The stock market saw a notable upswing on Monday, offering a breath of relief to investors after a tumultuous period marked by volatility and geopolitical tensions. The surge broke a six-day downward spiral that had ensnared the S&P 500, injecting optimism into the week ahead. As markets brace for a flurry of corporate earnings and major macroeconomic events, including the Federal Reserve’s monetary policy decision, investors are keenly eyeing pivotal indicators to gauge the trajectory of economic recovery.

The Federal Reserve is widely expected to maintain interest rates at current levels, but all eyes are on Chairman Jerome Powell’s press conference for insights into the central bank’s outlook. With investors recalibrating expectations regarding borrowing costs, Powell’s commentary holds significant sway over market sentiment.

Crucially, investors are looking for signs of robust growth in corporate earnings, with a spotlight on tech giants like Apple and Amazon.com, where artificial intelligence trends are expected to play a key role. Alphabet and Microsoft set a positive tone last week with their better-than-expected reports, while Tesla soared 16% following CEO Elon Musk’s surprise visit to China.

Last week’s market rollercoaster saw investors grappling with mixed signals and geopolitical uncertainties, underscoring the need for stability and clarity. As optimism returns, attention shifts to a packed week ahead, featuring earnings releases from Amazon.com and Apple, alongside the Federal Open Market Committee meeting and key economic data reports.

Amid this backdrop, the focus remains on crucial economic indicators. The eagerly awaited first-quarter U.S. Gross Domestic Product (GDP) figures, coupled with core Personal Consumption Expenditures (PCE) price index, provide vital insights into economic health and inflationary pressures. While March’s durable goods orders met expectations, concerns linger over inflation data, compounded by disappointing corporate earnings and slower-than-expected economic growth.

The Federal Reserve’s preferred inflation gauge reaffirmed concerns about stubborn price growth, further fueling uncertainty. Treasury yields, particularly the 10-year yield, surged above key levels, triggering apprehension among traders. The widening spread between Treasury and junk bond yields, along with currency dynamics, adds layers of complexity to market dynamics.

As the Federal Reserve’s decision looms and uncertainty persists, investors are adopting a cautious stance, mindful of the challenges posed by inflation, interest rates, and geopolitical tensions. While optimism endures, prudent navigation through market headwinds remains essential for sustained growth and stability. Key earnings this week will include 3M, Coca-Cola, Eli Lilly, PayPal, Amazon, AMD, MasterCard, and Apple.

