Thanksgiving week ended much better than it started. After being sharply lower mid-month, the Dow and S&P 500 fought back into small gains for November, while the Nasdaq trimmed its losses and stabilized into the holiday. The AI-heavy leaders that had been hit earlier in the month stopped falling, the VIX cooled toward the high teens, and major indices reclaimed their 50-day moving averages. It was a classic late-month save driven more by shifting expectations than by any dramatic change in the macro backdrop.

That set the stage for this week, and Monday’s session answered with a modest step back. Stocks opened December in the red, with the S&P 500, Dow, and Nasdaq all slipping after five straight days of gains. Utilities, typically a defensive refuge, led the decline as long-term yields jumped. Small caps, low-volatility strategies, and momentum names underperformed, while value and quality factor ETFs drew buyers. It was not a broad risk-off move so much as a reshuffling of where investors are willing to take risk.

At the same time, the AI complex held up better than it did during the November shakeout. The Magnificent Seven cohort was essentially flat, semiconductors edged higher, and Nvidia gained ground after a difficult month in which it beat earnings yet failed to spark the usual upside follow-through. That resilience, combined with Nvidia’s new $2 billion investment in Synopsys at a premium price, underscored that the market still believes in AI, but is now more discriminating about where it allocates capital inside that theme.

Bonds did not provide much of a cushion. A global bond selloff tied in part to hawkish signals from the Bank of Japan pushed U.S. Treasury yields higher, lifting the 10-year back toward the upper end of its recent 3.6%–4.2% range. The iShares 20+ Year Treasury Bond ETF (TLT) fell more than a percent on a day when the S&P 500 was also down, a reminder that the old “stocks down, bonds up” relationship is still inconsistent.

The macro data continue to tell a story of a cooling, but not collapsing, economy. The ISM manufacturing PMI slipped to 48.2 in November, marking another month in contraction territory and extending one of the most persistent slumps for U.S. manufacturing in recent history. The weakness is now showing up more clearly in employment, which reinforces the idea that higher rates are starting to bite in interest-sensitive parts of the economy even as the consumer holds up.

Inflation, meanwhile, has been drifting in the right direction, and commentary from key Fed officials into the end of November led markets to price in better-than-even odds of a rate cut as soon as December. That softer Fed narrative was a major driver of the Thanksgiving rally, but Monday’s rate move shows that the path lower for yields will not be a straight line. The bond market has not fully embraced the idea of a clean, gradual easing cycle.

In equities, the most important shift over the past two weeks has been psychological rather than fundamental. Earlier in November, the Magnificent Seven and other AI leaders sold off more than 6 percent at one point, and Nvidia’s strong earnings report could not initially break the downtrend as investors balked at heavy spending and already rich expectations. That episode sent a clear message: the market still believes in the long-term AI story, but is no longer willing to pay any price for it.

Nvidia’s investment in Synopsys adds a new layer to that story. It emphasizes that AI infrastructure, chip design, and “picks and shovels” are critical parts of the ecosystem, and it rewards companies with tangible leverage to that buildout. Overseas, companies like Alibaba and Dell have reminded investors that AI is global and politically complex, especially for China-exposed names and for traditional hardware firms whose fortunes remain tied to corporate spending cycles.

Crypto provided a different kind of signal. Bitcoin fell back below a key support level it had recently reclaimed, and the Crypto Fear and Greed Index plunged into “extreme fear.” Historically, December has been only slightly positive for Bitcoin, which means this combination of fragile sentiment and mixed seasonality is more likely to produce volatility than a clean trend.

Investor psychology right now is a tug of war between fear of missing out and fear of being the last buyer at the top.

The Thanksgiving week rebound showed how quickly greed can reassert itself when indices sprint higher, AI stops falling, and the market begins to price in earlier rate cuts. That dynamic pulled the Dow and S&P 500 back into the green for November and narrowed Nasdaq’s losses, all in a matter of days.

Underneath that surface optimism, however, there is still plenty of unease. The manufacturing slump, the jump in yields to start December, the earlier AI drawdown, and the memory of 2022’s “nowhere to hide” stretches keep investors cautious. Monday’s factor moves were telling: high-beta stocks could trade up even as the index slipped, while utilities and long-duration assets were punished by the rate move and capital rotated into value and quality. Investors are still willing to take risk, but they want to be paid for it and they are more selective about where it sits.

Crypto’s extreme-fear reading is the mirror image of lingering enthusiasm around AI and growth. In one corner of the market, participants are debating whether they have already missed the move; in another, they are debating whether they were far too early. That split mindset is typical of late-cycle, range-bound environments where fundamentals are not changing dramatically, but positioning and sentiment are.

