From Friday’s tone-driven grind to Monday’s relief rally—and how we’re sizing into bank earnings.

Markets followed through on the “buy-the-dip” instinct: tariff jitters faded, tech leadership reasserted, and the bounce broadened. By Monday’s close, the Dow added about 588 points (~1.3%), the S&P 500 rose ~1.6%, and the Nasdaq gained ~2.2%. The VIX, which finally poked above 20 on Friday for the first time since August, slid back to the high-19s into the close—alert, but no longer flashing. With the bond market shut for Columbus Day, rates took a holiday pause; the dollar firmed modestly while gold printed a fresh record and silver closed at its highest level since 1980. The immediate read-through: risk appetite stabilized without the crutch of lower yields, helped by calmer trade rhetoric and resilient mega-cap tech.

That Monday pop capped a peculiar week. By Friday (Oct 10), the federal funding lapse had paused marquee data—payrolls, CPI, retail sales—leaving investors to infer the macro from earnings calls, private surveys, and Fed commentary. That patchwork held the uptrend together. Two-year yields hovered near 3.6%, the 10-year stayed penned in a 4.0%–4.2% range, and the VIX around 17 signaled respect for headline risk without real fear. Tone often outweighed hard numbers: with official releases offline, every mic and transcript acted as a macro proxy.

Within that vacuum, three forces did the heavy lifting. First, the AI-capex flywheel re-accelerated as AMD’s multi-year partnership with OpenAI re-energized semis and compute, setting up Nvidia’s next print as a referendum on whether demand can compound into year-end. Second, tariffs and industrial policy re-centered the narrative—escalation chatter around China and Washington’s strategic stake in Trilogy Metals underscored how policy steers costs, supply chains, and single-name dispersion even when the indexes mostly key off rates and earnings. Third, early earnings—thin but pivotal—carried extra weight: Delta beat and raised on premium mix and capacity discipline (a recipe for operating leverage if fuel behaves), PepsiCo provided defensive ballast, crude softened on tentative cease-fire signals, sentiment gauges eased a touch, and claims estimates ticked up—together consistent with “slowing, not stalling,” which fits a cautious Fed glide path into 2025.

The weekend then reset the tape. A softer tone out of Washington—“Don’t worry about China, it will be fine!”—helped reverse Friday’s tariff scare, and U.S. equities did what they’ve done most of the year when shocks don’t stick: they climbed. Not everything cheered; China-linked shares struggled overseas on lingering tariff uncertainty, a reminder that policy remains the wild card. But stateside, breadth improved enough to turn Friday’s wobble into a one-day event.

That puts the burden squarely on earnings to confirm the story we’ve been trading. Today kicks off the first real slate of Q3 results with the big banks, and this cohort will effectively moonlight as macro nowcasters while official data remain delayed. We’re listening for three things: deposit-beta stabilization as rates normalize at lower levels, credit normalization in cards and C&I without a sharp turn in delinquencies, and a read on capital-markets pipelines that tells us whether year-end risk appetite is building or fading. Beyond financials, the week’s roster is dense—money-center banks and brokers (JPM, C, WFC, BAC, GS, MS, BLK), plus bellwethers across health care, airlines, semis, and platforms (JNJ, ABT, UAL, TSM/ASML, SCHW, DPZ). In a data-light regime, forward guidance will matter more than backward-looking beats.

