RoboStreet – July 3, 2025

To open the week, Wall Street concluded a remarkable second quarter with strong performances across all major indices. The S&P 500 rose 0.3% on Monday, achieving a quarterly gain of over 10%, its best since Q4 2023. The Nasdaq surged by 17.5%, marking its strongest quarterly performance since the tech rally in mid-2020, while the Dow Jones Industrial Average closed the quarter up 4.7%, its best result in a year.

Despite impressive headline gains, investor sentiment remained cautiously optimistic due to concerning economic indicators from the prior week. Revised Q1 GDP data showed contraction at -0.5%, May retail sales fell by 0.9%, and jobless claims increased, indicating emerging labor market stress. Moreover, the Core PCE Index persisted at a high 2.7% year-over-year, diminishing hopes for imminent Federal Reserve easing.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Geopolitical tensions briefly surged early in the week, with U.S. and Israeli strikes on Iranian targets causing oil prices to spike above $77 per barrel and the VIX volatility index to rise sharply. However, these concerns eased quickly following President Trump’s announcement of a brokered ceasefire between Israel and Iran, stabilizing markets and renewing investor confidence.

Among notable corporate developments, Oracle (ORCL) surged 6% following announcements of major cloud service agreements expected to generate substantial revenue. In contrast, Tesla (TSLA) faced continued pressure, declining slightly amid uncertainty surrounding a Senate bill threatening to end EV tax credits. Nvidia (NVDA), despite approaching a valuation of nearly $4 trillion, faced investor skepticism about the sustainability of its extraordinary growth.

Financial institutions, including JPMorgan, Goldman Sachs, and Wells Fargo, advanced positively, supported by robust Fed stress test results, which set the stage for increased dividends and share buybacks.

Tariff Tensions and Economic Uncertainty

Market volatility re-emerged midweek, driven by renewed tariff uncertainties and disappointing economic data. President Trump’s statements suggesting a potential end to the tariff pause with Japan, coupled with a preliminary agreement with Vietnam, led investors to reassess risks. The effective U.S. tariff rate rose significantly from 3% to 13%, reigniting concerns over inflationary pressures and impacts on corporate profitability.

Economic data further contributed to market unease, as Wednesday’s ADP employment report revealed a reduction of 33,000 jobs, while ISM reports indicated declines in new orders and employment. Although job openings data surpassed expectations, ongoing signs of weakening consumer spending and decreased industrial production raised recessionary fears.

Investors responded by rotating away from tech-heavy and mega-cap stocks toward traditionally defensive sectors, including materials, health care, and consumer discretionary. Tesla’s stock faced additional pressure due to anticipated weak Q2 deliveries, while FedEx suffered significant losses after withholding guidance and reporting mixed performance in European markets.

Despite previous market optimism, caution dominated investor sentiment. The SPDR S&P 500 ETF (SPY) stabilized around $617, reflecting ongoing uncertainties. The 10-year Treasury yield remained volatile, oscillating between 3.6% and 4.8%, indicative of investor uncertainty about future interest rates and economic stability.

Robust Jobs Report Fuels Renewed Optimism

Markets rebounded sharply on Thursday following the release of unexpectedly strong June employment data. The U.S. economy added 147,000 jobs, surpassing forecasts and countering Wednesday’s disappointing ADP employment figures. Additionally, the unemployment rate declined to 4.1%, bettering expectations of 4.3%.

In response, the S&P 500 rose 0.4%, and the Nasdaq Composite increased by 0.6%, both setting the stage for new closing highs. The Dow Jones advanced by 88 points, moving closer to its December high.

The upbeat employment data drove a significant rise in bond yields and bolstered the U.S. dollar. Consequently, expectations for imminent Federal Reserve rate cuts diminished sharply, with market odds for a July rate cut dropping to 4.7%, and September cut expectations notably reduced.

The U.S. dollar index rose notably by 0.42% to 97.39, underscoring renewed economic confidence. Traders recalibrated year-end expectations, now anticipating fewer rate cuts.

Despite closing near record highs, underlying market complexities persist. Inflation remains elevated, consumer spending shows signs of strain, and geopolitical issues, particularly unresolved U.S.-China trade tensions and the fragile Middle East ceasefire, remain significant concerns.

The upcoming Q3 earnings season begins with key reports from Constellation Brands (STZ), MSC Industrial Direct, Greenbrier Cos., and UniFirst, expected to provide essential insights into the health of industrial sectors and consumer sentiment.

Overall, market sentiment remains cautiously neutral. Clearly defined short-term trading ranges persist, with potential upside targets for SPY around $630-$640 and firm short-term support between $580-$590. Given increased recession risks and pressure on long-term market trends, upcoming economic data, Federal Reserve decisions, and geopolitical developments will be critical in determining market resilience. For reference, the SPY Seasonal Chart is shown below:

Investors are advised to approach the current environment selectively, manage risks prudently, and remain flexible, ready to adapt as conditions evolve.

And that’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

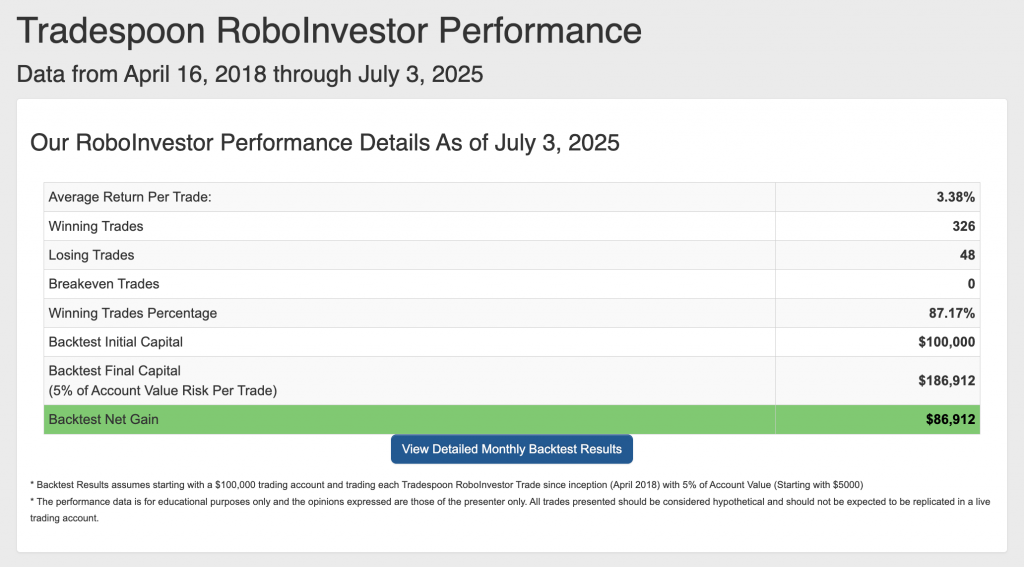

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.10% going back to April 2018.

As we near the end of Q2 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!