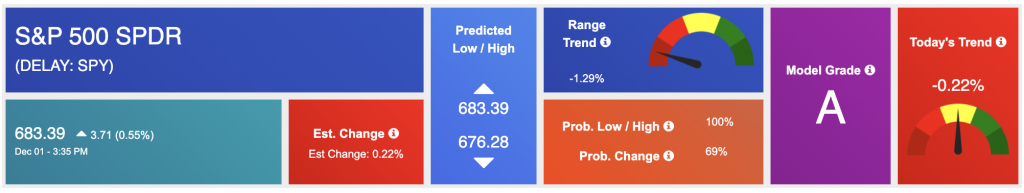

Against this backdrop, I’m still market-neutral at the index level and increasingly selective underneath. The late-November surge improved momentum off the lows, but the advance is choppier and more fragile than the smooth rally earlier this year. My base case is that SPY trades in a range over the next few months, with support in the 620–640 zone and upside toward 680–700. The long-term trend is intact, but the easy phase is behind us, and restrictive rates plus soft manufacturing can still pressure the most expensive parts of the market.

Practically, that means staying balanced on broad equity exposure instead of making an all-in directional call. As SPY approaches the top of the band, I’d rather trim, rebalance, and cut back on names where narrative has outrun fundamentals. If we revisit the lower end, I want to be ready with a shopping list of high-quality companies and resilient sectors that can handle a slower, bumpier economy. Within and beyond AI, I prefer businesses with real cash flow, strong balance sheets, pricing power, and clear competitive advantages—more Nvidia–Synopsys infrastructure plays, fewer pure story stocks.

I’m also watching cross-asset signals closely. Days when both TLT and the S&P 500 fall are reminders that duration risk still matters and bonds are not a guaranteed hedge, so I see little reason to reach far out on the curve just for a bit more yield. Crypto, meanwhile, stays a satellite allocation at best: extreme fear can create tactical opportunities, but it should not anchor a long-term plan in a high-uncertainty environment.

The through line is discipline. Over the past two weeks, prices have moved far more than fundamentals as sentiment swung from worry to relief and back toward caution. Once you accept that, you can stop chasing every mood shift and let the range work for you—stay neutral at the index level, stay selective underneath, and treat volatility as a tool to add and trim, not a trigger to overreact.

