RoboStreet – May 8, 2025

As the U.S. stock market enters a new week, it does so under a cloud of uncertainty, with investor sentiment teetering between cautious optimism and apprehension. After a nine-day winning streak, the market’s momentum is beginning to lose steam as key economic and political factors pull in different directions. The Dow has managed to extend its gains, driven by the continued strength of blue-chip companies, but the broader market, particularly the tech-heavy Nasdaq and S&P 500, faces a more precarious outlook, largely influenced by ongoing trade tensions, economic concerns, and inflationary pressures. While investors are hoping for a clearer path ahead, the immediate outlook remains mixed as the market grapples with how to price in these uncertainties.

This week has been marked by a series of developments that have left the market grappling with its next move. As President Trump has continued to push for new tariffs on foreign imports, concerns have resurfaced about the potential escalation of the U.S.-China trade war and its impact on global markets. While some companies are showing resilience, the volatility created by tariff fears is evident, particularly in the tech sector. Companies like Apple and Nvidia, key drivers of the S&P 500, have faced significant downward pressure, as investors are increasingly concerned about their exposure to tariffs, particularly as China remains a critical market for many U.S. companies.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The broader sentiment has been one of caution, with tech stocks, which had been leading the market’s gains, struggling under the weight of trade and tariff uncertainties. In contrast, the Dow has been buoyed by the performance of stalwart companies like American Express, UnitedHealth, and Visa, whose less tariff-sensitive business models have allowed them to outperform. This divergence in performance underscores how dependent the broader market has become on a small number of large-cap stocks, with the rally increasingly concentrated in a few sectors.

Adding to the complexity is the economic data, which has been a mixed bag. On the positive side, U.S. services PMI exceeded expectations, signaling continued strength in the services sector. However, the jobs report for April showed solid gains, but an increase in jobless claims suggested that the labor market might be showing signs of strain. This is a key concern, especially as rising unemployment could signal broader economic weakness.

Federal Reserve policy has also been under close scrutiny this week. The Fed’s decision to keep interest rates steady, with a cautious approach to future rate cuts, reflects the prevailing sentiment that inflationary pressures are far from over. While some market participants had hoped for a more dovish stance in light of weaker economic indicators, the Fed’s decision to remain cautious is in line with its broader focus on managing inflation while avoiding further stoking economic instability. With market participants pricing in potential rate cuts later in 2025, the market is left in limbo, unsure about the timing and magnitude of these cuts.

In corporate news, the earnings season has delivered some surprises. While Microsoft and Meta have posted strong earnings, primarily driven by growth in cloud and advertising revenues, the tech sector has experienced significant volatility. Apple, in particular, has struggled, with concerns about its dependence on China and the ongoing threat of tariffs weighing heavily on its outlook. These earnings reports offer a glimpse into the challenges faced by multinational companies in a highly uncertain trade environment.

In another significant development, Warren Buffett’s announcement that he will step down as CEO of Berkshire Hathaway at the end of the year sent shockwaves through the market. While the transition has been anticipated, the news led to a sharp drop in Berkshire’s stock. The company’s recent Q1 earnings report also highlighted challenges, including lower insurance profits and currency losses, which further fueled concerns about the broader market outlook. With Buffett’s cautious approach to deploying capital and a growing cash pile at Berkshire, questions remain about how the company will navigate the next phase of its growth.

As we move into the latter half of the week, the focus remains on inflationary pressures and the global trade landscape. President Trump’s continued emphasis on tariffs has only heightened market unease, with the potential for further disruptions to global trade. The markets have been hoping for signs of a trade agreement with the U.K., and although there was initial optimism, the reality of the situation has fallen short of expectations. While the details of the U.K.-U.S. trade agreement remain vague, the market’s reaction has been muted, with stocks briefly gaining before pulling back.

