The U.S. stock market had a turbulent week, with choppy trading and mixed economic indicators creating uncertainty among investors. The downgrade of the U.S. government’s credit rating by Fitch and concerns about fiscal policy in Washington weighed on market sentiment. However, strong economic growth and declining inflation offered some respite. The highlight of the week was the anticipation of the jobs report, which could influence the Federal Reserve’s next moves. Meanwhile, the earnings season saw surprises and disappointments, keeping investors on their toes.

Investors eagerly awaited the release of the jobs report, as the economy continued to show resilience. The GDP growth rate surpassed expectations in the second quarter, and inflation was on a downward trend, easing concerns about overheating. Private employers also added more jobs than anticipated in July, signaling a healthy labor market. Despite the positive indicators, the downgrade of the U.S. credit rating by Fitch sparked concerns about fiscal policy consensus in Congress.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The U.S. economy displayed remarkable resilience, with economic growth maintaining a roaring pace despite facing the highest interest rates in a generation. Gross Domestic Product (GDP) clocked in at an impressive 2.4% annual rate in the second quarter, exceeding expectations. This unexpected growth suggested that the economy was adapting well to changing conditions, countering concerns raised by the Fitch downgrade of the U.S. government’s credit rating from AAA to AA+.

The downgrade, while impacting the markets, appears to be more closely tied to Washington’s political dynamics rather than the country’s overall economic health. Nonetheless, the White House disagreed with the downgrade, and Treasury Secretary Janet Yellen attributed it to outdated data that failed to account for the economy’s resilience. Investors continued to watch for any potential fallout from the downgrade, but the robust GDP figures provided some assurance.

This earnings season proved to be a rollercoaster ride for investors, as companies across various sectors reported their quarterly results. Some companies, like Caterpillar, delivered impressive earnings, surpassing Wall Street’s estimates. The heavy machinery manufacturer crushed expectations for the second quarter, reflecting strength in its operations. Despite the positive performance, investors were more concerned about the broader economic cycle and remained cautious about the potential impact of global events on Caterpillar’s future earnings.

Humana, one of the largest Medicare Advantage insurers, also managed to beat earnings expectations during its second quarter. The company’s robust performance delighted investors, and as a result, Humana’s stock experienced a surge after the earnings release. Adding to the positive sentiment, Humana projected strong growth in individual Medicare Advantage membership, indicating promising prospects for the company in the coming year.

However, not all companies fared as well. CVS Health reported better-than-expected earnings in its second quarter, which initially provided some relief to investors. However, the company’s decision to revise its earnings targets for 2024 and 2025 raised concerns among investors about its long-term profit growth. Consequently, shares of the healthcare company experienced a 2.4% decline in the premarket hours, indicating uncertainty about its future outlook.

Starbucks, the renowned coffee chain, turned in higher earnings than expected for its fiscal third quarter, but its sales fell short of forecasts. Despite beating earnings estimates, the company’s revenue of $9.2 billion disappointed investors who had anticipated higher figures. The stock experienced a brief 1.1% drop after the numbers were released but soon stabilized, reflecting mixed reactions from the market.

PayPal Holdings, a prominent payments platform, experienced a decline in its stock price after its earnings failed to impress Wall Street. Three key concerns dominated discussions after the earnings release, leading to uncertainty about the company’s future performance.

The market is likely to remain volatile during the second half of the year, with investors keeping a close eye on economic data and corporate earnings. The upcoming job openings and labor turnover survey and the Institute for Supply Management’s manufacturing and services purchasing managers’ indexes will provide further insights. The earnings season continues with anticipation for reports from Big Tech companies like Apple and Amazon.

