In a continued show of strength and confidence, the Dow Jones Industrial Average extended its remarkable winning streak for the 13th consecutive day, propelled by the Federal Reserve’s decision to raise interest rates by a quarter of a percentage point during its latest meeting. Federal Reserve Chairman Jerome Powell, in a press conference following the meeting, maintained an air of caution as he spoke about the future trajectory of interest rates. He emphasized that the central bank will adopt a “meeting-by-meeting” approach when considering additional rate increases, keeping a close eye on economic data to make informed monetary-policy decisions.

The rate hike came amid lingering concerns over inflation, which continues to hover above the Federal Reserve’s 2% target. Chairman Powell reassured the public that the central bank remains steadfast in its commitment to address the inflationary pressures. During the press conference, he emphasized that there is still “a long way to go” in tackling inflation, indicating that further measures may be necessary to keep it in check.

Looking ahead, financial experts and investors are eagerly awaiting the Fed’s stance for the upcoming September meeting. Powell’s data-dependent approach hints at a cautious outlook, with the central bank closely monitoring major reports on the job market and inflation indicators. The Fed’s preference for taking a measured approach suggests that officials are wary of premature optimism, as they seek to prevent a potential resurgence of high inflation.

In a notable reversal of fortune, the Federal Open Market Committee’s staff altered their earlier projections of a recession hitting the U.S. later in the year. Chairman Powell reported that the staff now predicts a noticeable slowdown in growth starting later this year. However, they no longer anticipate a full-blown recession, a testament to the economy’s resilience in the face of challenges.

Beyond the central bank’s actions, investor attention is also focused on major players in the tech industry. Meta, formerly known as Facebook, is set to report its earnings after the bell, following impressive performances by Microsoft and Alphabet. Both Microsoft and Alphabet outperformed market expectations, driven by the growing significance of artificial intelligence in their operations.

Microsoft reported robust fiscal fourth-quarter earnings and revenue, exceeding analysts’ estimates. However, the stock experienced a slight dip of 3.7% as the company’s revenue guidance for the fiscal first quarter fell short of market expectations. Microsoft’s investments in artificial intelligence were acknowledged, but investors are carefully monitoring the associated rising costs.

Meanwhile, Alphabet, the parent company of Google, saw a substantial 5.8% increase in its shares after reporting better-than-expected second-quarter earnings. The announcement of Roth Porat as the new President and Chief Investment Officer, effective in September, further boosted investor confidence. The company’s focus on artificial intelligence initiatives was highlighted during the conference call, signaling its commitment to technological advancement.

In the telecommunications sector, AT&T reported second-quarter earnings that surpassed analysts’ estimates, delivering strong free cash flow. However, the stock’s modest 0.6% gain suggests that the market was disappointed with the company missing expectations for postpaid phone net subscriber additions during the same period.

In the aerospace industry, Boeing experienced an 8.7% surge in shares after reporting a narrower-than-expected second-quarter loss. The positive results were supported by better-than-forecasted free cash flow, signaling a potential rebound for the aerospace giant.

In a significant acquisition development, PacWest Bancorp’s stock soared by an impressive 27% after reaching an agreement to be acquired by Banc of California in an all-stock deal. The deal valued PacWest shares at $9.60 each, reflecting a premium over the previous closing price of $7.69 on Tuesday. This strategic move positions PacWest to solidify its position in the regional banking landscape, capitalizing on the turmoil that affected other lenders in the sector.