At the same time, the labor market remains resilient, with initial jobless claims ticking down, suggesting that the job market is not yet in crisis mode. However, with productivity in decline and some sectors showing signs of slowdown, it is clear that the economy is facing several headwinds. The first-quarter GDP contraction is a stark reminder of the fragility of the current economic recovery, and the market is left trying to gauge the extent to which tariffs, inflation, and global economic pressures will continue to shape the U.S. economic landscape.

Looking ahead, my market sentiment remains neutral with a downside bias. The combination of heightened tariff risks, mixed economic data, and an uncertain policy outlook from the Federal Reserve suggests that the market will likely continue trading sideways in the short term. While some sectors, particularly tech, have shown resilience, the broader economic risks are considerable, and concerns over inflation and unemployment persist.

The possibility of a recession is rising, and while the labor market has yet to show definitive signs of contraction, the uptick in jobless claims and the broader slowdown in productivity are warning signs. The risk is that interest rates may remain higher for longer, which could dampen economic activity further. With rising unemployment and mixed economic data, the risk of a protracted downturn is palpable.

Looking to the future, several key reports are due next week that will provide additional clarity on the economy’s trajectory. Consumer Price Index (CPI) and Producer Price Index (PPI) data will be closely watched for signs of inflationary pressures. Any signs that inflation remains stubbornly high will likely lead to continued market volatility, as investors adjust their expectations for future Fed policy.

Additionally, earnings reports from key companies, along with the ongoing corporate earnings season, will continue to influence sentiment. With recession fears mounting and inflationary pressures continuing to make headlines, the market remains in a fragile state, with no clear direction in sight.

In conclusion, the U.S. stock market faces a period of heightened uncertainty. While there are pockets of strength in certain sectors, the broader outlook is clouded by ongoing trade tensions, inflationary pressures, and a cautious Federal Reserve. As investors digest mixed economic data and prepare for upcoming reports, the risk of a deeper downturn looms large.