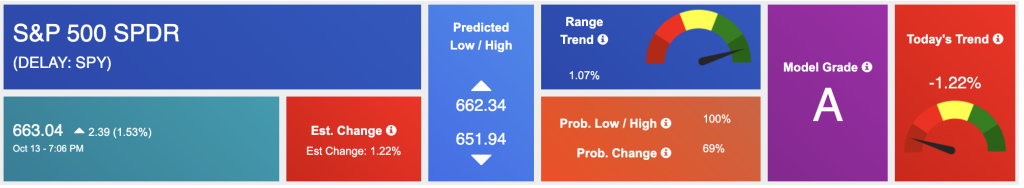

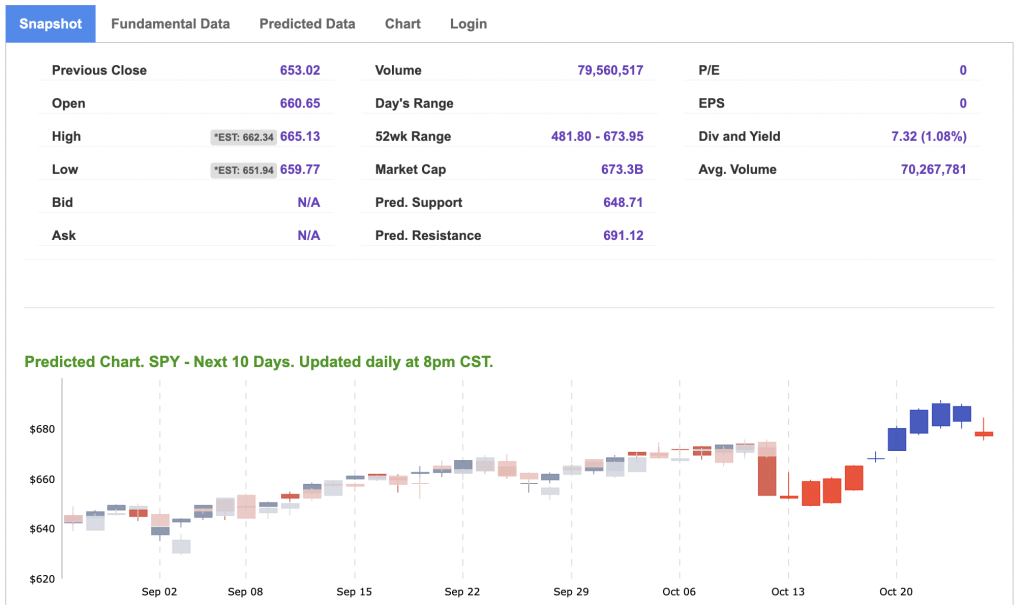

Our roadmap is unchanged. If earnings “hold serve” and AI-adjacent leadership persists, SPY can grind toward 680–700 on the next push, with near-term support anchored in the 620–640 band for any macro wobble. We’ll de-risk faster if the 10-year snaps decisively above its recent range or if the post-shutdown data catch-up shows a clear inflection higher in unemployment; a sustained VIX move north of ~20–22 without a rates shock would also argue for adding protection. Positioning remains pragmatic: maintain core exposure to AI horsepower into Nvidia’s print; scale into high-quality airlines like Delta on fuel-driven dips given improving mix and capacity discipline; keep selective hedges in place so tariff surprises don’t knock longer-term positioning; and retain a modest precious-metals allocation as a policy-risk buffer while the data backlog clears.

From Friday’s tone-driven grind to Monday’s relief rally, the market has been just constructive enough. Into today’s bank kick-off, the question isn’t whether the tape can levitate on hope—it’s whether guidance and credit color validate the soft-landing setup investors priced on Monday afternoon. Until the facts say otherwise, patient buys on quality weakness continue to earn their keep.

Using the “SPY” symbol to analyze the S&P 500, our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

