In an eventful day of trading on Thursday, the U.S. stock market took investors on a rollercoaster ride, as stocks dipped following the release of unexpected economic data. The much-awaited Gross Domestic Product (GDP) figures for the second quarter revealed a surprising 2.4% annual growth rate, surpassing economists’ projections and showing a robust bounce back from the first quarter’s 2% growth.

The upbeat GDP report initially buoyed investor sentiment, with U.S. stock futures pointing towards a positive opening. Moreover, Federal Reserve Chairman Jerome Powell’s assurances that the recent interest-rate hike might not signal a series of increases further bolstered confidence. Powell’s cautious approach and commitment to closely monitoring economic data for future monetary-policy decisions resonated well with market participants.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The GDP growth was primarily driven by robust consumer spending on both goods and services, signaling that Americans are determined to keep the economy humming. However, experts remain watchful, with some predicting a potential slowdown in spending down the road.

Meanwhile, across the pond, the European Central Bank followed the Federal Reserve’s footsteps and raised interest rates by a quarter-point, taking it to 4.25% for the 20 eurozone countries. However, the ECB left the door open for a potential steady stance in its next meeting, revealing a similarly cautious sentiment towards monetary policy.

Individual company performances also played a pivotal role in shaping the market landscape. Meta Platforms, the parent company of social media giants Facebook, Instagram, WhatsApp, and Threads, experienced an 8.1% surge in its shares after announcing better-than-expected second-quarter earnings. Adding to the tech excitement, Alphabet, the parent company of Google, saw its shares rise by a substantial 5.8% following an earnings beat and the announcement of a new President and Chief Investment Officer.

Yet, it wasn’t all sunshine and roses in the market. Chipotle Mexican Grill faced a 9.4% decline despite surpassing earnings expectations, as its revenue fell short and same-store sales growth missed projections by a whisker. eBay also experienced a disappointing day, with shares falling 7.6% after the online marketplace issued a third-quarter earnings forecast that failed to meet analysts’ estimates.

As investors kept a close eye on the Fed’s measured approach, Chairman Powell reiterated the central bank’s commitment to tackling inflationary pressures. He emphasized that while progress had been made, there is still “a long way to go” in curbing inflation, hinting at the possibility of further measures in the future.

Looking ahead, financial experts and investors eagerly await the Fed’s stance for the upcoming September meeting. Powell’s “meeting-by-meeting” approach, coupled with the central bank’s reliance on data, suggests a cautious outlook amid uncertainties.

Beyond the Fed’s influence, the tech industry continues to capture attention, with Microsoft and Alphabet leading the charge. Microsoft’s solid fiscal fourth-quarter earnings were overshadowed by a slight dip in shares due to cautious revenue guidance. On the other hand, Alphabet’s impressive earnings and the appointment of a new leadership figure added to its rising star in the tech arena.

In a significant acquisition development, PacWest Bancorp’s stock skyrocketed 27% after striking a deal to be acquired by Banc of California in an all-stock agreement. This strategic move positions PacWest favorably in the competitive regional banking landscape.

