This week’s key market event, the Federal Open Market Committee (FOMC) meeting, took place and laid out the framework for the Fed’s next move as well as the current market landscape. Since last week, markets have been grappling with a persistent pullback, suggesting a future characterized by heightened volatility during the second half of this year.

Investors were also keeping a keen eye on the release of Services Purchasing Managers’ Index (PMI) data. Simultaneously, the US Dollar Index (DXY) continues its robust rally, while long-term Treasury yields experience a substantial upward surge, approaching levels not seen since the Global Financial Crisis (GFC).

The prevailing consensus points toward a scenario of “higher for longer” interest rates, yet a significant portion of the market anticipates lower yields in the first half of 2024. The implications of this discrepancy are profound, potentially extending the duration of inflationary pressures and delaying interest rate cuts until the latter half of 2025—a factor not yet fully priced into current market valuations.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

As we delve into the current market landscape, it’s evident that several sectors are revealing signs of vulnerability. Among the sectors facing challenges are Europe, small-cap stocks, technology, cyclicals, and regional banks. However, it’s the technology sector, epitomized by the $SPY index, that warrants particular attention as it grapples with a critical test of its 50-day moving average.

Simultaneously, the US Dollar Index (DXY) continues its remarkable multi-month rally, underlining the strength of the dollar. This rally is crucial to monitor, as it can significantly influence various aspects of the financial markets, including commodities, international investments, and trade dynamics.

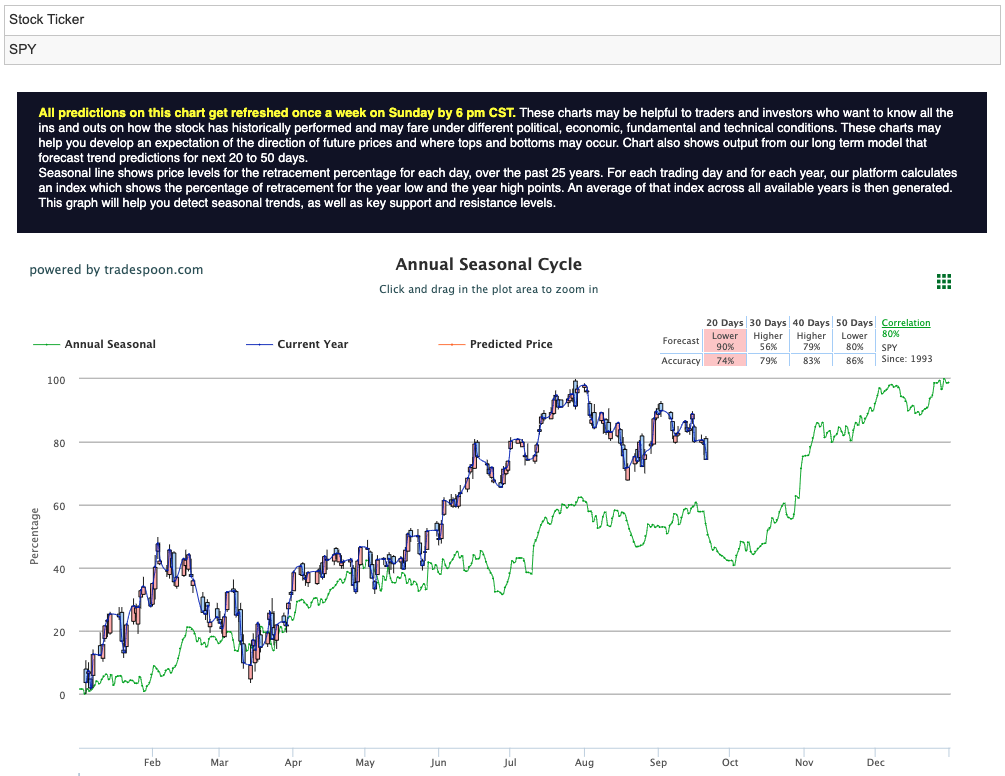

In light of recent economic data and the Federal Reserve’s stance on monetary policy, we are increasingly inclined toward adopting a market-neutral position. The probability of an impending recession appears to be relatively low at this juncture. Our analysis suggests that the SPY index’s rally may face resistance within the $450-470 range, presenting potential hurdles for further upward momentum. Short-term support levels, on the other hand, are likely to be found around the 400-430 range. Currently, there appears to be more room for downside movement, as we are witnessing the market’s retest of August lows. For reference, the SPY Seasonal Chart is shown below:

Additionally, cyclicals, which often mirror economic cycles, seem to be on the cusp of breaking their August lows. While this outcome may appear inevitable given the broader economic context, it’s essential to closely monitor this sector for any potential shifts and opportunities.