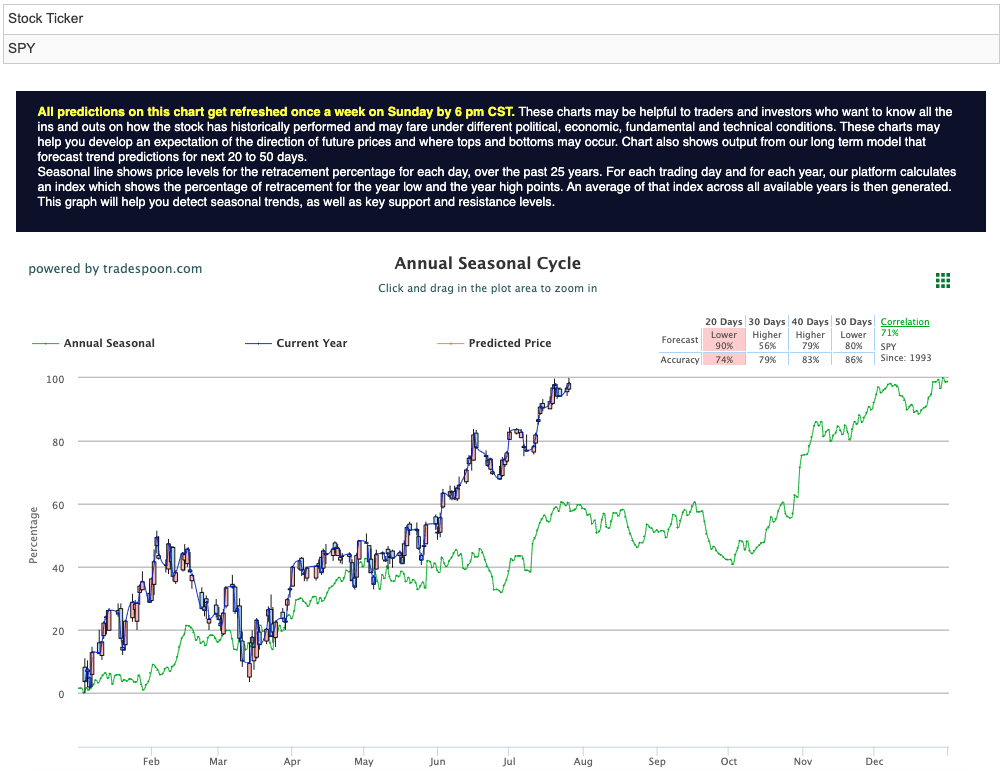

As the financial markets continue to navigate uncertainties, investors remain cautiously optimistic, closely monitoring both economic indicators and individual company performances. The Federal Reserve’s measured approach and the tech sector’s continued reliance on artificial intelligence are expected to be key factors influencing market movements in the coming days. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