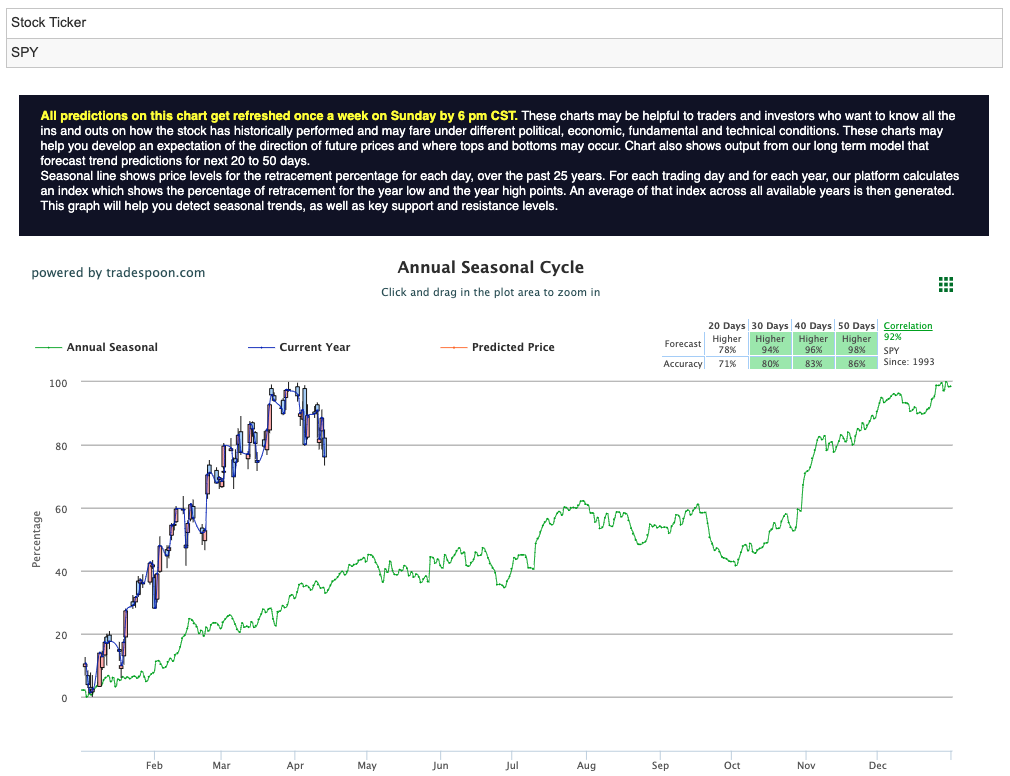

Looking forward, investors are preparing for increased market volatility as major indices such as SPY, QQQ, and small caps remain below critical support levels. Projections suggest a capped rally for the SPY, likely ranging between $530 and $540, while short-term support is expected in the $480 to $500 range, indicating a turbulent market trajectory. For reference, the SPY Seasonal Chart is shown below:

Navigating this uncertain terrain requires both vigilance and adaptability. Keeping a close eye on developments, including Chairman Powell’s speeches, economic data releases, and earnings reports, will be pivotal in crafting informed investment strategies. As investors brace for potential fluctuations, prioritizing risk management is essential, urging investors to maintain vigilance amidst unpredictable conditions.

