Last week, Federal Reserve Chairman Jerome Powell’s remarks on interest rates dominated headlines, significantly impacting market movements and shaping investor sentiment. Powell’s hint at potential rate cuts later in the year ignited discussions among investors, especially regarding savings, investments, and retirement plans. Additionally, the breach of a crucial threshold in the 10-year Treasury yield has prompted considerations about its potential impact on fixed-income investments and long-term financial objectives.

Optimism Amidst Economic Forecasts

Amidst these market shifts, optimism emerges with the Federal Reserve Bank of Atlanta’s upward revision of first-quarter economic growth forecasts. Projections now indicate a robust GDP increase, surpassing initial estimates. This positive economic outlook is prompting investors to reevaluate retirement strategies and asset allocations, aligning financial plans with emerging economic trends and potential adjustments in interest rates.

Encouraging Employment Figures

Turning to employment data, Friday’s jobs report brought encouraging news, with the U.S. adding 303,000 jobs in March, surpassing projections. Notable job gains were observed in healthcare, government, and construction sectors. Furthermore, the unemployment rate slightly dipped to 3.8%, indicating a resilient labor market. Improvements in wage growth further bolstered investor confidence.

Market Performance at the Start of the Week

Starting off this week, major stock indexes closed flat on Monday, with inflation data later in the week likely to capture market attention as traders reassess the possibility of multiple interest-rate cuts this year. Despite the cautious sentiment, five of the seven high-profile megacaps demonstrated strong performance. Tesla surged by 3.9%, Google parent Alphabet rose by 1.6%, and Amazon.com experienced a notable increase of 0.9%. Microsoft and Nvidia also saw modest gains, while Meta Platforms and Apple experienced slight declines.

Inflation and Interest Rate Expectations

March inflation figures are scheduled for release on Wednesday, with recent market sentiment scaling back expectations for Federal Reserve interest-rate cuts this year. The yield on the benchmark 10-year U.S. Treasury note stood at 4.444% early on Monday, ticking up from the previous week’s level of 4.427%.

Market Outlook

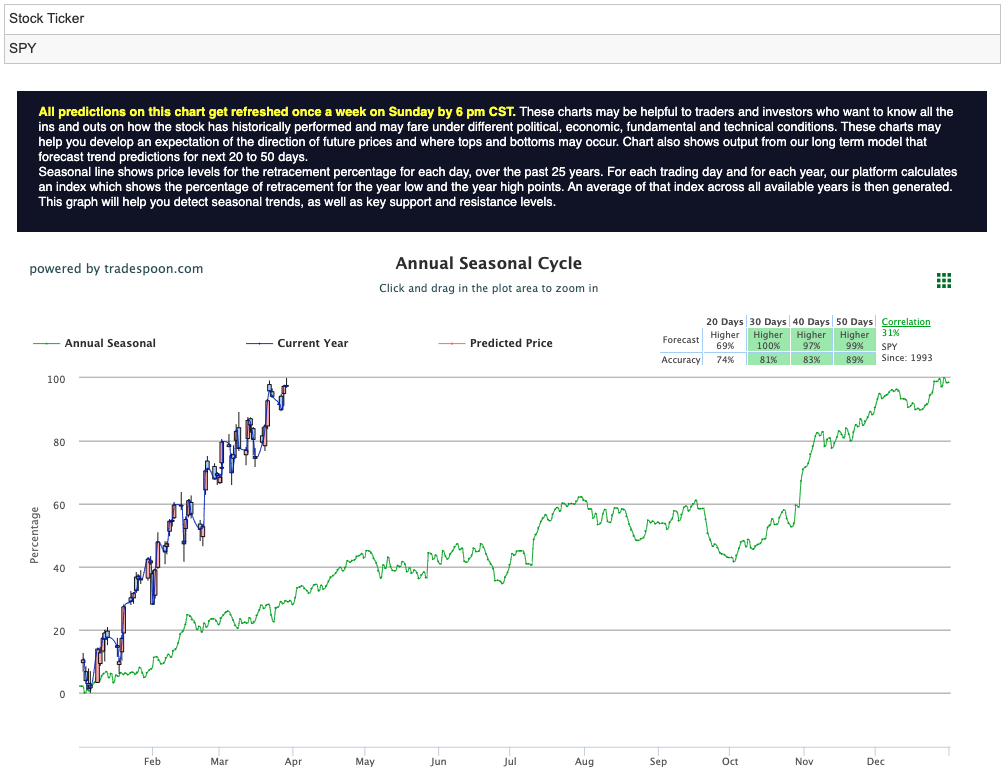

With the first quarter behind us and considering Powell’s recent comments, some investors are shifting to a bullish stance on the market. The broadening participation and the seasonally strong period in the stock market are encouraging signs. Investors are positioning themselves as buyers on pullbacks while closely monitoring the upcoming Fed decision and March options expiration. However, cautious optimism prevails, with expectations that the SPY rally may be capped at levels between $530 and $540. Short-term support is anticipated in the range of $490 to $500 over the next few months. For reference, the SPY Seasonal Chart is shown below:

