RoboStreet – Weekly Market News & Sentiment: Microsoft Stumbles on Cloud Growth, Meta Reclaims AI Leadership, Gold Hits Records, and Yields Keep Risk Assets in Check

This week’s market action was a study in crosscurrents. Equities were whipsawed by a volatile mix of tariff headlines, megacap earnings, and shifting macro expectations, leaving major indices hovering near their 50-day moving averages as volatility remained elevated but controlled. The S&P 500 and Nasdaq both tested downside levels early in the week before stabilizing, while the VIX held around 18, signaling unease rather than panic.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Early pressure stemmed from renewed tariff fears tied to geopolitical tensions, which briefly revived inflation concerns and weighed on risk appetite. That overhang eased midweek after President Trump stepped back from proposed tariffs on European and NATO allies, triggering a broad but short-lived rebound. By week’s end, however, markets were once again wrestling with earnings-driven dispersion—particularly within technology, alongside higher-for-longer interest rate risks.

Under the surface, leadership continued to fragment. Energy, materials, and select cyclicals showed relative strength, while growth-heavy software and cloud names came under sustained pressure. Treasury yields remained volatile, with the 10-year oscillating between roughly 3.6% and 4.35%, reinforcing the idea that macro conditions are no longer providing a tailwind for valuation expansion.

The most immediate catalyst early in the week was geopolitical relief. On January 22, markets rallied after the administration abandoned plans to impose a 10% tariff on European allies following negotiations tied to Greenland and Arctic security access. While the agreement was light on detail and left lingering uncertainty, the decision removed the near-term threat of a broader transatlantic trade conflict. That pause unlocked pent-up buying, particularly in energy and materials, helping erase earlier weekly losses.

Attention quickly shifted to earnings, where a stark divergence emerged within megacap technology. Microsoft’s results became the inflection point. Despite beating headline revenue and earnings expectations, the company’s shares sold off sharply after investors focused on softer guidance and a modest deceleration in Azure cloud growth. Azure revenue grew 39% year over year—above estimates—but down slightly from the prior quarter. In a market hypersensitive to marginal slowdowns, that nuance mattered. The stock extended its multi-month decline and dragged the broader software complex lower, sending the tech-software ETF sharply down and pulling the Nasdaq off its highs.

Meta Platforms delivered the opposite reaction. Strong fourth-quarter results and higher-than-expected first-quarter revenue guidance reassured investors that its aggressive AI spending is translating into tangible earnings power. The stock surged as the market rewarded clarity around monetization, even as the company outlined a substantial increase in AI investment. The contrast between Microsoft and Meta underscored a growing investor preference: spending is acceptable, but only when the path to near-term profitability is visible.

Outside of tech, earnings provided pockets of optimism. Southwest Airlines surprised investors with a constructive outlook, projecting a significant jump in 2026 profits and igniting a sharp rally in the stock. More broadly, a large majority of S&P 500 companies continued to beat expectations, but megacap tech’s sheer index weight meant that weakness in software overshadowed strength elsewhere.

Investor sentiment has shifted from enthusiasm to discernment. This is no longer a market that rewards growth narratives alone. Instead, participants are demanding evidence—clear margins, cash flow visibility, and a tighter connection between investment and profit.

That recalibration is occurring alongside a subtle but important macro shift. Recent reporting suggests the Federal Reserve is increasingly comfortable keeping rates steady into 2026, given resilient growth and sticky inflation expectations. Tariff rhetoric, fiscal expansion talk, and a still-firm labor market have pushed inflation expectations higher, even as hopes for aggressive rate cuts fade. Yields have responded accordingly, pressuring long-duration growth stocks and favoring value and cyclical exposures.

Despite these headwinds, volatility remains contained. The VIX’s retreat from earlier spikes reflects a market that is cautious but orderly, not disorderly. Capital is rotating rather than fleeing. Precious metals tell a similar story. Gold and silver both moved higher this week, with gold notching fresh records as global demand hit an all-time high. Investment flows into gold surged in 2025, driven by geopolitical uncertainty and persistent macro hedging, and the trend has accelerated into 2026. That behavior suggests investors are hedging risk—not abandoning equities altogether.

