Monday, August 7, 2023

The week began on a positive note for U.S. stocks, as Wall Street recovered from last week’s losses and shifted its attention towards the upcoming U.S. inflation data, which is expected to influence the Federal Reserve’s decisions regarding interest rates. Market sentiment was buoyed by a rebound in stocks, accompanied by a decrease in the market’s volatility index, reflecting a more composed atmosphere among traders.

In the early hours of Monday’s trading, the Dow Jones Industrial Average surged by over 400 points, defying the previous week’s sluggish start to August. As the day progressed, stocks held onto their gains, with investors cautiously awaiting a wave of corporate earnings reports and a pivotal inflation reading scheduled for later in the week.

However, not all stocks shared the rally’s enthusiasm. Apple, in particular, continued to experience downward momentum, with its shares declining by an additional 1.9%. This slump positioned the tech giant as the weakest performer within the Dow Jones Industrial Average.

Despite the overall positivity, the ongoing earnings season has seen a mix of strong performances and notable disappointments, exemplified by Apple’s struggle. A slew of upcoming earnings reports, including notable names like Walt Disney and United Parcel Service (UPS), has the potential to steer the market’s trajectory as investors eagerly await Thursday’s release of the consumer price index (CPI) data.

As Wall Street transitioned from July’s impressive market rally into August, traditionally a challenging month for stock market gains, some market participants opted to scale back their activity. This could introduce increased volatility throughout the latter half of the year.

The earnings calendar for the week ahead boasts a lineup of prominent companies, including BioNTech on Monday. Following suit, Tuesday will see earnings releases from Barrick Gold, Eli Lilly, Take-Two Interactive Software, and UPS. Wednesday’s lineup features reports from Walt Disney, Trade Desk, and Wynn Resorts, while Thursday will conclude the week’s key earnings cycle with announcements from Alibaba Group Holding, Brookfield, News Corp, and Ralph Lauren.

Thursday also brings the highly anticipated consumer price index release for July, presented by the Bureau of Labor Statistics. Analysts’ consensus estimates predict a 3.3% year-over-year rise in the CPI, with the core CPI, excluding volatile food and energy prices, expected to increase by 4.8%. These figures mark an incremental rise compared to June’s gains of 3.0% and 4.8% respectively.

