RoboStreet – August 7, 2025

Stocks flirt with records as recession signals rise and volatility returns

Markets continue to edge higher, with the S&P 500 nearing all-time highs and the VIX sitting at 18—a level that reflects modest unease but still well below panic territory. Despite mounting headwinds, from disappointing labor data to a new wave of global tariffs, investors appear cautiously optimistic, leaning into strong earnings and the growing likelihood of a September rate cut.

But beneath the surface, the narrative is far more complex. Recession odds are rising, interest rates remain volatile, and corporate guidance is beginning to flash warning signs. At Tradespoon, our A.I. models continue to forecast a tight trading range for SPY, with growing risks on both sides of the tape.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Jobs Report Falls Short, Fed Cut Odds Surge

Friday’s July employment report painted a weaker-than-expected picture: just 73,000 jobs were added versus the 95,000 forecast, with prior months revised lower. Initial jobless claims also ticked up to 226,000 last week, marking a second straight week of increases. With labor softness now undeniable, the market has priced in an 84% chance of a Fed rate cut at the September meeting.

Despite signs of stress, productivity data showed a modest upside. Labor productivity rose 2.4% annualized, beating expectations, while unit labor costs climbed 1.6%, also above forecast. Still, these improvements weren’t enough to offset concern about broader employment trends.

Trump’s Global Tariffs Rattle Tech, Fuel Inflation Worries

Tariff headlines returned to center stage as President Trump’s new global “reciprocal tariffs” took effect. The measures—ranging from 15% to 20% and targeting nations without new U.S. trade pacts—raise the average effective U.S. tariff to 18.3%, the highest in decades. Tech stocks were particularly sensitive after a 100% levy was imposed on semiconductors, though exemptions were announced for firms like Apple that pledged significant U.S. investment.

Markets initially shrugged off the tariffs, with the S&P 500 and Nasdaq rallying midweek. Some optimism stemmed from reports that Trump and Putin plan to meet for possible progress on Ukraine, and that some global manufacturers may shift supply chains to sidestep the worst of the new trade regime.

Earnings Season Remains Strong, but Guidance Fades

Corporate earnings continued to impress on a backward-looking basis: 82% of S&P 500 companies have beaten estimates so far, with overall EPS growth at 10.2%. Banks and AI-driven tech companies led the way, bolstering confidence in parts of the market.

However, forward guidance is less encouraging. Both Amazon and UPS offered weak outlooks tied to labor costs, logistics uncertainty, and slower global demand. Upcoming reports from AMD, Amgen (AMGN), and Super Micro Computer (SMCI) will provide another test for tech leadership and investor confidence.

Oil Pulls Back, Yields Stay Unsettled

Oil prices dropped 12% after reports of a ceasefire agreement between Israel and Iran, easing immediate supply concerns and helping temper near-term inflation risks. At the same time, NASA’s decision to cancel several climate-monitoring satellite programs raised questions about longer-term visibility into global environmental trends.

Bond yields were highly volatile, with the 10-year Treasury swinging between 3.6% and 4.8% before trending lower into the end of the week. That movement reflects the market’s uncertainty around growth, inflation, and future Fed action—and reinforces why many investors are shifting to a more neutral stance.

