RoboStreet – June 6, 2025

Markets ended the first week of June with a complex and contradictory mix of signals. Optimism around AI-fueled tech stocks and easing trade tensions helped the S&P 500 close out its best May since 2023, but the underlying economic data continues to flash yellow. From weakening services activity to slowing job growth, it’s becoming increasingly clear that the U.S. economy is losing steam even as stocks remain green year-to-date.

As of Friday morning, the market opened in negative territory despite futures pointing higher after the latest jobs report. The Dow and S&P 500 dipped at the open, with traders digesting stronger-than-expected employment numbers alongside a still-fragile macro backdrop. It’s a fitting end to a week where market resilience increasingly diverged from economic reality.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

President Trump’s renewed focus on trade protectionism dominated headlines. On June 4, the administration doubled tariffs on steel and aluminum imports, raising rates from 25% to 50%. The move reignited tensions with China—accused again of violating trade deals—and sent ripple effects across markets, particularly in manufacturing and retail sectors.

However, the tone softened midweek when Trump opted to delay his proposed 50% tariffs on European Union imports until July 9. That pause was framed as a window for fast-track negotiations, and markets responded with cautious relief. The S&P 500 and Nasdaq both rallied on the news, helped by hopes that diplomatic progress could avert further disruption.

Still, the inflation implications of these policies are real. The Congressional Budget Office (CBO) estimates that the current tariff regime could add 0.4% to inflation annually through at least 2026. Multinational firms like Apple, heavily reliant on Chinese manufacturing, remain especially vulnerable to any escalation.

Retailers are also beginning to feel the pinch. Gap warned of a multimillion-dollar hit to 2025 operating income due to higher input costs. Meanwhile, consumer brands are increasingly split between those able to pass on costs and those forced to absorb them.

Fresh signs of economic cooling came Wednesday, when the ADP National Employment Report showed that just 37,000 private-sector jobs were created in May, down sharply from April’s 62,000 and well below the Wall Street consensus of 110,000. It was the weakest monthly jobs print in over two years, raising new concerns about the durability of the labor market.

This slowdown in hiring is happening just as businesses are also contending with higher input costs, uncertain trade policy, and weaker demand.

Adding to the caution, the Institute for Supply Management (ISM) reported that services-sector activity contracted in May for the first time since June 2024. The ISM Services PMI dropped to 49.9, down from 51.6 in April and far short of the expected 52.1. A reading below 50 signals contraction. This marks only the fourth time since 2020 that the services index has dipped into contraction territory.

This follows Monday’s ISM report showing that manufacturing activity also declined at a faster rate in May. Together, the data suggest that both the consumer and industrial engines of the U.S. economy are now facing serious headwinds.

While financial markets continue to price in two rate cuts in 2025, Fed officials are signaling a more cautious approach. In remarks this week, Federal Reserve Governor Adriana Kugler acknowledged signs of slowing activity but emphasized that inflation remains the larger concern. With tariffs likely to push prices higher over the coming quarters, the Fed is reluctant to ease too soon.

Kugler’s remarks came just as the 10-year Treasury yield slipped, reflecting growing concern about the economy’s trajectory. Yields moved lower throughout the week, hovering between 3.6% and 4.8%, as softer jobs and services data pushed bond traders toward more defensive positioning.

The broader message from the Fed: we’re watching the slowdown—but we’re not ready to intervene yet.

Corporate earnings continued to reflect sector-specific divergence. Broadcom (AVGO) posted strong numbers, driven by robust demand for AI infrastructure and enterprise semiconductors. The stock surged, reinforcing the narrative that AI remains a dominant force driving tech sector gains.

Nvidia, likewise, continued its upward trajectory, hitting its highest level of the year and helping buoy sentiment across the Nasdaq.

However, not all tech names fared as well. MongoDB (MDB) reported solid results but sold off on weaker forward guidance, a reminder that high-growth names remain vulnerable to any signs of deceleration. Hewlett Packard Enterprise (HPE) also warned of cautious enterprise IT spending heading into the second half of 2025.

The theme across all these reports: companies at the heart of AI and infrastructure are thriving, while those tied to cyclical or discretionary spending are struggling to maintain momentum.

The consumer landscape also revealed more fissures. Cava Group, which has been one of the more celebrated IPOs of recent years, reported strong earnings but fell on guidance that same-store sales growth is expected to slow in the second half of the year. Meanwhile, Dollar Tree and other discount retailers are seeing their margins squeezed as cost pressures intensify.