I remain firmly in the market-neutral camp. Momentum has clearly deteriorated, and the primary risk remains a prolonged period of higher interest rates combined with early signs of softening in labor indicators. That said, the longer-term trend in equities is still intact, and pullbacks continue to attract selective buying rather than wholesale liquidation.

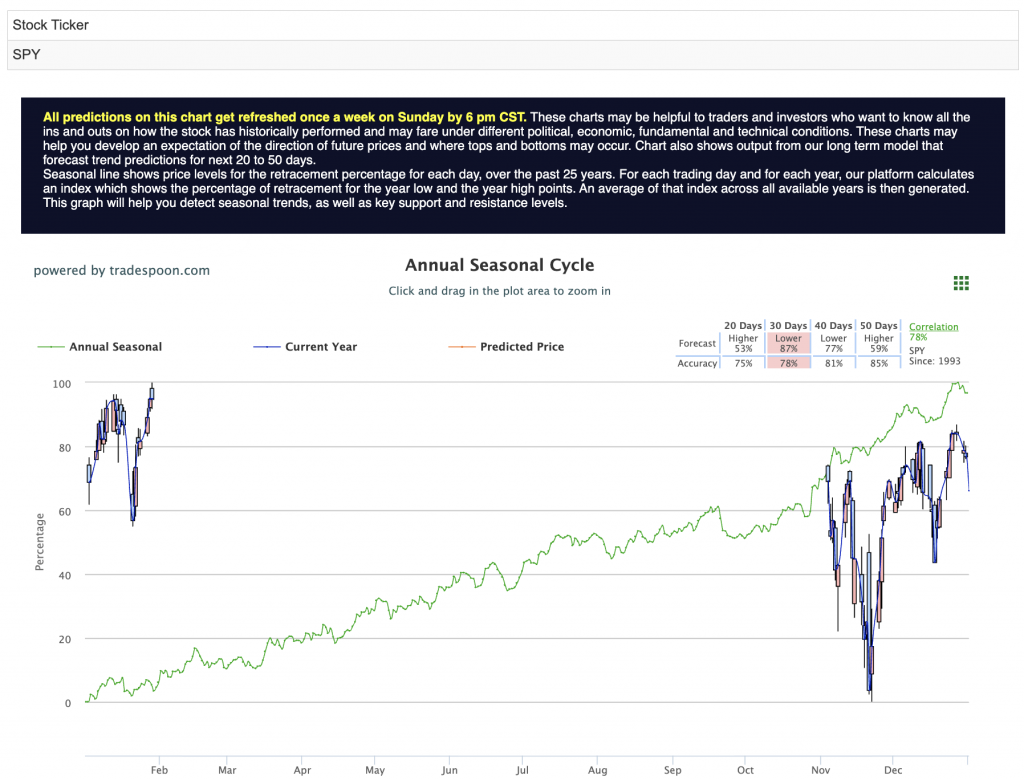

From a tactical standpoint, the market is likely to remain range-bound in the near term. On the upside, the SPY has room to push toward the 700–720 zone if earnings breadth holds and rates stabilize. On the downside, the 650–660 area represents key support over the coming months. Respecting those boundaries and avoiding emotional reactions to headline noise will be critical.

The clearest takeaway from this week is that selectivity matters more than speed. Investors should focus on companies and sectors where spending discipline, pricing power, and earnings visibility align, while remaining cautious toward areas where expectations still assume flawless execution. Keep an eye on rates, watch how markets digest the next wave of earnings, and continue to use volatility as a tool—not a trigger.

In this environment, capital preservation and disciplined positioning are just as important as chasing upside. The market is still offering opportunities, but only to those willing to be patient, flexible, and clear-eyed about risk.