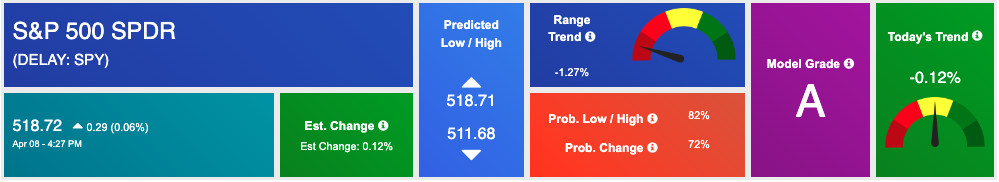

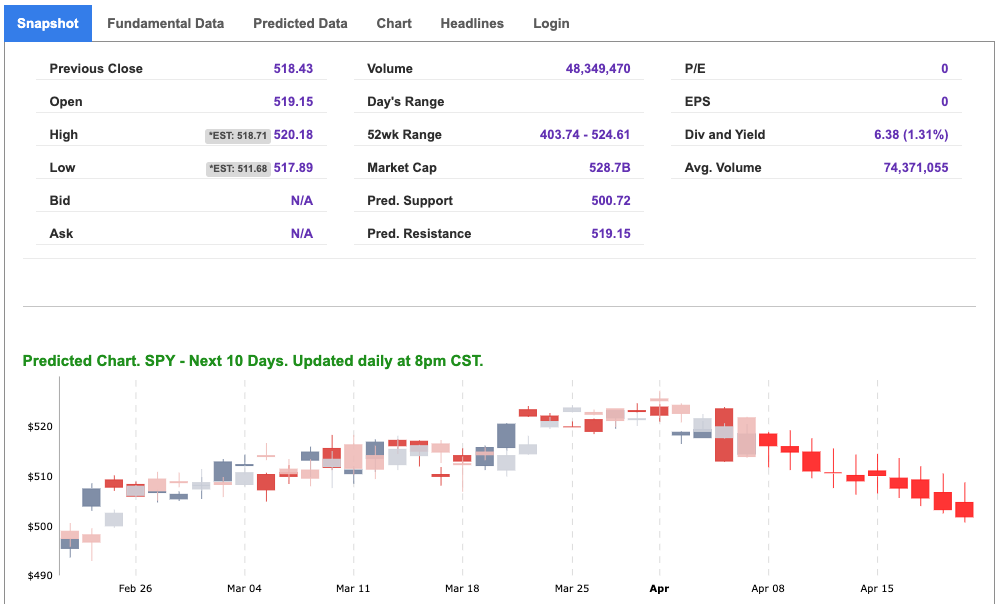

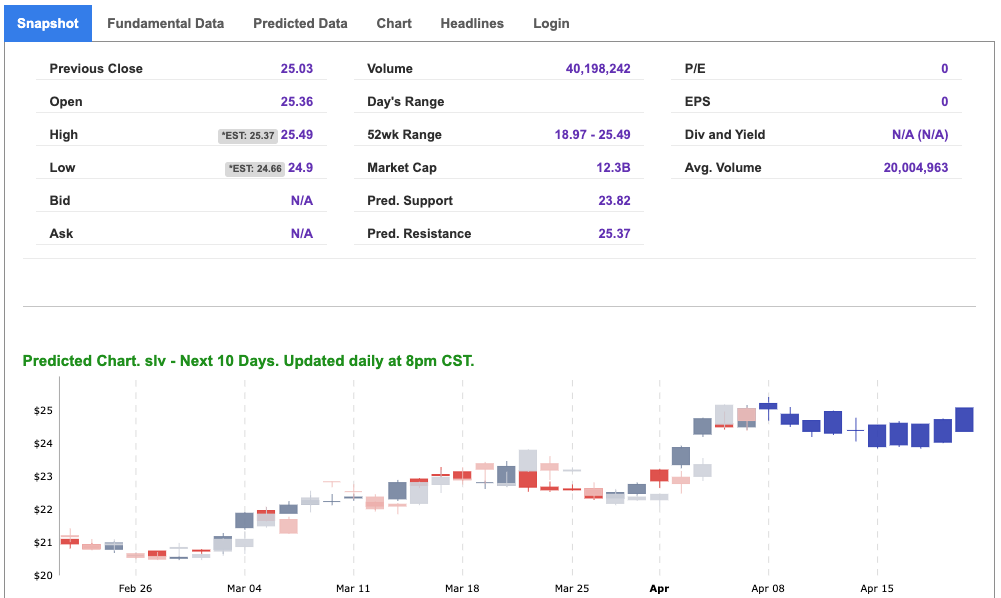

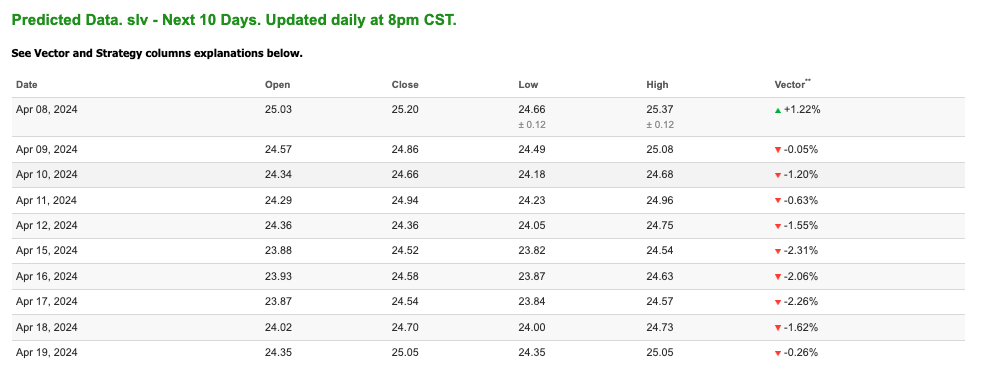

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

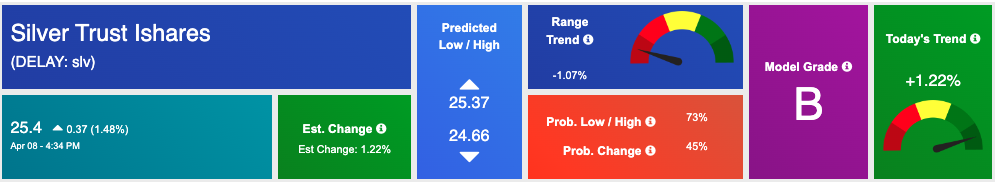