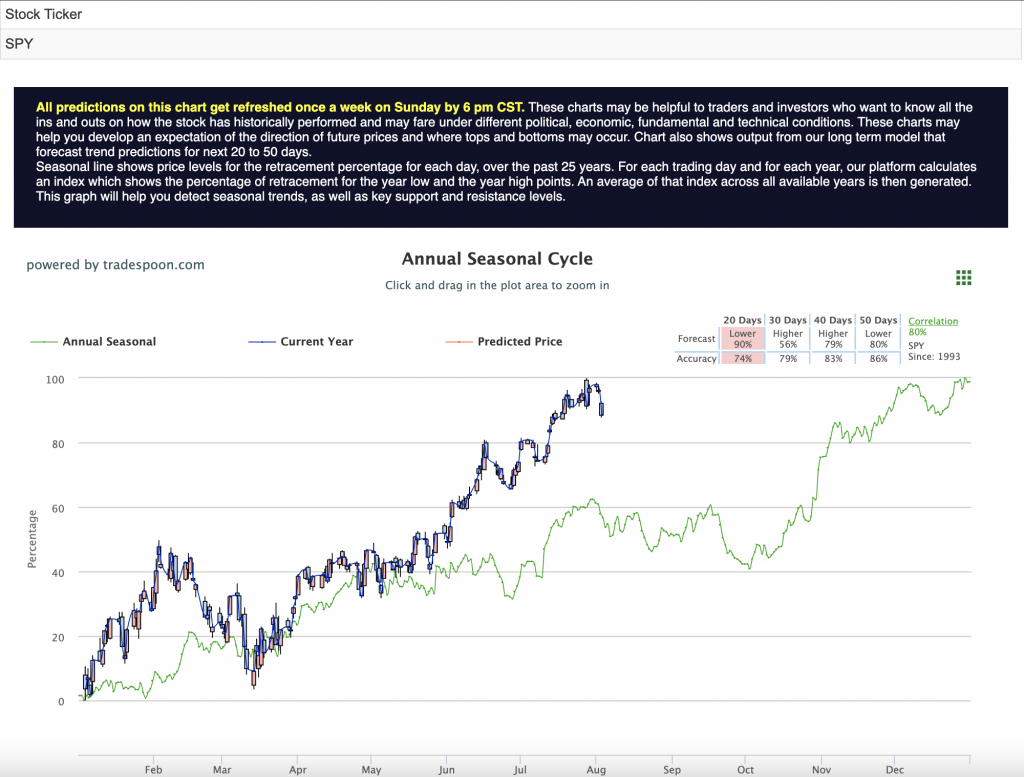

With the market on an upward trajectory, experts are bracing for heightened volatility in the latter half of the year. Despite encouraging economic data that suggests a low risk of a recession and a notable decline in $DXY, certain analysts are opting for a market-neutral approach. The S&P 500 is anticipated to stage a rally, potentially reaching levels between $450 and $470, but cautious investors foresee short support in the $400-430 range in the coming months. For reference, the SPY Seasonal Chart is shown below:

Amidst the market turbulence and mixed earnings, one sector stood out as a potential opportunity for investors – the energy sector. BP, along with other major oil giants like Shell, Exxon, and Chevron, reported sharp drops in profits due to lower oil and gas prices. The declines were more severe than anticipated, causing concern among investors.

However, BP’s announcement of a 10% dividend increase and a new $1.5 billion share buyback program brought a glimmer of hope to the energy sector. The company’s proactive approach to rewarding shareholders despite the challenging environment sparked interest among investors, leading to an early rise in BP’s stock price.

Additionally, oil prices surged to their highest levels in more than three months, driven by a significant decline in U.S. inventories. The sharp fall in oil stocks suggested robust demand and tightening supply, signaling a potential recovery for the energy sector. With increasing momentum in oil prices, investors began to view the energy sector as an attractive area for potential profits amidst the market turbulence. With this in mind, there is one symbol I will be looking to invest in in the coming weeks.

Schlumberger Limited(SLB) is a leading global provider of technology and services to the oil and gas industry. The company boasts a diverse portfolio of offerings, including drilling, reservoir characterization, production, and processing solutions. With a presence in over 120 countries, SLB serves a broad range of clients, from national oil companies to independent operators.

