Amidst a whirlwind of economic indicators and corporate earnings reports, the stock market exhibited a rollercoaster ride throughout the week, grappling with mixed signals and geopolitical tensions. Monday marked a refreshing shift as the market surged, breaking free from a six-day downward spiral that had gripped the S&P 500. Investors, fueled by optimism, braced themselves for a week teeming with crucial economic data releases and earnings announcements.

One of the key metrics that captured the market’s attention was the eagerly awaited first-quarter U.S. gross domestic product (GDP) figures, coupled with the core Personal Consumption Expenditures (PCE) price index. This index, esteemed by the Federal Reserve for measuring inflation, promised to offer significant insights into the nation’s economic health, potentially impacting future monetary policy decisions.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

However, as the week unfolded, geopolitical tensions escalated with Israel’s strikes on Iran, leading to a mixed investor sentiment. The market witnessed a flight to safe-haven assets amidst mounting inflationary pressures, contributing to heightened volatility, as reflected by the VIX index hovering near 20, signaling elevated levels of fear and uncertainty.

Wednesday brought a blend of positive and negative movements. Tesla shares soared by 12%, propelled by CEO Elon Musk’s optimistic remarks during the earnings call, particularly regarding the imminent arrival of self-driving technology. Meanwhile, other tech giants like Texas Instruments and Visa also witnessed gains after exceeding expectations on both top and bottom lines.

The release of March U.S. durable goods orders brought somewhat expected news, with orders expanding in line with forecasts. This data, coupled with the anticipation of interest rate movements, played a role in keeping Treasury yields near recent highs.

Thursday, however, witnessed a downturn as disappointing corporate earnings and elevated bond yields cast shadows on the market’s rebound. U.S. economic growth for the first quarter fell short of expectations, with GDP growing at a slower rate than anticipated. Inflation-adjusted GDP figures highlighted a notable pullback in consumer spending, exports, and government outlays. Moreover, the PCE price index and core PCE inflation both revealed significant increases, underscoring concerns about rising inflationary pressures.

However, amidst the flurry of economic data and corporate earnings, the focus remains on interest rates. The 10-year Treasury yield surged above key levels, reaching a critical threshold of 4.7%, triggering concerns among traders. The widening spread between Treasury and junk bond yields, alongside the weakening of the yen against the USD, adds further complexities to market dynamics, signaling potential challenges ahead.

As uncertainty looms, market volatility is expected to rise, with major indices like SPY, QQQ, and small caps trading below key support levels. The consolidation of assets like SLV and GLD reflects a cautious approach by investors, awaiting further inflationary data and the Federal Reserve’s decision.

Despite hopes for interest rate cuts, there’s a looming risk that the Federal Reserve might hold off in the first half of 2024. This uncertainty compounds as inflation surpasses expectations and geopolitical tensions persist. With the Fed’s decision due by the end of April, investors should tread cautiously.

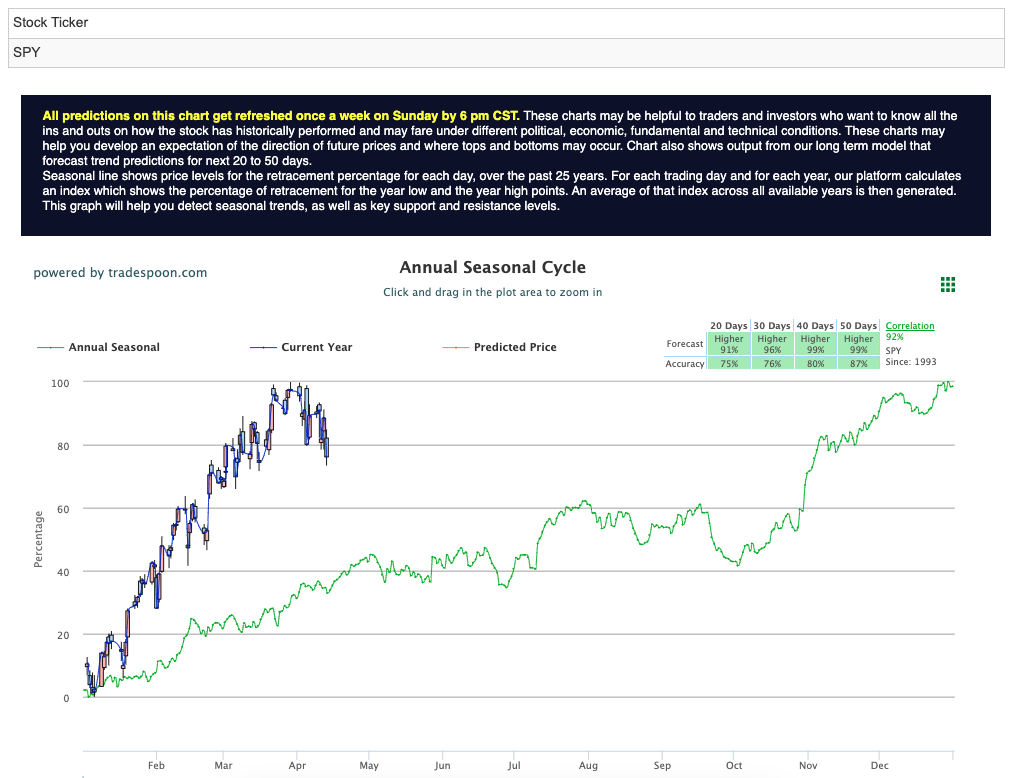

As a result, some are shifting to a market-neutral stance, given the unpredictable climate. Anticipating choppy markets with a downward bias in Q2, many believe the SPY rally might be capped at $530–$540 levels, with short support between 480–500. In this stock-picker’s market, risk management takes precedence, urging investors to stay vigilant amidst market volatility. For reference, the SPY Seasonal Chart is shown below:

With this in mind, the market braces for choppy waters ahead, with a downward bias prevailing in the second quarter. While optimism persists, concerns about inflation, interest rates, and geopolitical tensions cast shadows on the path forward. All eyes remain on the Federal Reserve’s decision, expected to provide crucial guidance in navigating the uncertain terrain of the financial markets.