The narrative is increasingly bifurcated: wealthier consumers are still spending on experiences and luxury goods, while middle- and lower-income households are tightening their belts. This divergence continues to weigh on earnings visibility across the retail sector.

The VIX remained around 17, suggesting mild but growing anxiety among investors. While markets aren’t in panic mode, volatility has picked up, especially in politically sensitive names.

Elon Musk added another layer of chaos on Thursday by polling his followers about forming a new centrist political party. Tesla shares dropped nearly 10% on the day, and while the political maneuvering had limited direct market impact, it reminded traders that sentiment can swing quickly on social media headlines.

Later that same day, President Trump tweeted that his phone call with Chinese President Xi Jinping was “very good,” sparking a rebound in risk assets. The Nasdaq rose 0.7%, and the S&P 500 gained 0.4%, showcasing the market’s hypersensitivity to diplomatic tone shifts.

Despite the upbeat headlines around AI and trade diplomacy, I remain in the market-neutral camp. We’re trading sideways for now, but recession odds are rising, and we’re beginning to see the early signs of economic fatigue—from slower hiring to contracting services and cautious consumer behavior.

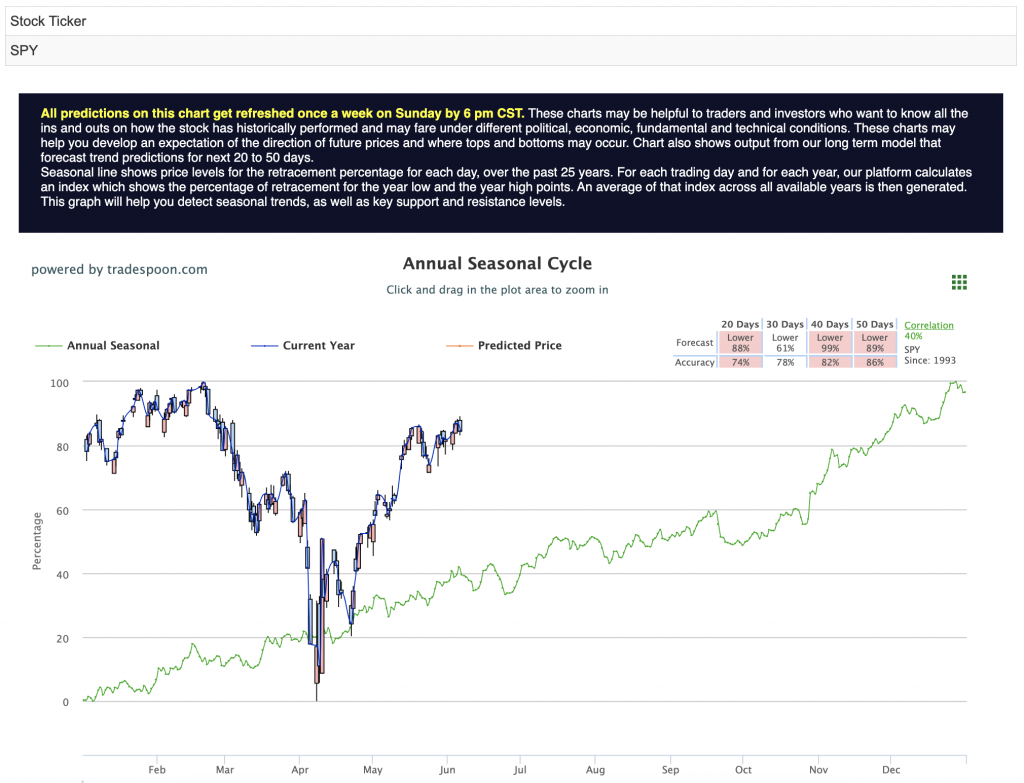

The SPY is holding a short-term support zone around $540–$550, with a potential upside target of $600–$620, but any rally will likely be capped unless inflation expectations drop or the Fed pivots more clearly. Neither seems imminent. For reference, the SPY Seasonal Chart is shown below:

The risk that interest rates remain higher for longer, coupled with a softening labor market, is not priced in fully. I expect the broader indices to drift as investors digest these conflicting signals. This is not the time for aggressive long exposure or dramatic portfolio shifts. It’s a time for discipline, selective positioning, and staying nimble.

That’s exactly where RoboInvestor comes in—our AI-powered advisory service is designed to deliver clear, data-driven insights in an increasingly complex market. RoboInvestor removes the emotional bias from decision-making and replaces it with precision, helping you cut through the noise and take advantage of high-probability trades.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with my latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.06% going back to April 2018.

As we progress through Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!