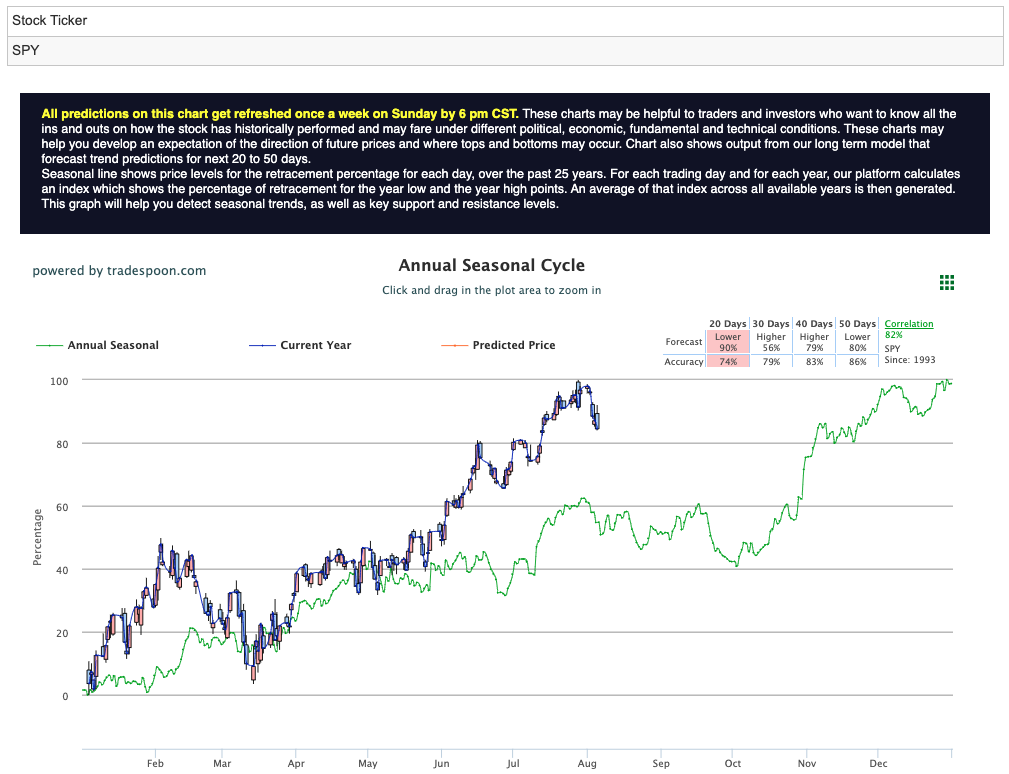

In an economic environment marked by low recession probability and a substantial pullback of the $DXY, some market observers have adopted a neutral perspective going forward. After a mid-summer shift in stance, expectations of heightened volatility during the latter part of the year persist. Despite the positive outlook, these experts anticipate a ceiling for the SPY rally within the $450-470 range, identifying short-term support levels at 400-430 over the coming months. For reference, the SPY Seasonal Chart is shown below:

In conclusion, the U.S. stock market’s buoyant start to the week underscores the significance of impending inflation data and corporate earnings reports in shaping the market’s trajectory. Amid ongoing economic shifts, a measured approach and strategic outlook remain paramount for investors navigating the dynamic financial landscape.