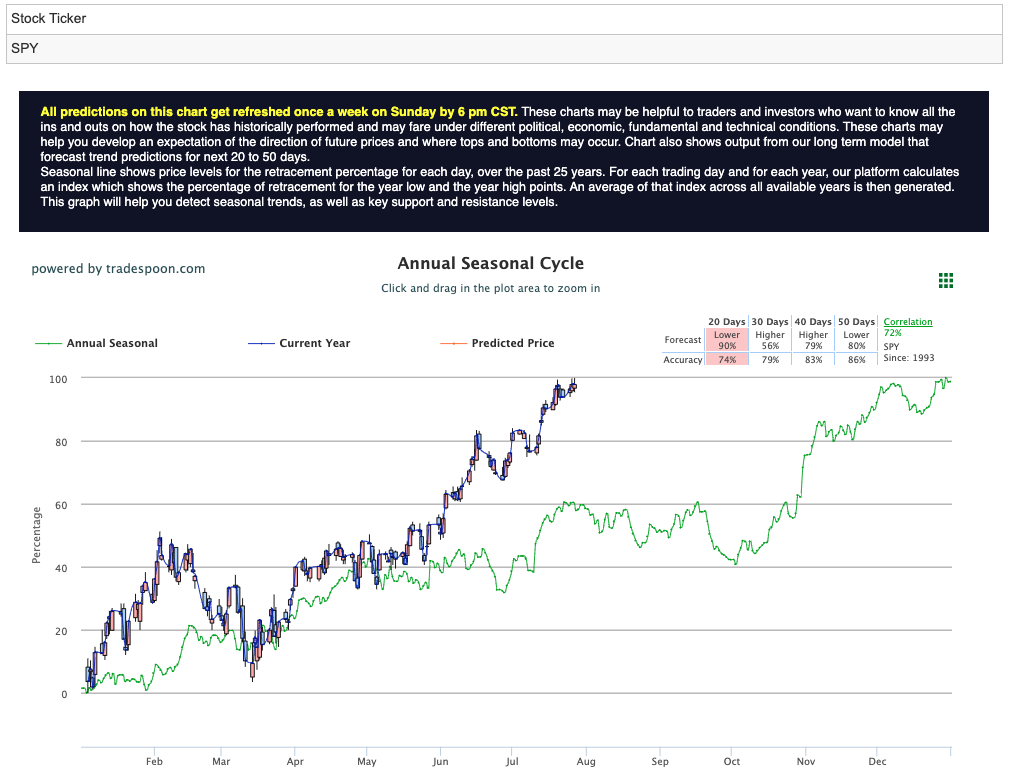

Better-than-expected CPI data from Europe and Great Britain may impact interest rates, potentially strengthening the $DXY. The market is overbought, with technology stocks forming a top while value stocks rise. Eyes are on $DXY and upcoming earnings reports. Some investors are shifting to a market-neutral stance due to low recession probabilities and $DXY’s pullback. SPY’s rally may cap at $450-470, with short support at 400-430 in the coming months. Caution prevails as the market navigates uncertainties. See $SPY Seasonal Chart:

As we navigate through market uncertainties, investors are cautiously optimistic, keeping a keen eye on both economic indicators and individual company performances. The Fed’s deliberate approach and the tech sector’s growing reliance on artificial intelligence are poised to play significant roles in shaping market movements in the days ahead. With this in mind, there is one specific sector I will be looking into in the next few weeks.

The industrial sector is a crucial component of the stock market, encompassing companies involved in manufacturing, construction, aerospace, defense, machinery, and more. As an essential driver of economic growth, the industrial sector plays a pivotal role in shaping global economies and is closely tied to infrastructure development and technological advancements.

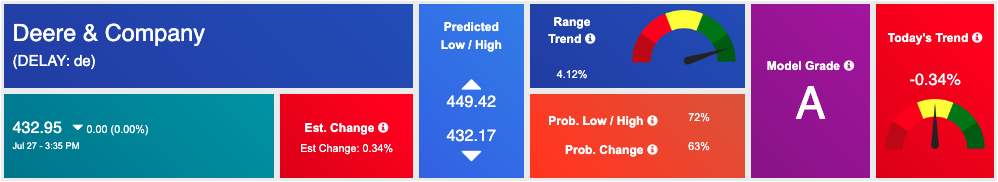

One prominent player in the industrial sector is Deere & Company ($DE). Founded in 1837, Deere & Company has established itself as a leading manufacturer of agricultural, construction, and forestry machinery, as well as equipment for lawn care and landscaping. With a rich history of innovation and a commitment to quality products, the company has become synonymous with reliability and efficiency.

Infrastructure projects, particularly in growing economies, are on the rise. Deere’s construction and forestry machinery segment stands to gain from increased infrastructure spending worldwide. Deere & Company has been at the forefront of incorporating advanced technologies into its products, enhancing efficiency and productivity. Their focus on innovation keeps them competitive in the rapidly evolving market.

The company has consistently displayed solid financial performance, with a history of generating healthy revenues and profits. This financial stability provides investors with confidence and reduces investment risk. Deere & Company has a strong global presence, serving customers in various countries. Diversification across markets helps mitigate risks associated with localized economic fluctuations.

While investing in any company carries inherent risks, Deere & Company’s strong market position, diversified product portfolio, and commitment to innovation make it an attractive investment option in the industrial sector – and our A.I. models agree.