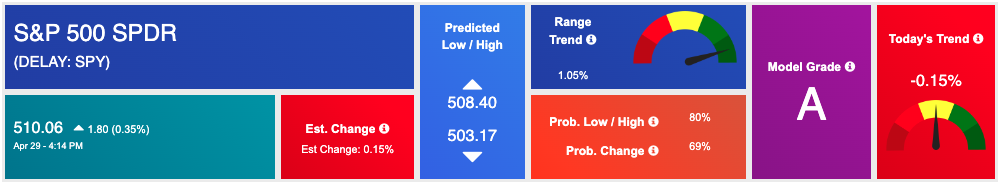

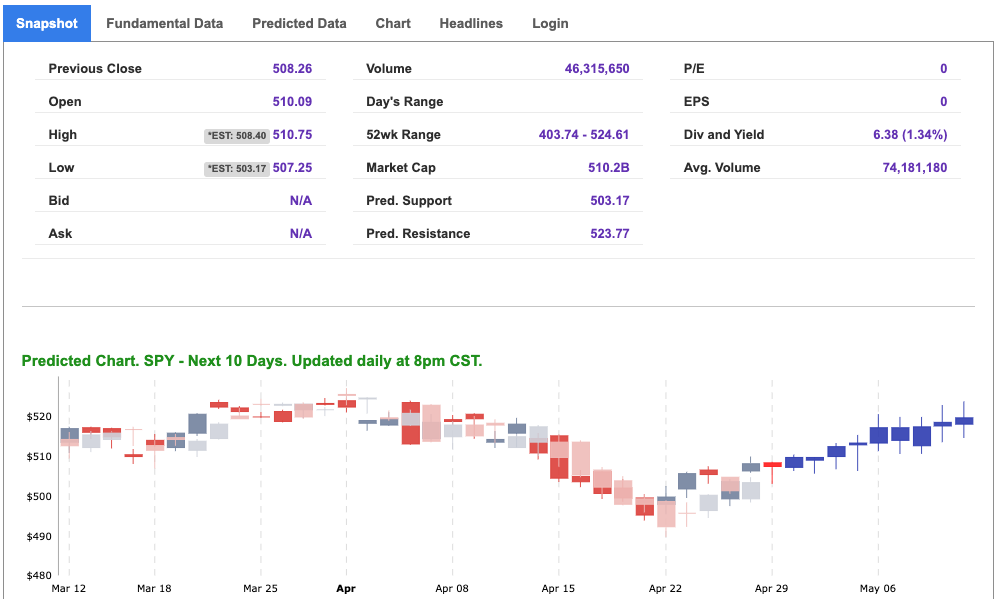

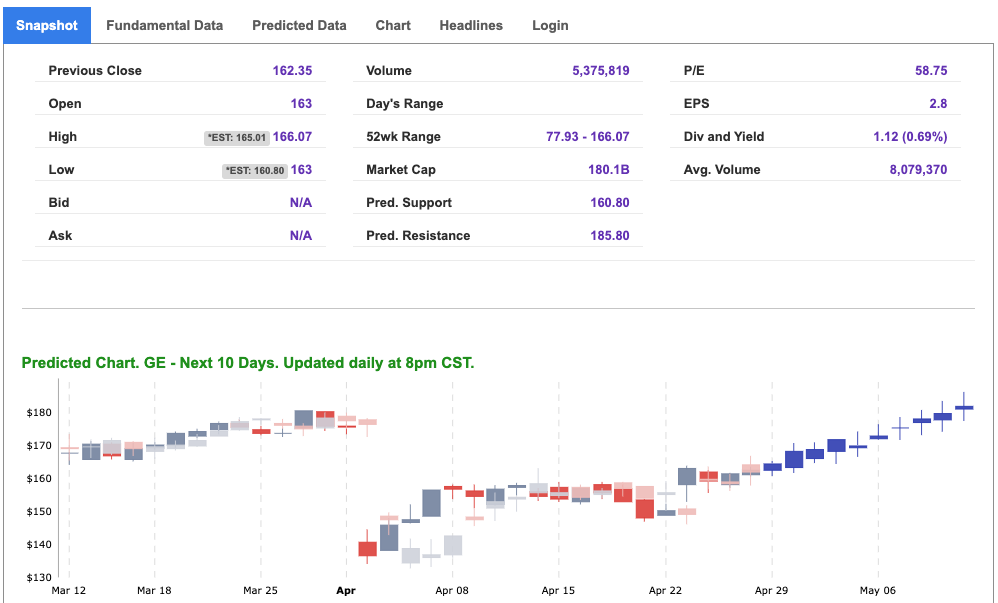

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

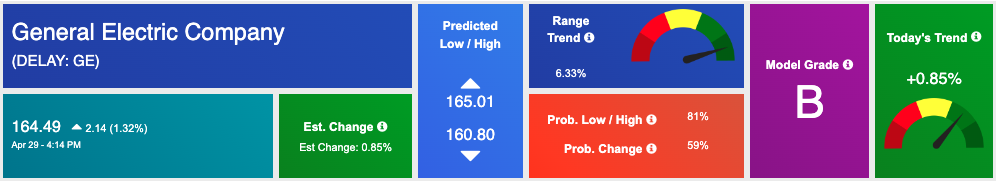

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, ge. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

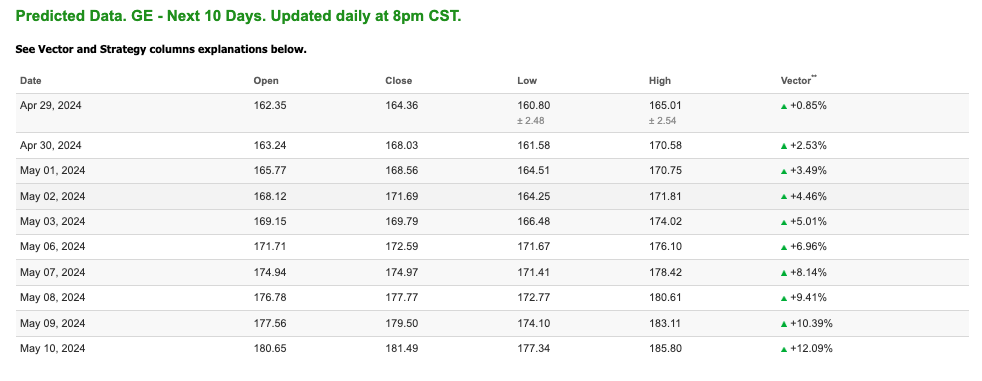

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $82.73 per barrel, down 1.34%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $79.5 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