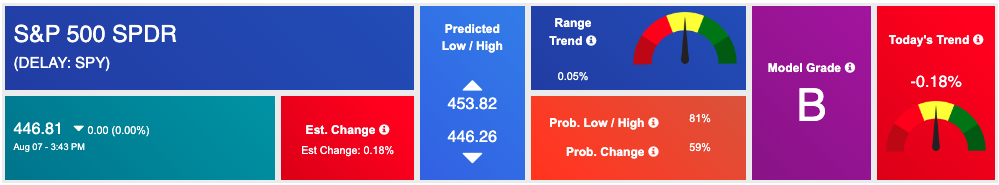

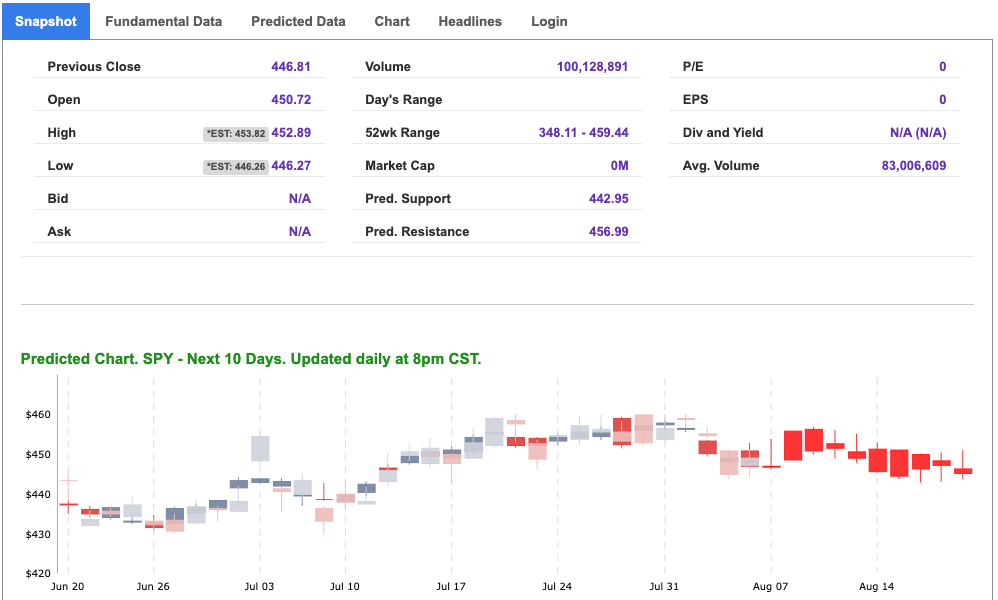

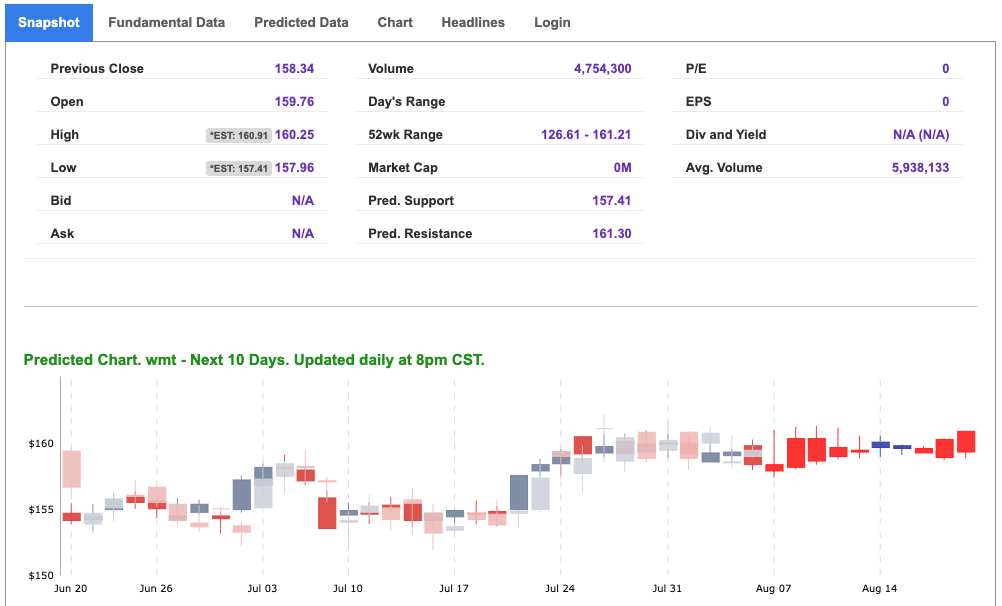

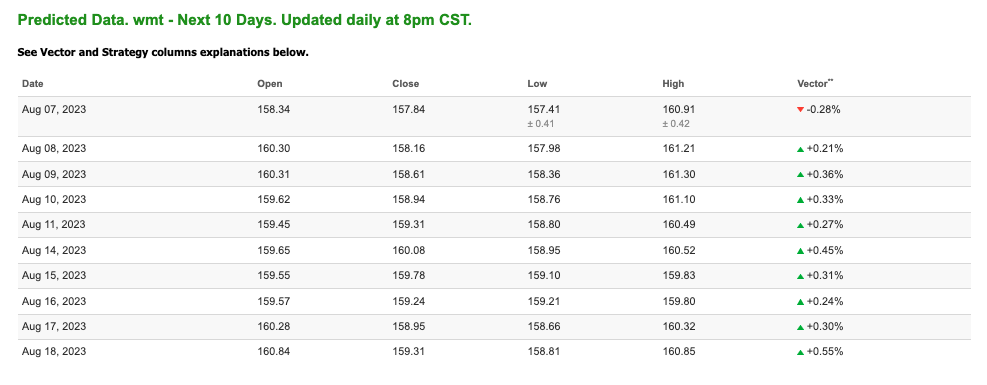

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

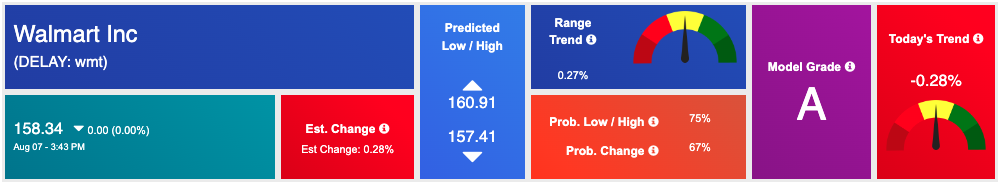

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, wmt. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