The company’s strong focus on innovation and cutting-edge technology has positioned it as a frontrunner in the industry, enabling it to adapt to evolving market conditions. SLB’s commitment to sustainability and efficient resource management has garnered recognition for its environmental efforts. Its consistent pursuit of excellence and customer-centric approach has cemented its reputation as a reliable and trusted partner in the oil and gas sector.

For investors seeking exposure to the energy industry’s potential resurgence, SLB could be an attractive option. Its global footprint, technological expertise, and commitment to sustainable practices may position it well for growth as the energy sector recovers from recent challenges.

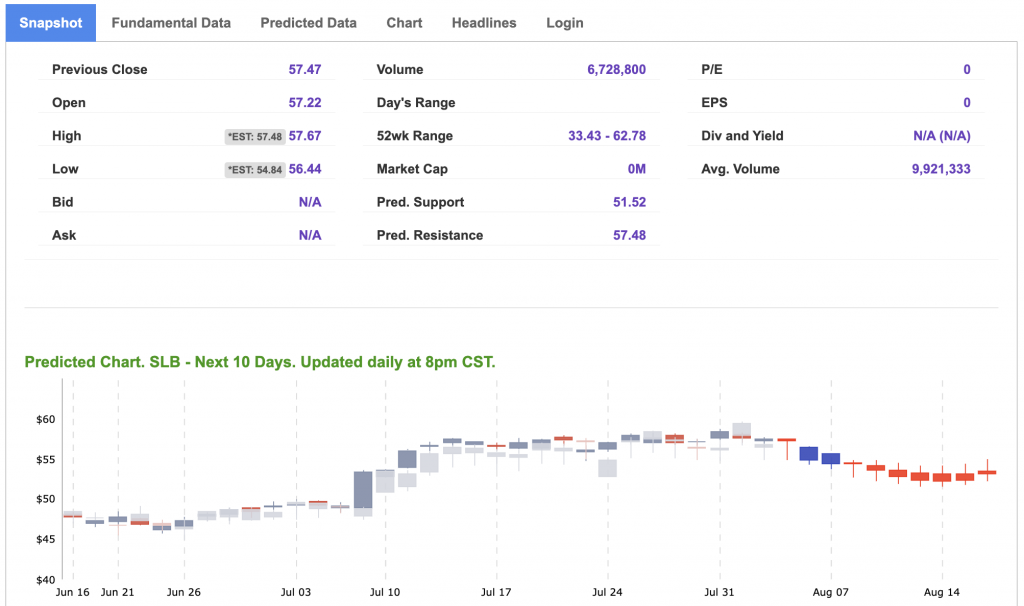

When reviewing our A.I. data on SLB we see several encouraging signals. After a slight dip, SLB has rallied in the past few weeks to book impressive gains for the year thus far. Having lowered off its high, SLB has room for the upside and plenty of catalysts to get it there!