As we grapple with the latest data, one sector and one symbol specifically could be unbothered and offer a great opportunity in the coming days.

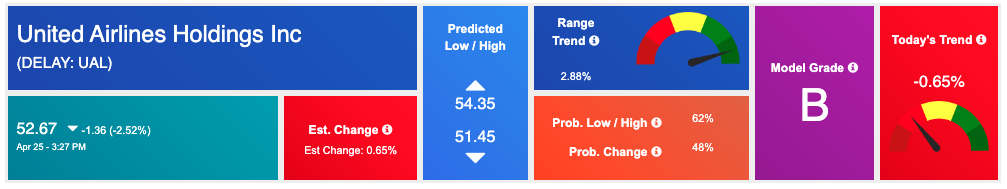

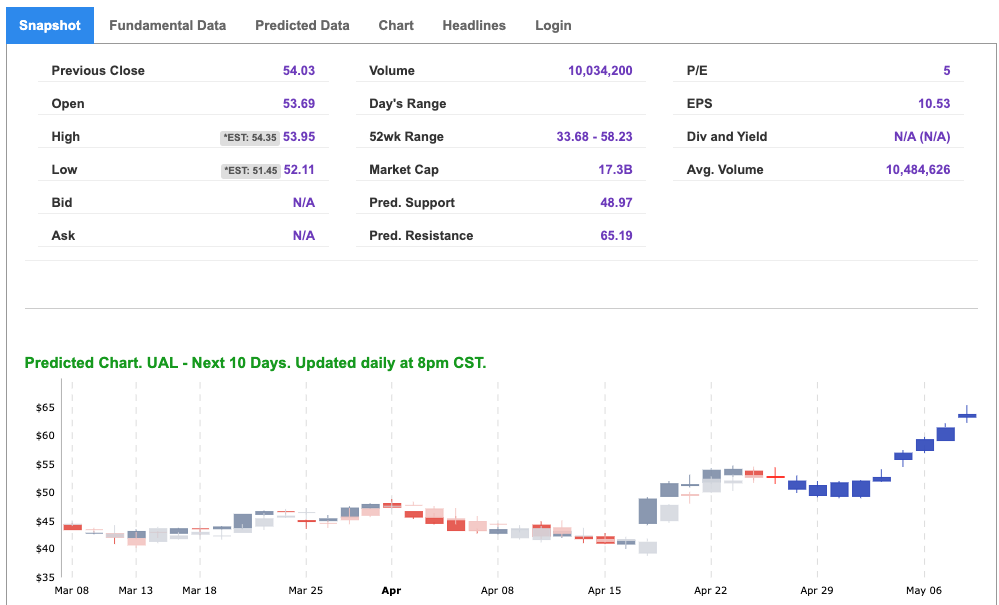

United Airlines Holdings, Inc. (UAL) is a leading global airline operating a vast network of domestic and international routes. With a fleet of modern aircraft and a strong presence in key markets, UAL serves millions of passengers each year, offering a range of services tailored to meet diverse travel needs.

Against the backdrop of market uncertainties and fluctuating economic indicators, United Airlines presents an attractive investment opportunity for several reasons.

United Airlines (UAL) emerges as a compelling investment opportunity amidst market uncertainties and evolving economic conditions. With its strong market position, strategic initiatives, and favorable valuation, UAL is poised to deliver value for investors seeking exposure to the aviation sector.

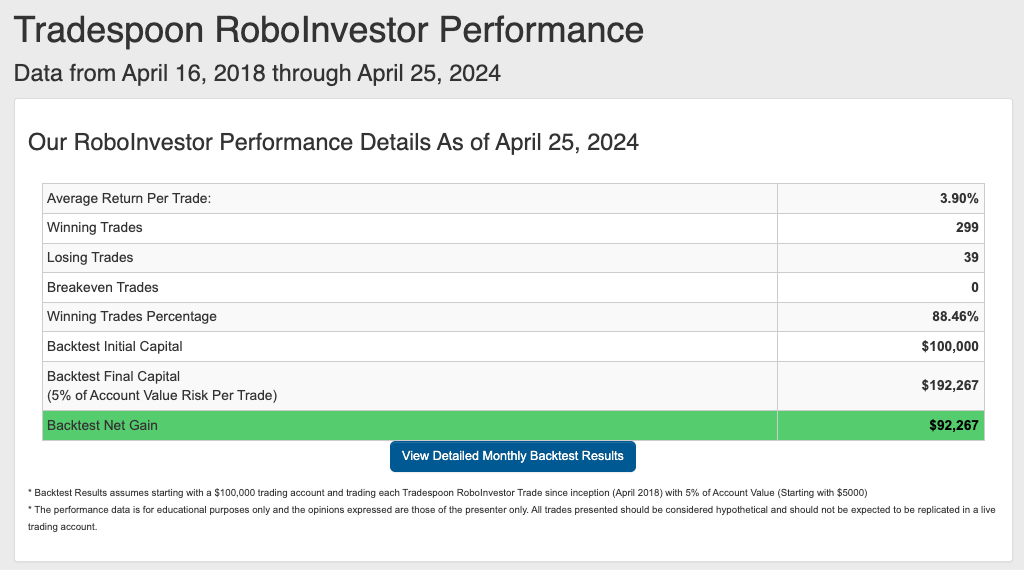

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.46% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!