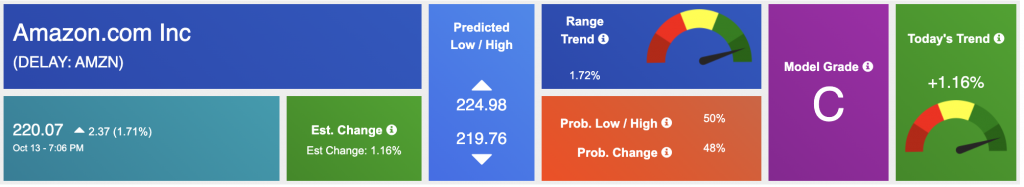

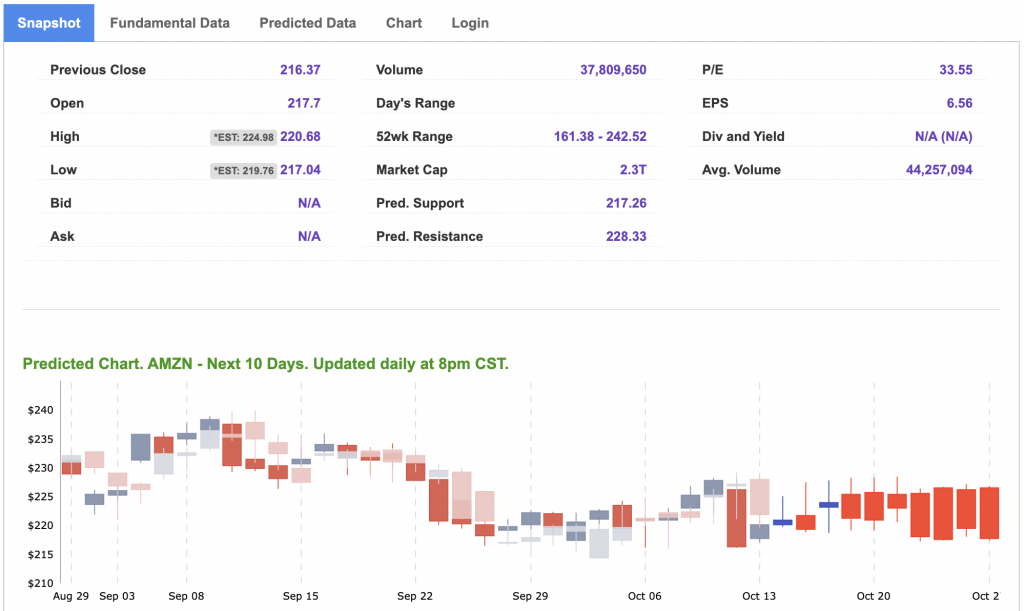

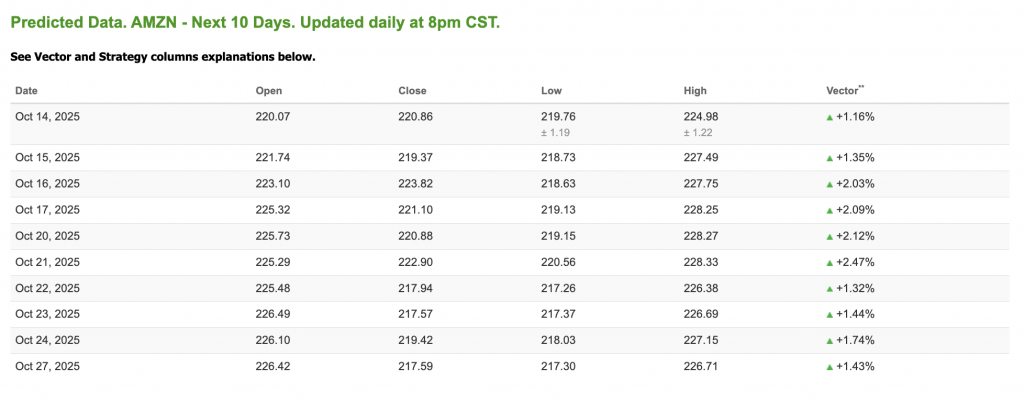

Our featured symbol for Tuesday is AMZN. Amazon.com Inc is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $220.07 with a vector of +1.16% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication, Vlad Karpel does have a position in the featured symbol, amzn. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

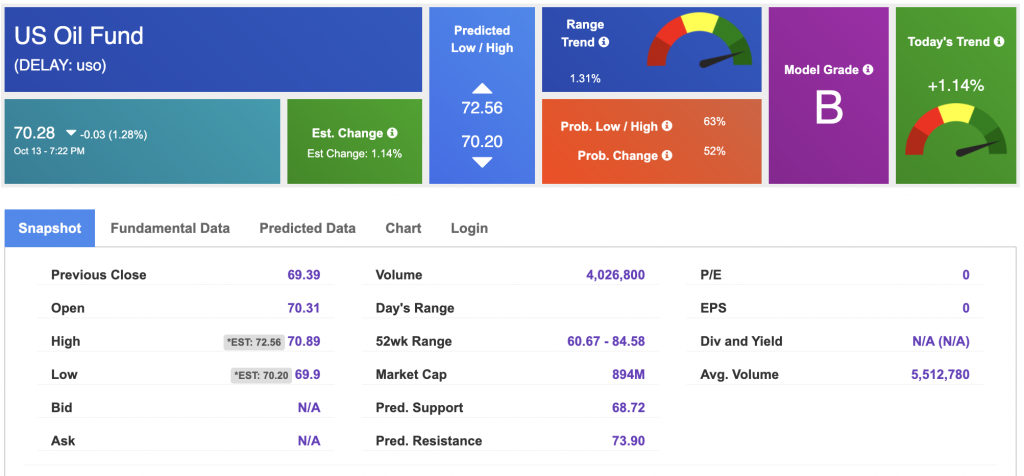

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $59.78 per barrel, up 0.49%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.28 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