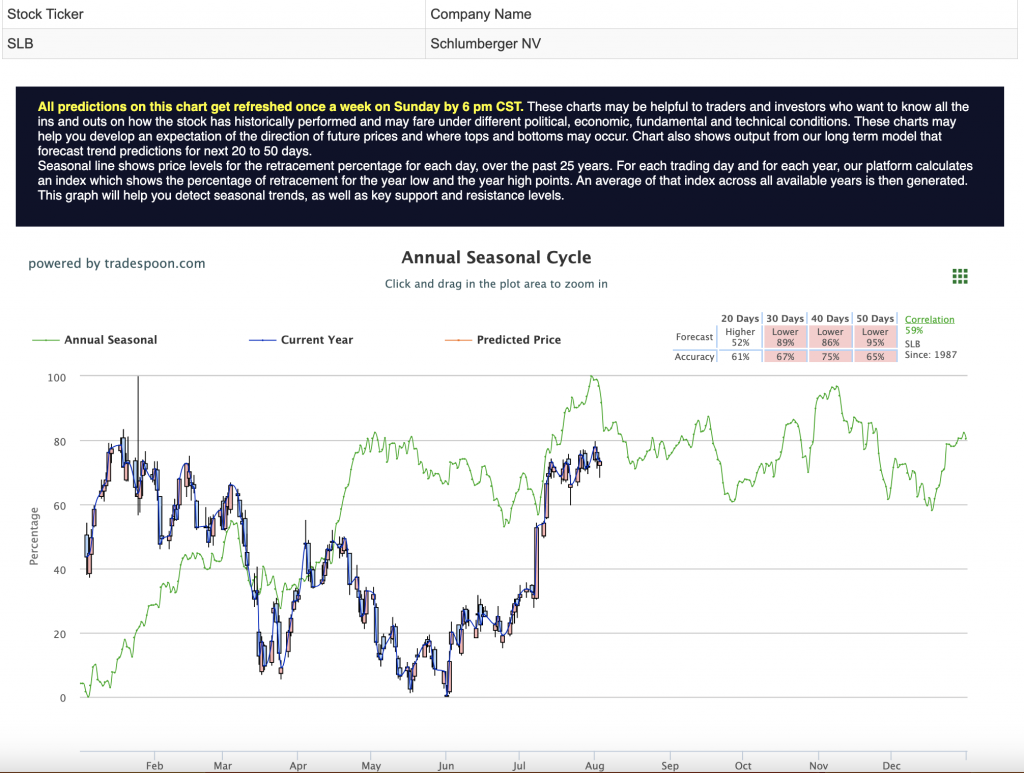

Our Seasonal Chart forecast for SLB is showing a strong likelihood of the symbol trading higher in the next 20 days and with an updated forecast coming Sunday, this trend could see the symbol rise even higher. For reference, the SLB Seasonal Chart is shown below:

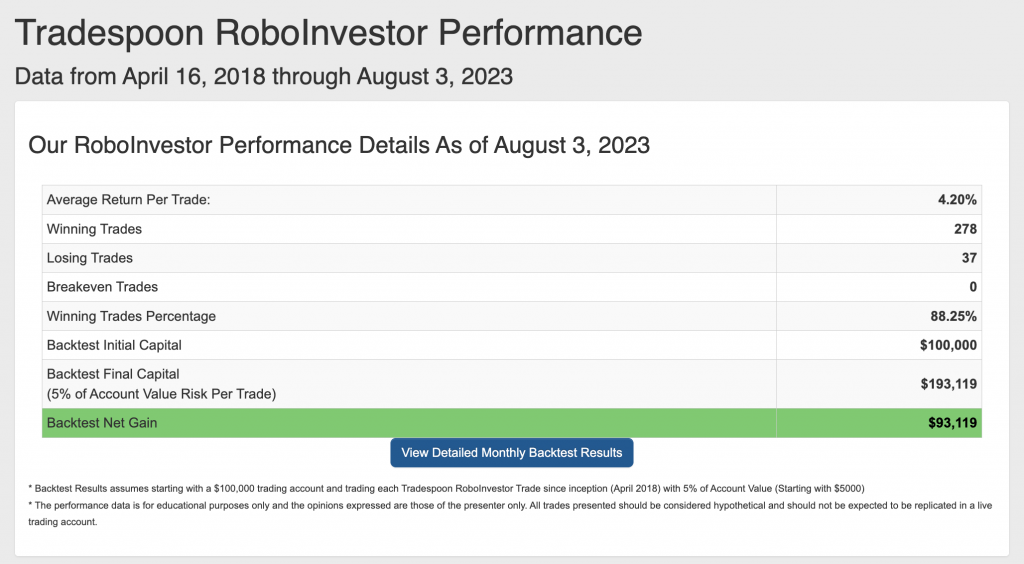

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we enter the second half of 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!