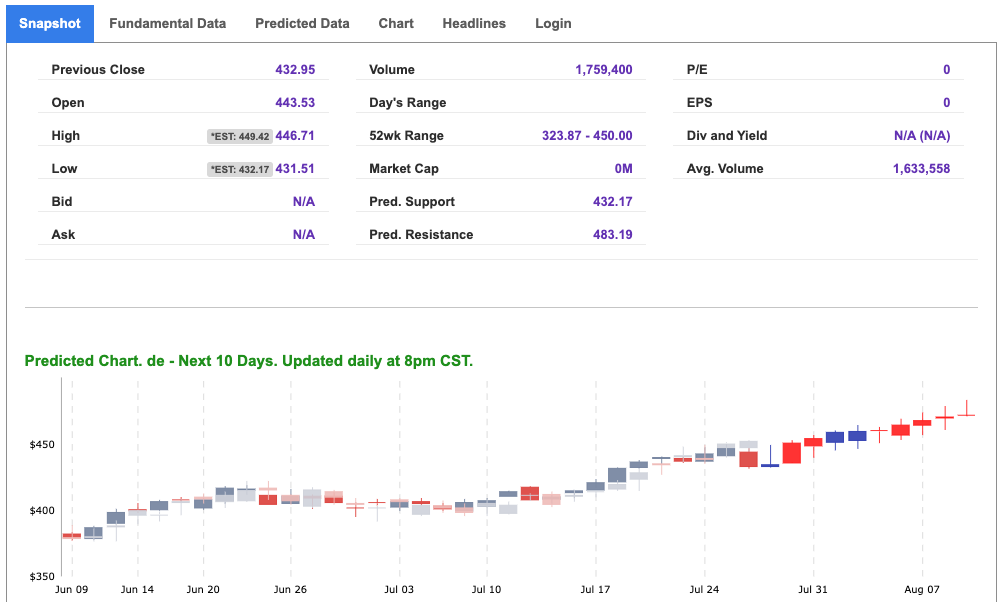

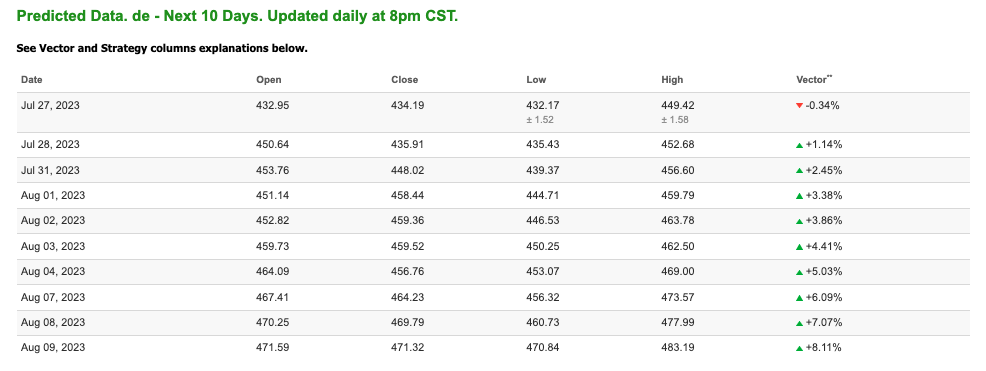

See 10-Day Predicted Data for $DE:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

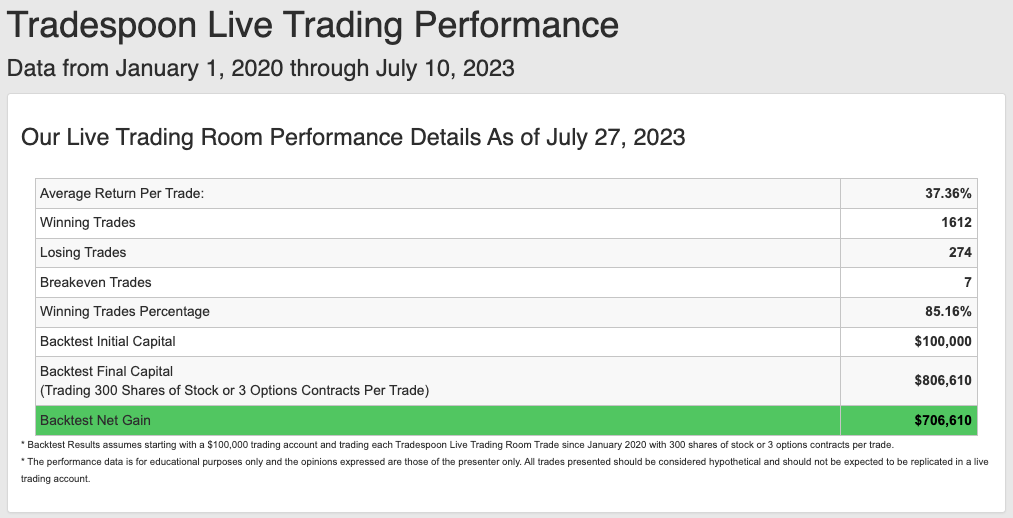

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!