As the curtain lifted on the financial markets in 2024, the stage was set for an intriguing drama marked by $AAPL’s precarious dance at its 200 DMA, $NVDA’s historic breakout, and the 10-year yield and $DXY engaged in a delicate prelude to the Consumer Price Index (CPI) data unveiling.

Amidst this volatility, geopolitical ripples in the Red Sea triggered an oil rebound, with Houthi rebels capturing attention. The Red Sea, a vital conduit for 10-15% of global oil shipping, became a focal point, introducing a layer of complexity to the already dynamic energy markets.

Thursday’s descent in stocks followed the CPI data revelation, showcasing a 0.3% uptick in consumer prices in December, propelling the year-over-year inflation rate to 3.4%. In the intricate dance between stocks and bonds, Louis Navellier observed a more measured response from the bond market, emphasizing the nuanced reaction to the inflationary report.

The Federal Reserve’s adept navigation through inflation challenges took center stage. Inflation, once looming at a staggering 9.1% in mid-2022, has now receded to a more manageable 3%. While the consensus among economists leans toward an economic slowdown in the first half of 2024 due to rising interest rates, the potential for a recession remains a topic of spirited debate.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The linchpin of this discussion lies in the jobs market. The Fed’s quest for equilibrium in labor supply and demand aims to alleviate upward wage pressure. Despite a late 2023 uptick in consumer prices interrupting a temporary slowdown in inflation, recent indicators point to an impending deceleration in the coming months.

December’s Consumer Price Index revealed a 0.3% surge, marking the most substantial gain in three months. The year-over-year inflation rate climbed to 3.4%, up from 3.1% in the prior month. Delving deeper into predictive insights, the core inflation rate increased by 0.3% in December. Interestingly, the annual core inflation rate nudged down to 3.9% from 4%, a milestone not witnessed since mid-2021.

While the CPI report may have added a touch of heat, the Federal Reserve remains unwavering in its projections. The central bank anticipates inflation to gradually recede, targeting less than 2.5% in 2024 and reaching its 2% bullseye by 2025.

Amid these market undulations, Microsoft briefly eclipsed Apple, underlining the transformative currents sweeping the technology sector, primarily fueled by excitement surrounding artificial intelligence.

Treasury yields saw an uptick, with the 10-year note hitting 4.043%. Simultaneously, the cryptocurrency realm celebrated the SEC’s approval of the first spot Bitcoin ETFs, prompting a cautious cheer as the SEC warned investors to tread carefully.

As market participants grapple with the Fed’s trajectory, the potential for lower interest rates in H1 2024 is a prevailing sentiment. The landscape is further complicated by multiple downgrades on $AAPL, Tesla retracing over 50% of gains since October 2022, and tech giants like META, MSFT, and GOOGL nearing all-time highs, creating a tapestry of intricate market dynamics.

Against the backdrop of elections and rising Trump ratings injecting uncertainty, the looming risk is that the Fed might refrain from lowering interest rates in the first half of 2024. Earnings season commences this week, featuring major banks and prominent names such as BlackRock, Delta Air Lines, and United Health.

In the European arena, stocks faced headwinds following hotter-than-expected US inflation data, with banks and property shares taking the brunt of the impact. Citigroup, grappling with geopolitical and economic risks, announced one-time charges impacting its fourth-quarter earnings.

Mortgage rates edged higher for the second consecutive week, signaling a reaction to inflation data and suggesting stability in the near term.

