak spots.

U.S. equities began the week by shrugging off last Friday’s geopolitical jitters and quickly reverted to their dominant drivers: measured Fed easing and an AI-led growth narrative. By mid-week, the S&P 500, Nasdaq, and Dow printed multiple fresh records as technology and communication services did most of the lifting.

Volatility stayed contained near 15–16, signaling confidence rather than complacency, while the 10-year Treasury yield oscillated inside its familiar 3.6%–4.8% corridor and drifted lower after weaker employment revisions before stabilizing. The market’s tone remains one of cautious optimism: macro data are “good enough,” policy is supportive, and AI capex continues to pull capital toward leaders even as breadth stays narrow.

Week in Review

The week opened with risk appetite improving as Middle East headlines pointed toward de-escalation. Attention swung back to policy after the Federal Reserve’s September 17 rate cut of 25 basis points, which Chair Powell framed as risk management rather than a dash back to zero. Markets shifted from debating whether the Fed would ease to how quickly it will proceed through 2026. Equities liked that framing, credit stayed orderly, and oil faded—classic conditions for a relief bid that put growth and AI leadership back at center stage.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

By mid-week, the rally drew fresh fuel from AI and global growth signals. The OECD lifted its 2025 global GDP outlook to 3.2%, citing U.S. AI-driven capital spending, Chinese stimulus, and pre-tariff industrial activity. AI beneficiaries extended gains, with storage and infrastructure names catching flows, and a marquee Nvidia–OpenAI collaboration—framed as up to $100 billion of incremental AI infrastructure investment—reaffirmed the scale of the build-out. Indices posted new highs as investors leaned into the “don’t fight the Fed” narrative, while healthcare joined the advance on M&A optimism after Pfizer’s agreement to acquire weight-loss drug developer Metsera, a headline that lifted sentiment across the obesity-treatment complex.

Late in the week, the tape met a measured reality check. A third estimate of second-quarter GDP revised growth up to 3.8% annualized on stronger consumption, weekly jobless claims edged down to 218,000, and the U.S. Dollar Index posted its best two-day run since July. With the dollar firmer and overbought signals flashing, the S&P 500, Dow, and Nasdaq extended a brief pullback. The move looked more like a positioning reset than a thesis break: stronger growth and a stronger dollar tend to pressure high-duration equities without undoing the case for measured easing, particularly with the 10-year still contained inside its range and trading lower after softer employment revisions.

Policy remains the anchor for asset prices. The Fed’s first cut of 2025, accompanied by a dot plot that points to two more reductions by year-end, is designed to lean against cooling labor conditions while inflation trends show gradual improvement. Headline inflation remained firm month over month but broadly in line year over year; core moderated at the margin; producer prices eased. Labor is the swing factor: downward revisions to the past sixteen months of payrolls—now showing a net loss of roughly 1.2 million versus previously reported—underscore cooling that both validates the Fed’s risk-management stance and keeps the bond market sensitive to every price print. Into Friday’s PCE release, yields were biased lower, aiding risk assets even as the stronger GDP read and firmer dollar tempered some enthusiasm for small caps and long-duration tech.

Technology and communication services continued to dictate index performance as AI-linked capex drew incremental capital. Semiconductors remained the bellwether for breadth, with upcoming updates from Nvidia’s ecosystem and Micron’s read-through on memory pricing set to test the durability of AI demand beyond the obvious winners. Healthcare participation improved on deal activity, highlighted by Pfizer’s move on Metsera, while energy lagged despite only modest changes in crude—another sign that the market’s factor preference still leans growth over value. In cross-assets, the 10-year remained the market’s weathervane inside 3.6%–4.8%, the dollar’s late-week strength tightened financial conditions at the margin, and gold softened as jobless claims surprised to the downside.

Investor psychology remains constructive but disciplined. The VIX anchored around 15–16 reflects confidence in a soft-landing script and a tendency to fade volatility spikes. Breadth, however, remains narrow—classic late-stage behavior in which index highs coexist with a large cohort of sideways names. Flows favored high-quality growth with real cash flow and clear AI adjacency, while Thursday’s weakness suggested a preference to buy dips rather than abandon trends. The near-term risk to that posture is a “higher-for-longer” rates scare or a renewed up-drift in unemployment that challenges earnings multiples; the near-term support is continued evidence of disinflation progress and resilient consumption.

Several catalysts framed the week’s price action and deserve emphasis because of their forward implications. The Fed’s September 17 cut consolidated the market’s easing narrative and helped push the 10-year toward five-month lows earlier in the week before the dollar’s rebound. The Nvidia–OpenAI partnership headline signaled that AI infrastructure spending remains on a multiyear glide path that can absorb cyclical wobbles, sustaining leadership in semis, compute, and storage. Pfizer’s acquisition of Metsera reinforced the idea that large-cap pharma will continue to buy growth in obesity and metabolic disease, adding a second engine to a market otherwise concentrated in tech. The OECD’s upgraded growth outlook provided a macro tailwind that validated the capex story, even as stretched valuations invited profit-taking and a mid-week volatility pop. Finally, the labor-market revisions paired with in-line CPI and softer PPI kept the easing path alive, though they also preserved recession anxiety at the edges of positioning.