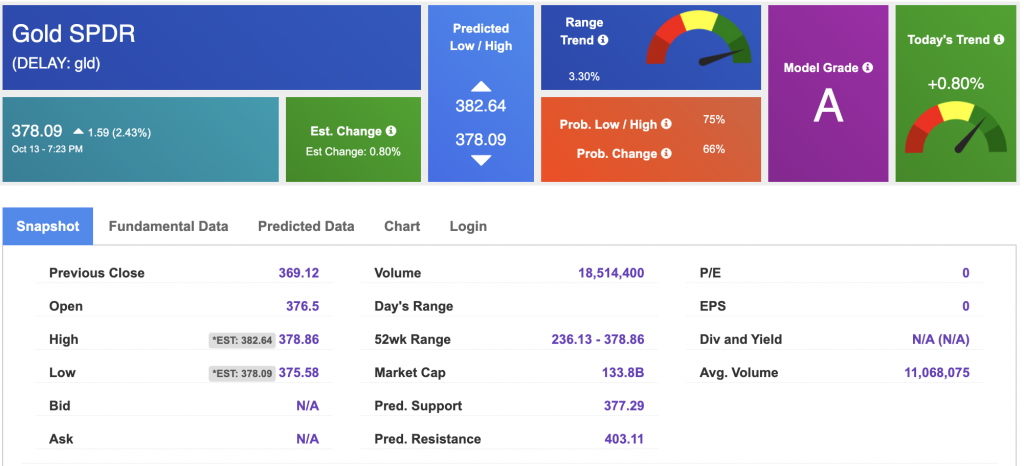

The price for the Gold Continuous Contract (GC00) is up 1.17% at $3,852.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $378.09 at the time of publication. Vector signals show +0.80% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

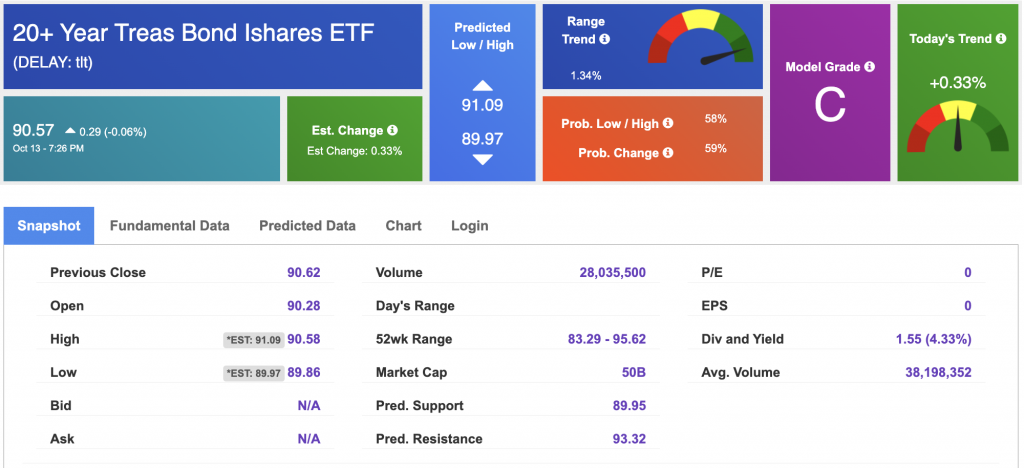

The yield on the 10-year Treasury note is up at 4.068% at the time of publication.

The yield on the 30-year Treasury note is up at 4.656% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

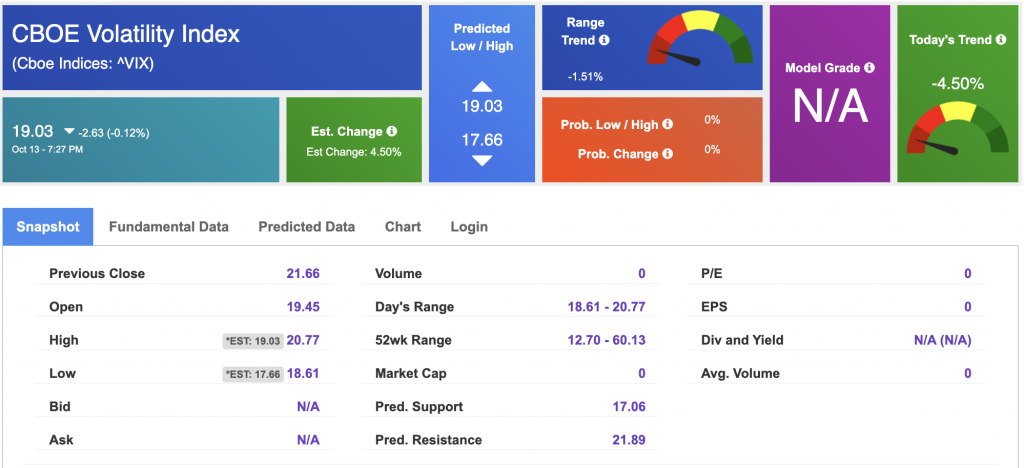

The CBOE Volatility Index (^VIX) is priced at $19.03 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!