FedEx Soars on Stellar Earnings Beat: FedEx Corporation took center stage in the stock market as its shares surged by over 5% in response to its stellar fiscal first-quarter earnings report, which surpassed market expectations. The company reported adjusted earnings of $4.55 per share, outshining the $3.73 consensus estimate from analysts polled by LSEG, formerly known as Refinitiv. While FedEx’s revenue for the quarter was slightly below expectations at $21.7 billion, compared to the anticipated $21.81 billion, the robust earnings performance showcased the company’s ability to excel in a challenging economic landscape.

KB Home Faces Mixed Market Reaction: In contrast, KB Home, a significant player in the homebuilding sector, witnessed a more nuanced market reaction despite exceeding expectations in its third-quarter financial report. The company posted earnings of $1.80 per share on revenue of $1.59 billion, surpassing analysts’ forecasts of $1.43 per share on $1.48 billion in revenue, as reported by LSEG. However, KB Home also provided a cautious outlook, indicating an expected contraction in housing gross margins for the forthcoming fourth quarter. This mixed guidance may have contributed to the stock’s modest decline of more than 3%. It underscores the complexity of the current market environment, where investors carefully weigh positive and negative signals from companies when making investment decisions.

Elsewhere, the uptrend in crude oil prices is showing signs of waning momentum – particularly as Saudi Arabia maintains a firm grip on supply. Widespread labor strikes continue to spread across various industries, with notable proximity to the “big three” car manufacturers in Michigan. Should these strikes persist, they have the potential to exacerbate inflationary pressures.

Interest rates are displaying signs of overshooting, primarily attributed to weak demand for US Treasuries. A decrease in demand, particularly from significant global players like Japan and China, can exert upward pressure on interest rates. This, in turn, could lead to lower Treasury prices and higher yields, thereby creating substantial pressure on equity valuations.

A notable resurgence in the IPO market is observed with companies like $CART and $ARM making impactful debuts. Both stocks rallied up to 30% on their first trading day, only to subsequently retreat back to their IPO prices. This revival in IPO activity serves as an insightful barometer of investor risk appetite, given that the IPO market has remained relatively stagnant over the past two years.

The most pivotal event of the week was the Federal Reserve’s latest FOMC meeting and the subsequent policy decisions. The Federal Reserve opted to maintain the benchmark federal funds rate at its current level. However, the committee conveyed a clear message: they are not done with rate hikes. The latest economic projections from the Fed indicate expectations for one more quarter-point rate hike this year.

While the Fed acknowledges the strength of consumer spending and a robust labor market, there is no intent to curtail economic activities. Federal Reserve Chair Jerome Powell emphasized the importance of a resilient economy but acknowledged the possibility of having to adopt a more proactive monetary policy approach should the economy perform even better than anticipated.

In the latest Summary of Economic Projections, released during the meeting, Federal Reserve officials slightly improved the economic outlook through the end of the year. The forecast for GDP growth was upgraded to 2.1%, a notable increase from the 1.0% forecast in June. Concurrently, the projection for the unemployment rate was reduced to 3.8% from the previous 4.1% forecast in June, aligning with the August rate.

The median forecasts released during the meeting indicate that Federal Reserve officials foresee one more interest-rate hike before the end of this year. The takeaway from this meeting and the latest Summary of Economic Projections is one of cautious optimism. It reflects a slightly rosier economic picture compared to previous assessments. Some economists even dubbed it a “no landing” scenario, indicating that there may be minimal trade-offs in terms of growth or employment when it comes to addressing inflationary concerns.