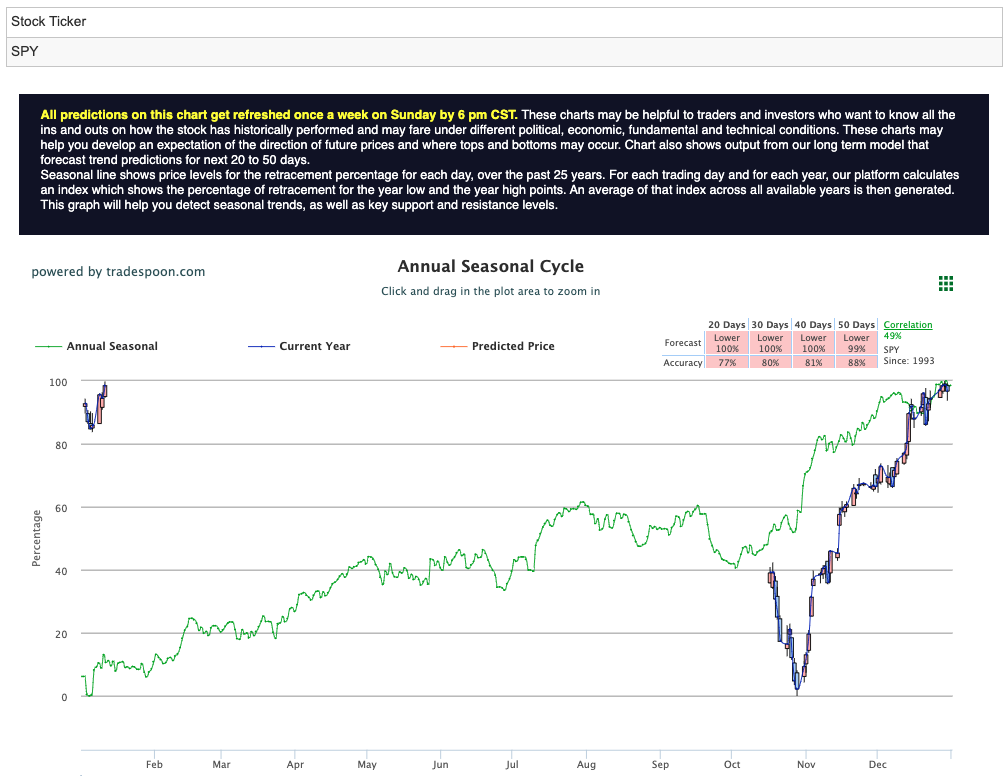

As economic data paints a low probability of a recession, the SPY rally, while capped at $470-490 levels, is poised for short-term support at 430-450. The market, akin to a ship navigating uncharted waters, anticipates short-term pullbacks while maintaining a pattern of higher highs and higher lows, contingent upon the prevailing belief in recession-free signs propelling the market higher. For reference, the SPY Seasonal Chart is shown below:

With the above conditions in mind, there is a particular symbol that I will be looking into, especially with key earnings coming up.

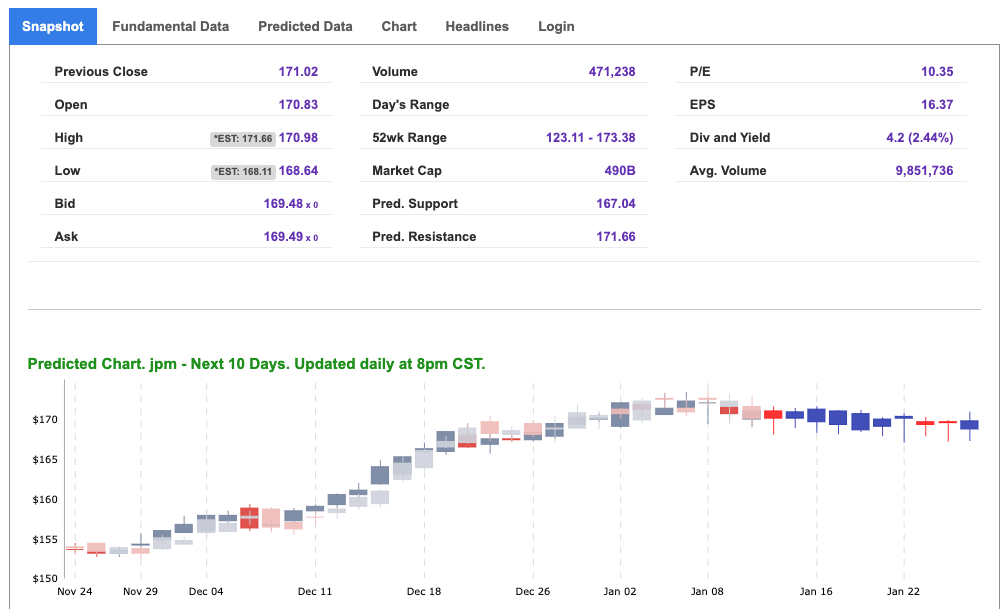

JPMorgan Chase & Co. (JPM) is a financial behemoth that has stood as a pillar of stability in the ever-shifting landscape of the banking and financial services sector.

JPMorgan Chase operates on a global scale, offering a comprehensive suite of financial services, including asset management, investment banking, retail banking, and more. Renowned for its robust risk management practices and an extensive network of branches, the institution has consistently demonstrated resilience through economic downturns and market fluctuations.

Against the backdrop of the current market narrative, JPMorgan Chase emerges as an intriguing investment opportunity, supported by several key factors.

JPMorgan Chase boasts solid financial fundamentals, positioning itself as a leader in the banking industry. With a diversified revenue stream and a commitment to prudent risk management, the bank has weathered economic storms successfully. As earnings season unfolds, JPMorgan Chase is slated to report, offering investors a closer look at its financial health. Positive performance and strategic initiatives could act as catalysts for the stock.