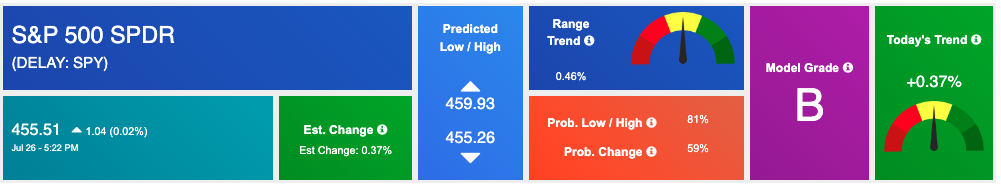

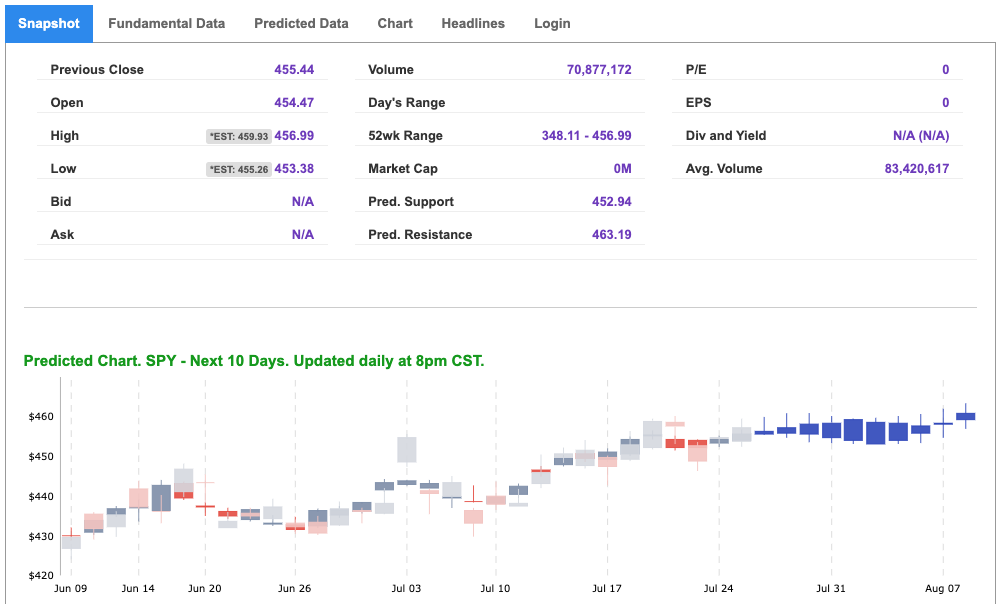

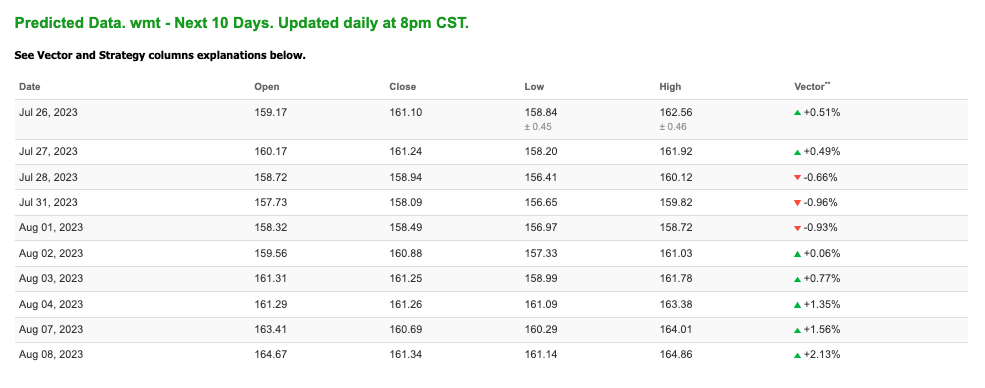

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

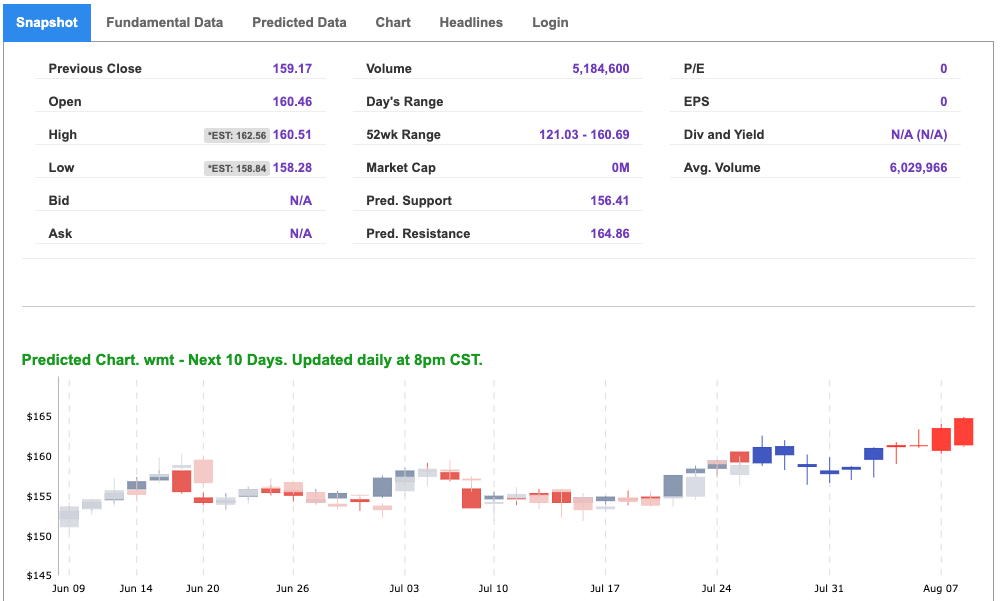

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, wmt. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

