RoboStreet – September 5, 2025

Stocks surged on rate-cut hopes and tech resilience, but tariff shocks, bond market stress, and labor cracks keep volatility close at hand

The first week of September offered investors a full plate of market-moving developments, with shifting Federal Reserve expectations, fresh tariff uncertainty, critical tech sector earnings, and mixed macroeconomic signals all tugging at sentiment. The result was a week that began with selling pressure but gradually recovered into a constructive rebound, leaving the S&P 500 and Nasdaq within striking distance of all-time highs. The VIX slipped back to 16, suggesting a measure of confidence, though risk factors remain firmly in play.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The week began on a rough note as tariff policy once again unsettled Wall Street. A U.S. court ruling against most of the administration’s 2025 tariffs, combined with President Trump’s earlier 90-day pause announced in April, left investors uncertain about the economic impact. The ambiguity weighed especially on technology and industrials, with the S&P 500 dropping 1.3% and the Nasdaq falling 1.6% on September 2. At the same time, global bond markets added to the stress. A wave of selling pushed long-dated Treasury yields higher, with the 30-year briefly approaching 5%. Investors shifted into gold as fiscal credibility came under question, while equities slipped on renewed concerns about tariff-driven inflation.

Technology then flipped the narrative midweek. Alphabet delivered a regulatory victory when a U.S. antitrust ruling upheld its Chrome dominance and confirmed the continuation of its revenue-sharing agreements, including the $20 billion annual deal with Apple. The decision sent Alphabet shares surging 8% and lifted Apple by 3%, pulling the Nasdaq higher and helping erase earlier losses. This legal clarity removed a major overhang for tech and reenergized market sentiment. Nvidia, however, found itself on the other side of the ledger. Despite posting solid quarterly results the prior week, the stock remained under pressure, down more than 6% across six straight sessions. After surging 35% earlier in the year on top of enormous 2023 and 2024 gains, expectations proved too high to sustain. Nearly $278 billion in market value has been shed in this short stretch, making Nvidia a symbol of profit-taking in a crowded trade.

Earnings outside the mega-caps also added to the week’s crosscurrents. Salesforce (CRM) and Broadcom (AVGO) both reported results that influenced sentiment in enterprise software and semiconductor supply chains. Their guidance underscored resilience in digital infrastructure but also hinted at a slower pace of growth compared to the previous quarters, reinforcing the idea that valuations in some corners of tech may need recalibration.

Macro data provided the week’s most important narrative thread. Initial jobless claims rose to 237,000, above consensus forecasts, while ADP reported that just 54,000 private-sector jobs were created in August, a steep decline from July’s upwardly revised 106,000. The labor market appeared to be losing steam, sharpening the focus on Friday’s nonfarm payrolls report. Meanwhile, the ISM Manufacturing PMI slipped further into contraction at 48.0, while the ISM Services PMI improved to 52.0, signaling expansion in the service economy. These conflicting signals left investors debating the sustainability of growth and the degree of policy support still needed.

Through it all, the Federal Reserve remained the central force. Traders increased their bets on rate cuts, with futures markets implying an almost 98% chance of a quarter-point cut at the September 17 FOMC meeting. Expectations for two cuts in 2025 are now firmly priced in. The Fed’s preferred inflation gauge, the PCE index, held steady at 2.6%, while core PCE ticked up to 2.9%, numbers that kept optimism alive for policy easing. However, political interference injected new volatility. Reports that President Trump sought to remove Fed Governor Lisa Cook unsettled markets briefly, raising concerns about the independence of monetary policy.

By Thursday, equities regained their footing. The S&P 500 rose 0.5%, the Nasdaq gained 0.5%, and the Dow advanced 256 points. Market breadth was encouraging, with nearly two-thirds of S&P 500 components closing higher. The equal-weight S&P ETF also rose, reflecting participation across the index rather than just a handful of mega-caps. Cyclical sectors led the rally, with consumer discretionary, energy, financials, and industrials all showing strength, while defensive areas like utilities, real estate, and consumer staples lagged.