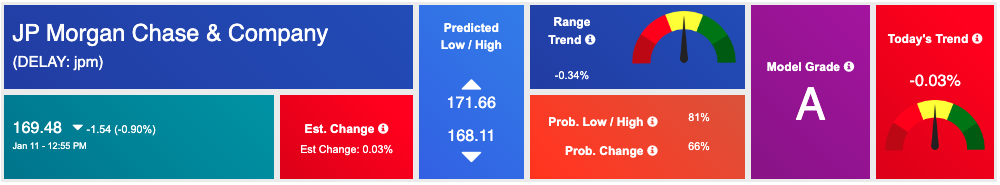

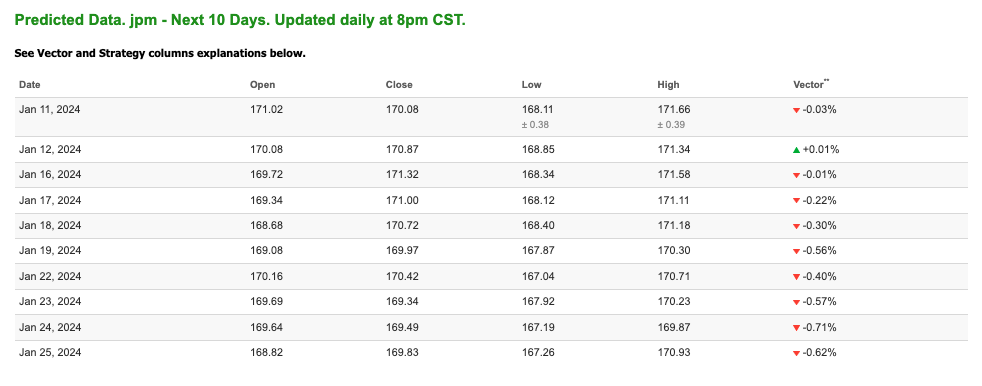

The prevailing sentiment in the market suggests that the Federal Reserve may embark on a path of lowering interest rates in the first half of 2024. This environment could be favorable for financial institutions, including JPMorgan Chase, as lower rates tend to stimulate borrowing and investment activity. And our AI agrees! Just take a look at our 10-day predicted data for JPM:

While market conditions are inherently unpredictable, the combination of JPMorgan Chase’s financial strength, strategic positioning, and potential tailwinds from a shifting interest rate landscape makes it a compelling investment prospect. With earnings around the corner, I’ll be looking to get involved in JPM based on my AI data.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

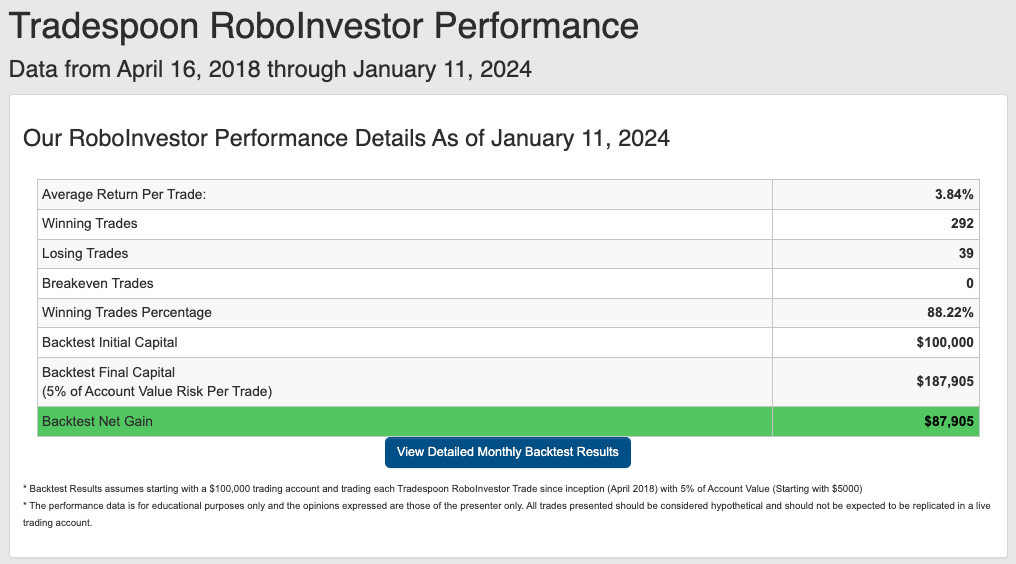

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!