RoboStreet – Weekly Market News & Sentiment: Jobs Strength Reshapes Rate-Cut Odds, Applied Materials Tests AI Momentum, Trade Headlines Stir Volatility, and the 10-Year Yield Holds the Market’s Steering Wheel

This week marked one of the most consequential stretches of the quarter, as inflation data, labor metrics, tariff developments, and a dense wave of earnings collided within a narrow window. Markets entered the week already recalibrating after January’s strong jobs report, and the additional macro data only intensified that reassessment. With the VIX holding near 17 and the major indices hovering around their 50-day moving averages, the surface appears calm. Underneath, however, the tone has clearly shifted.

The January payroll report, released just prior to this week’s trading but still shaping sentiment, showed 256,000 jobs added versus expectations closer to 180,000. Unemployment held steady at 4.1%, while average hourly earnings rose 0.4% month-over-month, pushing the annual rate to 4.1%. That combination forced markets to rethink the pace of rate cuts in 2026. Treasury yields responded immediately, with the 10-year continuing to trade within a volatile 3.6% to 4.35% range. Each subsequent data point this week was filtered through that lens.

Equities reflected this tension. The Nasdaq struggled on days when yields pushed higher, while the S&P 500 and Dow showed relative resilience but failed to generate strong upside momentum. Growth multiples compressed modestly, and leadership became less concentrated. The tape is not breaking, but it is clearly searching for direction.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The macro calendar delivered little room for complacency. The Employment Cost Index and import and export price data set the early tone, reinforcing that wage pressures remain central to the inflation debate. Markets are increasingly sensitive to any signal that services inflation could prove sticky.

The January CPI release was the pivotal moment of the week. With headline and core readings closely examined, traders attempted to determine whether the broader disinflation trend remains intact or is beginning to stall. What made the release especially powerful was its proximity to labor metrics and wage data, effectively compressing multiple macro signals into a single reaction window. This concentration of information heightened volatility and reinforced the idea that the Federal Reserve’s path remains data dependent.

Rate-cut expectations shifted again. Markets have significantly scaled back the probability of an early 2026 cut, and the projected pace of easing now appears more gradual. The Fed’s tolerance for inflation drifting above target will likely remain limited if wage growth stays firm.

Overlaying this macro backdrop were renewed trade tensions. The administration reiterated plans to move forward with tariffs on Canada, Mexico, and China unless concessions are secured, while additional rhetoric surfaced toward the European Union and India. Cyclical sectors and trade-sensitive names reacted accordingly. The dollar strengthened during risk-off moments, and implied volatility spiked intraday as headlines crossed.

Earnings added another layer of complexity. Semiconductor bellwether Applied Materials reported results that were dissected for signals about AI-related capital expenditures and chip demand sustainability. Investors continue to question whether the pace of AI-driven spending can maintain its current trajectory. Networking and cloud infrastructure names echoed that cautious optimism, suggesting growth remains solid but less explosive.

In biotech, Vertex Pharmaceuticals provided insight into defensive growth dynamics, while industrial and commodity-linked companies such as Southern Copper and Vale offered a window into global demand trends. Consumer staples names like Anheuser-Busch InBev and British American Tobacco reflected steady but unspectacular consumer resilience. Financial and asset management results underscored the influence of higher rates and tighter liquidity conditions on capital markets activity.

Taken together, earnings were neither broadly alarming nor unequivocally bullish. Instead, they reinforced a market that is transitioning from expansion driven by multiple growth to one increasingly dependent on durable cash flow and disciplined cost control.

A VIX reading near 17 suggests moderation rather than fear. Yet sentiment has clearly shifted from aggressive risk-taking to selective positioning. Rising real yields, tariff uncertainty, and higher inflation expectations have pressured longer-duration assets while offering relative support to value and quality-oriented sectors.

Consumer sentiment data added another wrinkle. The University of Michigan’s preliminary survey showed a decline in confidence alongside a rise in short-term inflation expectations back above 3%. Even modest increases in inflation expectations can complicate the Fed’s messaging and reinforce the “higher for longer” narrative.

Geopolitical headlines and ongoing government funding negotiations contributed to periodic volatility, producing brief rotations into Treasuries and gold. None of these episodes sparked sustained panic, but they reinforced the sense that markets are operating in a narrower corridor of tolerance.

The prevailing psychology is one of recalibration rather than capitulation. Investors are not exiting equities en masse. Instead, they are reassessing valuation thresholds in light of a rate environment that may remain restrictive longer than previously assumed.

I remain in the market-neutral camp. Momentum has deteriorated modestly, and while the long-term uptrend remains intact, the near-term setup warrants patience and tactical positioning.