Markets staged a rebound this week, even as bond market volatility persisted. The 10-year Treasury yield fluctuated within its broad 3.6% to 4.8% range, retreating late in the week as softer labor data bolstered expectations for policy support. Crude oil slipped for a second consecutive session, with traders eyeing the upcoming OPEC+ meeting and weighing the potential for increased output. Meanwhile, the dollar defied falling yields—a rare divergence that highlighted lingering investor caution.

Yet beneath the surface, risks remain. Rising unemployment and stubborn inflation continue to challenge both policymakers and market participants. The SPY remains range-bound, facing resistance near 650–660 and short-term support between 600–620. For now, I remain market-neutral. Sideways movement appears to be the most probable near-term outcome, especially as recession risks edge higher. With the long-term trend still under pressure, discipline and patience will be key to navigating the months ahead.

In this climate of mixed signals and subdued volatility, a disciplined, data-driven approach is more important than ever. At Tradespoon, our adaptive predictive models are designed to respond in real time—surfacing breakout candidates, uncovering hidden rotation trends, and forecasting high-probability moves with precision.

If you’re feeling overwhelmed by the noise and contradictions, you’re not alone. Let our tools help you cut through the clutter and stay focused on what truly matters.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Enter RoboInvestor—our flagship AI-driven advisory service. Designed for today’s unpredictable market environment, RoboInvestor cuts through the noise with clear, data-backed insights. By eliminating emotional decision-making and focusing on statistically sound opportunities, it empowers you to trade with precision, conviction, and confidence—regardless of what the headlines bring.

Every other weekend, you’ll receive our exclusive RoboInvestor newsletter packed with the latest market analysis, technical outlooks, updates on current positions, and actionable trade ideas designed for Monday’s open.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

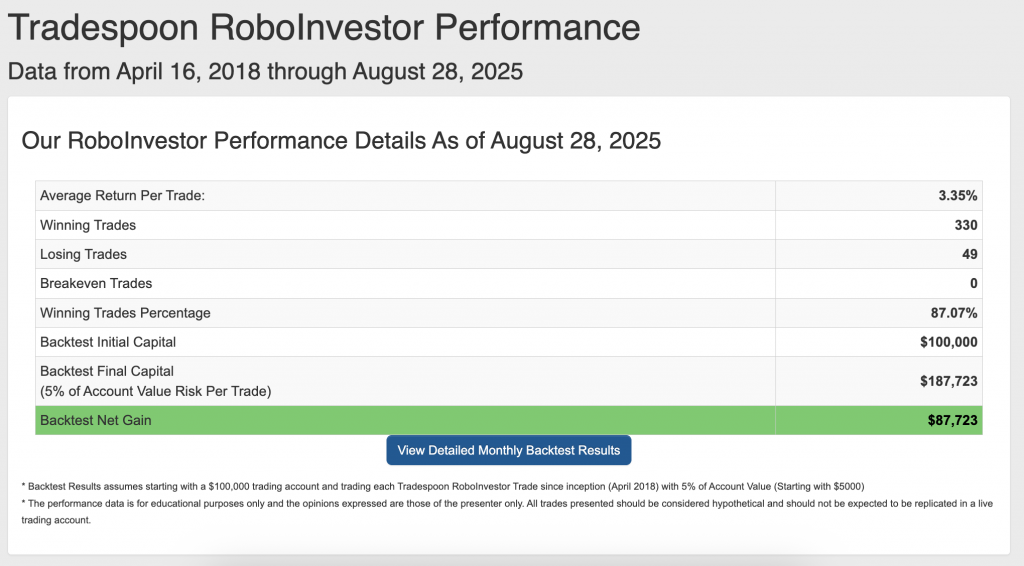

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.07% going back to April 2018.

As we progress through Q3 2025, investors face a challenging market environment shaped by renewed tariff threats, shifting Federal Reserve policies, mixed economic signals, and heightened geopolitical uncertainties, including escalating global trade disputes. Amid this ongoing volatility, aligning with a reliable and insightful investment partner is more critical than ever for navigating the complexities and positioning effectively in this dynamic market landscape.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!