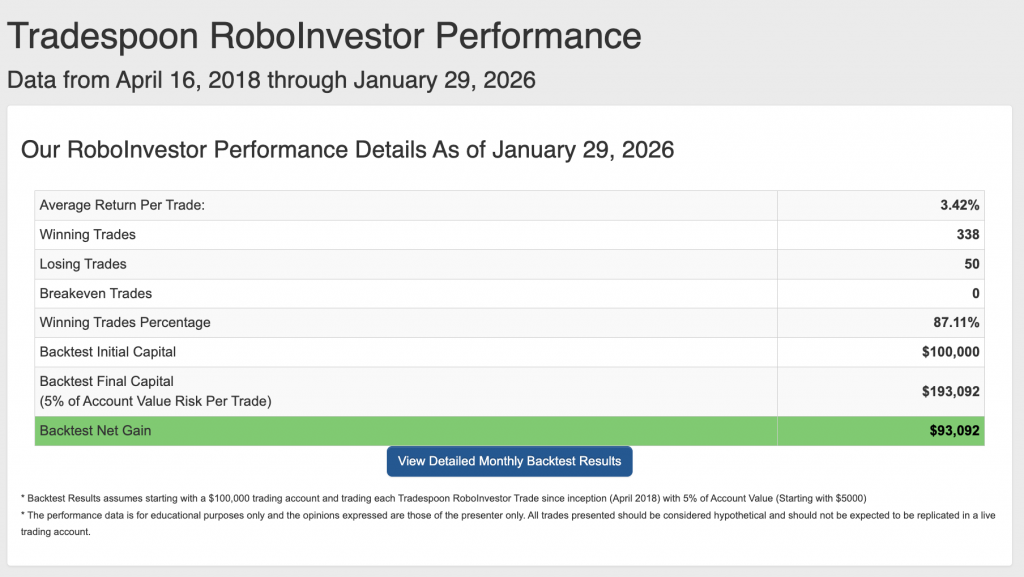

That’s exactly where RoboInvestor proves its value. Built for a rangebound, headline-sensitive tape, our flagship AI-driven advisory helps you cut through shutdown noise, tariff chatter, and AI hype to focus on what matters: statistically grounded setups and the clearest risk-reward opportunities. With RoboInvestor, you can stay invested, stay disciplined, and act with precision instead of reacting to every headline.

Every other weekend, you’ll receive the RoboInvestor newsletter—a concise, high-signal read with market context, technical outlooks, updates on open positions, and clear, actionable trade ideas. Hence, you’re prepared and confident heading into Monday’s open.

Explore our latest forecasts, trade signals, and live strategy sessions at Tradespoon.com. Navigate uncertainty with confidence—and position yourself ahead of the curve.

Whether you’re targeting blue-chip stocks, ETFs, commodities, or inverse ETFs, RoboInvestor offers a flexible, forward-looking approach tailored to today’s market conditions. Our model portfolio typically holds 12 to 25 carefully selected positions, and we’ve recently adopted an even more selective strategy—focused on quality, resilience, and opportunity.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the best in the retail advisory industry, with a Winning Trades Percentage of 87.11% since April 2018.

As 2026 gets underway, investors are stepping into a market that looks stable on the surface but is becoming more selective underneath. Tariff concerns briefly pressured sentiment before easing, megacap earnings exposed clear winners and losers, and the Fed’s path has grown less forgiving as inflation expectations remain sticky. Interest rates are no longer a background factor, labor-market signals are softening at the margins, and leadership is narrowing as investors demand a clearer connection between spending, margins, and profits.

Volatility remains contained but reactive, quick to spike around policy shifts, earnings surprises, and moves in the bond market. In this environment, earnings quality and forward guidance are doing the real work of setting direction. Navigating the first quarter will require a disciplined, insight-driven approach that respects the influence of rates, manages employment risk, and stays flexible enough to participate in rotation without chasing fragile momentum.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

Stay alert, stay strategic—and trade smart.

And remember, we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!