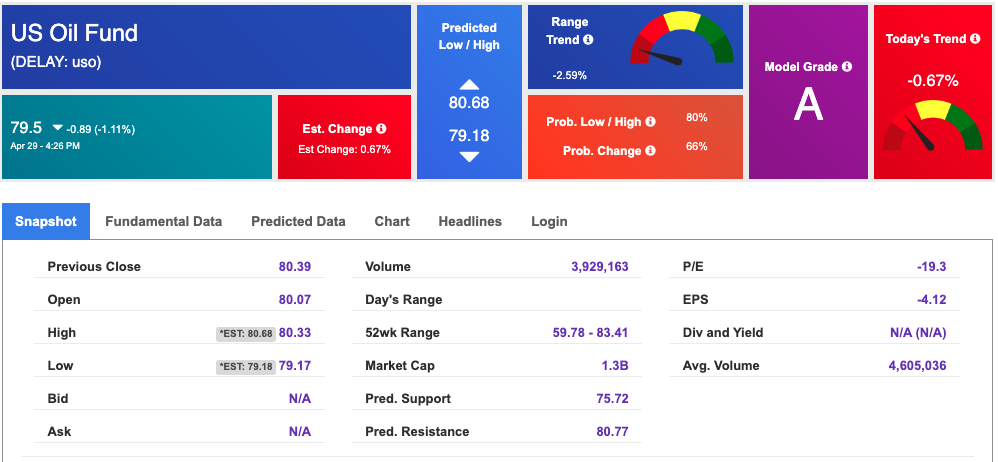

The price for the Gold Continuous Contract (GC00) is up 0.01% at $2347.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $216.18 at the time of publication. Vector signals show -0.52% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

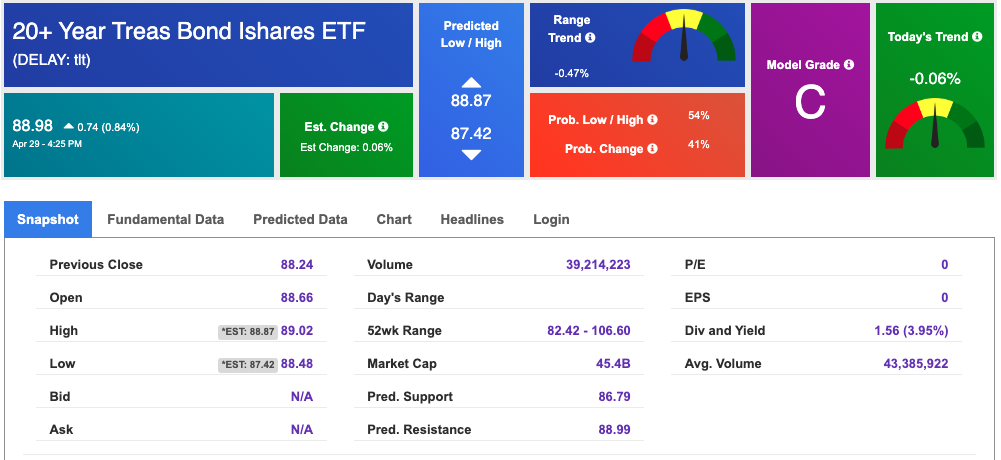

The yield on the 10-year Treasury note is down at 4.618% at the time of publication.

The yield on the 30-year Treasury note is down at 4.733% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

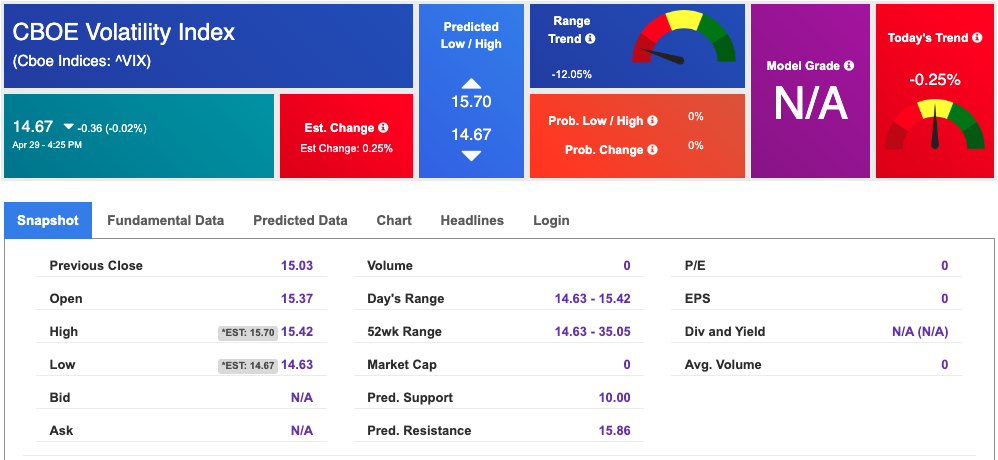

The CBOE Volatility Index (^VIX) is priced at $14.67 down 0.02% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!