Mid-July Market Outlook: Tariff Threats, CPI Surprises, and Where SPY Goes Next

RoboStreet – July 17, 2025

As July’s third week unfolds, U.S. markets have been buffeted by a potent blend of trade skirmishes, central-bank signals, and key economic releases, all framed by an underlying complacency that shows in the VIX hovering near 16 even as major indexes carve out fresh highs. What began last week as a tentative balance around SPY’s $617 level has given way to sharp swings and relief rallies, underscoring the tightrope that investors now walk between growth optimism and policy uncertainty.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The week kicked off on Monday, July 14, when President Trump formally dispatched letters to trading partners reupping proposals for a 50 percent tariff on copper and fresh duties on Canadian imports. Those missives marked the expiration of the 90-day tariff truce and added to earlier threats of a 10 percent duty on BRICS nations, stoking fears of escalating trade friction. The Dow surrendered its gains for the day, the S&P 500 bobbed near unchanged, and only the Nasdaq eked out a narrow advance, supported in large part by renewed enthusiasm for Nvidia and other AI champions. Bond markets reacted by pushing the 10-year Treasury yield up toward 4.45 percent and the 30-year close to 4.97 percent, reminding all that the Fed’s hold-the-line stance may not yet herald easier financial conditions.

By midweek, on Wednesday, July 16, sentiment found firmer footing as the Federal Reserve’s June meeting minutes revealed a growing internal debate about rate cuts in 2025, even as policymakers left the target range at 4.25 to 4.50 percent. Unexpectedly strong payrolls data, with 147,000 jobs added versus the 110,000 consensus, reinforced that the labor market retains the strength to withstand higher borrowing costs.

As the 10-year yield eased back to the mid-4 percent range, rate-sensitive sectors such as real estate and utilities rebounded, and Delta Air Lines’ better-than-forecast revenue and earnings gave a lift to the broader industrial complex. Simultaneously, China’s report of 5.2 percent GDP growth in Q2 offered an indirect tailwind to U.S. equities, even as unresolved tensions over the Strait of Hormuz and fresh tariff headlines kept oil and commodity traders on edge.

Retail sales for June beat forecasts with a robust 0.6 percent rise both on headline and core bases, and initial jobless claims fell to 221,000, down from a revised 228,000. Stocks responded broadly, with the Nasdaq powering ahead by 0.7 percent, poised for its tenth record close of the year, and the S&P 500 and Dow advancing by 0.5 percent and 0.4 percent, respectively, as only real estate, health care, and communication services lagged.

The official start of Q2 earnings has added yet another dimension to market dynamics. On July 15, JPMorgan Chase beat expectations with $4.96 in EPS versus the $4.48 consensus, fueled by a 15 percent surge in markets revenue despite Deutsche Bank’s warning of a modest tariff-related hit to profits. Citigroup and Wells Fargo also delivered upside surprises, reinforcing the notion that major banks can navigate headwinds.

This week, attention turns to General Electric and Netflix, both due to report later today, followed by Bank of America, Goldman Sachs, Morgan Stanley, Johnson & Johnson, GE Aerospace, PepsiCo, American Express, Charles Schwab, and 3M. With Wall Street’s consensus now calling for a scant 4.8 percent year-over-year rise in S&P 500 earnings—the weakest since late 2023—guidance will be the lodestar for second-half positioning.

Beyond tariffs and earnings, other global and geopolitical currents have left their mark. The U.S.-brokered Israel-Iran ceasefire helped ease oil prices by roughly 12 percent mid-last week, even as a contentious Iranian parliamentary vote on the Strait of Hormuz keeps energy markets cautious. Meanwhile, reports that European allies will purchase billions in U.S. defense systems offered a sliver of offset to trade anxieties. And in an unexpected flourish, Bitcoin vaulted past $122,800 before settling near $119,800 on Thursday, buoyed by growing ETF inflows and the advancement of crypto-friendly legislation through Congress.