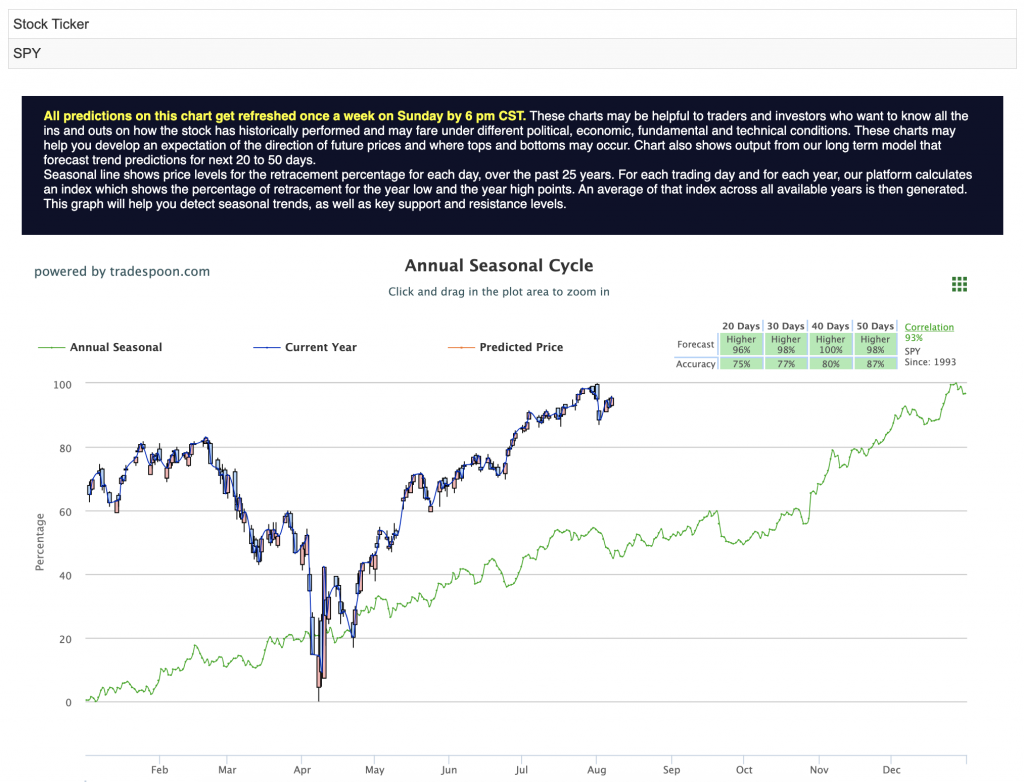

Despite the broader rally, price action has been defined by range-bound trading. Our models continue to identify SPY resistance between 630 and 640, with support in the 580 to 590 zone. The VIX hovering at 18—up from recent lows—suggests increased sensitivity to upcoming data, but not yet a full return to risk-off mode. For reference, the SPY Seasonal Chart is shown below:

Sentiment has shifted to a more market-neutral posture. While earnings and disinflation trends offer support, the threat of a policy mistake—keeping rates too high for too long—and rising unemployment are tilting some forecasts toward a mild recession by early 2026.

This week is data-heavy and will test the market’s resilience. Reports include:

Any surprise—upward or downward—could quickly shift expectations for the Fed’s September path and determine whether the market can break above resistance or retest key support.

In this environment of mixed signals and quiet volatility, disciplined trading and data-driven strategy are essential. At Tradespoon, our predictive models are built to adapt in real-time—highlighting breakout candidates, identifying hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by headlines and contradictions, you’re not alone. Let our tools help cut through the noise and keep you focused on what matters most.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

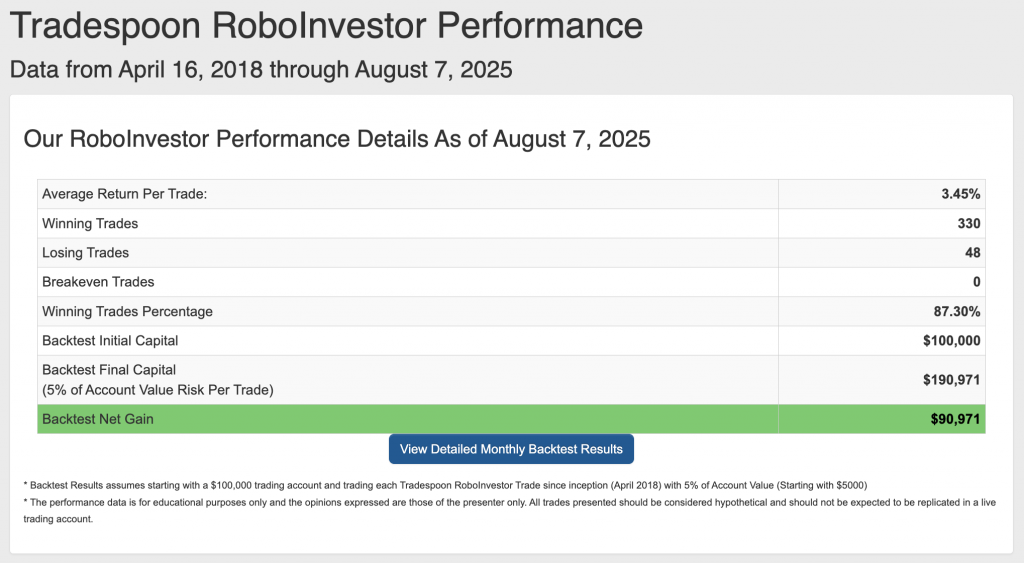

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.30% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!