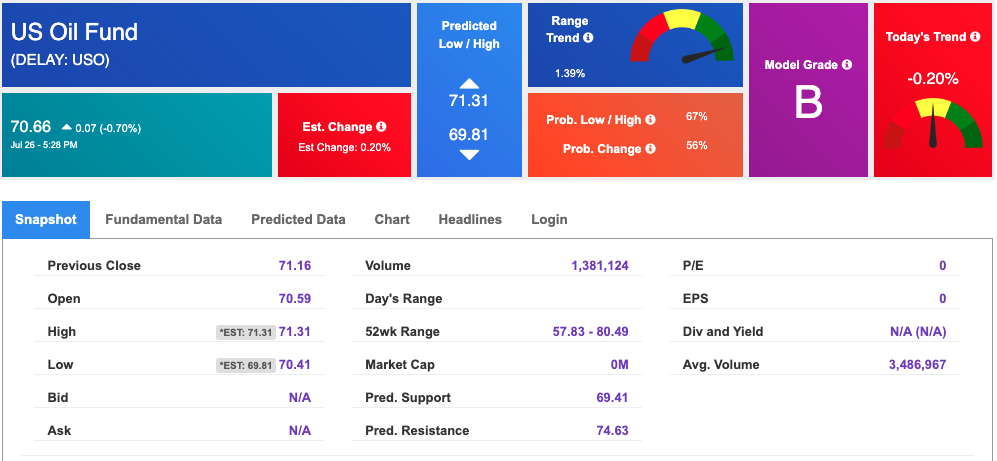

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $78.94 per barrel, up 0.20%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.66 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

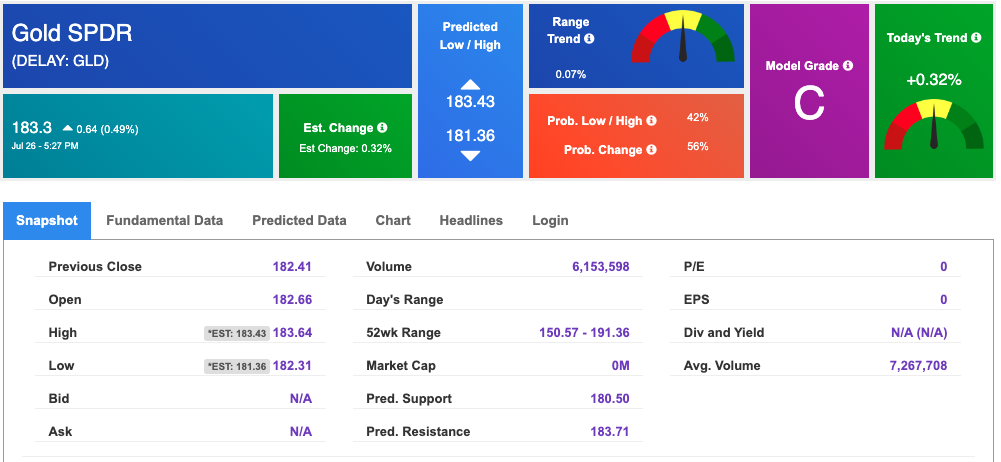

The price for the Gold Continuous Contract (GC00) is up 0.17% at $1973.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $183.3 at the time of publication. Vector signals show +0.32% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

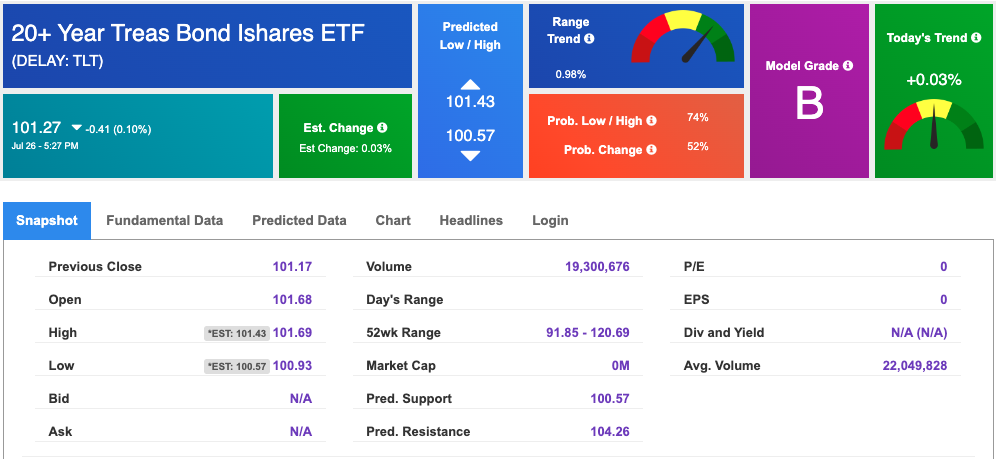

The yield on the 10-year Treasury note is DOWN at 3.865% at the time of publication.

The yield on the 30-year Treasury note is UP at 3.941% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $13.19, DOWN 4.83% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!