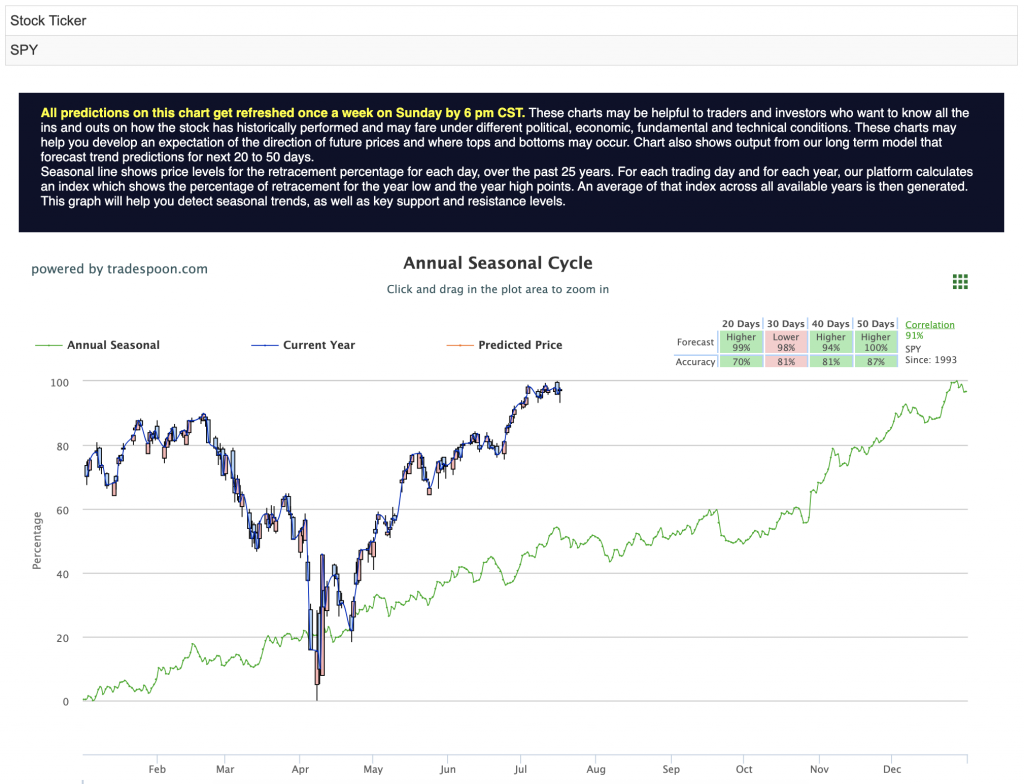

Looking ahead, SPY’s path seems destined to wander between firm support at $580–$590 and resistance around $630–$640. A sustained break above the mid-640s would signal fresh bullish conviction, while a tumble below $580 could open the door to a deeper pullback. For reference, the SPY Seasonal Chart is shown below:

In the current environment, I remain market neutral. Sticky inflation, dovish expectations for the Fed, and lingering trade uncertainties point to a sideways grind in the near term. Navigating this landscape calls for selective exposure to high-quality growth names, tactical hedges against interest rate swings, and a sharp focus on upcoming earnings reports and Fed commentary. Let data—not emotion—guide your decisions as markets continue to balance record highs with the persistent risk of renewed volatility.

Given these conditions, maintaining a neutral stance is a prudent approach. Investors should remain selective, prioritize risk management, and stay alert to key developments. The coming weeks will be pivotal, with tariff negotiations, Fed policy signals, and corporate earnings likely to shape the market’s next move.

That’s where RoboInvestor steps in. Our AI-powered advisory service delivers clear, data-driven insights tailored for today’s complex market. By removing emotional bias and replacing it with analytical precision, RoboInvestor helps you cut through the noise and seize high-probability opportunities with confidence.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

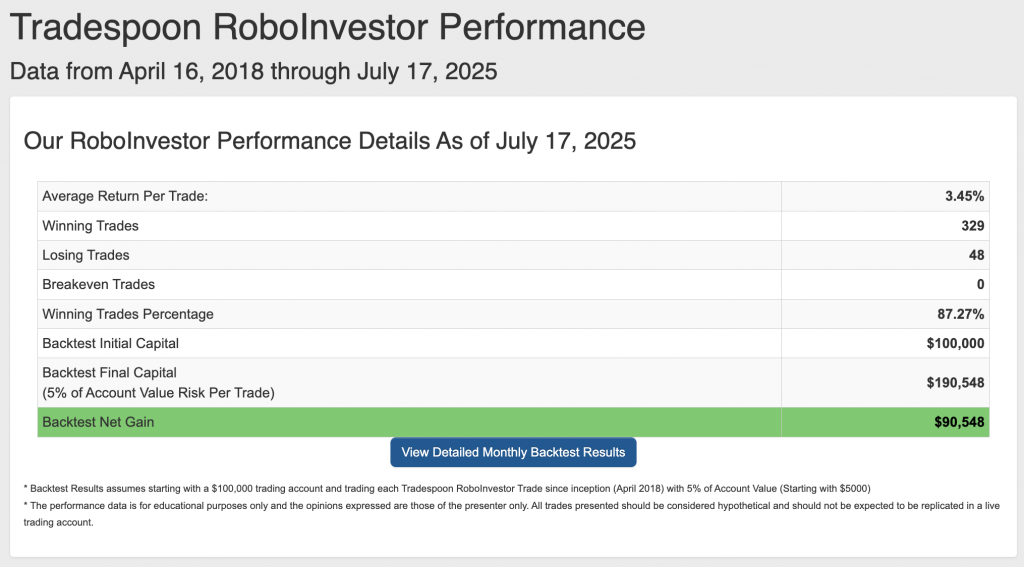

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.27% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!