Amidst the prevailing market uncertainties, one sector stands out as a beacon of opportunity: the energy sector. As the broader S&P 500 index recorded a third consecutive day of declines, the energy sector managed to defy the trend, posting a commendable gain of 0.49%. This standout performance can be attributed to several key factors that make it an enticing investment prospect.

A primary driver of the energy sector’s robust performance is the surge in oil prices. Brent crude, the international benchmark, experienced a notable uptick of 0.9%, reaching $94.35 per barrel. Simultaneously, WTI crude saw a substantial gain of 1.3%, reaching $90.82 per barrel on Thursday. The impending approach of oil prices to the $100 per barrel mark has garnered significant attention from investors and analysts alike. These escalating prices are injecting vigor into energy companies’ profitability and growth potential.

Within the energy sector, specific companies have delivered exceptional results, exemplified by Marathon Petroleum (MPC) and Valero Energy (VLO). Marathon Petroleum soared by an impressive 6%, while Valero Energy surged by 4.2% during Thursday’s trading session. These companies, among others in the sector, are capitalizing on the favorable environment created by rising oil prices.

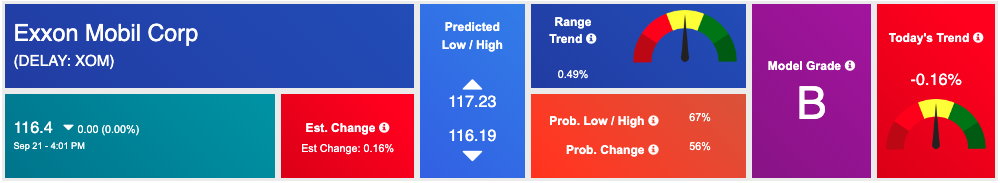

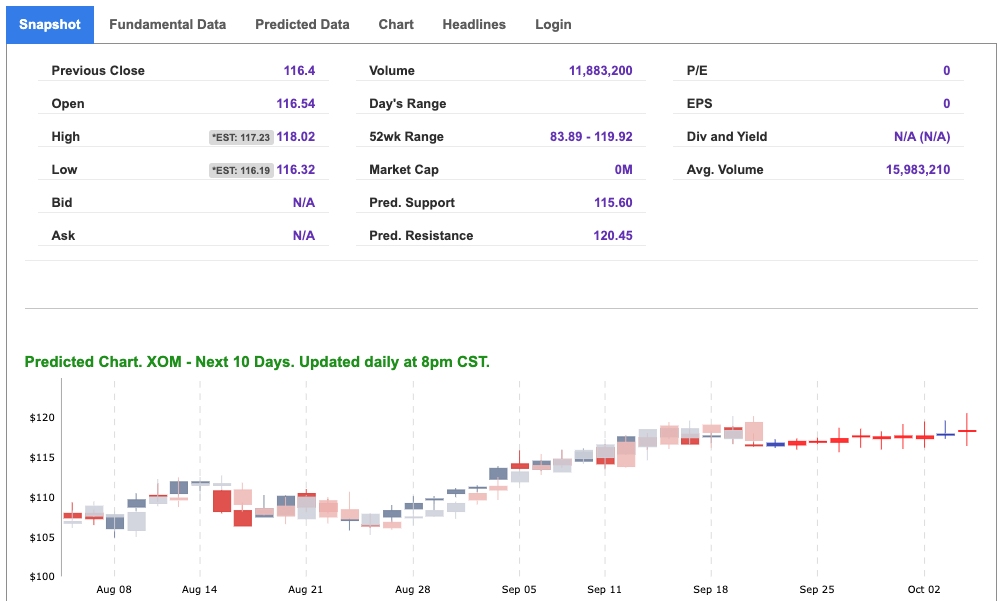

One stalwart in the energy sector is ExxonMobil (XOM), a multinational corporation renowned for its extensive involvement in the exploration, production, refining, and distribution of energy-related products and services. Founded in 1870, ExxonMobil has evolved into one of the world’s largest publicly traded energy companies, operating in over 200 countries and territories. Its comprehensive portfolio encompasses oil, natural gas, petrochemicals, and more.