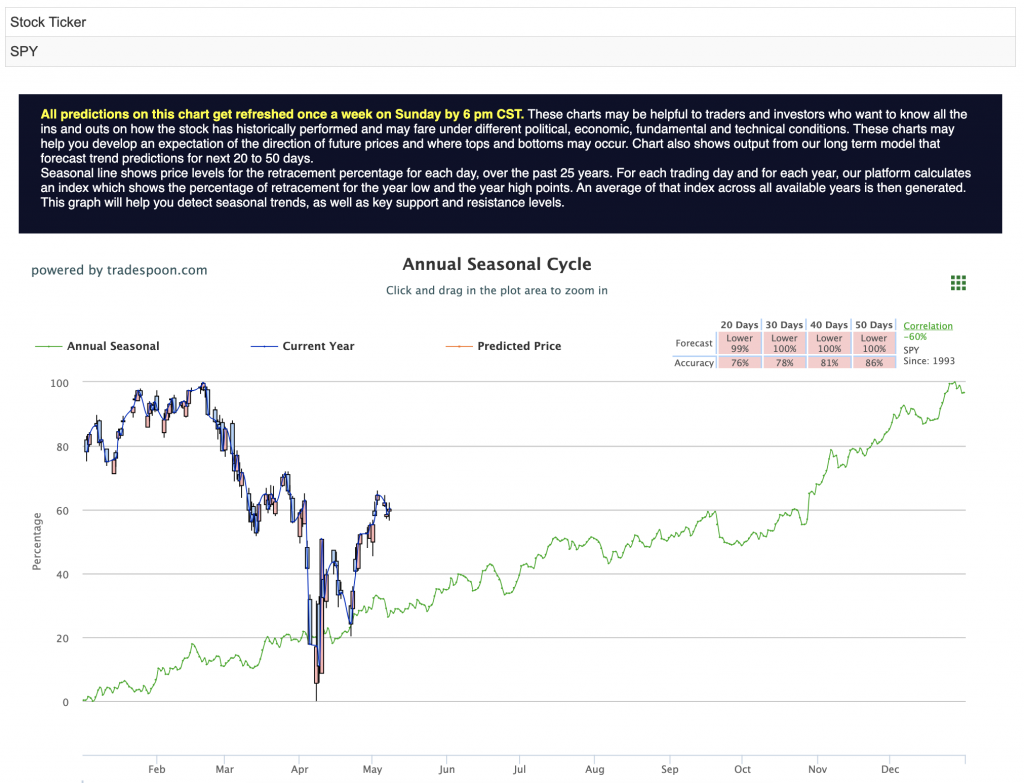

With key support levels for the S&P 500 hovering around the 500-530 range and potential upside capped at the 565-580 levels, the market is likely to continue its sideways movement in the short term. Until there is more clarity on the economic front, including inflation trends and global trade developments, caution will remain the watchword for investors navigating this volatile environment. For reference, the SPY Seasonal Chart is shown below:

Click Here To Subscribe To Our YouTube channel, Don’t Miss Out!

In this complex environment, a well-balanced and diversified strategy is essential. Agility is your advantage—capitalize on emerging opportunities while protecting against potential risks. Staying informed during earnings season and as macroeconomic conditions unfold will help you make timely, well-informed decisions.

While market challenges persist, ample opportunities for growth and strategic positioning remain. By focusing on key indicators and maintaining discipline, you can confidently navigate the market and position yourself for success.

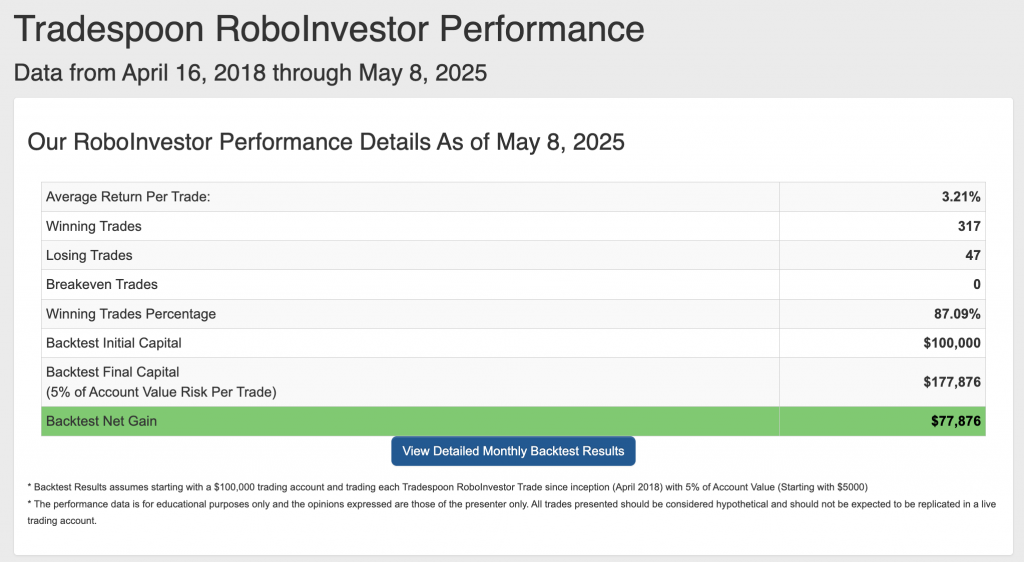

Step into the future of investing with RoboInvestor—your AI-powered advisory service designed to pinpoint high-profit opportunities in today’s dynamic market. Our advanced technology cuts through the noise, providing clear, data-driven insights and strategies. Say goodbye to emotional bias and hello to precision in every trade.

Every other weekend, you’ll receive our exclusive newsletter featuring my latest market analysis, technical outlooks, updates on existing positions, and fresh trade recommendations to act on when the market opens on Monday.

Whether it’s blue-chip stocks, ETFs, commodities, or even inverse ETFs, RoboInvestor offers a flexible approach tailored to current market conditions. With a model portfolio holding 12 to 25 positions, we’ve recently adopted a more selective strategy, focusing on the best opportunities for growth while remaining cautious.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.09% going back to April 2018.

As we progress through Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!