RoboStreet – September 22, 2022

Stocks Selloff Following FOMC Update

After the Federal Reserve increased interest rates by 75 basis points on Wednesday and reaffirmed its intention to quell inflation, even at the cost of an economic recession, stocks in the United States fell Thursday. Initially, shares attempted to gain back some of Wednesday’s losses but failed to do so as the dollar and Treasury yields moved higher. As the move to the range of 3% to 3.25% shook markets, major U.S. indices will now likely cap the week in the red and VIX has surged to the $28 level.

Looking at the latest moves in the market, I believe the pullback has officially started and the market is oversold. With earnings coming up, it will be interesting to see where the market could find support but it is my opinion that the current direction, as signaled post-FOMC, is downward. We could see a rally for a couple of weeks before retesting the June/July lows. With this in mind, I have identified a specific sector and symbol I will have an elevated interest in going into the next few weeks, but before that let’s review the latest action in the market.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Federal Reserve raised interest rates by a quarter of a percent on Wednesday, which sent American equities tumbling throughout the day as it revealed another rate boost and plans for further hikes that were greater than what investors had anticipated. The Federal Reserve officially stated that it will raise policy interest rates by .75% to a target range of 3%-3.25%, in the afternoon.

According to their projections, the Fed will raise rates by another 1.25% at the end of this year, bringing the benchmark rates up to 4.4 percent from 3.8%. The Federal Reserve also lowered its growth expectations, suggesting the economy will expand at a sluggish 0.2% annual pace this year and 1.2% in 2022, when compared with the 5.7% expansion expected in 2021.

On Wednesday, markets were also affected by reports that Russian president Vladimir Putin had called for a partial military mobilization as his latest action in his ongoing invasion of Ukraine.

The public statement provoked fear of an intensification in the war, as well as potential dangers to Western countries. This, in combination with the COVID shutdowns in China, is having an impact on global markets this week and will be a key point of interest going forward.

Next week, earnings are due to pick up slightly with several retailers including Nike, Rite Aid, Bed Bath & Beyond, as well as Micron Technology. Additionally, we will see revised Q2 GDP data and August PCE reports.

Having started its next leg down, the market quickly became oversold and now offers an opportunity for a multi-session rally to be staged. With the Fed behind us and earnings ahead, it will be interesting to see for how long the bearish market could be paused. With mega-cap tech offering guidance for how the rest of the market could perform, this sector is often the first to bounce out of a rut. We’ve already seen initial weakness in this field that has somewhat stabilized regardless of the current bearish-nature of the market. As we approach earnings season, I will be looking to get involved in the tech sector as a profitable sector according to my latest reading of the market as well as historical trends.

