RoboStreet – July 31, 2025

The S&P 500 and Nasdaq surged to fresh all-time highs this week, fueled by blockbuster tech earnings and steady economic growth. But make no mistake—beneath the euphoria, Jerome Powell just issued one of the most delicately worded warning bells of the year.

On the surface, it was a week tailor-made for bulls. Microsoft and Meta crushed expectations, pushing the Nasdaq 100 futures up over 1.3% after Wednesday’s close. The PCE inflation report—a key gauge for the Fed—came in just a hair above estimates, at 2.8% annually for core and 2.6% for headline. Yet the market’s reaction wasn’t exactly straightforward.

Why? Because the Fed didn’t play along.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

At its July meeting, the Federal Reserve held interest rates steady, as expected. But Powell’s tone in the follow-up press conference was notably cautious—even skeptical. Gone was the gentle guidance or suggestion of a September rate cut. Instead, Powell reminded investors that no decisions have been made, and that more data—two inflation reports and two job reports—will guide the Fed’s thinking between now and the next FOMC meeting on September 17.

That was enough to shake the foundation of dovish bets. The CME FedWatch tool showed September rate cut odds plunge from 63% to 45% in a single day. Treasury yields initially jumped, with the 10-year flirting with 4.5%, before falling back to 4.34% as markets tried to digest the mixed signals. Stocks gave up early gains, with the S&P 500 closing down 0.1% and the Dow off 172 points.

Inflation: Still Sticky, Still Stubborn

Powell and company remain laser-focused on inflation, which, while cooling from its peaks, remains stubbornly above the Fed’s 2% target. Core PCE—the central bank’s preferred inflation gauge—rose 0.3% in June and 2.8% year-over-year, slightly above expectations. While not a dramatic beat, it complicates the Fed’s ability to justify cuts in the near term.

Powell also acknowledged that President Trump’s new wave of global tariffs—ranging from 15% to 20%—are starting to affect prices in some categories. However, he described these as “likely one-time” effects that the Fed will monitor but not overreact to… yet. “We will, through our tools, make sure this does not move from being a one-time price increase to serious inflation,” he said.

The situation puts the Fed in a bind: cut too early, and risk reigniting inflation. Wait too long, and risk damaging an already-softening labor market.

Labor Market & Growth Outlook

The labor market, while still strong by historical standards, is losing momentum. Weekly jobless claims ticked slightly higher to 218,000, and unemployment now stands at 4.1%. That’s not yet a red flag, but it’s a clear deceleration from earlier in the year.

Meanwhile, Q2 GDP surprised to the upside, coming in at a 3.0% annualized rate, reversing a 0.5% contraction in Q1. The rebound was driven in part by trade flow distortions, as businesses initially overstocked to avoid tariff shocks earlier this year, only to draw down inventories in Q2. Despite the positive print, economists note that this doesn’t necessarily indicate sustained acceleration—especially if tariffs continue to disrupt global supply chains.

No August Fed Meeting—but Jackson Hole Looms

Importantly, there’s no Fed policy meeting in August. That means all eyes now turn to Jackson Hole on August 22, where Powell will speak at the annual Economic Symposium. Traditionally, Jackson Hole has been used as a soft launchpad for major policy shifts—or at least a readout of the Fed’s internal debate.

Given the current backdrop—modestly restrictive rates, mixed economic data, and political pressure to ease—the speech could carry outsized weight. Investors hoping for a September rate cut may find themselves reading between every line of Powell’s remarks, especially with the September FOMC meeting just days after (Sept. 16–17).

Politics, Tariffs, and the Global Chessboard

Markets also had to absorb a flurry of geopolitical and trade news this week. Trump’s aggressive new tariff plans rattled global markets, particularly after Canada announced it would formally recognize a Palestinian state—prompting Trump to threaten the breakdown of U.S.-Canada trade talks. Meanwhile, Treasury Secretary Scott Bessent tried to calm nerves, stating that a deal with China was close, though “not 100% done.”

One area where tariffs are already having a tangible impact is copper. After the U.S. unexpectedly exempted refined copper from its 50% tariff list, prices fell sharply. Refined copper, which supplies 50% of domestic U.S. demand, was spared—alleviating cost pressure on industries from construction to tech.

Outlook: Markets at the Crossroads

So where does that leave us? The S&P 500 has rallied over 15% year-to-date. The VIX remains near 15, suggesting investor complacency—or perhaps confidence—in the face of mixed signals. At Tradespoon, our AI-driven models see SPY’s rally pushing into the $630–$640 zone, but caution is warranted. Support sits at $580–$590, and the risk of sideways consolidation remains high. For reference, the SPY Seasonal Chart is shown below:

Despite the euphoria in mega-cap tech, this market is not as stable as it seems. The rate policy remains unresolved. Inflation is easing, but not fast enough. And tariffs are creeping back into the narrative in ways that could eventually hit margins and sentiment.

Yes, earnings remain strong. Yes, GDP rebounded. But the Federal Reserve isn’t ready to declare victory on inflation—and Chair Powell made that abundantly clear this week. Despite new market highs, investors should be cautious about getting too comfortable. With Jackson Hole around the corner and the September FOMC meeting on the horizon, the summer rally could quickly give way to an autumn reality check.

That’s why having a clear, disciplined strategy matters more than ever. At Tradespoon, we equip investors with A.I.-powered forecasts, real-time sentiment tools, and tactical guidance designed to navigate uncertainty—not just chase headlines.

That’s also where RoboInvestor comes in. This AI-driven advisory service delivers unbiased, data-backed insights tailored for today’s volatile market landscape. By removing emotional noise and focusing on high-probability setups, RoboInvestor helps you act with clarity and confidence—no matter what the headlines say.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

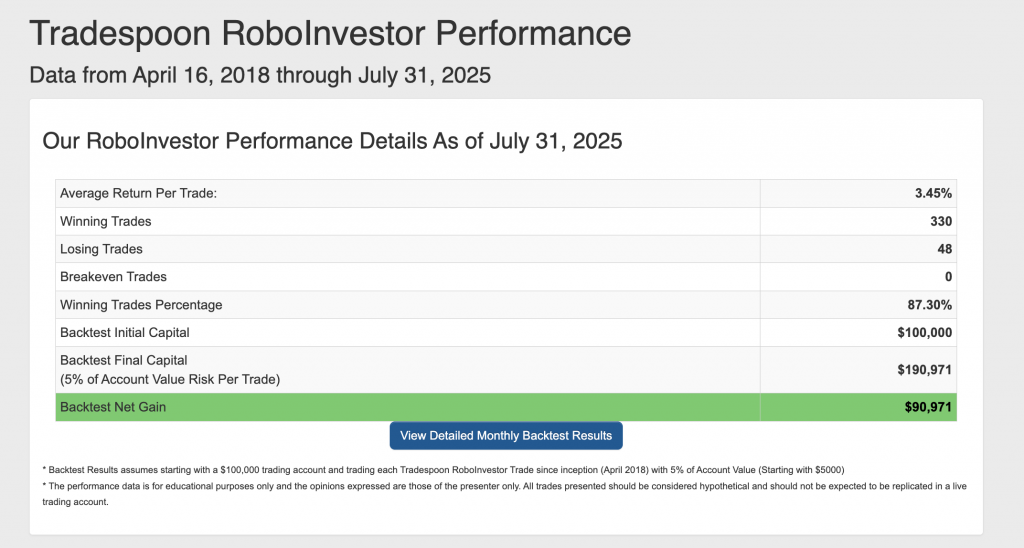

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.30% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!