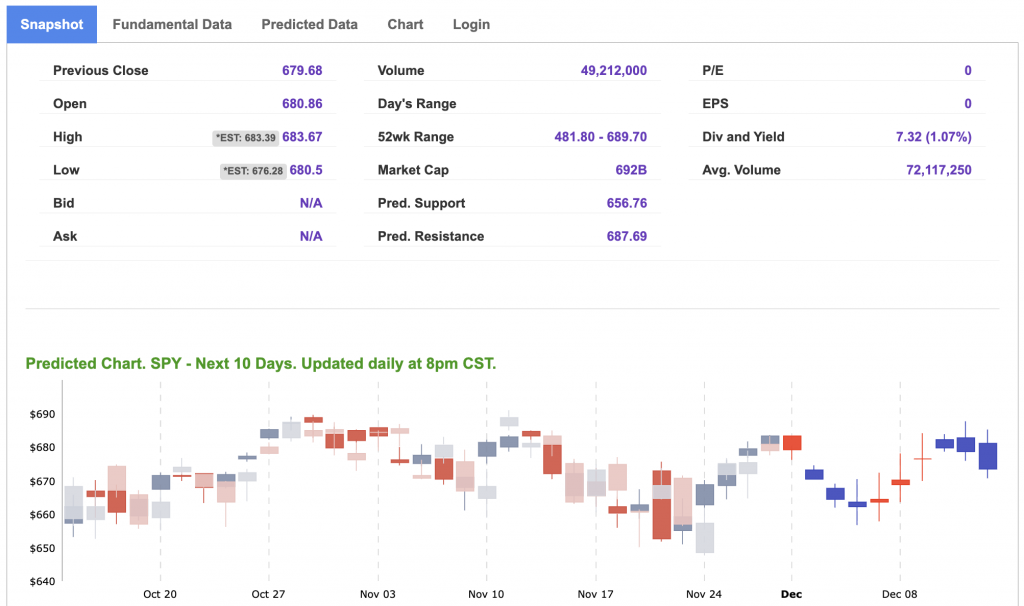

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

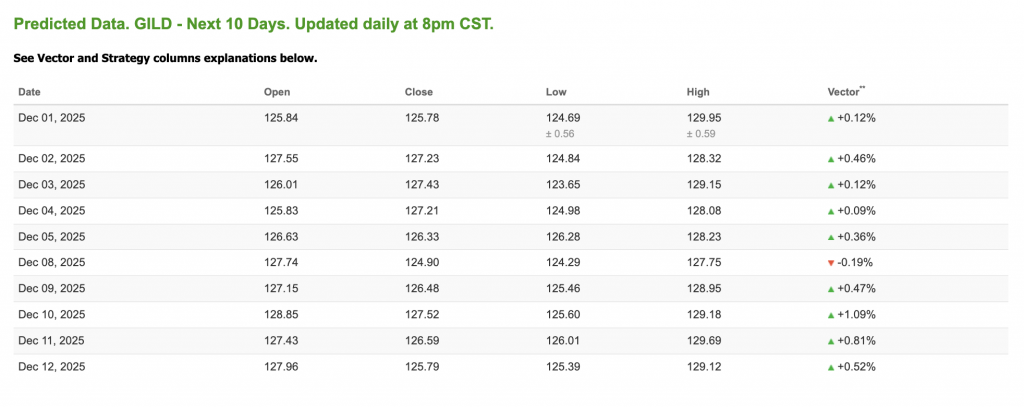

Our featured symbol for Tuesday is GILD. Gilead Science Inc. (GILD) is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $125.64 with a vector of +0.12% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, GILD. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

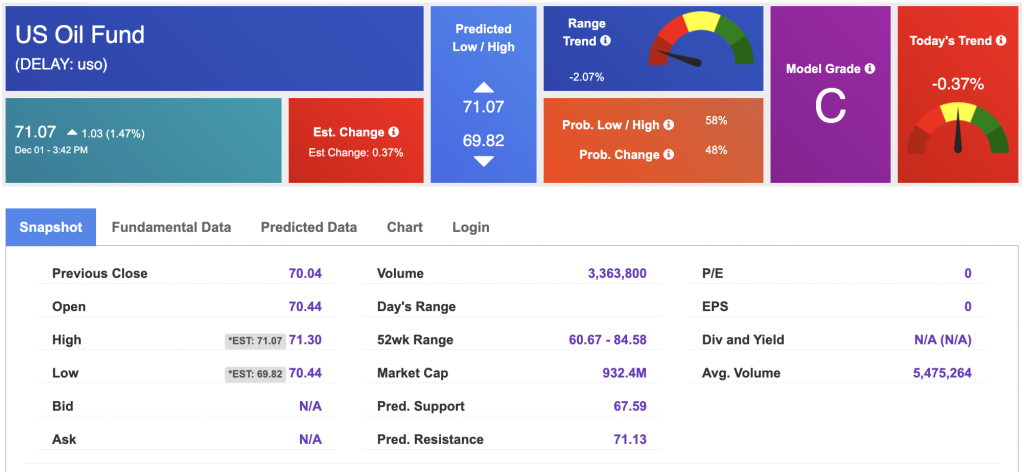

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $59.50 per barrel, up 1.62%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.07 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is up 0.28% at $4,267.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $387.88 at the time of publication. Vector signals show +0.68% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 4.094% at the time of publication.

The yield on the 30-year Treasury note is up at 4.742% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

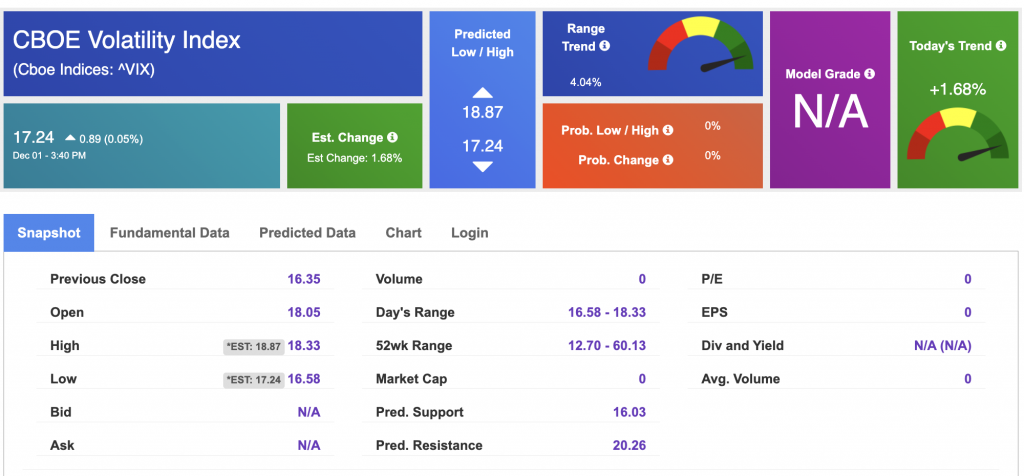

The CBOE Volatility Index (^VIX) is priced at $17.24 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!