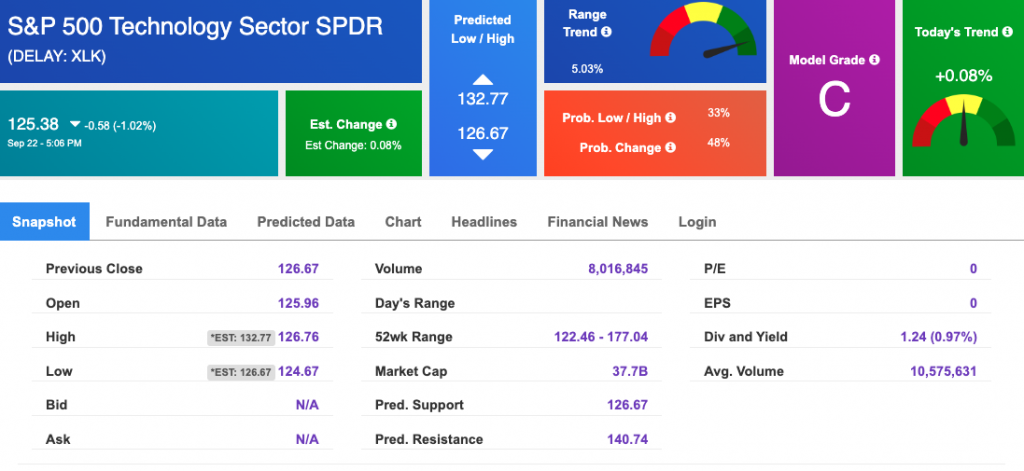

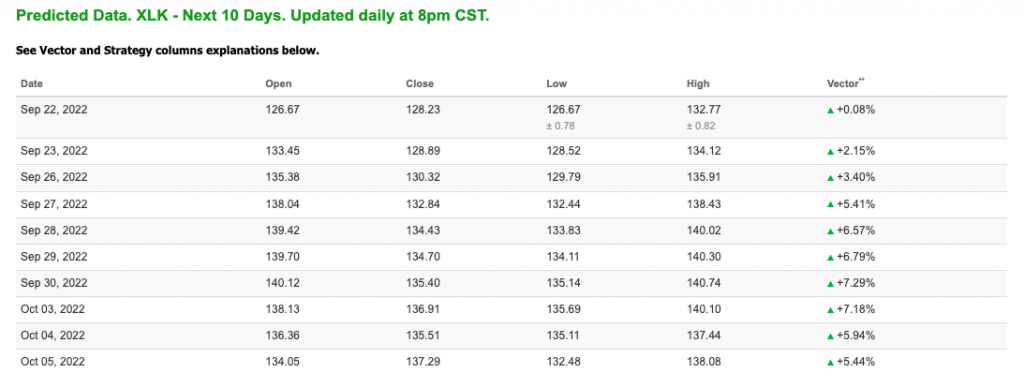

Technology Select Sector SPDR Fund (XLK) is one of the leading tech-sector ETFs and one of my favorite in its field. The ETF sold off on Thursday and will likely book a loss for the week. The fund is trading right above its 52-week low which offers plenty of room for the upside. As the oversold nature could lead to a rally, I will look for tech to be the starting point of said rally and my A.I. toolset is showing just the same.

Using the Stock Forecast Toolbox, $XLK is signaling a continuous trend upward in its 10-day forecast. The symbol is trading below its 52-week and monthly highs and has potential for the upside:

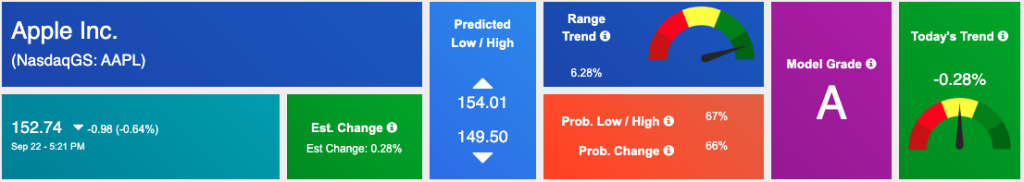

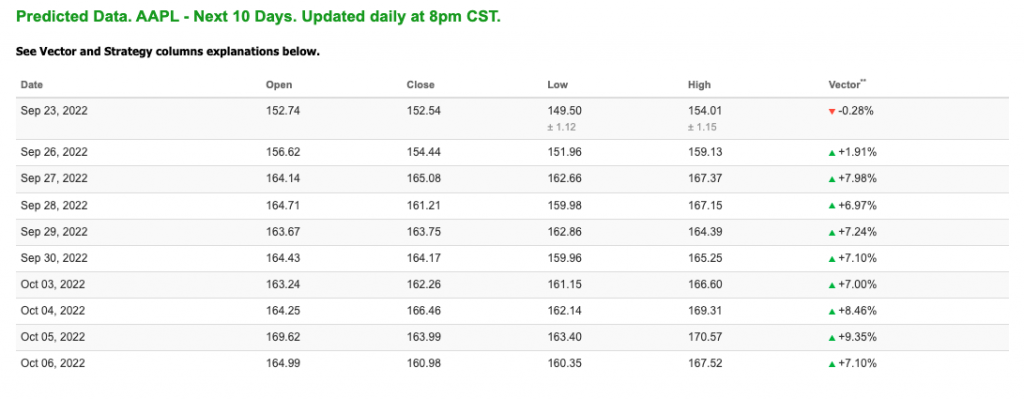

Along with XLK, I’ll be monitoring and looking for an opportunity with Apple, Inc. (AAPL) which is a major component of the tech field. Apple Inc. is one of the tech leaders that not only sets the tone for tech sentiment but also plays a role in dictating where U.S. markets are headed. With a market cap exceeding $2 trillion, this company can find success in even short-term periods of high market volatility- which is something I believe we will see more of in the near future.