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

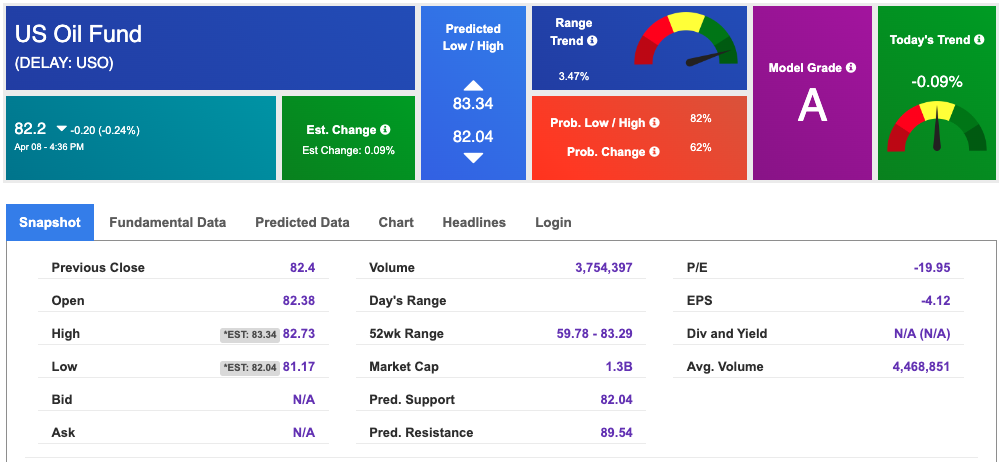

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $86.57 per barrel, down 0.39%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $82.2 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

