RoboStreet – August 21, 2025

Tariffs, mixed data, and Fed signals keep investors cautious as stocks retreat from highs

Markets spent most of the week circling near record levels, but optimism proved fragile. Early gains gave way to choppier trading as tariff headlines, uneven economic data, and shifting expectations from the Federal Reserve eroded confidence. By Thursday, stocks were back under pressure, underscoring just how much hinges on Jerome Powell’s keynote in Jackson Hole.

The week began calmly on Monday, with the S&P 500 and Nasdaq little changed and Treasury yields holding steady—the two-year around 3.8 percent and the ten-year near 4.34 percent. Beneath the quiet surface, investors were firmly in wait-and-see mode. Inflation data has cooled, but not enough to dismiss concerns, and futures markets continued to price in a strong probability of a September rate cut. The real question was not whether the Fed trims, but how Powell frames the path beyond September: a one-and-done move, or the start of a broader easing cycle.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

By midweek, policy and politics had taken center stage. President Trump extended a 90-day pause on tariffs for Chinese goods, temporarily easing nerves. Yet his threats of new duties, potentially as high as 250 percent on semiconductors and pharmaceuticals, unsettled markets. Technology stocks bore the brunt of this, with Nvidia and AMD sliding after being forced into revenue-sharing agreements on China exports, a stark reminder of how quickly tariff policy can alter corporate margins.

At the same time, corporate earnings painted a mixed picture. Walmart topped same-store sales but missed on profit, citing tariff-driven costs that are already changing consumer behavior. Palantir was a bright spot, surging nearly 8 percent on booming AI demand. Eli Lilly fell sharply after disappointing obesity drug trial results, while airlines gained ground thanks to rising airfares revealed in inflation data.

Economic signals only muddied the outlook further. July CPI cooled to 2.7 percent, suggesting progress on disinflation, but Producer Price Index data surprised to the upside, logging the largest monthly increase since 2022. Hawkish tones in the Fed’s meeting minutes reinforced the idea that tariff-driven price pressures complicate the central bank’s policy path.

By Thursday, the tone had turned decisively weaker. The Dow lost more than 230 points, the S&P 500 slipped 0.6 percent, and the Nasdaq fell 0.7 percent. Odds of a September cut, which had stood above 90 percent just two weeks ago, dropped to around 71 percent as Fed officials signaled that easing is not guaranteed. Fresh labor data added to the caution. Weekly jobless claims rose to 235,000, continuing claims climbed to 1.97 million, and earlier downward revisions confirmed that spring hiring had been far weaker than initially reported. The job market is no longer the sturdy anchor it once was, even if layoffs remain modest by historical standards.

Volatility crept back in, with the VIX edging higher toward 16. The dollar held steady after weeks of pressure tied to political attacks on the Fed and uncertainty about U.S. policy. Taken together, the week underscored how sensitive markets remain to even small shifts in expectations.

The larger story remains unchanged. The S&P 500 continues to trade in a sideways range, with buyers stepping in near 600 to 620 and sellers reappearing around 640 to 650. Treasury yields swing in a broad band between 3.6 and 4.8 percent, a reminder that rate-sensitive sectors remain under constant pressure. Sentiment is sustained by confidence in AI-driven earnings strength but is capped by stretched valuations, tariff uncertainty, and evidence of a cooling labor market. For now, range-bound strategies—buying dips toward support and trimming rallies into resistance—have proven more reliable than chasing breakouts.

Friday’s Jackson Hole keynote now becomes the defining moment. A hawkish tone that emphasizes sticky inflation could push the S&P back toward the lower end of its range. A balanced message, cutting rates in September but keeping policy restrictive thereafter, would likely reinforce the status quo. A more dovish shift, acknowledging weaker growth and hinting at follow-on cuts, could be the catalyst for a decisive move through resistance at 650.

Looking into next week, the calendar remains data-heavy. Housing figures, consumer spending, and updated inflation measures will provide further clarity on whether the slowdown is gradual or accelerating. Tariff developments remain an unpredictable wildcard, particularly for semiconductors, retail, and healthcare.

After a week of mixed signals, Powell’s words now carry the potential to either reset the market’s range or confirm it. Until then, discipline remains the edge. Investors leaning on quality earnings stories, keeping risk defined, and respecting established guardrails remain best positioned to navigate a market that has not yet decided whether it wants to break higher or retreat.

In this environment of mixed signals and quiet volatility, disciplined trading and data-driven strategy are essential. At Tradespoon, our predictive models are built to adapt in real-time—highlighting breakout candidates, identifying hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by headlines and contradictions, you’re not alone. Let our tools help cut through the noise and keep you focused on what matters most.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

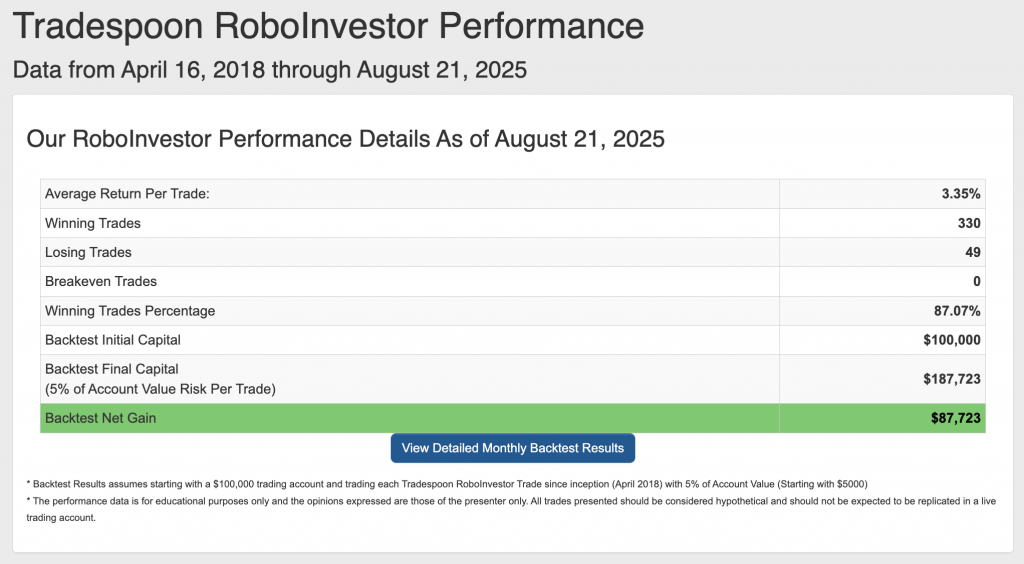

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.30% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!