RoboStreet – June 20, 2025

Wall Street returned from the Juneteenth holiday with modest gains, seeking clarity in a week marked by geopolitical stress, economic ambiguity, and shifting central bank policy. Traders are finding themselves stuck between cautious optimism and growing signs of fragility, particularly as rate expectations, inflation pressures, and conflict abroad stir fresh uncertainty.

The S&P 500, Dow Jones, and Nasdaq all posted small gains as the market digested signals of possible de-escalation in the Israel-Iran conflict. President Donald Trump, via his press secretary, announced on Thursday that a decision on U.S. military involvement would be made within two weeks, noting there’s a “substantial chance of negotiations.” This pivot from earlier hawkish tones helped lift equity futures, which had dropped sharply earlier in the week amid concerns about imminent U.S. strikes.

The conflict, which has seen five days of missile attacks between Israel and Iran, initially drove up oil and gold prices, as traders rushed into safe havens and speculated on disrupted crude supplies. Yet by Friday, as talk of diplomacy entered the conversation, markets steadied. Crude oil futures eased slightly, and the dollar softened. Treasuries, meanwhile, held remarkably steady, with the 10-year yield hovering between 4.36% and 4.52% since late May, and the 2-year stuck within a 3.88% to 4.04% band. Investors appear hesitant to make bold moves while the broader policy picture remains uncertain.

The Federal Reserve left interest rates unchanged at its latest meeting, but Fed Governor Christopher Waller hinted in a CNBC interview that a rate cut could arrive as soon as July. Waller emphasized inflation was trending lower and added that a cut reflects his personal outlook, whether or not the broader committee agrees. Markets responded accordingly, with traders now pricing in an 80% chance of a September cut. President Trump, for his part, criticized Fed Chair Jerome Powell for not easing sooner, suggesting that tighter policy is undermining growth just as global tensions rise.

Economic data this week added to the murky backdrop. Initial unemployment claims came in slightly below expectations at 245,000, indicating a labor market that is stable but not particularly robust. Homebuilder sentiment, however, continued to slide. The NAHB/Wells Fargo Housing Market Index dropped to 32 in June, signaling weakening sales and diminished buyer activity in the housing sector. Traders are also awaiting May’s inflation data, which will be the first to reflect the impact of President Trump’s new round of tariffs. The administration is pushing for a 55% tariff on Chinese imports and a 10% levy on U.S. exports to China, raising the risk of a prolonged trade confrontation just as fragile talks with Beijing stall.

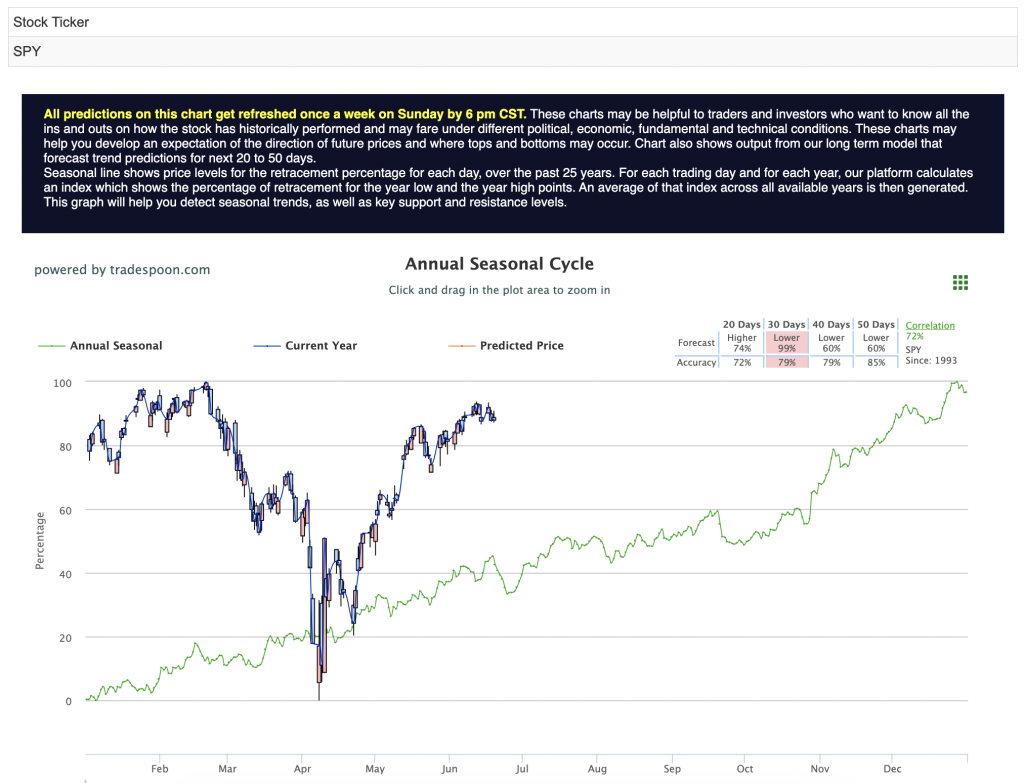

Even with this wave of uncertainty, the broader indices remain in positive territory for the year. However, participation is thinning. Fewer than 50% of S&P 500 stocks are trading above their 200-day moving averages, and that weakness beneath the surface has not gone unnoticed. The VIX remains elevated near 20, suggesting that traders are staying hedged even as the S&P flirts with record highs. Technical models continue to show SPY support between $540 and $550, with room for a breakout toward $600–$620 if inflation continues to cool and the Fed turns decisively dovish. But for now, we remain in a market-neutral stance, expecting sideways movement in the short term as long-term risks—particularly around rates, employment, and global demand—persist.