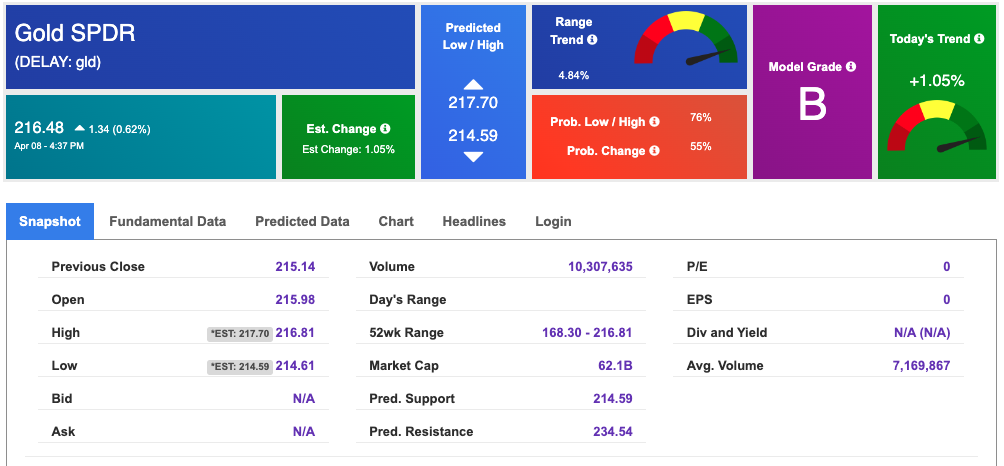

The price for the Gold Continuous Contract (GC00) is up 0.55% at $2358.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $216.48 at the time of publication. Vector signals show +1.05% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

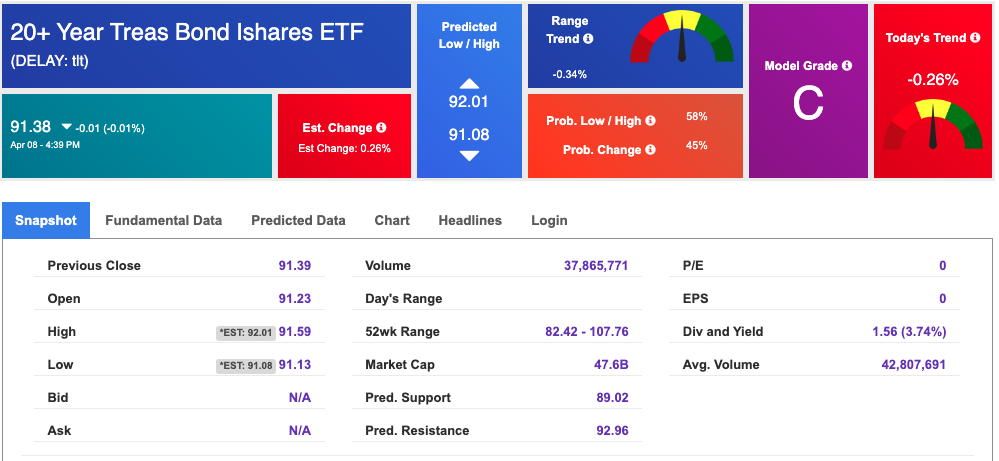

The yield on the 10-year Treasury note is up at 4.430% at the time of publication.

The yield on the 30-year Treasury note is down at 4.550% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

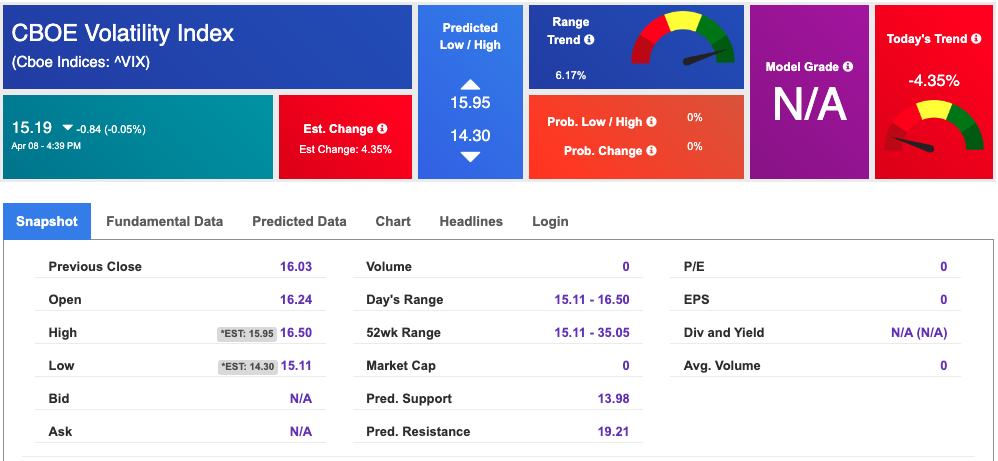

The CBOE Volatility Index (^VIX) is priced at $15.19 down 0.05% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!