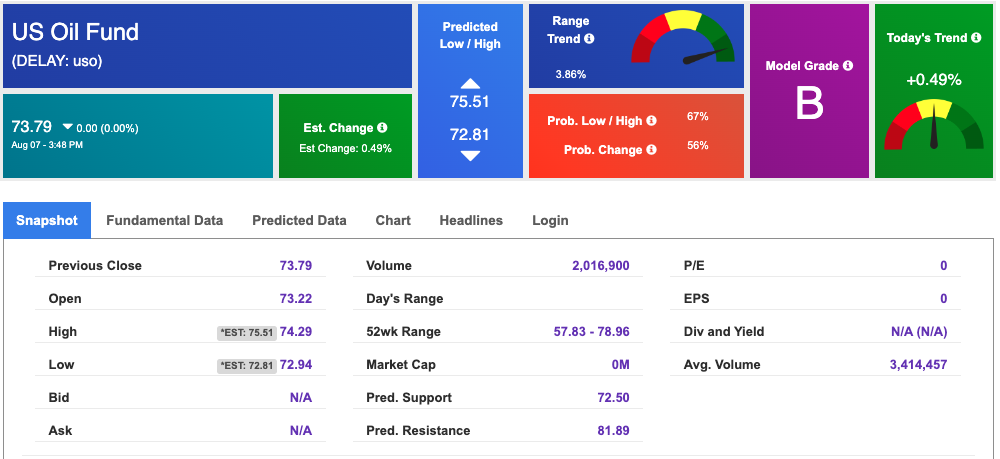

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $82.50 per barrel, down 0.39%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.79 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

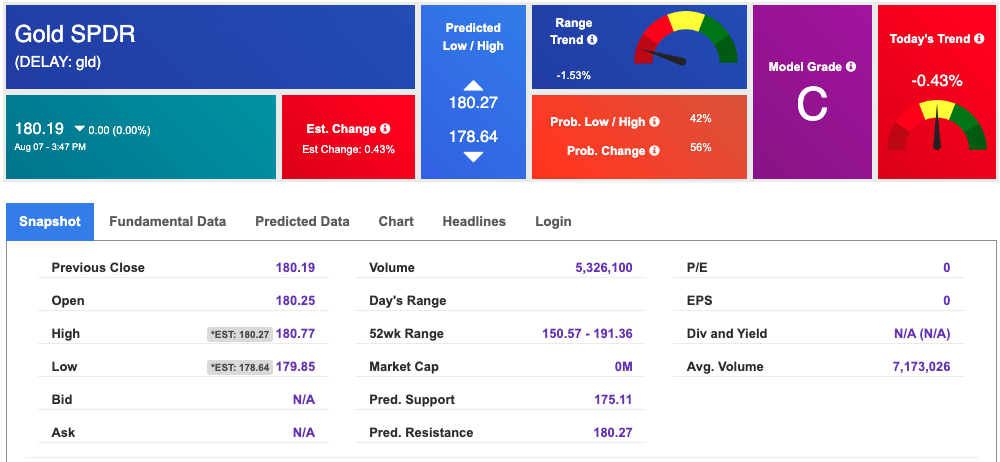

The price for the Gold Continuous Contract (GC00) is down 0.23% at $1971.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $180.19 at the time of publication. Vector signals show -0.43% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 4.092% at the time of publication.

The yield on the 30-year Treasury note is up at 4.269% at the time of publication.

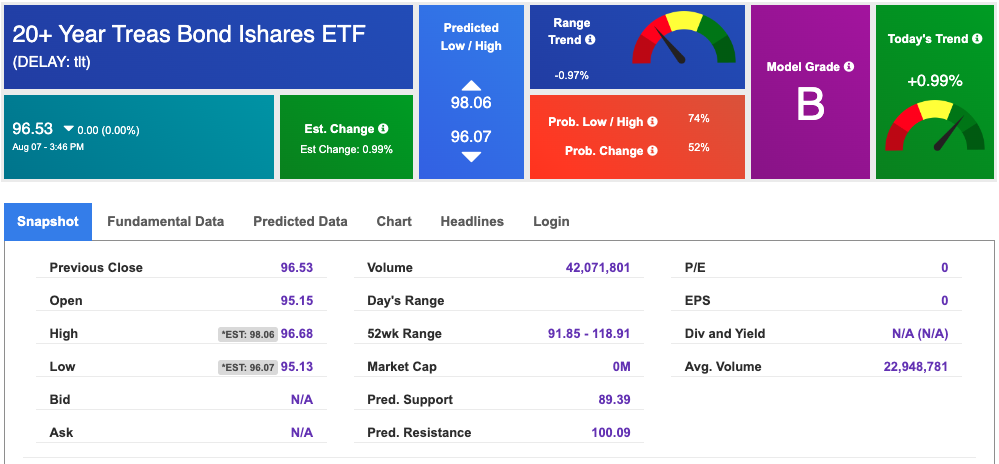

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $15.77, down 7.78% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!