Friday’s Movers: Market Rebounds on Geopolitical Breather and Company News

Stocks pushed higher on Friday, helped by President Trump’s statement that a decision on potential U.S. involvement in the Israel-Iran conflict would be delayed for at least two weeks. The possibility of negotiations offered markets a moment of reprieve, and several high-profile names surged on individual catalysts.

Tesla rose 0.9% heading into the weekend, just days ahead of its highly anticipated robotaxi launch in Austin. The rollout—scheduled for Sunday—has drawn political scrutiny, with Texas Democratic lawmakers urging Tesla to delay until September 1, when a new self-driving safety law takes effect. CEO Elon Musk has yet to confirm if the company will comply, but traders appeared encouraged by Tesla’s bold step toward autonomous mobility.

GMS Inc. delivered one of the biggest surprises of the day, soaring nearly 29% after reports surfaced that Home Depot had made a takeover offer for the building-products distributor. That offer, reportedly higher than a $95.20-per-share bid previously made by QXO, signals strong M&A interest in the construction and home improvement sector. Home Depot shares rose slightly, while QXO climbed over 5%.

On the downside, Accenture fell more than 7% despite beating third-quarter earnings expectations. Investors were more focused on the continued decline in bookings and an announced leadership shake-up, which raised concerns about future growth. Meanwhile, CarMax rose over 3% after topping both revenue and profit estimates. The used-car retailer posted an impressive 8.1% jump in comparable-store sales, signaling renewed consumer demand in the auto market.

In crypto, Coinbase gained 2.4% on the back of Wednesday’s 16% surge, as excitement builds around the newly passed Genius Act. The legislation regulates stablecoins and lays the foundation for a digital payment infrastructure. Coinbase also launched “Coinbase Payments,” a stablecoin-focused commerce platform designed to simplify online transactions. Circle, the issuer of USD Coin (USDC), was up 7% following a 34% rally earlier in the week, buoyed by a fresh Buy rating from Seaport Research.

Bitcoin rallied to $106,081, up roughly 1.1% over the last 24 hours, as risk appetite improved heading into the weekend. The token had been trading in a tight range near $105,000 for most of the week before Friday’s breakout.

Oil markets, which have been closely linked to the Middle East conflict, showed divergence on Friday. West Texas Intermediate futures rose 0.5% to $73.83 following data that showed a larger-than-expected drawdown in U.S. crude inventories. This boosted energy names like Exxon, Chevron, and Occidental Petroleum, all of which traded modestly higher. Brent crude, however, fell 2.3% to $77.03 as President Trump’s softer rhetoric cooled expectations for near-term military escalation.

Final Takeaway: Volatility Without Direction

This week underscored how fast sentiment can swing in today’s market. From missile strikes to rate speculation to merger news, traders were bombarded with competing signals. Underneath the headlines, the structure of the rally is showing wear—breadth is weak, macro risk is high, and the market is increasingly dependent on just a handful of names to keep moving forward.

For now, we’re in a holding pattern. The market has room to run if rates fall and global tensions ease—but the next leg higher will require more than hope. It will require participation.

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

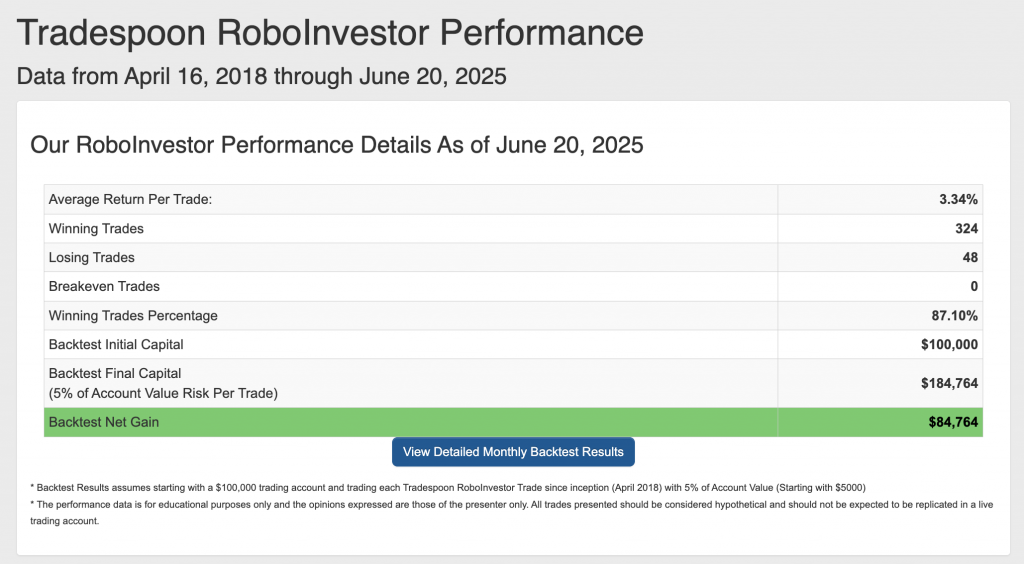

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.10% going back to April 2018.

As we near the end of Q2 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!