ExxonMobil boasts a rich history of innovation and a commitment to sustainability. The company is dedicated to advancing cleaner energy solutions and reducing its environmental footprint. With a global presence and a legacy of success, ExxonMobil continues to be a key player in the energy sector, poised to benefit from the ongoing surge in oil prices.

Why Consider Investing in Energy Now: Investors looking for opportunities in today’s market should consider the energy sector for several compelling reasons:

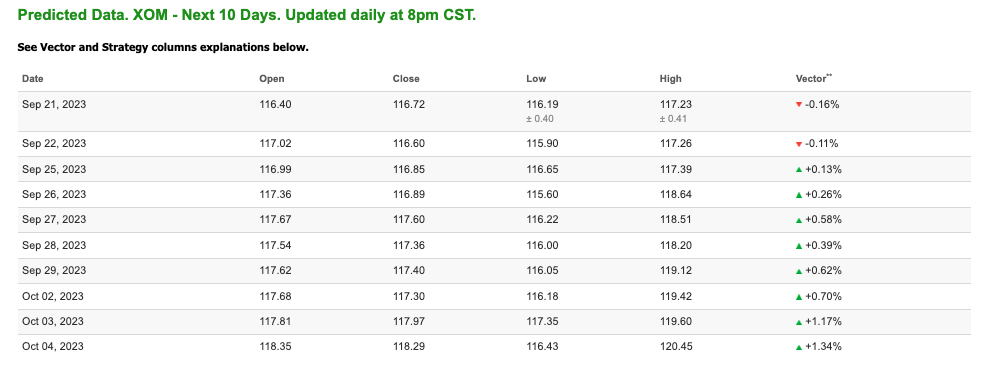

The energy sector’s recent resilience and strong performance, driven by rising oil prices, present a compelling case for investors. ExxonMobil (XOM) and other leading energy companies are well-positioned to capitalize on this favorable environment. And our A.I. system agrees! Just take a look at XOM’s 10-day Predicted Data from the Stock Forecast Toolbox:

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

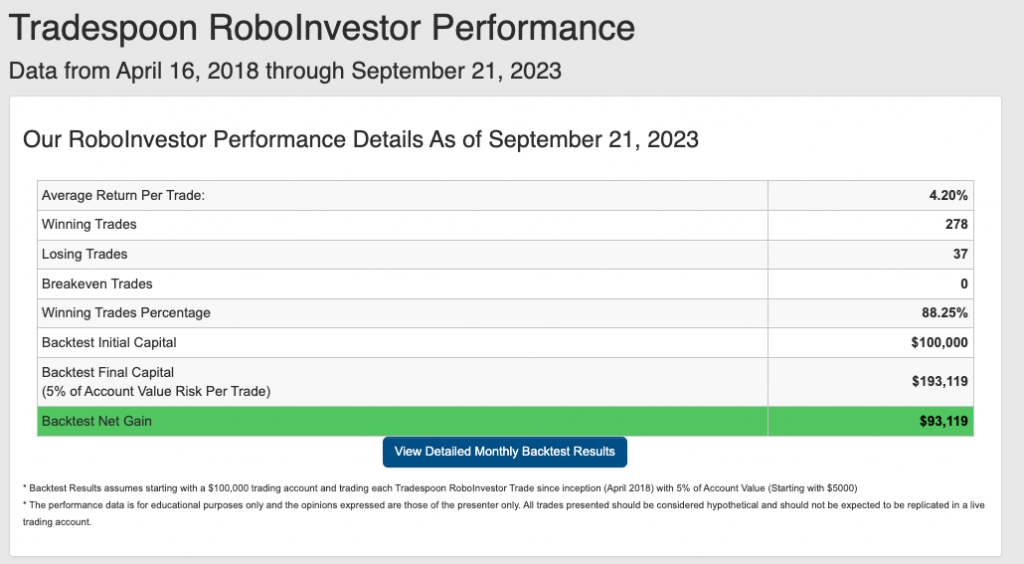

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we inch closer to Q4 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!