The principal risk continues to be a “higher for longer” rate environment combined with early signs of labor softening. If wage growth remains firm while unemployment indicators begin to tick higher, margins could face pressure just as multiples contract. That combination would create a more challenging environment for broad-based equity expansion.

From a technical standpoint, I believe the SPY can extend toward the 700–720 range over the coming months if inflation resumes its cooling trajectory and earnings remain stable. However, the 650–660 zone represents meaningful support in the near term. A decisive break below that level would signal that macro pressures are overwhelming earnings resilience.

In this environment, capital preservation carries as much weight as upside participation. I am favoring balanced exposure rather than aggressive concentration, and I am avoiding chasing extended growth names into rising yields. The 10-year Treasury yield remains the market’s pressure valve. A sustained move above the upper end of its recent range would likely tighten financial conditions further and challenge risk assets.

The coming weeks will hinge on whether inflation expectations stabilize, whether labor data softens in an orderly fashion, and whether trade rhetoric translates into measurable economic drag. Until those questions are resolved with greater clarity, selectivity and discipline are essential.

The long-term structure of the market remains constructive, but in the short term we are clearly in a recalibration phase. Staying neutral right now does not mean doing nothing. It means being selective, waiting for true asymmetry, and managing risk with intention instead of reacting emotionally to every headline.

Capital preservation is just as important as upside participation in this environment. Opportunities are still there, but they are more tactical and require discipline. This market rewards patience, flexibility, and thoughtful execution—not impulse.

That’s where RoboInvestor adds value. Built for a range-bound, headline-driven tape, our AI-powered advisory focuses on statistically grounded setups and defined risk-reward opportunities. It helps you stay engaged without overtrading and act with precision instead of reacting to noise.

Every other weekend, you’ll receive the RoboInvestor newsletter—a concise, high-signal read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas. Hence, you’re prepared and confident heading into Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

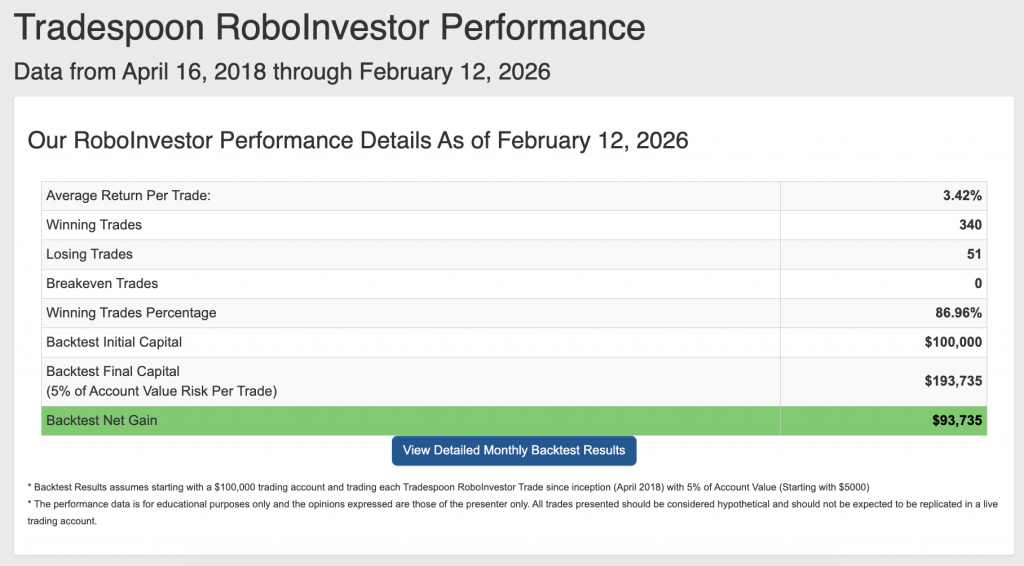

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 86.96% since April 2018.

As 2026 gets underway, investors are stepping into a market that looks stable on the surface but is becoming more selective underneath. Tariff concerns briefly pressured sentiment before easing, megacap earnings exposed clear winners and losers, and the Fed’s path has grown less forgiving as inflation expectations remain sticky. Interest rates are no longer a background factor, labor-market signals are softening at the margins, and leadership is narrowing as investors demand a clearer connection between spending, margins, and profits.

Volatility remains contained but reactive, quick to spike around policy shifts, earnings surprises, and moves in the bond market. In this environment, earnings quality and forward guidance are doing the real work of setting direction. Navigating the first quarter will require a disciplined, insight-driven approach that respects the influence of rates, manages employment risk, and stays flexible enough to participate in rotation without chasing fragile momentum.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!