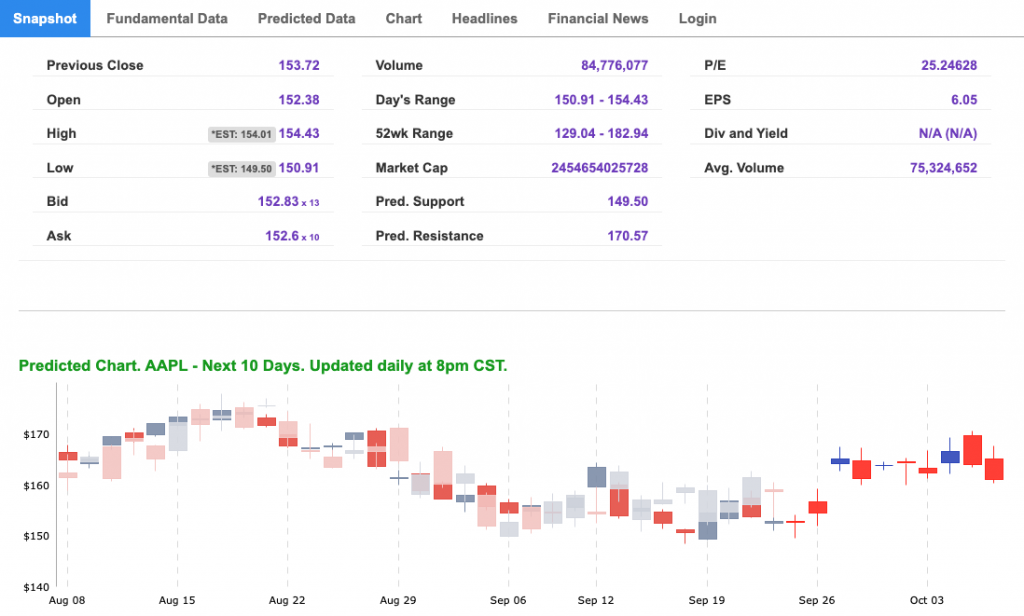

Apple began to return some of its weekly gains on Thursday and is currently trading in the $152 range. This is on the lower side of the stock’s 52-week range (129-182) and offers us a steady winner to back with any potential relief rallies. I still believe the market is primarily bearish, but rallies in an oversold market can bubble up. I will utilize the tech sector’s inherent strength, as well historical trends and my latest A.I. readings, to back these symbols when the time is right.

Reviewing the $AAPL Seasonal Chart, seen above, we see that the annual seasonal price, marked in green, has been trading back and forth with the current year price, marked in blue. The symbol is showing potential to go higher in the next 20, 30, and 40-day ranges! This type of strength is also portrayed in the accuracy ratings which I love to see.

Using the Stock Forecast Toolbox, $AAPL is signaling, after an initial drop-off, a continuous trend upward in its 10-day forecast. With vector trend, as well as historical trends, on our side Apple has the potential to lead off any rallies that could manifest as the market shakes out post FOMC.

As we head towards earnings season, some sectors will see relief in the current bear-controlled market. Apple and XLK are perfect candidates to do just that!

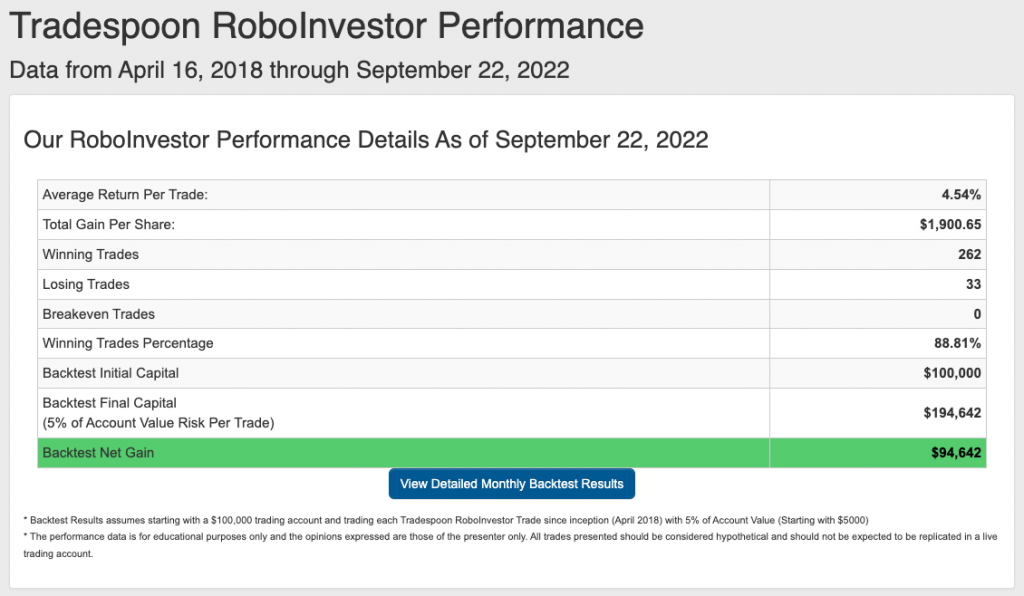

And this is exactly what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior. We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.81% going back to April 2018.

The market is still very unpredictable, and we still have an entire quarter left in 2022. Inflation, midterm elections, geopolitical tension, and the Ukraine war are all influencing how money is being gained and lost. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!