The tape is now focused on the cadence of easing rather than its existence. Every inflation and labor print will tweak expectations for 2025–2026 and, by extension, equity duration and factor leadership. Micro will have an outsized impact at current multiples: Micron’s update on memory pricing and AI server demand, Costco’s read on traffic and price perception, and logistics and housing proxies tied to FedEx and Lennar will determine whether leadership can broaden beyond mega-cap tech. Currency moves are the quiet swing variable. Another leg higher in the dollar would pressure multinational margins and commodity-linked assets; a pause would ease that headwind and support cyclicals. Breadth is the tell. Confirmation from transports, housing-adjacent names, and staples with demonstrable pricing power would extend the advance on firmer footing; disappointment would push the market back onto the same narrow set of leaders.

Our stance is bullish as momentum has resumed and the long-term trend remains intact. We continue to see upside potential for SPY toward 680–700 over the next few months if AI momentum persists and macro readings remain “good enough,” with 620–640 as a practical short-term support band. The principal risks are that rates prove higher for longer and that unemployment ticks up, scenarios that would compress multiples and test leadership. Tactically, stay engaged while letting position sizing and exit discipline manage risk. Favor high-quality growth with free-cash-flow durability and clear AI leverage; selectively rotate toward areas where earnings can confirm breadth—logistics, housing-adjacent, and staples with pricing power—and hedge FX where appropriate to respect the dollar’s late-week strength.

This week followed a distinct trajectory: early optimism sparked a relief bid, AI-driven momentum pushed markets to record highs, and stronger growth data combined with a firmer dollar prompted a late-week pullback. Despite these shifts, the core thesis—orderly disinflation, supportive policy, and robust AI capital investment—remains intact. Leadership continues to be narrow and rate-sensitive, but with PCE data on deck and a packed calendar of micro catalysts ahead, investors should use pullbacks to upgrade quality. Keep a close eye on the 10-year yield and the dollar, as they may signal the next factor rotation. Earnings will be key in determining whether this rally expands beyond a few standout names into something more sustainable.

In a market defined by mixed signals and low volatility, a disciplined, data-driven strategy is essential. At Tradespoon, our adaptive predictive models are built to respond in real time—identifying breakout opportunities, revealing hidden rotation trends, and forecasting high-probability moves with precision.

If the current noise and contradictions feel overwhelming, you’re not alone. Let our tools help you cut through the clutter and stay focused on what truly drives performance.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

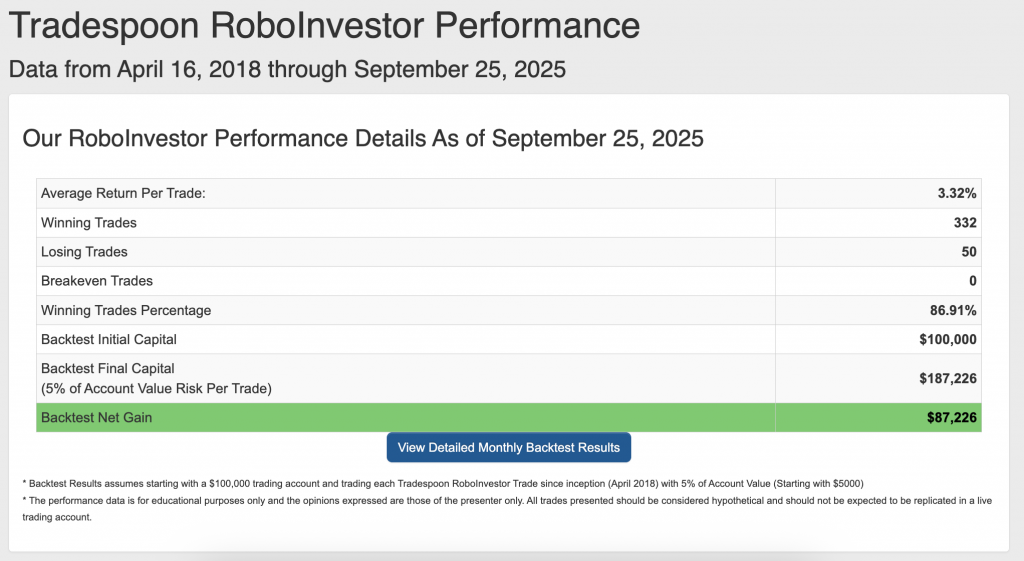

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 86.91% going back to April 2018.

As we near the end of Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!